Weekly Market Update by Retirement Lifestyle Advocates

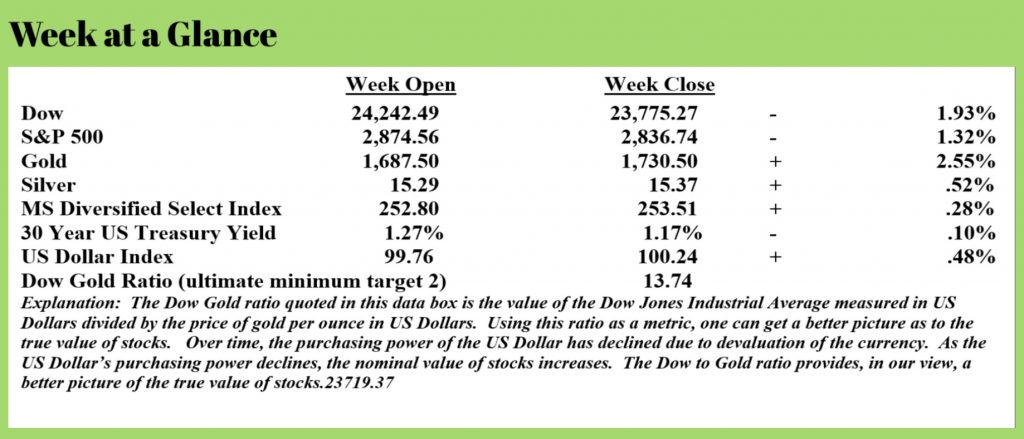

Volatility declined in markets last week. Stocks fell while metals rose.

Last week, we stated that we are entering a time of significant financial transition.

While that is clear, the ultimate direction of the transition is dependent on one, vitally important fundamental question. Will the Federal Reserve continue money creation literally from thin air indefinitely until faith in the currency is eventually lost? Or, will the Federal Reserve stop short of that, preserving the US Dollar but allowing markets and the economy to go through a deflationary financial reset?

That is not a new question.

In 2011, in the book “Economic Consequences”, we wrote about the slippery slope of money printing and the two inevitable outcomes. The first, money creation continues until faith in the currency is lost. Or, the second, money creation stops, and the forces of debt excesses thrust the economy into a deflationary recession or depression.

In the 2016 book “New Retirement Rules”, we revisited these two outcomes and confirmed that we would have to experience one or the other.

Presently, it appears the Federal Reserve has no intention of slowing down or stopping the money creation.

While the corona-virus situation has muddied the water from a financial and economic analysis perspective, money creation began again in earnest in September of 2019, a full 6-months before the coronavirus restraints were implemented.

In other words, money creation in the trillions of dollars began long before anyone heard of COVID 19.

After the Great Recession of 2007-2009, the Federal Reserve began ‘temporary’ and ‘emergency’ measures of quantitative easing to assist the economy’s transition from bust to recovery. At that time the ‘extra-ordinary’ measures taken were to create billions of dollars per month through quantitative easing.

It seemed that it worked for a while. But it never works long term.

As we have noted many times over the past decade in books and in this publication, as time passes, more money needs to be created to get diminished results.

Beginning last September,

the Federal Reserve began injecting tens of billions of dollars into the repo market,

which is the overnight, intrabank lending market. On October 7, in this publication, we reported

on this and warned it was a red flag of problems to come. We talked about it again on October 21.

Presently, in response to COVID 19, money creation is off the charts. The Fed is printing money for the US Treasury to backstop corporate debt and is printing still more money to directly purchase junk bonds. From March 11 to April 13, the Fed’s balance sheet has expanded from $4.31 trillion to $6.13 trillion. That’s an eye-popping 42% increase in only one month. (Source: https://www.strategic-culture.org/news/2020/04/21/real-new-deal-debt-jubilee-or-green-new-deal-global-dictatorship/)

While no one knows exactly how long the Federal Reserve can print without a loss of confidence in the US Dollar causing a currency collapse, we can all acknowledge it’s not forever.

Which brings us back to the question, will they stop or won’t they?

Over the past month, we have had many conversations with many very bright economists and financial experts. We have concluded that no one knows for sure.

So, it’s best to prepare for either outcome understanding that by doing so, one strategy will ultimately be wrong, but you have a good chance to protect yourself and even prosper.

The first outcome has the Fed put the brakes on money creation.

That leads to a deflationary depression.

As bad as that sounds, that’s the better of the two outcomes here.

Under our money system, since 1971 when the link between the US Dollar and gold was eliminated, money has been loaned into existence. If the Federal Reserve wanted to create more money, the central bank would reduce interest rates to encourage more borrowing. The result was more money and the illusion of prosperity. I intentionally use the word “illusion” here since debt-fueled consumption does not ultimately lead to prosperity, rather it leads to the exact opposite.

After the Great Recession, when interest rates were reduced to 0%, no one borrowed. The strategy that the Fed had used for the past 35 years suddenly quit working.

Why?

The answer is simple.

