Weekly Market Update by Retirement Lifestyle Advocates

Volatile

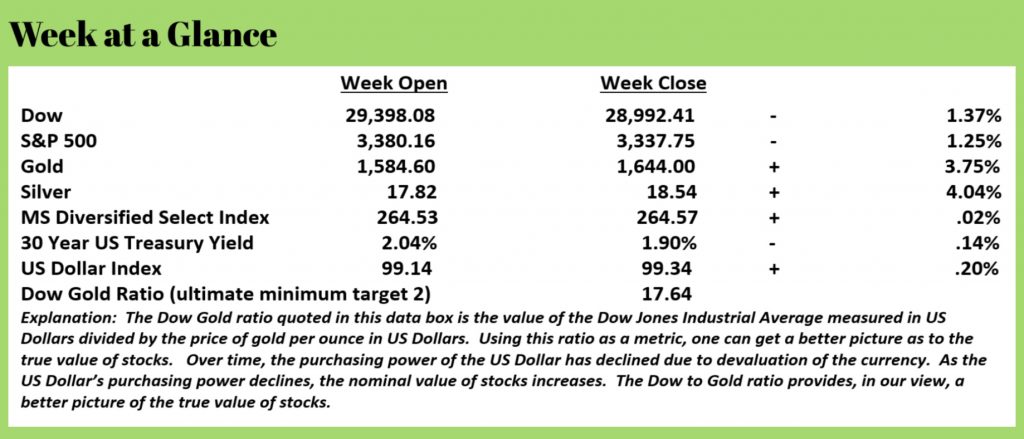

stocks finished down for the week with the Dow Jones Industrial Average

declining 1.37% and the broader Standard and Poor’s 500 falling 1.25%.

The big

story of the week was the price action of US treasury long bonds and precious

metals. The long bond rallied powerfully

with yields plummeting .14% back below 2%.

Metals advanced strongly as we have been anticipating. Gold and silver both rallied about 4%. Over the last two months or so, precious

metals are up about 12%. Long term, we

are bullish on metals as central banks around the world continue with money

creation policies, negative interest rates and they are now openly, seriously

considering helicopter money. Helicopter

money has central banks creating money but instead of using the newly created

money to buy assets from banks, the newly created money is distributed directly

to consumers.

While that

may sound good to some of our readers, history teaches us that policy pursuit

always ends badly.

Short-term,

it’s possible that we will witness a bit of a pullback in the price of precious

metals as markets rarely move upward over a long time at a 6% monthly gain

trajectory. Our most reliable technical

indicators tell us that we could see a pullback in gold prices. We would view those price pullbacks as buying

or accumulation opportunities if your time frame is long term.

When the

Federal Reserve began to increase interest rates in 2019 and the stock market

reacted negatively, the central bank quickly reversed course and began to

cut. The reality is that the easy money

policies of central banks have provided some juice to the economy and the

markets but as time has passed it has taken a more easy money juice to produce

a watered-down economic result.

This past week, Dr. Lacy Hunt, chief economist at Hoisington Management Company, did an interview in which he discussed this phenomenon. Dr. Hunt is certainly worth paying attention to. Hoisington Management Company manages more than $5 billion for retirement plans, charitable organizations, and insurance companies.

During his

interview, Dr. Hunt stated that debt-financed fiscal programs are

ineffective. He cited statistics from

2019 that revealed each dollar of private nonfinancial debt generated only 40

cents of GDP. That’s down 25% in the

last twenty years according to Dr. Hunt.

Here is an excerpt from his interview (Source: https://milleronthemoney.com/just-the-facts-please/) (emphasis

added):

While the aggregate debt

problem is not as bad in the U.S. as in other major economies, debt levels

are unprecedented in the government and corporate sector, and thus should

serve as a major constraint on U.S. economic growth. Gross U.S. government

debt outstanding increased to 107% of GDP late last year, the highest since the

1940s.

…. Substantial peer-reviewed economic research indicates that the U.S. economy loses one-third of its trend economic growth rate when the government debt ratio rises above 90% for a period of five years. The U.S. has met that condition since 2014. When viewed from a cyclical perspective, the increase in Federal debt in 2018 and 2019 is even more serious.

In late-stage expansions, economic theory indicates that budget deficits should be reduced and with it, the ratio of debt to GDP should fall.

