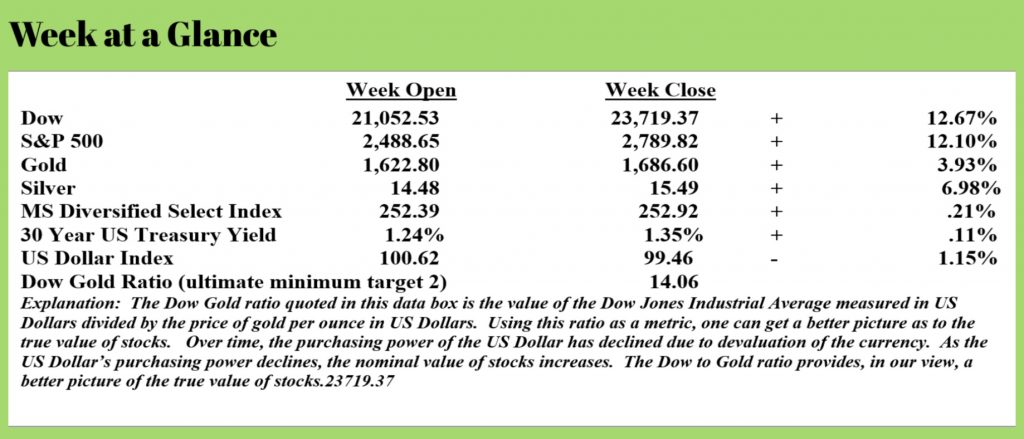

Weekly Market Update by Retirement Lifestyle Advocates

After a relatively calm week

last week, all markets were active last week.

Stocks were up big – more than 12% as the market continues its bi-polar

behavior.

Metals rallied and the

long-term US Treasury Bond declined as yields rose. The US Dollar was also weaker relative to

other currencies.

Stocks fell last week in

what would have been considered a volatile week not that long ago. Given recent stock market price action

however, last week’s price action in the major stock market indices was

relatively calm.

Metals fell slightly, the US

Treasury long bond rallied some and the US Dollar strengthened on a relative basis.

Financial and economic

conditions continue to rapidly change and evolve as the coronavirus economic

restrictions remain in place.

While the focus of

policymakers is to ‘flatten the curve’ as far as coronavirus infections are

concerned, there is a curve that is being discussed far less. But, over time, this curve won’t flatten and

will end up causing economic and financial outcomes that will be devastating to

those who are unprepared.

What curve might that be?

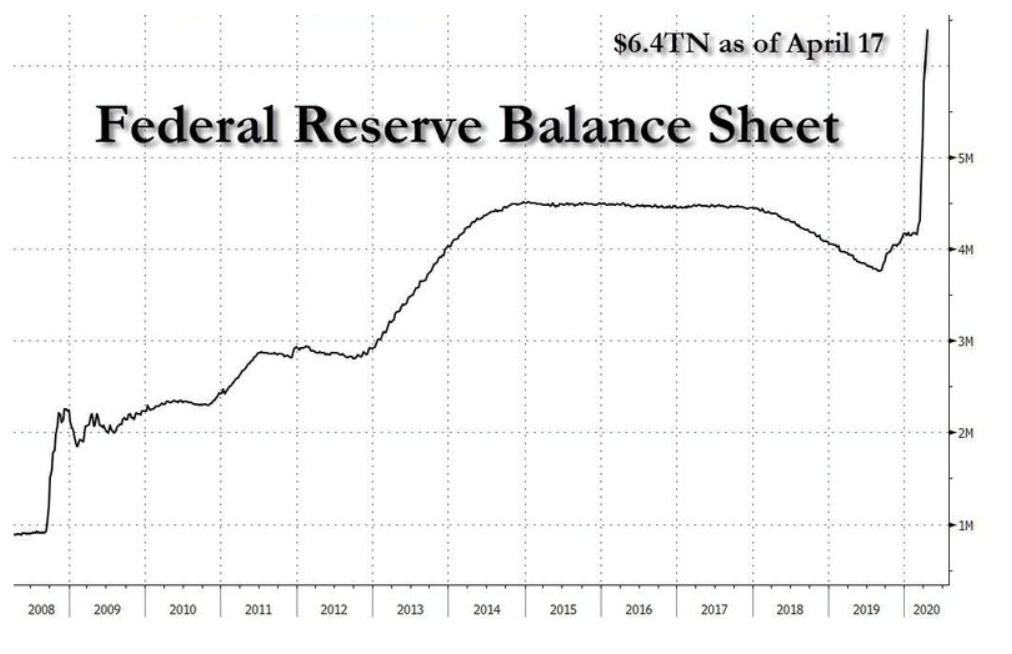

The balance sheet of the

Federal Reserve.

For those of you who are new readers of “Portfolio Watch”, when the Fed’s balance sheet expands, it means that the Fed is creating money, virtually out of thin air.

The Fed doesn’t manufacture

anything to sell so in order for the Fed to get money to buy assets from member

banks, that money is just created.

And, now, under the new

rules post-stimulus, the Fed can print money to loan to the US Treasury. The US Treasury can use SPV’s, or special

purpose vehicle, to buy corporate bond vehicles on the open market by borrowing

newly created money from the Federal Reserve.

In effect, this nationalizes

more of the private sector and does so through money creation.

