Weekly Market Update by Retirement Lifestyle Advocates

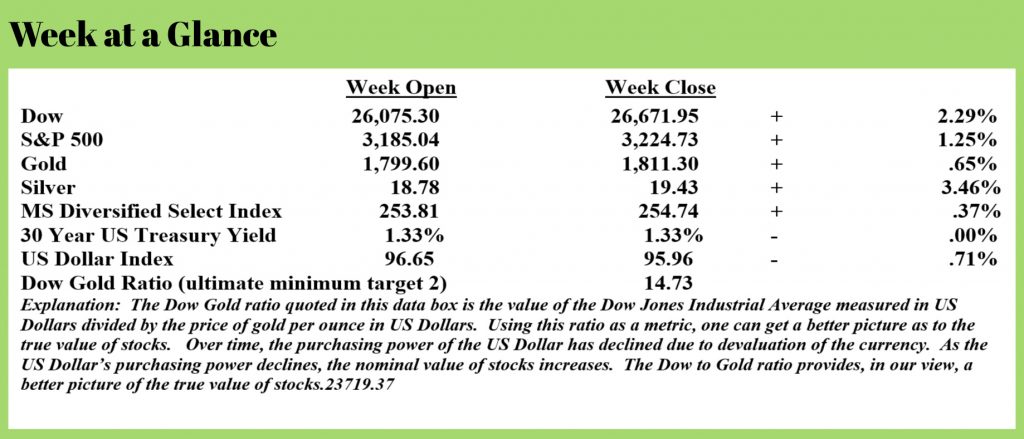

All markets advanced once again last week, except the US Dollar, and the Dow to Gold ratio remains between 14 and 15.

We are holding to our long-term forecast of a Dow to Gold ratio of 2 or 1 as unlikely as that may seem present. It’s highly likely in our view that the dollar will continue to lost purchasing power at an ever-increasing rate and that will impact the nominal price of gold. As earnings are reported moving ahead, we believe that will negatively impact stock prices.

There is an interesting phenomenon taking place around the country presently. It’s one that we believe will continue to intensify. People are moving from high tax states to lower-tax states and from the city to the country.

In a recent blog post, past RLA Radio guest, Mish Shedlock noted that it now takes three weeks to leave the State of Illinois. This from his post (emphasis added):

Why 3 weeks? That's how long it takes to reserve a one-way U-Haul outbound.

"Everyone is leaving. No one is coming," a U-Haul agent told us a few weeks ago.

Illinoisans Leave State in Record Numbers, and So Are We

On January 2, 2020, I announced Illinoisans Leave State in Record Numbers, and So Are We

I am pleased to report we loaded our U-Haul rental yesterday and I am on the road driving to our new home in Utah.

Right now we are just a few hours into the trip, but we have crossed the state line and are now in Iowa.

Goodbye Illinois

On February 12, Wirepoints noted If the wealthy flee, ordinary Illinoisans will be left holding the progressive tax bag.

Yep, and we have had enough.

We were paying about $15,000 a year in property taxes on a home now worth about $380,000 or so. We have a beautiful 1-acre lot, surrounded by 30 white or and burr oak trees 100-200 years old.

But property values are sinking. We will sell the house for a lot less than we paid for it 20 years ago.

Property taxes are a killer and taxes, in general, are going to rise in Illinois.

Despite the exodus from high-tax states, some politicians in high-tax states continue to push for higher taxes.

Alexandra Ocasio-Cortez, or AOC as she’s known, recently began a campaign to have the State of New York be the first state in the country to implement a wealth tax. This from “Zero Hedge” (emphasis added):

But after months of hard work in Washington, AOC is turning her attention back to NYC, with her latest campaign: A "wealth tax" to finance an emergency worker bailout fund for poor and undocumented New Yorkers.

According to Bloomberg, AOC's proposed wealth tax would tax the wealthy on unrealized gains in their stock portfolios. Currently, investments typically aren't taxed until they are sold and a profit (or loss) is realized.

New York would be the first state in the country to enact a wealth tax that targets wealth, instead of solely income (whether individual or corporate) and consumer spending. The state bill will be considered when the NY legislature returns from vacation on Monday.

