Weekly Market Update by Retirement Lifestyle Advocates

Stocks

declined last week as we anticipated they might. Last week we wrote this:

Stocks at

this juncture are overbought in our view.

The chart below illustrates the Standard and Poor’s 500. It is a weekly chart with Bollinger

Bands. Bollinger Bands track price

extremes. Notice that stock prices are

currently near the top Bollinger Band on the chart. Often, when this chart pattern occurs, a

pullback in price follows.

That is

precisely what happened as the Dow and the S&P 500 declined. More decline from here to move stock prices

closer to their longer-term moving average of price would not be surprising.

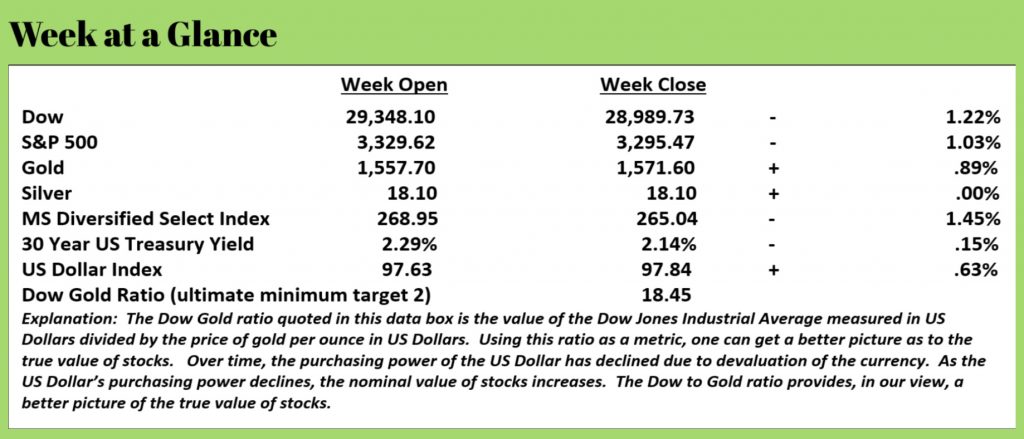

Predictably,

US Treasuries rallied hard with the decline in stocks. The yield on the 30-Year US Treasury Bond

fell to 2.14% as bond prices rose. Gold

prices rallied and silver prices were unchanged from last week.

“Barron’s”

reported that stocks experienced their worst weeks since August. (Source:

https://www.barrons.com/articles/stocks-catch-a-cold-after-fed-stops-expanding-its-balance-sheet-51579916069). Here is an excerpt from the article (emphasis

added):

Interest rates

remain the primary underpinning for stocks, as equity valuations look

stretched, except when compared with the paltry returns offered by the debt

market. Much of the credit for that is owed to the world’s central banks, notably

the Federal Reserve. In addition to last year’s three one-quarter

percentage-point short-term rate cuts, the central bank has expanded its

balance sheet by over $300 billion since September, when ructions in the

repurchase-agreement market led it to inject liquidity. Since then, U.S.

stocks’ value has jumped by more than $3 trillion.

The Fed prints and stocks

rally. It’s a predictable pattern. More from the Barron’s article (emphasis

again added):

The Fed insists that its

operations don’t constitute quantitative easing, as it calls its purchases of

long-term securities intended to boost stock and bond prices. Its recent

operations consist of adding liquidity to the money markets through repurchase

agreements and by buying short-term bills. Others call this a distinction

without difference, given the impact on stock and bond prices.

Interestingly,

the Fed’s balance sheet contracted by $25 billion for the week that ended last Wednesday,

and stocks declined.

Coincidence?

Probably

not in our view.

Money

creation and stock rallies occur in tandem.

Since

September, the Federal Reserve has been ‘injecting liquidity’ into the repo

market. What does that mean exactly?

Simply

put, the repo market is the overnight or short-term lending market between

banks. In September, for some reason

that has not yet been disclosed, some banks refused to lend to other banks or

financial institutions on an overnight basis.

In

our view, there is only one reason for this – the lending banks were concerned

that the borrowing banks could not pay them back. In other words, it’s a red flag of trouble

that may be brewing in the banking sector.

To

ensure that the banks could get the short-term loans that they needed to meet

reserve requirements, the Fed stepped up and provided the loans that the

borrowing banks and financial institutions couldn’t get from other banks.

