Weekly Market Update by Retirement Lifestyle Advocates

Stocks

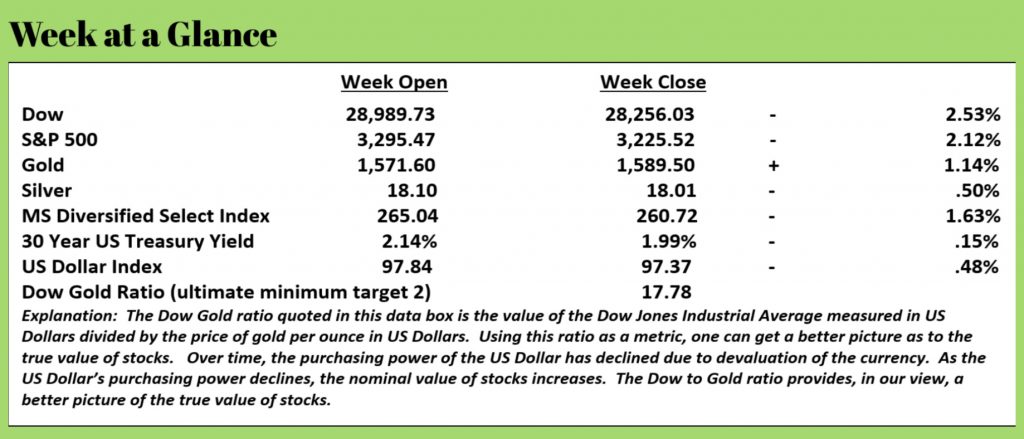

declined again last week as we anticipated they might.

Here is an excerpt from last week’s “Portfolio Watch”:

More

decline from here to move stock prices closer to their longer-term moving

average of price would not be surprising.

On a daily

price chart, the decline in stocks stopped at the 50-day moving average, an

important long-term technical indicator.

The Dow to

Gold ratio fell below 18. As our

longer-term readers know, our ultimate forecast has this ratio falling to 2 or

1. That means a lot more upside for gold

and more downside for stocks.

In our

view, the manner in which wealth is stored, preserved and grown is changing

radically presently.

Many who

are not paying attention to financial and economic developments remain unaware

of these changes. However, anyone who

chooses to be a serious observer of these developments can see that fiat

currencies are weakening, and alternate wealth management strategies are

quietly becoming more mainstream.

Driving

these changes is wildly evolving monetary policies.

Central

bankers around the world set money policies and they’ve painted themselves into

the proverbial corner. They have few

options left.

While the

country and the world are focused on the impeachment trial and the coronavirus,

wealth preservation and storage are changing before our very eyes.

After the

financial crisis, central banks resorted to printing money after reducing

interest rates to zero failed to produce the desired result of another boom

cycle.

In the

fractional reserve banking system under which we operate, as money moves from

one bank to another money is created.

Here’s a quick example.

I deposit

$100,000 in my bank. Under the current

reserving rules of 10%, my banker must reserve $10,000 and can loan out the other

$90,000. In other words, money is

created as money is loaned.

If money is

moving fast and the velocity of money is high, more money is created. The $90,000 that my banker loaned to a home

buyer was paid to the home seller who deposited the $90,000 in her bank. That banker reserved $9,000 and loaned out

$81,000.

By reducing interest rates, borrowing becomes more attractive, borrowing activity increases and more money is loaned into existence. After the financial crisis, due to the level of private-sector debt that existed, borrowing did not pick up despite interest rates of nearly 0%.

So, the

Federal Reserve embarked on a path of “quantitative easing” or money

printing. Since money was not being

loaned into existence because private sector debt levels were too high and

consumers weren’t borrowing money, the Federal Reserve decided to just print

it.

Whenever

you hear or read that the Fed is expanding its balance sheet, it simply means

the Fed is printing money.

Initially,

money printing creates the illusion of prosperity. In many areas of the economy today, this

prosperity illusion exists. But, in

other parts of the world, new and even crazier monetary experiments are being

executed.

In much of the world, bonds now have negative yields. A negative-yielding bond gives you back less than you invested at maturity.