There was too much debt. Speaking figuratively, citizens and businesses had collectively maxed out their credit cards and couldn’t take on more debt.

The Fed was backed into a corner.

They had two choices, endure the deflationary recession or depression, allowing irresponsible banks to fail or bail out the banks and resort to money printing. The Fed chose the latter and the can was kicked down the road.

In September of last year, as noted above, the Fed again faced a similar choice although it was not widely reported. The Fed again chose money creation.

Now, that money creation has reached levels that seem totally ludicrous and will undoubtedly be impossible to maintain for any extended period of time. One of the two admittedly ugly outcomes will have to soon emerge – devastating deflation or massive inflation.

Alasdair McLeod, a past guest on the RLA Radio program and highly regarded economist reasons that, as far as money creation is concerned, it may already be too late. In his piece titled, “Anatomy of a Fiat Currency Collapse” (Source: https://www.goldmoney.com/research/goldmoney-insights/anatomy-of-a-fiat-currency-collapse), he concludes that some or all fiat currencies could be gone by the end of the year.

Mr. McLeod concludes (accurately) that government inflation statistics cannot be trusted. That’s something that we’ve discussed extensively in this publication and on RLA Radio with guest experts like Dr. Chris Martinsen and Economist John Williams. Government inflation reporting uses ‘adjustments’ to the reported inflation rate like hedonic (pleasure) adjustments as well as weighting adjustments and substitution to arrive at an inflation number that is lower than reality.

The Chapwood Index, a private inflation index, that tracks the prices of 500 consumer items has the actual annual inflation rate at about 10% which is very close to the alternative inflation number reported by John Williams of Shadow Stats.

Mr. McLeod’s second point in the excellent piece is that the general populace lacks a general understanding and is generally ignorant of what inflation or an expansion of the money supply actually does. He states, “given proclamations by central bankers that they are about to hyperinflate, ignorance of monetary matters becomes an expensive condition. When trying to understand money, credit, and how they flow, the vast majority of people find themselves in an Alice in Wonderland confusion where nothing makes sense. They are setting themselves up to lose everything they possess.”

Mr. McLeod explains that inflation comes in two phases and the first phase is coming to an end. Worldwide, all citizens expect that their currencies will buy less in the future without actually understanding exactly how much purchasing power has already been lost. In the case of the US Dollar, McLeod found that when measured against gold, the US Dollar has retained only 2.2% of its 1969 purchasing power.

At the present time, Mr. McLeod speculates, we are entering the second phase of inflation which is currency destruction.

McLeod writes: “With the general public and virtually all the financial establishment ignorant of or blind to the inflationary situation, central banks have chosen this moment to announce unlimited monetary expansion to buy off the consequences of the coronavirus. They have committed to the virtual nationalization of their economies, to be paid for by debauching their currencies. The process depends on public ignorance of the consequences. In all the announcements of government support for their economies and of their central banks’ monetary role, there has been virtually nothing said or written about the consequences of the monetary inflation involved.”

It is during phase two Mr. McLeod states that the general public will wake up and become aware of the fact that the currency is collapsing.

This collapse in purchasing power will be exacerbated by the fact that many foreign entities holding US Dollar-denominated assets will find themselves in a position of needing to liquidate them due to the rapidly deteriorating economy. And, given the artificially low-interest rates presently, there is not much that is attractive about owning US Dollar assets.

McLeod says, “On both Wall Street and Main Street, Americans are bound to become increasingly aware of the inflationary consequences. The problem for the Fed is that there is no Plan B alternative to financing by means of inflation of money and credit, particularly in an election year.”

After a persistent and unusually protracted period of monetary inflation over the last fifty years, it is increasingly likely the public will finally understand what is happening to prices. They will then begin to realize that it is excessive quantities of money in circulation that is the reason for rising prices and that they must dispose of currency as quickly as possible for anything they want or can barter in the future for something else. Empirical evidence is that this second and final phase of monetary debasement is likely to last only a matter of months.

Once this second phase starts, it is almost impossible to stop it, because the public will have lost faith not just in the currency, but in the government establishment’s monetary

and economic policies as well. It ends when an unbacked fiat currency is no longer accepted as money by the public.”

Whether the outcome of the present situation is deflation or inflation as Mr. McLeod has described, there is a lot at stake here.

Educate yourself.

If you are a client of our company, you are getting an invite to a private, client-only webinar update.

We do have a public educational webinar coming up this week as well. This contains the information that our clients already have. It is designed to educate and inform about maximizing Social Security benefits and the two-bucket approach to money management in today’s environment. If you are not a client or our company but would like to learn more about current circumstances and strategies that you might employ to not only survive financially but possibly prosper, you may call the office to register at 1-866-921-3613.

This week’s RLA radio show features an interview with Ian Gordon, former director of The Long Wave Group. Mr. Gordon predicted some of the events we are now seeing 7 years ago. We visit with him again to get his perspective on current conditions.

“It is well enough that the people of the nation do not understand our banking and monetary system. For if they did, I believe there would be a revolution before tomorrow morning.”

-Henry Ford