Weekly Market Update by Retirement Lifestyle Advocates

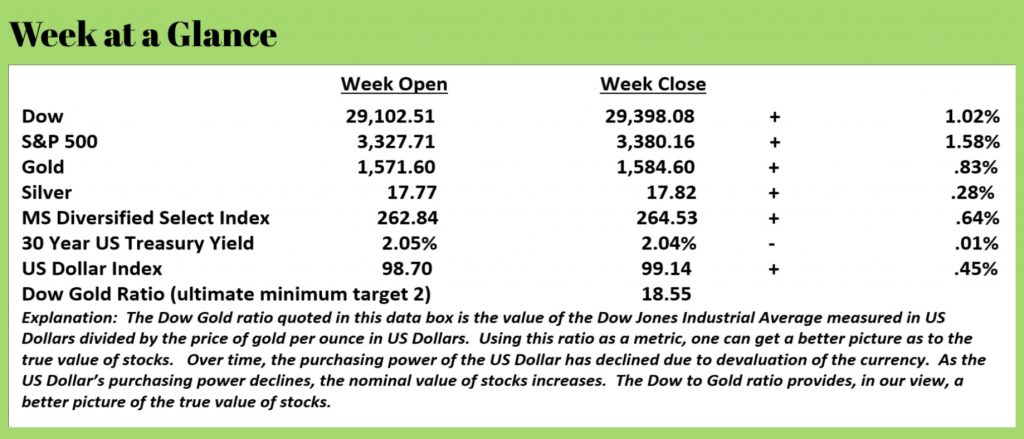

All markets finished higher last week. Stocks continued their rebound after touching the 50-day moving average. Metals were once again higher as well.

If you regularly read “Portfolio Watch”, you know that as recently as last week we wrote about the strong correlation between the Federal Reserve’s expanding balance sheet and the continued rise of stocks.

For newer

readers who may not be familiar with what expanding the Fed’s balance sheet

might actually mean, it simply means the Fed is printing money.

Historically

speaking, the pursuit of this policy never ends well. And, once the practice starts it’s a very

slippery slope and extremely difficult to stop.

But, the practice can’t go on forever.

As the late economist, Herbert Stein said, “if something cannot go on forever,

it will stop.”

Simple, but

profound.

This past week, Societe Generales strategist, Albert Edwards commented on this practice and also forecast what’s next in his view. For those unfamiliar, Societe Generales is a French-based, multi-national investment bank.

Mr. Edwards stated that he believes the Fed’s fondness for “pouring more and more liquidity” into the markets will ultimately lead to a deflationary bust. When the bust occurs. Mr. Edwards predicts the Fed will turn to negative interest rates to try to recover.

For the

uninitiated reader, “pouring more and more liquidity” simply means to print

money.

In a letter

to the bank’s clients, Edwards called the Fed’s actions a “new level of fiscal

debauchery for the US” that won’t stop.

Obviously, if you’ve been reading this weekly update for any length of

time, you know that we agree.

This from

the article (Source: https://moneyandmarkets.com/albert-edwards-nirp-mmt/) (emphasis

added):

And when the crash comes, Edwards predicts the only thing the Fed will be able to do is to engage in negative interest rate policy (NIRP).

“(I’m) now more convinced than ever before that the coming

deflationary bust will take the US 30-year yield below zero,” he said.

“I am also convinced that helicopter money will be the chosen way out of

this deflationary quagmire, especially as it becomes increasingly clear that

there is now no way left to reverse every government’s exploding fiscal

liabilities. The Ice Age is nearing the end.”

Looking around the world, negative interest rates are now the norm

in Japan and parts of Europe. Around $11 billion of global sovereign debt is

yielding in the negative currently, and U.S. President Donald Trump has blasted the Fed in the past for not being more open

to trying NIRP.

Edwards also thinks Modern

Monetary Theory (MMT), aka “helicopter money” is inevitable as well,

which backers of the policy believe is OK to use as long as inflation doesn’t

balloon out of control.

On the surface, it’s difficult to reconcile money printing with a

deflationary bust that sees many asset prices, particularly financial asset

prices plummet. When one thinks about

money printing, inflation is the anticipated outcome in the minds of most

people.