Let that sink in, it’s

alarming.

The chart on this page shows

that the balance sheet of the Federal Reserve will reach $6.4 trillion by April

17 – that’s just one week away. That’s

up about $2.5 trillion this year alone!

But, this past week, the Fed took an even more extreme position, stating that they would begin purchasing junk bonds as well. Junk bonds are bonds that are below investment grade and carry more risk than an investment-grade bond.

This from “Bloomberg” (Source: https://www.bloomberg.com/news/articles/2020-04-09/fed-unleashes-fresh-steps-for-as-much-as-2-3-trillion-in-aid) (emphasis added):

As fresh evidence of the economic toll

from the coronavirus pandemic floods in, the Federal Reserve unleashed another

round of emergency measures, including a pledge to provide support to

risky corners of financial markets that have been some of the hardest

hit.

The Fed said Thursday it will invest up to $2.3 trillion in loans to aid small and mid-sized businesses and state and local governments as well as fund the purchases of some types of high-yield bonds, collateralized loan obligations. and commercial mortgage-backed securities.

The money comes on top of the massive

stimulus that the Fed had already announced and it thrusts the institution into

the sort of speculative lending activities it had shunned in the past --

underscoring the risks that Chairman Jerome Powell is willing to take to shore

up the economy.

This demonstrates how

desperate the Fed has become.

As noted above, as part of

the CARES Act, the Fed will loan money to the Treasury to buy corporate bond

issues. Now, the Fed has announced that

the central bank will directly buy junk bonds.

This despite the fact that it is not legal for the Fed to directly purchase any security that is not government-backed.

It also puts the Fed in a

position of deciding which junk bonds to buy; essentially putting them in a

position of picking winners and losers.

This makes the Fed even more political.

What could go wrong?

Money creation is on

steroids.

In contrast, the Federal Reserve created about $3 trillion in new money from the end of 2008 to the beginning of 2020. At this rate, the Fed will have printed an equivalent by the first of May of 2020.

That’s as much

‘out-of-thin-air’ money creation in 4 months as has occurred over the last 12

years!

We have been repeatedly

warning of a slippery slope and an ultimate Dow to Gold ratio of 2, or even 1

based on our study of history. Now, the

path on which we arrive there seems clearer.

As we discussed last week,

it seems highly unlikely that we will see the ‘V-Shaped’ recovery for which so

many are hopeful. There are many reasons

for this, but the primary two are:

- Already anemic corporate

earnings becoming even weaker as a result of the anti-coronavirus constraints. - The primary driver of higher

stock prices since the financial crisis, corporate stock buybacks, will now be

going the way of the dinosaur given that companies that take money from the

government will now be prohibited from engaging in this activity. (Important note: stock buybacks were illegal

from 1934 until 1982)

We see stocks as having more

potential downside from here – probably significant downside if the anticipated

economic forecast holds true. A 30% to

50% decline in GDP in the second quarter of this year combined with a headline

unemployment rate of 15% to 25% will be ruinous for stocks.

These are truly historic

times.

At the same time, money

printing in quantities that could only be described as colossal will have to be

bullish for tangible assets at some future point. That is an indisputable fact of history.

The immediate focus of

politicians and policymakers has been reacting to the economic chaos. Over the past three weeks, 17 million people

have lost their jobs and filed for unemployment. There are many more than this actual but

there are lots of reports of glitches in state unemployment systems that have

not made it possible for all those who are eligible to file. We expect that this number goes significantly

higher before this curve flattens.

We are on the brink of the deflationary depression that we have been warning about since the book “Economic Consequences” was published in 2011. Congress, the president, and the Fed are determined to do whatever it takes to avoid such an outcome. So, they are responding by doing the only thing they know how to do – print, print, print.

Here’s the reality

though. The $2.1 trillion stimulus

package is not a stimulus package, it a subsistence package. This newly printed money will merely replace

some of the incomes lost as a result of the coronavirus constraints.

In other words, this initial

package is designed to prevent the plunge into a depression, it won’t provide

stimulus. Look for more government

packages in the future funded by money creation.

So, when will the inflation

hit?

No one knows for sure. But at this point, stagflation seems like the

most likely economic outcome as Michael Pento discusses with RLA Radio host, Dennis

Tubbergen on this week’s radio program. This week’s Retirement Lifestyle Advocates Radio

Program is now posted at www.RetirementLifestyleAdvocates.com.

If

you are a client of our company, you are receiving an invitation to a weekly

educational webinar on which we provide analysis and comment. If you are a client and for whatever reason

are not receiving an invitation to the client only webinar, call the office at

1-866-921-3613.

We do have a public educational webinar coming up this week as well. This webinar contains information that our clients already have. It is designed to educate and inform. If you are not a client or our company but would like to learn more about current circumstances and strategies that you might employ to not only survive financially but possibly prosper, you may call the office to register at 1-866-921-3613.

If

you know of someone that might benefit from the information in this weekly

publication, direct them to get a free subscription at www.RetirementLifestyleAdvocates.com.

As

you all know, we respect the privacy of our subscribers and never inundate them

with e-mails.

Again,

blessings to all of you in these difficult times. Stay safe.

“In times of change, learners inherit the earth; while the

learned find themselves beautifully equipped to deal with a world that no

longer exists.”

-Eric Hoffer