“It’s time to stop protecting billionaires, and it’s time to start working for working families,” Ocasio-Cortez said in a video directed at Cuomo. The message spread on Twitter with the hashtag #MakeBillionairesPay.

But as the public debate over the wealth tax advances, we suspect we won't be hearing AOC delve into the finer points of tax policy. It's much more effective to simply organize a protest and get all your media buddies to come out and photograph crowds with their "soak the rich" signs.

And there's a reason for that: She has no incentive to educate her voters on the drawbacks of driving away Amazon and the billionaires. Her political rhetoric plays on mass resentment of the wealthy. AOC's willingness to pander to the "Occupy Wall Street" set by demonizing the wealthy is what made her stand out.

And what does it matter if the state's coffers take a hit from all the wealthy leaving the state? AOC will forever be known as the socialist who drove out the billionaires like snakes. While the middle-class, college-educated voters who comprise many of her most vocal supporters (think the hosts of the podcast Chapo Trap House) would never feel the sting of falling state revenues, the half of AOC's district that's Latino, and those who fall below the poverty line, might not be so forgiving.

After all, it wasn't long ago that AOC rallied support for opposing Amazon by focusing on the billions of dollars in on-paper tax incentives. However, she never delved into the full story: That those incentives aren't coming out of the state coffers, rather they're a discount on a hypothetical tax rate that the company would be paying only if it met certain obligations relating to economic development. Whether the deal was too generous was up for debate, but AOC argued that tax reforms are wrong on principle.

With the state in desperate need of new revenue, we wouldn't be surprised to see Gov. Cuomo, who has previously resisted more taxes on the rich, assent and agree to sign some version of AOC's wealth tax proposal to help restore the state's desperately low coffers.

The sad irony is that such a move might exacerbate the situation in the long term.

The situation will be exacerbated. Not long ago, we reported to you here in this publication that billionaire Carl Icahn, a New Yorker, picked up his business and employees and moved to Florida.

Others will follow.

The reality of the situation is that taxing only billionaires is nothing more than political rhetoric. There are only about 600 billionaires in the entire United States. Taxing them to 100% of their wealth won’t even run the country for an entire year.

But, it’s not just billionaires who are moving. The many companies who have discovered that their employees are now as effective working remotely are now giving those employees the freedom to live and work wherever they want.

This trend will make low tax jurisdictions accessible to these employees and country living possible for many who never thought it would be possible.

Morgan Stanley, Nationwide Insurance, and food giant, Mondelez are all moving toward more of their employees working remotely, and eliminating office real estate that they have discovered is now unneeded.

This from CNBC (emphasis added):

Morgan Stanley CEO James Gorman is uncertain about what work-life will look like after the pandemic but said the bank would need “much less real estate” in the future. About 90% of Morgan Stanley’s employees have been working from home during the pandemic.

“We’ve proven we can operate with no footprint,” he said in a recent Bloomberg TV interview. “Can I see a future where part of every week, certainly part of every month, a lot of our employees will be at home? Absolutely.”

Barclays CEO Jes Staley said this week that putting thousands of workers in a corporate office building may never happen again. “There will be a long-term adjustment in how we think about our location strategy ... the notion of putting 7,000 people in a building may be a thing of the past,” he said in public comments this week after the company’s earnings.

It’s our belief that most of our readers are utilizing the two-bucket approach to managing assets as outlined in the book “Revenue Sourcing”. If you are not, give the office a call and we’ll help you get started.

Thank you for your referrals!

If you know someone who might appreciate this publication, invite them to subscribe for free at www.RetirementLifestyleAdvocates.com. Or, just forward your newsletter e-mail to them.

This week’s RLA radio show is now posted at www.RetirementLifestyleAdvocates.com. This week’s program features an interview with economist John Williams of shadowstats.com.

Mr. Williams is forecasting a hyperinflationary environment as a result of the current monetary policy of money creation.

You won’t want to miss this interview. If you are already using the two-bucket approach to manage your money as outlined in the best-selling book, “Revenue Sourcing”, this interview will confirm your approach.

If you are not attending our Monday noon update webinars, we are getting great feedback. Each week we give you our perspective on where the markets and economy are headed. To get an invitation, call the office at 1-866-921-3613.

“Facts are stubborn things, but statistics are more pliable”

-Mark Twain