Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

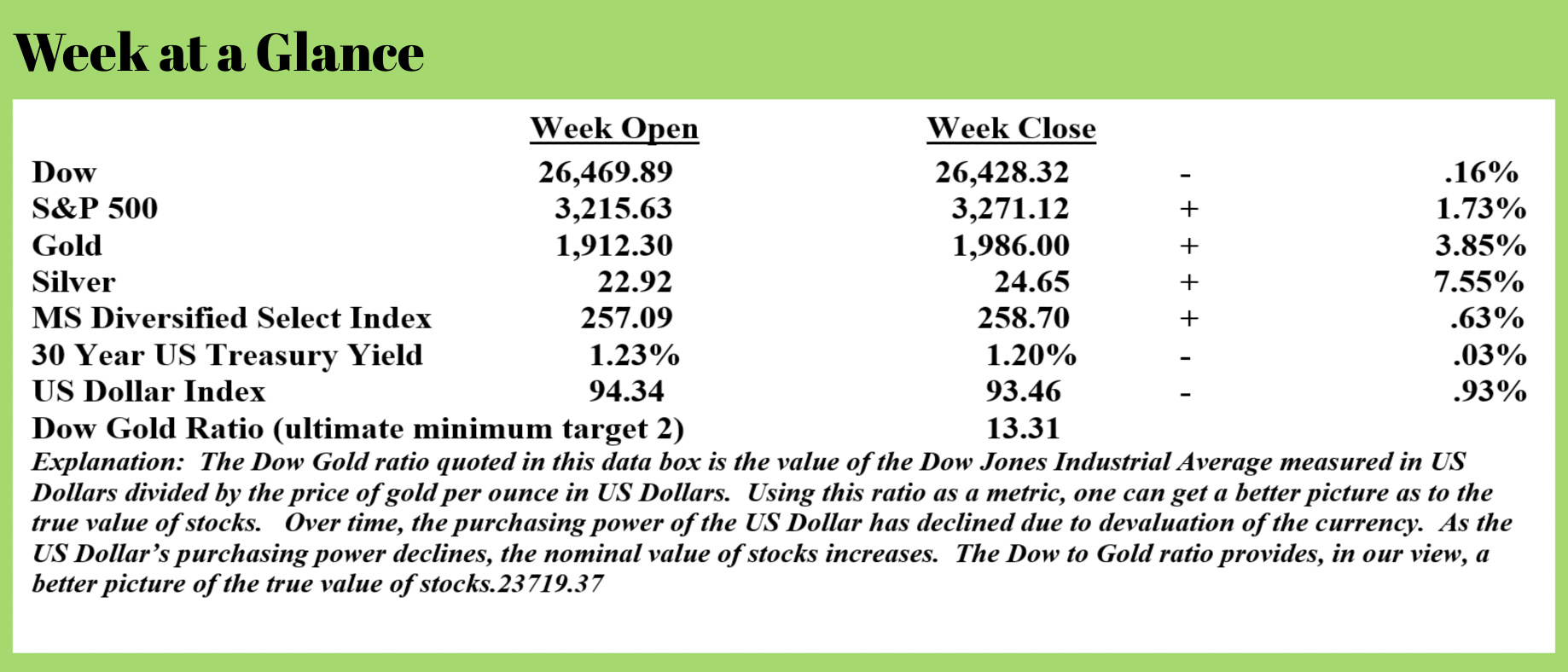

Metals continued their breakout last week. Gold advanced another 3.85% while silver jumped more than 7.5% on price. As we stated last week, we expect that this trend will continue over the long term as the Federal Reserve will likely continue its easy-money policies.

Given the big run-up in price in the metals, it would not be surprising to see a pause in the rally or even a fairly significant pullback. However, we would suggest that many investors consider using pullbacks as a purchase opportunity.

Since the economy just officially experienced the worst quarterly decline in US history, we expect that there will be more stimulus coming from Washington. It’s already being discussed. As we all know, there is no money to fund another stimulus package so it will be funded the same way as the last economic rescue bill was funded – more money will be created from thin air.

That will continue to be bullish for metals and be bearish for the US Dollar.

The US Dollar Index, which measures the purchasing power of the US Dollar against other fiat currencies has declined notably as the Fed has been engaging in money printing. On March 20, the US Dollar Index stood at nearly 103. Presently, it stands at 93.46; that’s a decline of more than 9% in 4 months. Huge when looking at currency valuation from a historical perspective.

It’s important to remember that the currencies against which the US Dollar is being measured are also fiat currencies that are also being devalued. The US Dollar is just presently winning the “race to the bottom”.

It seems clear to us that the current policy of money printing will now continue until confidence is ultimately lost in the currency. Since the financial crisis, we have always taken the position that money printing to the point of currency failure was one possible economic outcome. The other potential end result was a deflationary depression like the one experienced in the 1930’s. The deflationary outcome would be the result of ceasing to print money and allowing the debt to be purged from the system.

While there are many analysts whose opinions we respect who still hold to the view that the deflationary outcome will be the most likely outcome, it seems to us that we may be past the point of no return when it comes to money creation.

