Weekly Market Update by Retirement Lifestyle Advocates

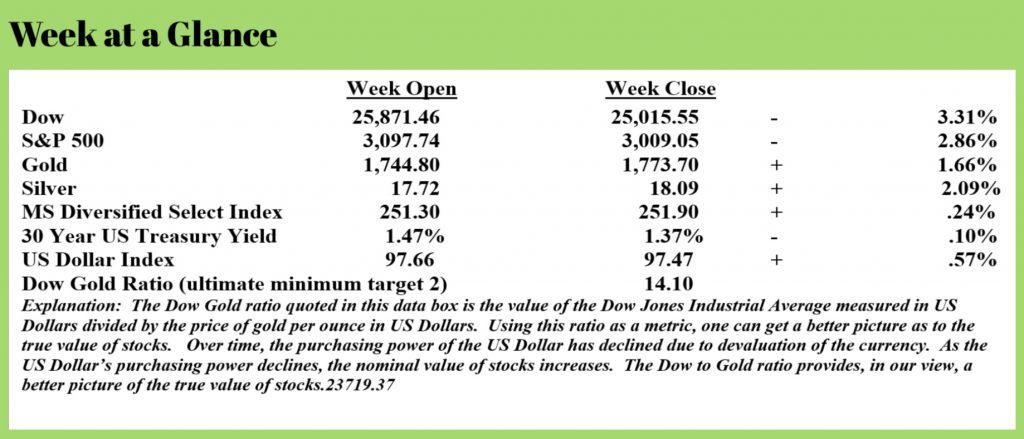

Stocks fell last week while precious metals advanced. That affected the Dow to Gold ratio, reducing it to 14.10 from 14.83 last week.

As we have been reminding readers of “Portfolio Watch”, we have been predicting the Dow to Gold ratio will eventually fall to two, or perhaps even one.

Our favorite asset classes moving ahead continue to be precious metals, cash, and highly rated corporate bonds. Many insurance companies invest their portfolios in highly rated corporate bonds as well. Given that since the end of March, banks have a zero percent reserve requirement, some financial vehicles offered by insurance companies can be a viable alternative for some aspiring retirees.

We would continue to be extremely cautious about stocks at these valuations. The economy has experienced a huge hit the extent of which is still somewhat unknown.

Evidence is beginning to emerge, however.

In March 3.8% of all US mortgages were delinquent. That number rose to 7.76% in May, more than doubling in just two months.

This from “Housing Wire” (emphasis added):

The U.S. mortgage delinquency rate rose to 7.76% in May as Americans struggled to pay their bills during the worst public health crisis in more than a century.

The rate rose from 6.45% in April and was 3.39% in March, the month when states began issuing stay-at-home orders to try to stem the spread of COVID-19, according to the report on Monday. Black Knight counts loan in forbearances – meaning they have an agreement with the servicer to suspend payments – as being delinquent, as does Mortgage Bankers Association.

Measured as a number, rather than a percentage, there were 4.12 million mortgages in the U.S. that had payments more than 30 days overdue in May, Black Knight said.

It’s important to put these numbers in context. Mortgage delinquencies at these levels are alarming but it’s important to remember that this level of delinquencies has occurred while stimulus checks have been mailed to Americans and while combined unemployment benefits have been around $1,000 per week in many states. The federal benefit of $600 per week runs out in July.

When many households cease collecting an additional $2,400 monthly, how many more delinquencies will we see?

We would forecast that a minimum of 20% of mortgages will become delinquent; 30% is not out of the question.

Real estate prices will be affected.

Lockdowns imposed as a response to COVID-19 are devastating the economy which was weak going into the crisis. The full economic effect of the lockdowns remains to be seen in our view.

There are many industries and institutions that will be even more adversely impacted than they already have been.

Higher education is just one of a myriad of examples.

Tuition rates, already in a bubble due to massive amounts of credit extended to students (about $1.5 trillion), will have to come down and as they do, many colleges and universities will cease to exist.

This from “Campus Reform” (Source: https://www.campusreform.org/?ID=15129) (emphasis added):

Scott Galloway, professor of marketing at the New York University Leonard N. Stern School of Business told Hari Sreenivasan on PBS’ “Amanpour and Co.” that many colleges are likely to suffer to the point of eventual extinction as a result of the coronavirus.

He sets up a selection of two-tier universities as those most likely not to walk away from the shutdown unscathed. During the pandemic, wealthy companies have not struggled to survive. Similarly, he says, “there is no luxury brand like higher education,” and the top names will emerge from the coronavirus without difficulty.

