Weekly Market Update by Retirement Lifestyle Advocates

Stock

bloodbath. That about sums it up after

the worst week for stocks since the financial crisis.

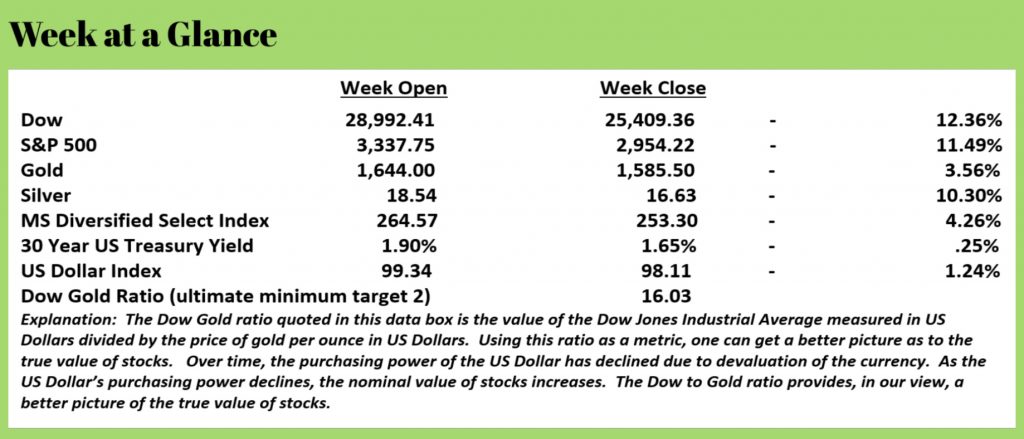

We have been writing about the volatility of stocks of late in this publication and have been publishing our long-term forecast for the Dow to Gold ratio for many years. For new readers, the Dow to Gold ratio is calculated by taking the value of the Dow Jones Industrials and dividing by the price of gold per ounce. As the databox above reflects, that ratio now stands at about 16.

Our long

term forecast for this ratio is 2, more likely 1. Granted, it may take a while to get there,

but given all the artificial stimulus that has been used to prop up the stock

market, we expect the ultimate bust to be 1929 like.

For those readers

who believe that we have free markets, let this short piece serve as a quick

primer and a wake-up call to taking steps to protect your assets. A word to the wise, no matter what your

relationship is with your broker or advisor, no one cares as much about your

money as you do.

Back in

1988, after the ‘flash crash’ in the stock market, President Reagan put in

place a group known as the Working Group on Financial Markets. In 1997, “The Washington Post” coined the

term “Plunge Protection Team” to describe the group. The group was created by the president’s

executive order (Executive Order 12631) and was charged with "enhancing the integrity, efficiency, orderliness, and

competitiveness of our Nation's financial markets and maintaining investor

confidence."

The original purpose of the group was to report on the market events of October 19, 1987, or “Black Monday”. It was during that time that the Dow Jones Industrial Average fell 22.6%, rattling the confidence of investors and creating panic in the markets.

Yes, the Plunge Protection Team does exist. This from “Seeking Alpha” in December of 2018

(Source: https://seekingalpha.com/article/4230043-plunge-protection-team-to-strike-again):

In plain English,

monetary sovereign currency creation powers are being used to make the markets

maintain stability. Treasury funds are made available, but the WGFM is not

accountable to Congress and can act from behind closed doors.

This illustrates how

central banks can create money electronically without causing consumer price

inflation, rather than taxing populations to pay for government budget

deficits.

The PPT is meeting at

this very moment.

The main reason we

have a stock market plunge at the moment is the general withdrawal of world

Central Bank liquidity support.

The same

thing happened in 2015-2016 and the world stock market response was the

same.

A

withdrawal of central bank liquidity that began in 2014-15 resulted in a stock

market and GDP slump twelve months later.

So, let’s look at this. What does ‘monetary sovereign currency

creation powers are being used to make the markets maintain stability’ really

mean?

Money is/was being created to

stabilize the markets. Need a stock

rally?

In comes the Plunge Protection Team

to save the day. On the committee is the

Chair of the Federal Reserve, the nation’s central bank. A stock rally can be fueled by throwing newly

created currency in the markets.

Skeptical? We don’t blame you, but here is a quote from

an interview with Richard Fisher, former member of the Federal Open Market

Committee (Source: www.cnbc.com/2016/01/06/dont-blame-china-for-the-market-sell-off-commentary.html) (emphasis

added):

“I spent 10 years (through last March) as a

participant in the deliberations of the Federal Open Market Committee, setting

monetary policy for the U.S. The purpose of zero interest rates engineered by

the FOMC, together with the massive asset purchases of Treasuries and agency

securities known as quantitative easing, was to create a wealth effect for the real economy by

jump-starting the bond and equity markets.

