Weekly Market Update by Retirement Lifestyle Advocates

Stocks

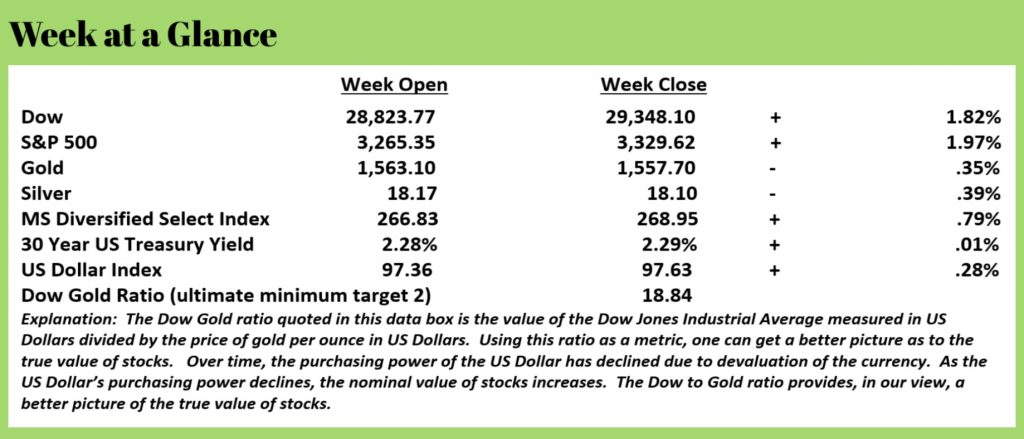

continued their 2020 rally last week with the Dow Jones Industrial Average

climbing 1.82% and the Standard and Poor’s 500 advancing 1.97%.

Metals

pulled back slightly. Gold fell .35%

while silver dropped .39%. US Treasuries

fell a little again last week.

The Dow to

Gold ratio which we wrote about extensively in last week’s “Portfolio Watch”

rose to 18.84. With the exception of the

US Treasury long bond, all markets were up last week.

With the

advances experienced by stocks and gold, the Dow to Gold ratio didn’t change

significantly, remaining at about 18.5.

Stocks at

this juncture are overbought in our view.

The chart below illustrates the Standard and Poor’s 500. It is a weekly chart with Bollinger Bands. Bollinger Bands track price extremes. Notice that stock prices are currently near

the top Bollinger Band on the chart.

Often, when this chart pattern occurs, a pullback in price follows.

For this

reason, we are of the opinion that a pullback in stocks could happen soon.

A couple of

weeks ago, here in “Portfolio Watch”, we discussed the SECURE Act, a recent law

change affecting retirement accounts.

In this issue, we want to zero in on one particular aspect of the SECURE Act that will affect anyone with an IRA, 401(k), 403(b) or other retirement accounts who leaves money to a non-spouse beneficiary at his or her passing.

That’s

nearly everyone.

Prior to the passage of the SECURE Act, an heir who inherited an IRA had the option of doing a ‘stretch out’ IRA. In essence, a stretch out allowed that heir, typically a child of the deceased IRA owner, could keep the money in an ‘inherited IRA’ and take required minimum distributions based on the heir’s remaining life expectancy.

Say a 50-year old inherits an IRA from his mother who recently passed on. Per the IRS single life expectancy table, that son who has a life expectancy of 34.2 years could take a distribution equal to the inherited IRA account value divided by 34.2. If the inherited IRA had an account balance of $500,000, the distribution required the year after his mom’s passing would be $14,620. Taxes would be paid on that distribution amount and the balance of the inherited account would continue to grow on a tax-deferred basis. The next year the distribution factor would be adjusted by one year. It would be reduced from 34.2 to 33.2.

Using this

stretch out strategy, it was possible for one who inherited an IRA to adopt the

inherited IRA and use it as his or her own retirement account.

No more.

Under the

new law, any inherited IRA must have the taxes paid on the inherited balance

within 10 years. That totally kills the

stretch out strategy that so many had incorporated into their planning.

But there

may be a viable alternative for those who wish to use a stretch out type

approach in their planning.

This

approach is probably best explained through an example.

A 60-year

old single woman with three daughters has an IRA with a current balance of

$1,000,000. She wants to use her

retirement account to provide income for her daughters when she passes. Her daughters are presently 35, 32 and 30

years old.

She

establishes three charitable remainder trusts.

Each of these trusts has one of her daughters as the income beneficiary.

A

charitable remainder trust is an irrevocable trust that has income paid to an

income beneficiary for the life of the income beneficiary and then, at the

death of the income beneficiary, the remaining trust balance passes to a

selected charity or charities.

The level

of income that an IRA owner can draw from the charitable remainder trust must

be at least 5% of the trust balance and could be higher provided certain

minimum IRS rules are met.

Again, an example, let’s say that by the time each of the three daughters inherits their Mom’s IRA, each of the three daughters inherit $500,000. The $500,000 balance is paid into the charitable remainder trust and no tax is paid.

Now, each daughter may be able to collect an annual income of $25,000 as long as she lives. At each daughter’s passing the remaining trust balance passes to a charity.

Each

daughter will pay taxes on the income received each year; however, this

strategy can allow the IRA owner to establish a stretch-life vehicle to use as

part of an estate plan.

Another

nuance to this strategy that can be incorporated is the use of a relatively

low-cost life insurance policy to provide an additional tax-free benefit to

each daughter.

The life

insurance policy type that would work well in this design is a no-lapse

guarantee policy. This kind of policy

guarantees that the policy won’t lapse before a certain age as long as the

premiums are paid on a timely basis.

Think about this kind of policy as a term life until you die policy.

It does not

build cash values. It provides only

protection.

In the case

of this 60-year old woman, a $1,000,000 non-lapse guarantee to age 100 policy

could be purchased for a level premium of $1,045.20 per month as long as the

proposed insured was in good health.

When one

considers the outlay versus return on a policy like this one, it can be very

favorable.

A premium

outlay of $1,045.20 monthly equates to about $12,543 per year.

Assuming this 60-year old passes on at age 90, she will have paid about $376,000 in premiums in exchange for a guaranteed death benefit of $1,000,000 that could be paid to her daughters' income tax free.

The

premiums for this no-lapse guarantee policy can be paid from the IRA.

At her passing at her assumed age of 90, the three daughters will each receive $333,333 in tax-free cash and another $25,000 per year for as long as they live.

Taxes will

be minimized and a charity that might not otherwise benefit gets named as the

remainder beneficiary and will ultimately receive everything left in the trust.

Arguably,

depending on one’s charitable intent, this can be an even better outcome than

using a stretch-out strategy.

If you’d

like to explore plan designs for this strategy, give the office a call at

1-866-921-3613. We’d be glad to put a

report in writing for you to review.

This week’s RLA Radio program features John Tamny prolific author and frequent “Forbes” columnist.

Host, Dennis Tubbergen, chats with Mr. Tamny about his new book titled “They’re Both Wrong” and the ongoing automation trends in the workforce.

That

show is now available at www.RetirementLifestyleAdvocates.com.

There

are many other valuable resources available on that site as well. We’d encourage you to visit the site and

check it out.

“Ability is what you are capable of

doing. Motivation determines what you

do. Attitude determines how well you do

it.”

-Lou

Holtz