Technically defined, deflation is a contraction of the money

supply. So if the Fed is continuing to

print, how can we have a deflationary bust?

The answer is that most money today is debt. Many analysts would tell you that more than

95% of money today is debt. In other

words, it’s only money as long as the borrower pays the debt. As soon as the borrower defaults, it’s no

longer money.

Here’s an example that could have taken place about a decade ago to

make the point clear.

A banker loans a home buyer $200,000 to buy a $250,000 house. The home buyer signs a promissory note agreeing to pay the banker $200,000 over time, per the terms of the promissory note.

Now, let’s say that due to the hefty decline in home prices, the

home buyer decides to move out of the house and default on the note.

The bank has taken the home as collateral for the note but finds

the house is now worth only $175,000 on the open market.

The bank had $200,0000 in cash and loaned it to the home buyer. Now, after selling the home for $175,000, the

bank finds its assets have diminished by $25,000. That money has simply disappeared, or as we

like to say, it went to money heaven.

That’s deflation.

A little more than a decade ago, we had a deflationary bust that saw the stock market crash. It was the second crash within a ten-year time frame. The first crash saw the Federal Reserve reduce interest rates to around 1%. It had the desired effect.

Since money is loaned into existence, significantly lower interest rates resulted in more borrowing and more money creation. Gradually the Fed increased interest rates until they reached 5% in 2007. Then the next crash hit.

The Fed’s response was predictable. They reduced interest rates, this time to

zero. The desired outcome of more money

creation didn’t happen. So what did the

Fed do?

They began printing money and using the newly created money to buy assets from banks. On and off for the past 10 years, the Fed has been chasing this policy. Most recently, since mid-September, the Fed has been expanding it’s balance sheet to keep the repo market (the overnight lending market between banks) operating.

Mr. Edward’s point is that the next crash will require an even

more radical response than printing money to give to banks. He says that money will be printed and given

to consumers. This is also known as

‘helicopter money’ a phrase coined by the late economist Milton Friedman. It simply means that large amounts of money

are distributed to the public to stimulate the economy and get growth.

Edwards makes the case for negative interest rates and helicopter

money:

“You can call it Modern Monetary Theory (MMT), you can call it

‘Fiscal and Monetary Co-operation’ or you can call it whatever you like, but

there is only one realistic way out of this mess – and that is for governments

to inflate away their debts.

Does anyone seriously believe that any democratically-elected government would be willing to raise taxes or cut government spending and future pension/health benefits in a bid to delay the fiscal timebomb? Of course, they wouldn’t! Any government that attempts to do so will be hounded from office by an indignant public armed with pitchforks and much else besides.”

Edwards is of the opinion that governments won’t be able to resist

the power a tool like MMT could provide,

“Helicopter money will work for Joe Sixpack much more effectively

than it will for Mike Moneybags and so it will be much more widely

popular. Once politicians have their

hands on this policy tool, make no mistake, they will never hand it back to the

central bank.”

A study of history confirms Edward’s forecast.

It also reveals that it won’t end well.

100% of the time historically speaking, disrespecting currency destroys it.

Our forecast?

Look for negative interest rates here sooner than you might

imagine.

On this week’s Retirement Lifestyle Advocates’ Radio Program host,

Dennis Tubbergen interviews the publisher of “Trends Journal”, Mr. Gerald

Celente. Gerald is of the opinion we

could see negative interest rates this year.

Once negative rates get here, or perhaps simultaneously, look for

helicopter money.

When you see these policies appear, think about getting tangible and maybe even tax-free with some of your investments.

History teaches us that’s how you not only survive but can also

potentially prosper.

During the hyperinflation in the Weimar Republic after World War

I, when the German government printed money to make reparations payments to the

point of destroying the currency, those holding physical assets survived, those

with only paper assets perished.

There is a lesson there.

The most recent RLA Radio program featuring Gerald Celente is now

posted at www.RetirementLifestyleAdvocates.com.

There

are many other valuable resources available on that site as well. We’d encourage you to visit the site and

check it out.

“I sincerely believe that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.”

― Thomas Jefferson