Weekly Market Update by Retirement Lifestyle Advocates

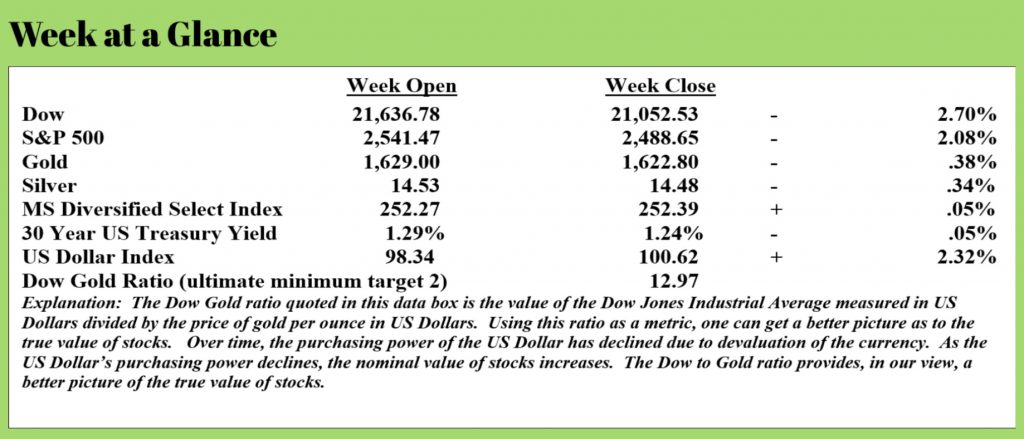

Stocks fell last week in

what would have been considered a volatile week not that long ago. Given recent stock market price action

however, last week’s price action in the major stock market indices was

relatively calm.

Metals fell slightly, the US

Treasury long bond rallied some and the US Dollar strengthened on a relative

basis.

Financial and economic

conditions continue to rapidly change and evolve.

Money creation by the Federal Reserve continues to intensify. As of April 1, the Fed’s balance sheet hit $5.8 trillion an increase of $557 billion in just one week. You read that right; the fed created more than a half-trillion dollars in just one week! (Source: https://www.zerohedge.com/markets/feds-balance-sheet-hits-6-trillion-16-trillion-3-weeks)

The Fed officially revived

the quantitative easing program (money printing) on March 13 as it began its

current “bailout everything and everyone” program. Since then, over the last few weeks, the Fed

has printed more than $1.6 trillion.

Money creation at this pace may mean that our projection of a $10 trillion Fed balance sheet at year-end will be low as incredible as that seems.

Lest you think that high-volume

money creation is a new phenomenon in response to the corona-virus situation,

think again. This response first began

in September of 2019 when the Fed began printing money to prop up the repo

market – the overnight lending market between banks.

While coronavirus was not

predictable, the eventual outcome of this Fed policy has been completely

predictable. We wrote this in the

October 7, 2019 issue of “Portfolio Watch”:

There is currently a grand experiment taking

place. Policymakers are trying to

determine how far below zero yields can actually fall. Our take is that on a global basis, yields

can continue to fall for a little while yet, but the bottom can’t be far away.

When the bottom hits and bond investors panic, that may very well be the catalyst that drives stocks and bonds lower.

At that point, the policy response may be more

money creation. Since that is a real

possibility, owning some tangible assets like precious metals along with highly

rated corporate bonds might be a good idea.

In

our view, we are now on our way to the bottom.

The Fed is pulling out all the stops to attempt to reflate the

bubble. Given the numbers, it’s our firm

conviction that they will fail. At best,

they may delay the inevitable for a brief period of time.

History

teaches us that massive money creation schemes always end badly.

History also teaches us that tangible assets are the best hedge against inflation. We are in the process of helping our clients find physical gold, silver, and platinum in order to add to their holdings of tangible assets. While it requires a bit of work to locate precious metals in which to invest at a reasonable price, it can now likely be accomplished. That was not the case last week.

If

you don’t own physical gold, silver or platinum, we’d urge you to get

some. These metals can also be held in

an IRA or a Roth IRA account.

