Weekly Market Update by Retirement Lifestyle Advocates

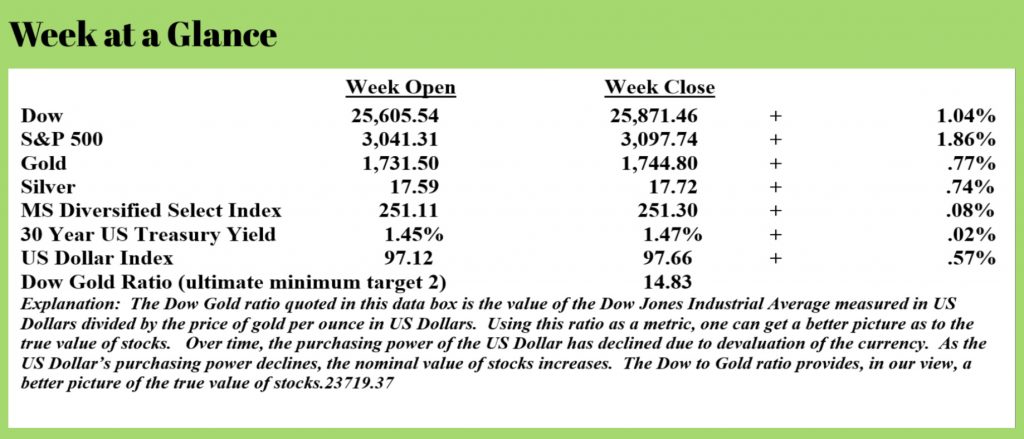

Stocks and gold both advanced last week, leaving the Dow to Gold ratio unchanged at 14.83.

All markets that we track here in “Portfolio Watch” were higher with the exception of the US Treasury long bond, which slightly declined as yields rose 2 basis points to 1.47%.

As we stated last week, we continue to stand by our prediction of a Dow to Gold ratio of 2, perhaps even 1.

That forecast, which seemed radical when we made it, now seems more realistic.

The Federal Reserve policy of enormous quantities of money creation will have to eventually lead to inflation in our view. That will be bullish for gold; individuals and foreign governments are already beginning to seriously question the role of the US Dollar as a world reserve currency moving ahead.

As currencies evolve and as money is created out of thin air, the wealth gap will widen. Beaten down economies will likely not recover as quickly as many hope. This will likely lead to more geopolitical tensions and social unrest.

Six years ago, David Morgan, a renowned and recognized silver expert, noted that “you cannot have true peace and prosperity unless you can absolutely trust the money.”

As Patrick Heller observed in his June newsletter, “it is no accident that the relatively free markets and a stable dollar tied to gold resulted in American becoming the most prosperous (and benevolent) country in the world. This has become less true since former President, Richard Nixon, closed the gold exchange window in August of 1971.”

Mr. Heller also noted that the US Dollar, as recently as one month ago, was still holding up reasonably well against other world currencies, although it was still trailing gold.

Over the one-month time frame ending on June 2, the US Dollar lost a lot of ground against other world currencies as well as tangible assets.

Most notably, the US Dollar was down against gold, more than 10% against platinum and palladium, and more than 20% against silver.

The chart, reprinted from Mr. Heller’s newsletter, illustrates.

The decline of the US Dollar is continuing as evidenced by the price of precious metals. Keeping in mind that markets rarely go straight up or straight down, we would not be surprised to see a dollar rally and a metals decline given the magnitude of the decline over the past month. However, we would view declines in metal’s prices to be countertrend at this point given current monetary policies.

Worldwide, the signs of low confidence in the US Dollar continue to emerge.

Just last week the chair of the Chinese Banking and Insurance Regulatory Commission, Guo Shuqing, delivered a warning about the US Dollar.

While delivering a speech in Shanghai, Mr. Shuqing made four points:

One: The US Federal Reserve is the de facto central bank of the world. When the policy of the central bank targets its own economy without considering the spillover side effects, the Fed is very likely to “Overdraft the credit of the dollar and the US.”

