Weekly Market Update by Retirement Lifestyle Advocates

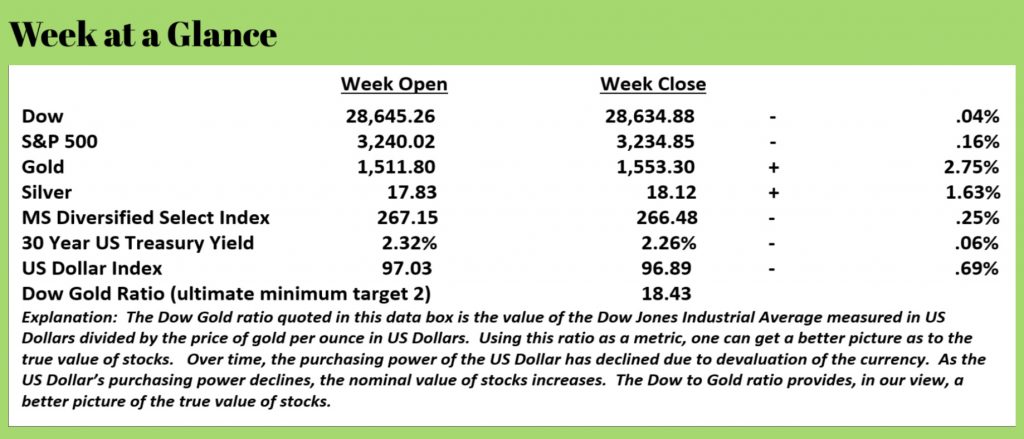

Stocks were

down slightly last week but finished the year much higher.

The Dow Jones Industrial Average

ended calendar year 2019 with a gain of 25.3%.

The Standard and Poor’s 500 bested the return of the Dow, concluding the

year with an annual return of 30.43%.

All-in-all, it was a good year for stocks. We remain convinced that most of stock’s gains in 2019 can be attributed to the easy money policies being pursued by the Federal Reserve.

If you’re an IRA or 401(k)

investor, 2020 brings sweeping changes on which you should get up to speed.

As 2019 drew to a close both the

House and Senate passed the SECURE Act.

The President signed it into law, and it is effective as of January

1. We will break this new law down in

more detail in our January client newsletter “The You May Not Know Report” but

will give you an overview in this week’s “Portfolio Watch” newsletter.

The SECURE Act allows required

minimum distributions to be postponed until you are 72. Prior to the passage of the SECURE Act,

required minimum distributions had to start at age 70 ½.

But, if you turn age 70 ½ after

December 31, 2019, you can now postpone your first distribution until age 72.

The SECURE Act also changes the

rules regarding IRA contributions. Now

as long as you are working, you can contribute to a traditional IRA regardless

of your age. Previously, you could not

contribute to a traditional IRA once you attained age 70 ½.

The SECURE Act also expands access to Multiple Employer Plans

(MEP’s). A MEP is a plan that allows

employers to band together and pool resources to give employees access to

retirement plans. The SECURE Act

incentivizes the establishment of these plans by smaller employers by offering

tax credits.

The SECURE Act also allows employers to auto-enroll employees in a plan at a savings rate of 6% of pay. Workers can opt-out at any time.

The SECURE Act also allows plans to add annuities as investment options in employer-sponsored retirement accounts. This is a big legislative victory for insurance companies that openly lobbied heavily for the bill.

529 plans were also revised under the SECURE Act. A 529 plan is a tax-advantaged plan that allows for educational savings. 529 plan assets can now be used to pay for registered apprenticeships, homeschooling, up to $10,000 of qualified student loan repayments (including for siblings) and private elementary, secondary or religious schools.

The student loan provision allows for student loans to be repaid for a

529 plan beneficiary up to $10,000. An

additional $10,000 can be used from the 529 plan to pay off student debt for

each of the 529 plan beneficiary’s siblings.

The SECURE Act would also allow investors to have early access to IRA

funds for any ‘qualified birth or adoption’ without paying the 10% early

withdrawal penalty. This change allows

each parent to take a penalty-free withdrawal of up to $5,000. The withdrawal will be taxable but would not

be subject to the 10% penalty.

But the SECURE Act is not all good news in our view. The new law eliminates the stretch-out IRA

that has been used as a cornerstone of estate planning for many IRA and 401(k)

owners.

A non-spouse beneficiary (often a child) of an IRA or 401(k) had the

ability to inherit the retirement plan and spread the taxes on the inherited

account over his or her lifetime prior to the passage of the SECURE Act. For example’s sake, a 50-year-old child

inheriting an IRA from a parent could take minimum distributions based on his

or her life expectancy, pay tax on the distribution but allow the remaining IRA balance to continue to

grow on a tax-deferred basis.

