Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

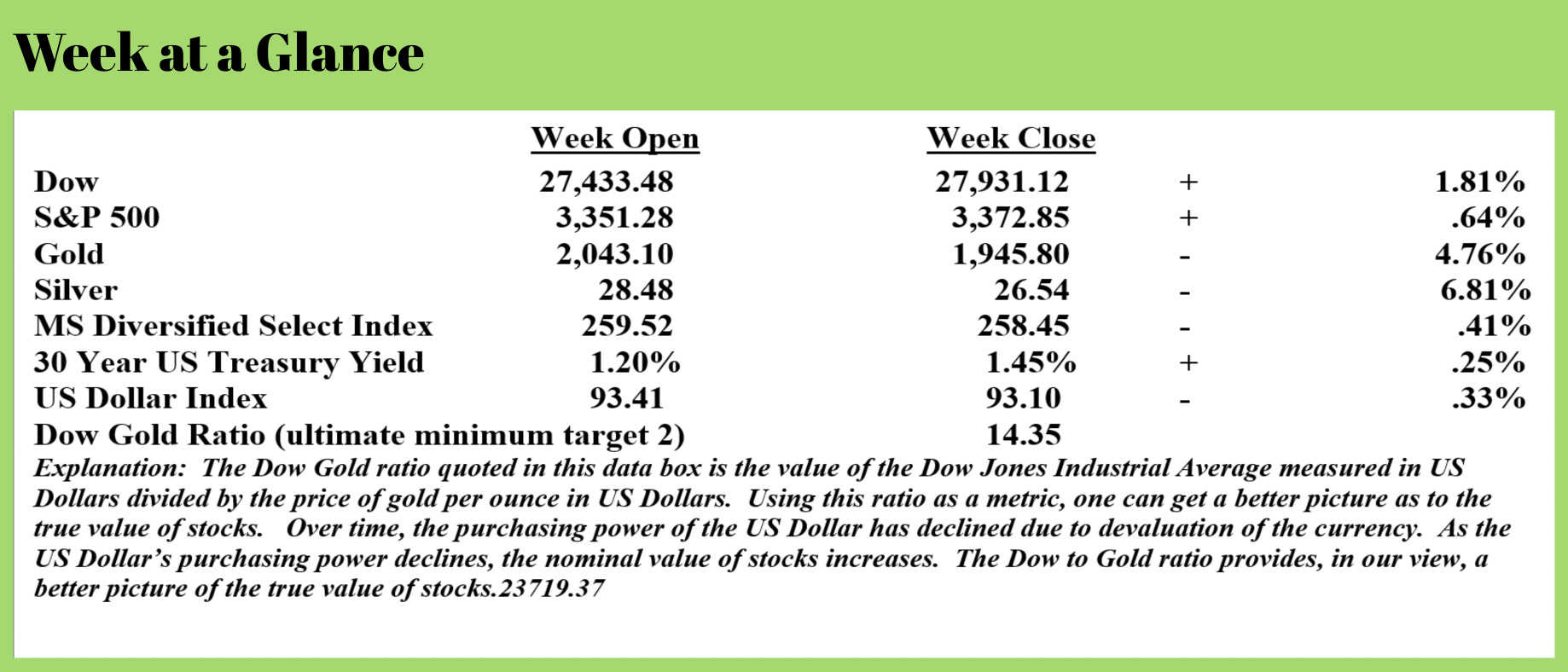

As we suggested might happen on our “Portfolio Watch” live webinar last week, both gold and silver pulled back after big, parabolic moves up. It would not be unusual to see the pullback continue for a bit or to see these markets consolidate. From a fundamental perspective, we remain bullish on precious metals.

By our technical measures, stocks are now once again in an uptrend. We remain very skeptical of stocks given that stock valuations using the market capitalization to gross domestic product ratio is at all-time highs.

In this week’s “Portfolio Watch” report, we’ll examine the financial state of many states and cities around the country. In a word, many states and cities have finances that are abysmal.

John Rubino of dollarcollapse.com and past RLA radio guest had this to say on the topic last week (emphasis added):

Lacking monetary printing presses, US cities and states tend to behave more like normal economic entities than do most nations. That is, they’re always balanced on the knife-edge of insolvency as taxes fail to cover the promises, legitimate and otherwise, that mayors and governors have made to voters.

Toss in the COVID-19 lockdowns and – in a few especially badly-run places, continuing riots – and many if not most American cities and states are looking at functional bankruptcy, featuring mass layoffs of teachers, cops, librarians and pretty much every other kind of employee. Trash won’t be collected, libraries won’t open, 911 calls won’t be taken.

To repeat the guiding prediction of this series, American towns will look more like Caracas than Zurich.

The one hope mayors and governors have been nursing is a massive federal bailout that papers over unfunded pensions and ongoing operating deficits alike with trillions of newly created dollars.

This prospect seemed imminent just a couple of weeks ago. After all, in an election year how can Washington allow the above carnage? But now imminent seems to be off the table and even “inevitable” is in question. Republicans (who don’t much care about big cities run by the opposition) and Democrats (who desperately want a bailout, but maybe not as much as they want to crush Trump in November) can’t agree on a new plan and have, for now at least, given up trying.

Mr. Rubino references an Associated Press article in his piece (emphasis added):

Stay-at-home orders in the spring, business shutdowns, and tight restrictions on businesses that have reopened are slamming state and local government revenue. In a June report, Moody’s Analytics found that states would need an additional $312 billion to balance their budgets over the next two years while local governments would need close to $200 billion.