This

Negative Interest Rate Policy, or NIRP as it’s known by, is changing the

dynamics of wealth storage, preservation and growth. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/negative-rates-are-forcing-german-banks-hoard-cash) emphasis

added):

In the era of

NIRP, "cashless societies" like Sweden are at a clear disadvantage.

When banks are charging wealthy customers additional fees for storing their

cash on deposit, the option to transition a chunk of one's fortune to cash

suddenly makes sense. And as Bloomberg reported Friday, this phenomenon hasn't been lost on German

banks.

(Editor’s

Note: Bloomberg story here- https://www.bloomberg.com/news/articles/2020-01-31/german-banks-are-hoarding-so-many-euros-they-need-more-vaults)

To help them keep as little money in reserve accounts as

possible, banks in Germany are reportedly stuffing vaults with euro

banknotes in to keep them handy for customers (and avoid the additional NIRP

tax on deposits). Some banks have hoarded so much cash that they're running out

of room and are searching for more storage. This behavior has been going on for

years, practically since Draghi introduced negative rates almost six years ago.

But the trend has gotten so out of hand German

banks are running out of space to stash the notes.

The physical cash holdings of German banks

rose to a record 43.4 billion euros ($48 billion) in December, according

to Bundesbank data published on Friday. That’s almost triple

the amount at the end of May 2014, the month before the European

Central Bank started charging for deposits and raising the pressure on

Germany’s already beleaguered banks.

By the end of last year, German banks were

holding a record amount of physical cash.

Andreas Schultz, who runs a German

savings bank had this to say, “These days it’s better to keep

funds in cash rather than park them at the ECB.

That’s despite the

risk, insurance costs and logistical hassle involved. It’s a ludicrous

demonstration of the consequences of the ECB’s interest-rate policy."

Frank Schaeffler, a member of the

German Parliament commented, “This is just the beginning. If it continues, we’ll see a boom for vault

makers and security companies.”

In our view, negative interest rates could become a worldwide phenomenon. If it happens, consumers and banks alike will look for alternative ways to store and grow wealth, likely outside the banking system.

Former Federal Reserve Board Chair Alan Greenspan stated fairly recently that it was his view that US interest rates could go negative. In a CNBC interview, Mr. Greenspan said, “You’re seeing it pretty much throughout the world. It’s only a matter of time before it’s more in the United States.” (Source: https://www.cnbc.com/2019/09/04/alan-greenspan-says-its-only-a-matter-of-time-before-negative-rates-spread-to-the-us.html)

Demand for secure

storage and alternate assets is exploding in Europe. Markus Weiss, managing director at Degussa

Goldhandel which sells gold and offers clients space to store their valuables

said, “We’re seeing increased demand for our safe deposit boxes, frequently for

storing cash. That high demand has

lasted for months now and we’re continuously expanding our capacities.”

Looking ahead

to the next monetary experiment, it’s quite possible that we will see

helicopter money in our view. While no

one knows for sure, the advent of helicopter money could likely be the last

money experiment before the reset.

Helicopter

money was once proposed by former Federal Reserve Chair, Ben Bernanke, earning

him the moniker “Helicopter Ben”.

Helicopter

money is money that is printed but rather than using the newly printed money to

buy assets from banks, it is distributed directly to the public. It could come in the form of a direct bank

account deposit or a tax credit.

Treasury

Secretary, Steve Mnuchin recently stated that the administration is working on

tax cuts for the middle class. A CNN

article (Source: https://www.cnn.com/2020/01/23/politics/mnuchin-trump-tax-cuts-2020-election/index.html)

quoted Mr. Mnuchin, “ They'll be tax cuts for the middle class, and we'll also be

looking at other incentives to stimulate economic growth.”

Helicopter

money may indeed be on the way.

That

will mean the way wealth is stored will continue to evolve. When doing your planning for 2020, think

tangible for some of your assets.

This week’s RLA Radio program features best-selling author, Harry

Dent.

Host, Dennis

Tubbergen, chats with Harry about his forecast for stocks.

That

show is now available at www.RetirementLifestyleAdvocates.com.

There

are many other valuable resources available on that site as well. We’d encourage you to visit the site and

check it out.

“No

one has ever drowned in sweat.”

-Lou

Holtz