Weekly Market Update by Retirement Lifestyle Advocates

With the

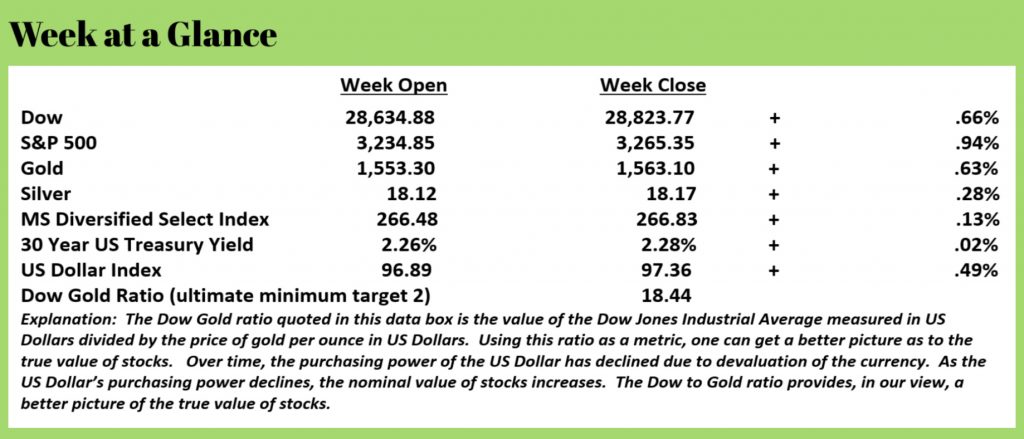

exception of the US Treasury long bond, all markets were up last week.

With the advances experienced by

stocks and gold, the Dow to Gold ratio didn’t change significantly, remaining

at about 18.5.

As long-term readers of Portfolio

Watch know, our long-term forecast is for the Dow to Gold ratio to reach a

level of 2, but more likely 1.

As far out as that forecast may seem presently, when one looks at this level from a historical perspective, it’s not that far out. Since markets often move from one extreme to another over long periods of time, and since the last extreme saw the Dow to Gold ratio exceeding 40, we are of the belief that the next extreme will be at the low end of the spectrum.

Given the direction that Fed policy

seems to be taking, we expect that gold will continue to move higher over time

as will other tangible assets.

We would be remiss if we didn’t

point out that gold, silver and other tangible assets will move higher

nominally but probably not much higher in real terms.

If you are planning your financial

future or are planning for retirement, this is one of the most important

concepts to understand. And,

incorporating strategies that will allow you to potentially capitalize on this

concept could be the most important thing that you do to have a bright

financial future.

We’ll give you an example and then

discuss some strategies.

In nominal terms, stocks are much

higher today than they were 20 years ago at the turn of the century.

As one can see from the databox

above, the Dow Jones Industrial Average stands at about 28,800. Also noted in the databox above is the Dow to

Gold ratio which stands at about 18.4.

This ratio is calculated by taking the price of the Dow Jones Industrial

Average in dollars and dividing it by the price of gold in US Dollars.

Historically speaking gold has

always been money.

Going back to ancient Egypt over

5000 years ago, gold and other precious metals were used in commerce.

An ounce of gold 5000 years ago had

exactly the same intrinsic or tangible value as an ounce of gold today.

The same statement could be made

about an ounce of gold 20 years ago and an ounce of gold today. An ounce of gold has not changed.

Yet, when pricing that ounce of

gold in US Dollars, one gets a different picture. 20 years ago, an ounce of gold sold for about

$250 in US Dollars. Today, that same

ounce of gold sells for more than 6 times as much.

Does that mean an ounce of gold is

worth more than it was 20 years ago?

Obviously not. It’s the same ounce of gold.

Gold has not gained tangible value; the US Dollar has lost purchasing power. That’s why we like to use the Dow to Gold ratio to determine the real value of stocks.

Let’s go back to calendar year

2000. The Dow was at about 11,700 in

January of that year which was, at the time, a record high. At that same time, gold was selling for about

270. That’s a Dow to Gold ratio of about

43.

In other words, it took about 43

ounces of gold to buy the Dow. Today, it

takes about 18.

So, looking at it from that

perspective, what might one conclude about the price of stocks?

They are higher in nominal terms,

but they are lower in real terms.

We are of the opinion this is

almost totally due to the monetary policies of the Federal Reserve.

The Federal Reserve’s balance sheet

was about ½ a trillion in 2000. Today,

it’s more than $4 trillion.

How does the balance sheet of the

Fed expand?

The Fed creates money to buy assets

from member banks.

More recently, the Fed has been

‘injecting liquidity’ into the repo market which is the overnight lending

market between banks.

What does this mean?

Simply put, for whatever reason,

some banks are not willing to loan money to other banks on an overnight basis.

While no one knows exactly why, one

does not have to be a financial genius to conclude that the only reason one

would not loan a person or entity money on a short-term basis is because you

perceived that there was too much risk to do so.

That’s what we believe is happening

presently; money is being created to stabilize this overnight lending market.

But, looking ahead, there are other

reasons that we believe the Fed will continue this loose money policy.

The biggest reason is the state of

the nation’s finances and debt levels.

This is a topic that we have often discussed, but the problem continues

to get larger.

John Mauldin, in his excellent

newsletter “Thoughts from the Frontline” had this to say on the topic this past

week (emphasis added):

To think that we have somehow eliminated recessions

and risk, or that central banks and the government have somehow become adept at

managing the business cycle, is simply foolish. Yet we keep doing it, every single time.

Debt seems harmless enough at first. You have reliable

cash flow, repayment is no problem, and you’re going to spend the borrowed

money wisely. But human nature tends to make us overdo otherwise good

things. And, with debt, you may also have lenders actively urging you to borrow

even more. Everything is fine… until it’s not.

Personal debt, while sometimes excessive, isn’t the

main problem. Government and corporate debt are the bigger challenge and

the reason we will spend the 2020s living dangerously. All that debt is

ultimately personal debt, too, since most of us are either taxpayers,

shareholders, or both.

In Part 1 of this forecast I

described my relatively benign outlook for the next 12 months. The calm may

last into 2021 and even beyond. But beneath the surface, pressure will still be

increasing. It will grow slowly, almost imperceptibly, but eventually

explode.

Or, to use another metaphor: We are frogs in the

kettle and someone just turned on the heat. By the time we notice, our good

options will be gone.

To

be clear, money creation is NOT a good option, but given the size of the debt,

it is the only option that the politicians will consider to be viable.

The

only other two choices are to raise taxes or cut spending both of which are not

very viable politically.

Any

budget can be balanced by cutting spending but the level of cuts that would be

required to solve the deficit problem would create a deflationary environment

that would be so severe, politicians would be voted out of office in droves.

You

simply cannot raise taxes to a level that would be high enough to solve the

deficit problem. There is not enough

money in existence.

The

only other option is money creation.

In

our view, that’s what will continue to happen.

As more

money is created, moving more toward tangible assets in your portfolio may be

the best way to preserve purchasing power.

This

week’s RLA Radio program features Dr. Chris Martensen, author of “The Crash

Course”.

Host, Dennis

Tubbergen, chats with Chris about his book and his economic forecast. His insights are valuable, and his

perspective is one that we always appreciate.

That

show is now available at www.RetirementLifestyleAdvocates.com.

There

are many other valuable resources available on that site as well. We’d encourage you to visit the site and

check it out.

“Reflect

on your present blessings, of which every man has many; not on your past

misfortunes, of which all men have some.”

-Charles

Dickins