Two: The pandemic may be around for a long time. Countries around the world keep throwing money at it with diminished impact. Mr. Shuqing advised that countries “think twice and reserve some policy space for the future,”

Three: Money printing will cause future economic turmoil. There is no free lunch. Watch out for inflation.

Four: Financial markets (stocks) are disconnected from the real economy and these distortions are “unprecedented”. Mr. Shuqing noted that it's going to get “really painful’ when the policy withdrawal begins.

Mr. Shuqing concluded by saying, “Some people say ‘domestic debt is not debt’, but external debt is debt. For the United States, even external debt is not debt. This seems to have been the case for quite some time in the past, but can it really last for a long time in the future?”

This from a “Zero Hedge’ article on this same topic (https://www.zerohedge.com/markets/beijing-sounds-alarm-about-dollars-reserve-status) (Quote is from Mr. Shuqing):

“China cherishes the conventional monetary and fiscal policies very much. We will not engage in flooding the system, nor will we engage in deficit monetization and negative interest rates.”

It’s not the first time China vented frustration against the “exorbitant privilege” of the dollar. After the financial crisis, then-PBOC Governor Zhou Xiaochuan proposed using the SDR to replace the dollar as the main reserve currency.

It went nowhere. But this time, China seems to be determined to enhance its reserve-currency status by avoiding unconventional policies. It won’t dislodge the dollar tomorrow, but its attractiveness is clear in the foreign flows to its bond market.

As the US Dollar continues to lose favor and alternatives are sought out and adopted, the US Dollar will lose purchasing power and the price of gold will rise in nominal terms. That will be a key factor in getting the Dow to God ratio back to 2 or even 1.

Stephen Roach, former Chairman of Morgan Stanley Asia agrees. This from an MSN article (Source: https://www.msn.com/en-us/money/markets/the-dollar-will-collapse-under-a-ballooning-us-deficit-and-deglobalization-former-morgan-stanley-asia-chairman-says/ar-BB15yROf) on the topic (emphasis added).

The US dollar's dominance faces major threats as the post-pandemic global economy emerges, Stephen Roach, former chairman at Morgan Stanley Asia, said Monday.

The currency's strength survived attacks from President Donald Trump, a trade war, and the start of the coronavirus outbreak. Yet its winning streak has faded in recent weeks as investors prepare for record borrowing to fund trillions of fiscal and monetary stimulus. A sinking national savings rate also stands to drag on the dollar, Roach told CNBC's "Trading Nation."

"The US economy has been afflicted with some significant macro imbalances for a long time, namely a very low domestic savings rate and a chronic current account deficit," he said. "These problems are going to go from bad to worse as we blow out the fiscal deficit in the years ahead."

Looming shifts in the global manufacturing industry will create a more long-term pressure on the currency, the Yale University senior fellow added. Several experts project the US will promote domestic production and move away from increasingly complex supply chains. Roach sees such a transition taking place over the next couple of years and sealing the dollar's fate.

"Generally, it's a negative implication for US financial assets," he said. "It points to the probability of higher inflation as we import more higher-cost foreign goods from overseas, and that's negative for interest rates."

The argument for a weaker dollar and higher gold prices is a very solid one.

Gold rising to $3000 per ounce or more as stocks fall is not an unrealistic expectation in our view.

At the same time, the argument for much lower stock prices is also an easy argument to make given current stock valuation levels.

As we noted at the outset of this piece, we have been predicting a Dow to Gold ratio of 2, or more likely 1 for many years, now it seems that there is now a path on which we get there.

If you are not using the two-bucket approach to manage your assets, we would encourage you to begin immediately. Economic conditions that we predicted would appear are now appearing.

This week’s RLA radio show is now posted at www.RetirementLifestyleAdvocates.com. This week’s program features an interview with multi-time best-selling author, Mr. Harry Dent.

There are also other resources posted there as well as all past podcasts of the radio program.

Thank you for your support! The book “Revenue Sourcing; The Retirement Planning Strategy for the Post Pandemic Economy” by Dennis Tubbergen has reached #1 best-seller status in 4 Amazon categories.

“I told my psychiatrist that everyone hates me. He said I was being ridiculous, everyone hasn’t met me yet.”

-Rodney Dangerfield.