Deterioration

in economic conditions would lead to a quick worsening in the ratio, pushing

the debt ratio further into uncharted waters, even without new fiscal

measures that would likely be enacted in such circumstances.”

As we have been stating, debt levels brought the economy and the

markets down in 2007 and they are worse now than they were then both in the

private sector and the public sector.

The economic research that Dr. Hunt spoke about in his interview concluded that when government debt exceeds 90% of gross domestic product for a period of five years, the US economy loses one-third of its trend economic growth rate. The US has been there for going on 6 years now.

That seems to forecast an economic slowdown.

The most important thing to take from the interview with Dr. Hunt

is that the “new fiscal measures that would likely be enacted in such

circumstances" will make the problem worse. In other words, the economic medicine that

will be prescribed will make the patient sicker.

We have long forecast that we will get deflation or inflation

followed by deflation depending on the course of action that the Federal

Reserve elects. Presently, the Fed can

print money and buy assets from banks. The

Fed cannot legally print money and pay the government’s bills. In order for that to happen the Federal

Reserve Act which was passed in 1913 would need to be amended.

Dr. Hunt states in his interview

that is what the proponents of Modern Monetary Theory want to do; change the

Federal Reserve Act to allow for the Fed to print money and pay the

government’s bills.

That dramatically changes the

dynamics of money printing.

Dr. Hunt states that is exactly what

occurred during 60 hyperinflationary periods that he’s studied including

Germany after World War I which was the infamous Weimar Republic

hyperinflation. It is precisely what

happened in China in the 1930’s and 1940’s and in the great Yugoslavian and

Bolivian inflations that have been studied extensively.

We have often written about the hyperinflation of John Law’s

France in the early 1700’s and again in France in the late 1700’s.

Each time “Modern Monetary Theory” has been tried, it’s been an

unmitigated economic disaster. (For the

record it’s not modern and it’s not theory, the outcome is totally

predictable.) Yet, it’s being seriously

tossed around by economic advisors to politicians as a viable economic policy.

Stephanie Kelton, economic advisor to Presidential hopeful, Bernie

Sanders and economics professor touts MMT as a panacea for everything that ails

us. The title of her upcoming book (to

be released in June of this year) is “The Deficit Myth; Modern Monetary Theory

and the Birth of the People’s Economy” is telling.

Here’s an excerpt from Ms. Kelton’s website about her

soon-to-be-released book (Source: https://stephaniekelton.com):

Deficits

can help us fight a myriad of problems that plague our economy–inequality,

poverty and unemployment, climate change, housing, health care, and more. But

we can’t use deficits to solve problems if we continue to think of the deficit

itself as a problem.

It’s a nice thought to think that we can cure poverty and

inequality by just printing the money we need, but history teaches us it won’t

work. We’ll side with Dr. Hunt here,

thank you.

Will we ultimately get to MMT as an economic reality?

Probably. We come to that

conclusion only because there is one other alternative; cutting spending to the

point that the budget is balanced, or at least far closer to balanced. That is unlikely to happen.

We recently did some research in this area to prepare for a new

presentation that we were giving. When

you consider the numbers, it’s nothing short of mind-boggling. Collectively through the years, our

politicians have put us in a tough position financially speaking.

Here are the stats:

-55% of American households pay taxes. There are 128 million US Households which

means 70 million households pay taxes.

-The national debt is now more than $23 trillion. On a per taxpaying household basis, that

amounts to more than $325,000.

-The last Social Security trustee report stated that Social

Security is underfunded by about $43 trillion.

That’s an additional share per taxpaying household of more than

$600,000.

-Medicare’s underfunding by some accounts is twice that of Social

Security. That’s another $1,200,000 for

each taxpaying household.

-Total per household for just these 3 items? More than $2 million.

-Total national debt and unfunded Social Security and Medicare

liabilities far exceed the total net worth of all households combined.

There are two courses of action.

Massive cuts to balance the budget or more printing.

If you haven’t yet taken steps to protect yourself, you should. This week’s Retirement Lifestyle Advocates Radio Program is now posted at www.RetirementLifestyleAdvocates.com. It features a tax conversation with host, Dennis Tubbergen and author, Dan Pilla.

“All my life I’ve been trying to get a hole-in-one. The closest I’ve come is a bogey”

― Lou Holtz