“Regardless of enrollments in the fall, with endowments of $4 billion or more, Brown and NYU will be fine,” Galloway wrote in a blog post. “However, there are hundreds, if not thousands, of universities with a sodium pentothal cocktail of big tuition and small endowments that will begin their death march this fall.”

“You’re gonna see incredible destruction among companies that have the following factors: a tier-two brand; expensive tuition, and low endowments,” he said on “Amanpour and Co.,” because “there’s going to be demand destruction because more people are gonna take gap years, and you’re going to see increased pressure to lower costs.”

Approximating that a thousand to two thousand of the country's 4,500 universities could go out of business in the next 5-10 years, Galloway concludes, “what department stores were to retail, tier-two higher tuition universities are about to become to education and that is they are soon going to become the walking dead.”

The reality is that many families had already begun to question the value of higher education given the costs. Now, with classes taking place on Zoom, it will be even harder to justify tens of thousands of dollars per year for a degree that costs a lot more than it used to and arguably delivers less.

In that respect, the college and university tuition bubble, funded by easy credit, will likely behave like any other bubble.

The Federal Reserve, in response to the deteriorating economic conditions, is becoming more desperate as we’ve discussed here often.

As noted above, banks now operate with a zero-reserve requirement. Last fall, we reported to you here that the Fed was propping up the repo market, the overnight lending market between banks.

Ron Paul, past guest on our radio program, commented: (Source: http://www.ronpaullibertyreport.com/archives/the-federal-reserve-is-getting-desperate) (emphasis added):

In a sign that the Federal Reserve is growing increasingly desperate to jump-start the economy, the Fed’s Secondary Market Credit Facility has begun purchasing individual corporate bonds. The Secondary Market Credit Facility was created by Congress as part of a coronavirus stimulus bill to purchase as much as 750 billion dollars of corporate credit. Until last week, the Secondary Market Credit Facility had limited its purchases to exchange-traded funds, which are bundled groups of stocks or bonds.

The bond purchasing initiative, like all Fed initiatives, will fail to produce long-term prosperity. These purchases distort the economy by increasing the money supply and thus lowering interest rates, which are the price of money. In this case, the Fed’s purchase of individual corporate bonds enables select corporations to pursue projects for which they could not otherwise have obtained funding. This distorts signals sent by the market, making these companies seem like better investments than they actually are and thus allowing these companies to attract more private investment. This will cause these companies to experience a Fed-created bubble. Like all Fed-created bubbles, the corporate bond bubble will eventually burst, causing businesses to collapse, investors to lose their money (unless they receive a government bailout), and workers to lose their jobs.

Under the law creating the lending facilities, the Fed does not have to reveal the purchases made by the new facilities. Instead of allowing the Fed to hide this information, Congress should immediately pass the Audit the Fed bill so people can know whether a company is flush with cash because private investors determined it is a sound investment or because the Fed chose to “invest” in its bonds.

The Fed could, and likely will, use this bond-buying program to advance political goals. The Fed could fulfill Chairman Jerome Powell’s stated desire to do something about climate change by supporting “green energy” companies. The Fed could also use its power to reward businesses that, for example, support politically correct causes, refuse to sell guns, require their employees and customers to wear masks, or promote unquestioning obedience to the warfare state.

Another of the new lending facilities is charged with purchasing the bonds of cash-strapped state and local governments. This could allow the Fed to influence the policies of these governments. It is not wise to reward spendthrift politicians with a federal bailout — whether through Congress or through the Fed.

With lending facilities providing to the Federal Reserve the ability to give money directly to businesses and governments, the Fed is now just one step away from implementing Ben Bernanke’s infamous suggestion that, if all else fails, the Fed can drop money from a helicopter. These interventions will not save the economy. Instead, they will make the inevitable crash more painful. The next crash can bring about the end of the fiat monetary system. The question is not if the current monetary system ends, but when. The only way Congress can avoid the Fed causing another great depression is to begin transitioning to a free-market monetary system by auditing, then ending, the Fed.

Dr. Paul’s comments are spot on in our view. His remarks are even more unnerving when one keeps in mind that the Federal Reserve is a private group of bankers.

This week’s RLA radio show is now posted at www.RetirementLifestyleAdvocates.com. This week’s program features an interview with Dr. Charles Nenner a cycles expert. Dr. Nenner uses his study of cycles to conclude that the Dow will fall to 5,000 by late next year. While we are not so bold as to forecast timing, his cycle research squares nicely with our Dow to Gold ratio research.

There are also other resources posted there as well as all past podcasts of the radio program.

“Don’t go around saying the world owes you a living. The world owes you nothing. It was here first.”

-Mark Twain