In either scenario, a reset will have to occur. Resets occur when unsustainable economic conditions exist. Presently, debt levels in the private sector and on the balance sheets of every level of government are totally unmanageable. At the federal level, debt and unfunded liabilities are well in excess of $100 trillion. Third-grade math concludes that this debt and these liabilities will never be paid. And yet, the federal government continues to spend at levels never before seen.

Why?

Reversing the spending trajectory results in the deflationary, 1930’s style reset. So, the politicians and the federal reserve are doubling down in an effort to avoid that outcome doing the only thing they know how to do. Spend and print.

This course of action, should it continue, assures that the reset will be an inflationary, or hyperinflationary outcome.

Since 2014, we have been suggesting to many clients that they begin to add precious metals to their portfolio. As time has passed, and the likelihood of an inflationary outcome increased, we have recommended that metals holdings increase. For many investors, holding 20% of a portfolio in precious metals may be advisable.

So, what will the coming reset look like?

Every area of the economy will be affected in our view.

As we discuss in the August “You May Not Know Report”, we expect to see anywhere from 1/3rd to nearly half of all colleges and universities cease to exist. While top-tier universities with large endowment funds will be fine financially, many second-tier universities and colleges with limited endowments will fall by the wayside. There are already entire campuses for sale at what would have been considered to be bargain-basement prices just a year or two ago.

The American Alliance of Museums published the results of a survey that was conducted among 760 member museums. One-third of the museum directors reported a high likelihood of the museum closing permanently within the next 16 months. (Source: https://www.zerohedge.com/markets/third-us-museums-not-confident-they-will-survive)

Many small businesses, devastated by lockdown orders, have closed. Now, with lockdown orders again being imposed in many states, small businesses that weathered the initial round of lockdown orders, are now closing permanently.

As many as 1/3rd of New York City’s businesses will never reopen (Source: https://nypost.com/2020/07/20/a-third-of-nycs-small-businesses-may-never-reopen-industry-report/).

Of the businesses listed on Yelp as being temporarily closed due to government-imposed lockdowns, 55% now convey they are permanently closed (Source: https://www.marketwatch.com/story/41-of-businesses-listed-on-yelp-have-closed-for-good-during-the-pandemic-2020-06-25).

These developments are all deflationary and will contribute to another collapse in the banking system which we believe is inevitable and is quickly approaching. Ironically, as past RLA Radio guest Alasdair Macleod suggests (https://www.goldmoney.com/research/goldmoney-insights/the-path-to-monetary-collapse) it is this event that will lead to a loss of confidence in the currency which is always the ultimate cause of an inflationary currency failure. This from Mr. Macleod’s piece “The Path to Monetary Collapse” (emphasis added):

Governments and central banks can be expected to cooperate with each other to stop their currencies collapsing, but ultimately it is a matter for the general public. While inflations have persisted for considerable periods, the final collapse, when the public realizes what is happening to money, in the past has typically taken between six months and a year. The German inflation 97 years ago started before the First World War, but its catastrophic phase can be identified as starting in May 1923 and ending the following November. John Law’s monetary collapse, the closest parallel to that of today, ran from approximately February 1720 to the following September.

In the run up to its collapse, Law’s Mississippi experiment depended increasingly on money-printing to support financial asset values. The same inflationary policies apply today. The end point of Law’s inflationary stimulation is lining up to be identical with our neo-Keynesian experiment, and on that basis alone is increasingly likely to come to a rapid conclusion.

It’s generally accepted that the Fed’s policies are propping up stocks as Mr. Macleod points out. JP Morgan CEO, Jamie Dimon had this to say on the topic (Source: https://needtoknow.news/2020/05/jp-morgans-dimon-admits-fed-liquidity-is-propping-up-stocks/) (emphasis added):

The Fed’s liquidity, bringing out the bazooka, is propping up stock prices as well as all other asset classes.”

We track the Dow to Gold ratio since it is, in our view, a better way to determine the true value of stocks. Since the year began, stocks priced in gold have become more affordable. Earlier in the year, the Dow to Gold ratio was around 19 and the ratio presently stands at about 13. That’s a decline of more than 30% in the value of stocks when priced in gold.

New readers should be aware that the Dow to Gold ratio is simple to calculate. One takes the value of the Dow Jones Industrial Average in US Dollars and divides by the value of an ounce of gold in US Dollars. Since the value of US Dollars is rapidly changing but an ounce of gold is unchanged, pricing stocks in gold is a much more accurate way to determine the real value of stocks.

As long-term readers know, our forecast is for the Dow to Gold ratio to reach 2 or more likely 1.

A Dow to Gold ratio of this level is not historically unprecedented. In the early 1980’s. gold was selling for $850 per ounce and the Dow was at 850.

A similar relationship (with different numbers) is a likely outcome this time around too.

This week’s RLA radio show is now posted at www.RetirementLifestyleAdvocates.com.

This week’s program features an interview with Alasdair Macleod mentioned above.

During this interview, Mr. Macleod discusses his forecast for the US Dollar and gold and also reveals how he sees the timing of his forecast moves.

“That man is richest whose pleasures are the cheapest.”

-Henry David Thoreau