The impact we had expected for the economy and

for the markets was achieved. By February of 2009, the Fed had purchased over

$1 trillion in securities. With interest rates throughout the yield

curve moving in the direction of eventually resting at the lowest levels in 239

years of history, the stock market reacted: It bottomed in the first week of

March of 2009 and then rose dramatically through 2014. The addition of a third

round of QE, which had the Fed buying $85 billion per month of securities to

ultimately expand its balance sheet to over $4.5 trillion, juiced the

markets.”

Translation?

The Fed printed

$1 trillion and dumped it into the financial markets. As Mr. Fisher so plainly stated, the Fed

“juiced the markets”.

Quietly and

unbeknownst to the average IRA or 401(k) investor, the Fed manipulates

markets. Stock markets and bond markets

are being artificially influenced to attempt to achieve a desired outcome.

So, if that’s the

case, what happened this week?

Is the

coronavirus to blame. Mostly not in our

view.

The market

fundamentals have been screaming correction for a long time as we’ve often

written here. Significant market

corrections typically begin when stocks are overvalued and margin debt levels

are high. Then a “black swan’ event occurs,

and the market correction begins. That’s

how we view the current situation (we are not attempting to trivialize or

minimize the coronavirus situation, only look at it from the perspective of the

massive market correction that occurred this week).

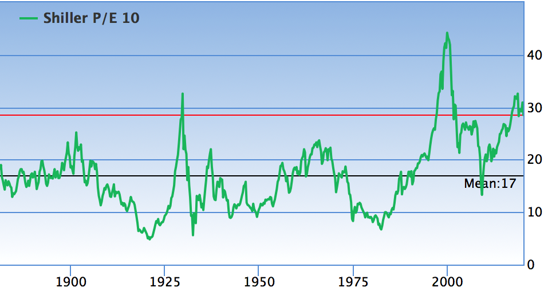

One of the most common methods used to value stocks is the price-to-earnings ratio. This ratio is calculated by taking the price of stocks and dividing by earnings. The higher the number, the more overvalued stocks are.

Notice from the

chart on this page that the current 10-year P/E ratio average was slightly

higher than in 1929. Only once have

stocks been more overvalued and that was prior to the tech stock bubble

collapsing.

To muddy the

water up a bit when it comes to calculating P/E ratios, as we have reported

here in “Portfolio Watch”, many publicly traded companies have been buying back

shares of their stock. This once illegal

practice increases earnings per share but not by increasing company

earnings. Higher earnings per share is

accomplished by having fewer shares outstanding.

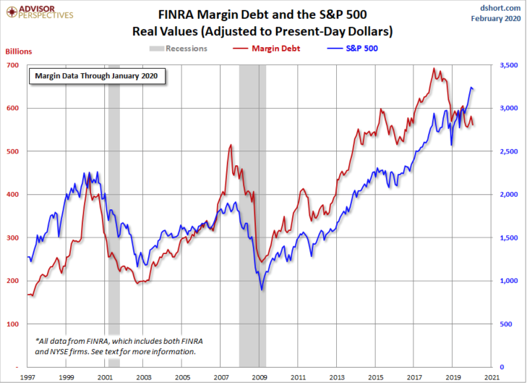

Margin debt is

also high. Margin debt is debt an

investor acquires to buy securities, often stocks.

This chart below illustrates the level of margin debt that exists according to FINRA. Notice how margin debt pulled back prior to the stock market corrections of 2000 and 2007. Then observe how margin debt has recently pulled back perhaps forecasting the correction that began this past week.

So, what’s next?

We expect the

Plunge Protection Team and the Federal Reserve to pull out all the stops. Look for interest rate cuts for sure in our

opinion.

But the reality is still the reality. Stocks have long been artificially manipulated. Basic laws of economics tell us that cannot go on forever.

Can the Fed and the

PPT squeeze some more juice out of this market?

Perhaps, but

given the market activity of last week, it’s looking less likely.

So, what should

you do?

Make sure you’re

protected, at least on some of your investments. Especially those that you might need for

retirement. Given market action last

week, we think there is a strong possibility that this correction will continue

long term although we do expect markets could rally some first. We would view any rally at this point as a

bear trap.

For that reason,

you may also want to think long and hard about taking the traditional broker

and advisor advice about staying in the stock market for the long haul,

‘keeping your eyes on the horizon’. At

some point here in the relatively near future, we are of the mind it will fail

many investors miserably and cost them their dream of a comfortable,

stress-free retirement.

This

week’s Retirement Lifestyle Advocates Radio Program is now posted at www.RetirementLifestyleAdvocates.com. It is a ‘best of’ show featuring Gerald

Celente from two weeks ago. On the

program, host, Dennis Tubbergen and Mr. Celente discuss the strong possibility

of a stock market correction which began just a week after the show originally

aired.

“Stock prices have reached what looks like a

permanently high plateau. I do not feel there will be soon if ever a 50 or 60

point break from present levels, such as (bears) have predicted. I expect to

see the stock market a good deal higher within a few months.”

-Irving Fisher, Ph.D. in Economics, October 17, 1929

“Stocks

look pretty cheap to me”

-Larry Kudlow, Nat'l Economic Council Director, February 28, 2020