Many states already are staring at ledgers of red ink. Texas is projecting a $4.6 billion deficit. In Pennsylvania, it’s $6 billion. In Washington state, the deficit is expected to be nearly $9 billion through 2023. California’s budget includes more than $11 billion in cuts to colleges and universities, the court system, housing programs, and state worker salaries.

Will the Washington politicians bail out state and local governments?

This being an election year, there will probably be some additional form of a stimulus package and it’s important to remember that regardless as to the extent that state and city governments are included in the package, there is no money to pay for such a package without once again resorting to the printing press and simply creating the money that is needed to fund any additional spending.

That’s the problem. Nothing is free. There is ALWAYS a tax to pay, either an actual tax where the government has you parting with some of your hard-earned dollars or an inflation tax where the value of the currency is diminished.

An inflation tax punishes savers and investors.

On this week’s RLA Radio program, guest expert, Peter Schiff, commented that presently 60 cents out of every dollar that the United States spends is created by the Federal Reserve.

As next weeks’ RLA Radio guest, Jeff Deist, president of the Mises Institute and former advisor and chief of staff to Congressman Ron Paul noted when the year 2020 began a $1 trillion operating deficit at the federal level was anticipated.

Now, however, the reality of the situation is that the United States could finish the year with an operating deficit that exceeds total tax receipts. That is simply remarkable when you think about it. And, it’s completely unsustainable.

While it remains to be seen if the Washington politicians decide to bail out states and cities and to what extent, it’s likely that many states and cities will require more than one bailout even if they get their first one.

We reach this conclusion for a couple of reasons.

First, state and city tax revenues will continue to decline as lockdowns in response to COVID continue to force more businesses to permanently close. As we have reported here in “Portfolio Watch”, many businesses that closed temporarily to comply with lockdown restrictions are now closed permanently. Businesses that are permanently closed no longer pay taxes.

Second, there is literally an exodus taking place from many states and municipalities as people are seeking out a peaceful country living. This will further diminish tax revenues in these areas. Past RLA Radio program guest, Jim Rickards had this to say on the topic (emphasis added):

I want to discuss some of the permanent changes that the national economy is going through. It has to do with what you might call the Great American Exodus. There’s a massive migration out of the big cities. Millions of Americans are fleeing the cities for the suburbs or the country from coast to coast.

There’s hard data to support that claim.

For example, let’s say you want to rent a U-Haul trailer from New York City to the Catskill Mountains, which are not that far away. Or you want to rent a U-Haul trailer from Los Angeles to, maybe Sedona, Arizona.

It’ll cost you much, much more than if you were going the other way. If you went from Sedona to LA or the Catskills to New York, the price is only about one quarter as much. In other words, you have to pay a 400% premium to get the trailer going out of town, but U-Haul will practically pay you to bring it back in.

And there are shortages. If you’re moving out of your apartment to a house or another apartment outside of the city, try getting movers. I’ve done this recently myself, and know others who have. It was very hard to book moving companies or something as simple as a U-Haul trailer.

So the mass exodus out of cities is a real phenomenon, backed by solid evidence.

This is a shift we probably haven’t seen since the 1930s, when people left the Dust Bowl and moved out to California, looking for jobs in the agricultural industry. That was a mass migration. We’re seeing another one now, except this one’s going in the opposite direction.

And that’s a big problem for the economy because cities are centers of economic activity that contribute a lot to GDP.

Rickards cites three reasons for this mass migration.

One, millennials are getting older. The first of the millennial generation will turn 40 in a couple of years. It’s normal for people who enjoyed living in the city in their 20’s and 30’s to want to move to the country as they get older.

Two, the pandemic. Highly populated areas are inherently more dangerous when it comes to virus transmission. Many people are looking to minimize that risk by moving to less populated areas.

Three, the riots. Peaceful protests are protected by the constitution. Peaceful protests against injustices should be supported. But, no one has a right to loot stores and burn buildings; that shouldn’t even be a debate.

Rickards adds that calls to defund the police are making many city dwellers see the writing on the wall and they’re opting to move while they can. Rickards notes that crime rates in New York are already rising and since the riots, retirement applications among police officers have increased by 400%.

No matter the amenities offered by city life; if citizens perceive it to not be safe, many will understandably opt to move. And they are.

Rickards concludes by saying (emphasis added):

Now, you cannot underestimate the economic impact of this. The cities are where most 80% or more of the population, economic output, job creation, and R&D are centered. And who’s leaving the cities?

It’s the people who can have the option to leave. It’s the talent. It’s the money. It’s the energy. It’s the people that you most want in your cities who have the ability to leave.

And of course, now we have this whole work from home model. So a lot of corporations are saying, we don’t need 10 floors on 53rd and Park Avenue. We can do two floors of shared conference facilities, with a shared receptionist. So the commercial real estate market faces some strong headwinds.

The bottom line is, we’re looking at a substantial drag on economic recovery based on this migration out of the cities. It’s a big story that’s not getting nearly enough coverage.

As economic recovery lags, so do tax revenues. As people leave cities, taxes these people would have paid leave with them.

The facts are pretty clear. One bailout of states and cities will lead to another. And if you’re a saver or investor, you’ll be paying for the bailout via the inflation tax.

There is still time to protect yourself. If you’ve not already done so, consider using the two-bucket approach to manage your assets.

You might also be wise to see if it makes sense for you to eliminate the tax liability on your IRA or 401(k) while tax rates are lower. We can help. If you’d like an analysis done on your ultimate income tax liability on your retirement account(s), give the office a call at 1-866-921-3613.

As noted above, this week’s RLA radio show featuring special guest, Peter Schiff is now posted at www.RetirementLifestyleAdvocates.com.

“However beautiful the strategy, you should occasionally look at the results.”

-Sir Winston Churchill