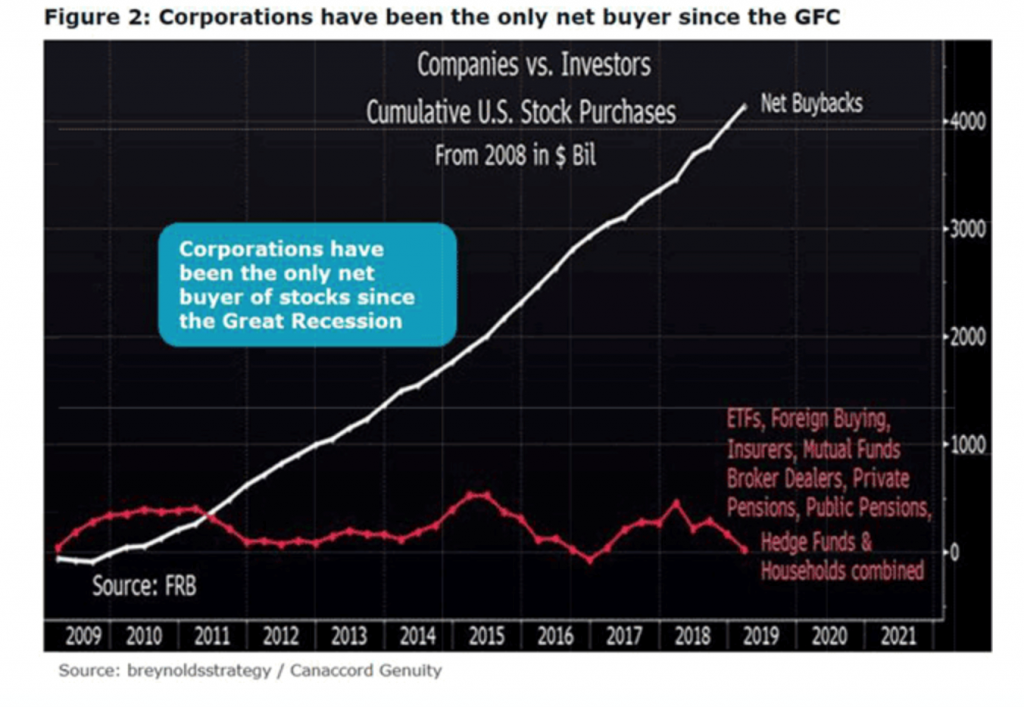

We are surprised at the level of bullishness that still exists as far as stocks are concerned. It’s important to understand that the biggest purchasers of stocks since the financial crisis have been the companies that issued the stock. Stock buybacks have been one of the primary driving forces behind the bull market in stocks that, at this point, is just a fond memory.

In his excellent weekly newsletter, “Thoughts from the Frontline” (Source: https://www.mauldineconomics.com/frontlinethoughts/notes-from-lockdown) publisher and economist John Mauldin commented on this phenomenon this week (emphasis added):

The stock market had a rough first quarter. The

second one may not be much better and could be worse. But more than a few

traders expect a quick recovery once the virus is under control. Many

expect the various Fed injections and stimulus programs to drive asset prices

higher in late 2020. I have my doubts.

A report I just saw from Canaccord Genuity analysts Tony Dwyer and Michael Welch says the market may have another problem. For prices to rise, the market needs a) willing buyers who b) have the cash to spend. Who is going to fill that role?

Well, since the Great Financial Crisis, the

primary stock buyer has been the listed companies themselves via their stock

repurchase programs. Their net purchases dwarf all others.

This is a problem for bulls because the main buyer is suddenly leaving the scene. One reason is political pressure. It’s a bad look to be rewarding shareholders when the country is in such dire straits. But that aside, many companies are already highly leveraged and, with a recession looming, need to conserve their cash and borrowing power. Buybacks are not a priority. On top of that, the CARES Act restricts buybacks from companies receiving federal loans, loan guarantees, or other assistance.

All that means buybacks will

likely be scarce for a while, and stock prices may have a hard time rising

unless some other large buyer appears. Bull markets require people

willing to buy. Bear markets develop simply in the absence of buyers.

We agree with Mr. Mauldin.

It will be difficult for stocks to rise to their prior

levels.

Last week, we shared the market capitalization to gross

domestic product chart with you. It’s

Warren Buffet’s favorite indicator to evaluate stock prices. A fact that has gone largely unnoticed by

many market pundits it that after the recent stock decline, valuations fell

to a level that was equal to stock valuations at the start of the 2007 decline.

During the great recession, the biggest hit to gross domestic product in any quarter was 8.4%. We are looking at 4 times that level in the second quarter of this year.

Speaking

of Mr. Buffet, Berkshire Hathaway held massive levels of cash at the end of

2019. This from “Barron’s” (emphasis

added):

The company held $125 billion in cash and

equivalents at its insurance and other key businesses at the end of 2019. Some $101 billion, or 81% of that $125

billion was in ultra-safe U.S. Treasury bills, equal to nearly 4% of the $2.6

trillion of T-Bills in public hands. Berkshire has another $3 billion of cash

and equivalents elsewhere at the company. The cash and equivalents

account for about 25% of Berkshire’s market value.

Let’s read between

the lines here a bit.

If you’re a raging

stock market bull, you don’t have 25% of your assets in cash with almost no

yield.

And, while we have no first-hand knowledge of Mr.

Buffet’s thinking presently on financial markets, it’s interesting that be just

dumped airline stocks. This from CNBC

(emphasis added):

Warren Buffett’s Berkshire Hathaway said on Friday it sold

about 18% of its stake in Delta Air Lines and 4% of its holdings in Southwest Airlines this week, as the coronavirus

pandemic drives the airline industry into perhaps its biggest crisis ever.

According to regulatory

filings, Berkshire sold nearly 13 million Delta shares for about $314 million

and roughly 2.3 million Southwest shares for about $74 million.

The sales were conducted on

Wednesday and Thursday, the filings show. Berkshire previously owned about

11.1% of Delta stock and 10.4% of Southwest stock, according to Refinitiv data.

Again, reading between the lines, is that action you take

if you’re anticipating a “V-shaped” recovery?

We

are living in unprecedented times. Be

informed. Be educated.

If

you are a client of our company, you are receiving an invitation to a weekly

educational webinar on which we provide analysis and comment. If you are a client and for whatever reason

are not receiving an invitation to the client only webinar, call the office at

1-866-921-3613.

We

do have a public educational webinar coming up this week as well. This contains information that our clients

already have. It is designed to educate

and inform. If you are not a client or

our company but would like to learn more about current circumstances and

strategies that you might employ to not only survive financially but possibly

prosper, you may call the office to register.

This

week’s Retirement Lifestyle Advocates Radio Program is now posted at www.RetirementLifestyleAdvocates.com. This week, host, Dennis Tubbergen, interviews

David Skarica of the “Addicted to Profits” newsletter. David offers his forecast and some inflation

predictions.

If

you know of someone that might benefit from the information in this weekly

publication, direct them to get a free subscription at www.RetirementLifestyleAdvocates.com.

As

you all know, we respect the privacy of our subscribers and never inundate them

with e-mails.

Again,

blessings to all of you in these difficult times. Stay safe.

“In politics, absurdity is not a handicap.”

-Napoleon Bonaparte