According to the IRS’ life expectancy table, a 50-year-old has a life

expectancy of another 34.2 years. That

means that prior to the SECURE Act becoming law, that 50-year-old would have to

take the inherited retirement account balance at the end of the year and divide

that total by 34.2 to determine the required distribution from the inherited

IRA.

The next year, the IRA beneficiary would adjust the divisor by subtracting 1 from it. In this example, the 34.2 would be adjusted to 33.2 (34.2 – 1 = 33.2). The prior year-end balance would be divided by 33.2 to get the new required distribution for the current year.

In this way, should the beneficiary elect, the inherited IRA could be

maintained for their life expectancy. In

this example, to age 84.

That stretch out option is no longer available under the new law. The SECURE Act mandates that inherited IRA’s,

401(k)’s and Roth IRA’s be totally distributed within 10 years of inheriting

them.

The SECURE Act makes leaving an heir

money in a retirement account far less desirable. And, it makes Roth conversions that much more

attractive for some IRA owners, especially those who plan to pass most of their

retirement savings on to a non-spouse beneficiary.

Alternatively, there is another

strategy that may make sense for some IRA owners to consider. One way to potentially establish a

stretch-out like outcome under the new rules would be to establish a Charitable

Remainder Trust that would be the beneficiary of the IRA or 401(k)

account. The income beneficiary of the

Charitable Remainder Trust would be the IRA beneficiary, typically a child.

Since

distributions from a Charitable Remainder Trust are calculated based on the

life expectancy of the beneficiary, the equivalent of a stretch out may be able

to be established. This strategy could

be combined with a life insurance trust to replace the portion of the IRA going

to charity.

Here is a

hypothetical example to make the possible outcome clearer:

A 72-year-old female has $1,000,000 in her

IRA. She plans on taking only required

minimum distributions and leaving her IRA balance to her only daughter at her

death. Her daughter is presently 47

years old.

Currently, her required minimum distribution

will be just under $40,000 and then increases from this point on. Assuming a 5% growth rate and taking only required

minimum distributions, at her death (assuming death at age 90), her IRA balance

will be about $834,000. Under the new

law, her daughter will have to distribute and pay taxes on the entire IRA

balance within 10 years. (Note: If returns other than 5% are realized, the

outcome illustrated here could be significantly different.)

What if this 72-year old client decided to

establish a charitable remainder trust and name her daughter the income

beneficiary?

The daughter, in this hypothetical example

would be 65 years of age. Assuming the

charitable remainder trust was established with a 5% payout to the daughter and

the assets continued to earn 5% annually, the daughter would receive income of

$41,700 annually for as long as she lived.

At her passing, a charity would receive the $834,000 in the trust.

There is no tax on the IRA transfer to the

charitable trust on the death of the original IRA owner and no tax on the

ultimate distribution to charity. Only

the distributions to the daughter of $41,700 per year would be taxable.

The original 72-year old client could opt to

combine this strategy with a life insurance trust in which she purchases a life

insurance policy on her life in the amount of $1,000,000. The annual premium is $25,000. She pays this using her IRA assets. This strategy will reduce the ultimate

benefit to charity but increase the net benefit to her daughter.

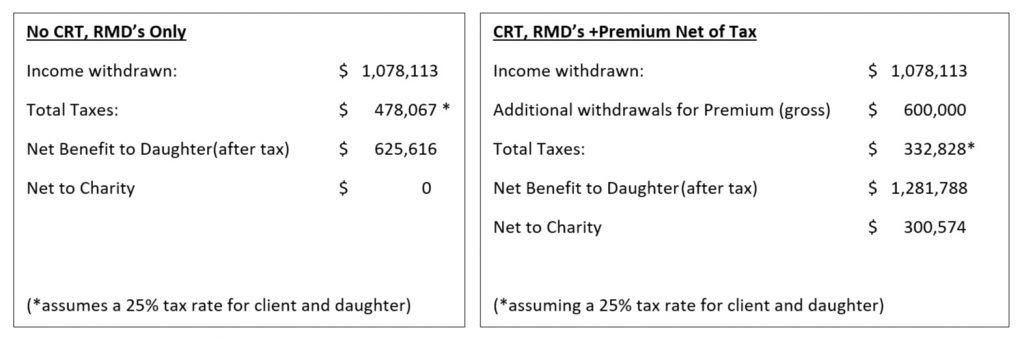

Let’s

compare potential outcomes:

Nice outcome isn’t it. The client takes the same income. Daughter gets a net benefit of nearly double. And a charity wins that wouldn’t have otherwise received anything. It’s important to note that the IRA balance at the client’s death is lower using the CRT because the IRA is funding life insurance premiums. If you’re likely leaving retirement account assets to children, you might want to take a look at this Salvage Your StretchTM strategy.

This

week’s RLA Radio program features Lawrence Reed. That show is now available at www.RetirementLifestyleAdvocates.com.

“When I started counting my blessings, my

whole life turned around.”

-Willie

Nelson