Where

does the Federal Reserve get the money to loan to these borrowing banks?

They

print it.

Of

course, it’s not reported as straightforwardly as that in the news. As the “Barron’s” article above states, “the

central bank (the Fed) has expanded its balance sheet by over $300 billion

since September”.

“Expanded

its balance sheet” means printed money.

A

visit to the Fed’s website illustrates where the balance sheet was at the

beginning of September and where it is presently. At the beginning of September, prior to

‘injecting liquidity’ into the repo market, the Fed’s balance sheet was just

over $3.7 trillion.

Presently,

it’s approaching $4.2 trillion.

Over

that same time frame, the S&P 500 has increased from about 2,850 to about

3,350.

We’ve

long suggested that Fed policy is driving stocks and while this relationship

between stocks and the Fed’s balance sheet level does not prove anything

conclusively, it is, at the very least, interesting.

The

bottom line is this.

Money

creation to price inflation.

Price

inflation occurs in stocks and in consumer goods.

John

Mauldin, best-selling author and publisher of an excellent weekly newsletter

“Thoughts from the Frontline” had this to say on the topic of inflation in his

newsletter this week (we’ve pulled excerpts) (emphasis added):

Wonks

tell us, with all sincerity, things like “the US cost of living rose 2.1% last

year.” Really? To an actual numerical decimal place? On something as vague and

as complex as inflation? Now, to give them credit, they are looking at the

total national inflation rate and it is extraordinarily complex. They do the

best they can.

But

the inflation you and I experience? They don’t know that.

They can’t know it, at least not with any precision because the cost

of living is so individualized. Everyone spends their money differently, and

the things they spend it on vary in price for many reasons.

I believe

the analysts try to be fair and scientific. They have to work within boundaries

that don’t always make sense. So, we get crazy things like “hedonic

adjustment.” That’s where they modify the price change because the

product you buy today is of higher quality than the one they measured in the

past.

According

to Consumer Price Index data, a television set that cost $1,000 in 1996 is now

$22. You can’t buy any such product today, but the fact you can spend the

same amount of money and get a better TV depresses the inflation rate.

They

do the same thing for cars, as Peter Boockvar noted earlier this month.

Last week Edmonds.com said

the average price of a new vehicle sold in 2019 was $37,183, a new record high

and up 30% from where it was 10 years ago. Within today’s CPI, the price of a

new car reflected a 2% increase in TOTAL since 2009. This is magically done via

hedonic adjustments which discount the value of new add-ons with each

subsequent iteration of cars.

The

Fed relies on hedonically-adjusted data points and not the price that people

are actually paying out of pocket.

Hedonically-adjusted

prices exist only in theory. They don’t reflect what people

actually have a choice of spending.

The Chapwood Index might be a better measure of the actual

inflation rate.

This index compares the retail price of 500 consumer items that

consumers most frequently purchase over different time frames.

Using this arguably more practical measure of inflation, one finds

that the average annual inflation rate over the past five years ranges from 8%

annually in Dallas, Texas to 13% annually in San Jose, California. Mesa, AZ on the low end of the metro areas

tracked, had an average annual inflation rate over five years of 6.6%. On the high end was Oakland, CA with an

average annual inflation rate over five years of 13.1%.

The dollars used to purchase consumer items are the same dollars

used to purchase stocks.

We believe the driving force behind higher consumer prices and

higher stock prices is largely Federal Reserve policy.

The changes in the way the official inflation rate is calculated

has masked this reality.

Given higher debt levels at the government level and trillion

dollar plus deficits as far as the eye can see, this money creation will have

to continue in our view.

To protect yourself, we’d urge you to consider ‘going tangible’

with some of your assets. Tangible assets have physical characteristics and

intrinsic value.

This week’s RLA Radio program features David

McAlvaney.

Mr. McAlvaney is the author of “Intentional

Legacy” and has been in the wealth management industry for more than two

decades.

Host, Dennis

Tubbergen, chats with Mr. McAlvaney about his Canadian based program that is

re-establishing gold as currency.

That

show is now available at www.RetirementLifestyleAdvocates.com.

There

are many other valuable resources available on that site as well. We’d encourage you to visit the site and

check it out.

“If God had wanted man to play soccer, He

wouldn’t have given us arms.”

-Mike

Ditka