Weekly Market Update by Retirement Lifestyle Advocates

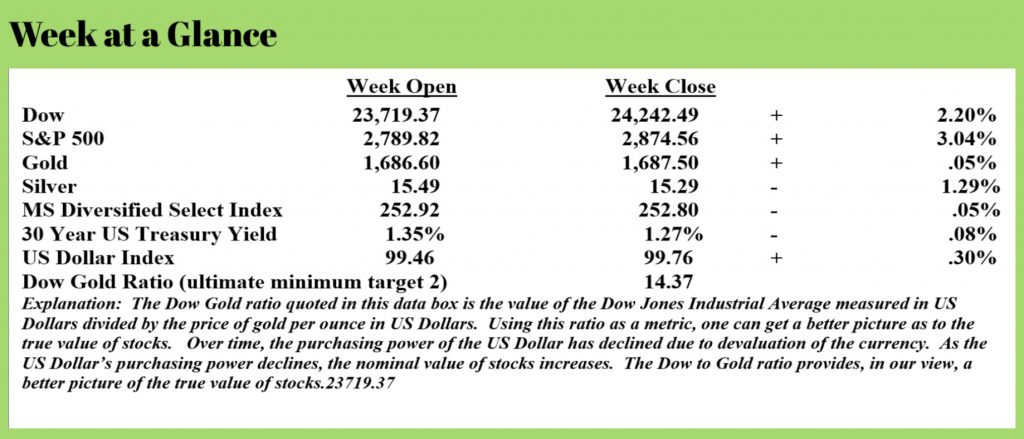

Markets were fairly subdued

last week. Stocks and gold were up

slightly while silver fell. US

Treasuries and the US Dollar rose.

In our view, we are entering

a time of significant financial transition.

Most financial markets are now artificial. As we’ve discussed, the CARES Act changed the

financial rules to allow for more money creation. Prior to the CARES Act becoming law, the

Federal Reserve, the central bank of the United States, could only purchase US

Government bonds and US Government backed mortgage securities.

The CARES Act changed the

rules allowing the Federal Reserve to loan money to the US Treasury to use to

purchase corporate debt securities through the use of a SPV or special purpose

vehicle.

Within a week of that rule change,

the Fed announced it would begin the direct purchase of junk bonds despite the

fact that the central bank has no legal authority to do so.

Monetary policy change is as

extreme as the policies themselves.

Despite the Fed’s venture

into purchasing junk bonds, it seems that there will still be a record number

of defaults on lower quality corporate debt issues. This from “Market Watch” (Source: https://www.marketwatch.com/story/feds-foray-into-buying-junk-rated-corporate-debt-wont-stop-wave-of-defaults-that-could-reach-21-analysts-warn-2020-04-17) (emphasis added):

Even with the Federal Reserve aiming a

$750 billion fire hose at U.S. corporate

debt markets to offset carnage from the pandemic, defaults at

speculative-grade companies already are starting to climb as business buckle

under their debts.

Frontier Communications Corp, LSC Communications Inc., and hospital operator Quorum Health Corp. in April defaulted on a combined $14.3 billion of speculative-grade (or junk-rated) bonds, a sharp uptick from the $4 billion seen earlier in the year, according to B. of A. Global analysts.

They called the Fed’s announcement last week to

start buying riskier assets “bold, surprising, and reflecting its commitment to

respond forcefully to signs of dysfunction in the key corners of U.S. debt

funding markets,” in a client note Friday, but also cautioned that

defaults among junk-rated U.S. companies will likely reach 21% over the next

two years.

The Fed will be directly

buying junk bonds. Yet, despite their

aggressive purchases, Bank of America analysts forecast that 21% of junk bonds

will default. That gives you an

indication of how dismal the financial health of many smaller and already

distressed companies really is.

“Forbes” reported that JC

Penny elected to skip a $12 million interest payment that was due on April

15. (Source: https://www.forbes.com/sites/walterloeb/2020/04/17/pandemic-bankruptcies-threatens-jcpenney-neiman-marcus-and-many-others/#59e688354b10). “Business Insider” reported that the company

was considering bankruptcy (Source: https://www.businessinsider.com/experts-say-several-retailers-to-consider-bankruptcy-amid-coronavirus-2020-4).

It is an accepted fact at this point that even if the constraints put in place to attempt to contain COVID 19 are soon lifted, the second quarter of this year, economically speaking, will be the ugliest in US history. “Market Watch” reported (Source: https://www.marketwatch.com/story/morgan-stanley-forecasts-38-drop-in-second-quarter-us-gdp-2020-04-03) that Morgan Stanley recently lowered second-quarter economic expectations on what was an already dismal forecast (emphasis added):

Morgan Stanley has

lowered its U.S. economic forecasts, as social distancing measures and closures

of nonessential businesses have spread to an increasing number of states. The

bank lowered its first-quarter GDP forecast to -3.4% from -2.4% and its

second-quarter GDP forecast to -38% from -30%.

Later in the article, it was

reported that Morgan Stanley expected 2020 GDP to drop more than at any time

since 1946.

Meanwhile, over the past 4 weeks,

stocks have rallied off their lows.

The stock rally in our view is

reminiscent of past stock rallies – the Fed announces more radical monetary

policies due to deteriorating economic conditions and stocks rally. Financial markets, as noted above, really are

artificial at this point with markets reacting to more easy money the same way

as an addict reacts to another hit.

Short-term the effect is positive,

but long term it will be harmful. And,

the longer the artificial market stimulus is applied, the worse the ultimate

crash will be.

Back in 2011, when the book

“Economic Consequences” was written and then again in 2015 when the

best-selling “New Retirement Rules” was published, we predicted a Dow to Gold

ratio of 2, or more likely 1.

We still stand by that

forecast. Now; however, it seems like

there is a more obvious path forward to that eventual outcome.

Jim Rogers, billionaire investor,

co-founder of the Quantum Fund with George Soros and past guest on RLA Radio

has the same perspective. This from a

recent interview with “Business Insider” when Rogers was asked if the current

crash was going to be the big one. (Source:

https://www.businessinsider.com/coronavirus-market-outlook-forecast-legendary-investor-jim-rogers-federal-reserve-2020-4) (emphasis added):

“In 2008 we had a

very serious problem because of too much debt. Since then, the

debt has skyrocketed everywhere, so it seems to me self-evident. The

next one has to be worse than 2008. People seem to be surprised.

Anyway, so yes, this

is probably it. I'm sure that the rally is going to be nice. It

already is a nice rally. You know, governments all over the world are

spending huge amounts of money, printing huge amounts of money. There is an

election in November, so the rally will probably be nice, but it's not

over, Sara, it's not over.”

When Rogers was asked how low stocks

could go, this was his response (emphasis added):

I can tell you in history, bear

markets go down 50, 60, 70% this is just history. This is not an opinion and

many stocks go down 80, 90%. Some disappear. That's just the way bear

markets work.

It’s important to remember that

markets rarely go straight up or straight down over the long term. That’s true of every market including stocks.

Our opinion remains that we are

likely going to see some initial deflation and then, assuming no change on

monetary policy, probably significant inflation.

Egon vonGreyerz, the founder of Matterhorn Capital Management, states that inflation or hyperinflation has to be the ultimate consequence of the greatest financial bubble in history. He forecasts that massive inflation, like coronavirus, will quickly move from one country to the next with very few being spared (Source: https://goldswitzerland.com/the-greatest-financial-crisis-hyperinflation/). This will be a direct result of money printing by central banks which creates artificial markets. This excerpt from a piece recently written by Mr. vonGreyerz explains (emphasis added):

Ever

since the last interest cycle peaked in 1981, there has been a 39-year

downtrend in US and global rates from almost 20% to 0%. Since in a free

market interest rates are a function of the demand for credit, this long

downtrend points to a severe recession in the US and the rest of the world. The

simple rules of supply and demand tell us that when the price of money is zero,

nobody wants it. But instead debt has grown exponentially without

putting any upside pressure on rates. The reason is simple.

Central and commercial banks have created limitless amounts of credit out of

thin air. In a fractional banking system banks can lend the same money

10 to 50 times. And central banks can just print infinite amounts.

Global

debt in 1981 was $14 trillion. One would have assumed that with interest rates

crashing there would not have been a major demand for debt. High demand

would have led to high interest rates. But if we look at global debt in 2020 it

is a staggering $265 trillion. So, debt has gone up 19X in the last 39 years

and cost of debt has gone from 20% to 0% – Hmmm!

You don’t have to be an economist to

understand that today’s markets are completely artificial. As Mr. vonGreyerz points out, when interest

rates fall, it indicates no demand to borrow money. Yet, despite this, debt has ballooned to

levels that are totally unsustainable.

That simple fact proves our argument

that all financial markets are now artificial.

That’s also why we have long

advocated the two-bucket approach to managing money. One bucket consisting of assets that are safe

and stable to provide income needs and another bucket containing assets that

will function as an inflation hedge.

If you are a client of our company,

you are receiving an invitation to a weekly educational webinar on which we provide

analysis and comment. If you are a

client and for whatever reason are not receiving an invitation to the client

only webinar, call the office at 1-866-921-3613.

We

do have a public educational webinar coming up this week as well. This contains information that our clients

already have. It is designed to educate

and inform about maximizing Social Security benefits and the two-bucket

approach to money management in today’s environment. If you

are not a client or our company but would like to learn more about current

circumstances and strategies that you might employ to not only survive

financially but possibly prosper, you may call the office to register at

1-866-921-3613.

This

week’s RLA radio show features an interview with Mr. Jeffrey Tucker, editorial

director for the American Institute for Economic Research. Host, Dennis Tubbergen, talks with Mr. Tucker

about strategies to consider now in the current economy.

“That is the greatest fallacy, the wisdom of old men. They do not grow wise, they grow careful.”

-Ernest Hemingway