Weekly Market Update by Retirement Lifestyle Advocates

Has 1929 Arrived?

As bad as markets were the

week before last, they were even worse last week.

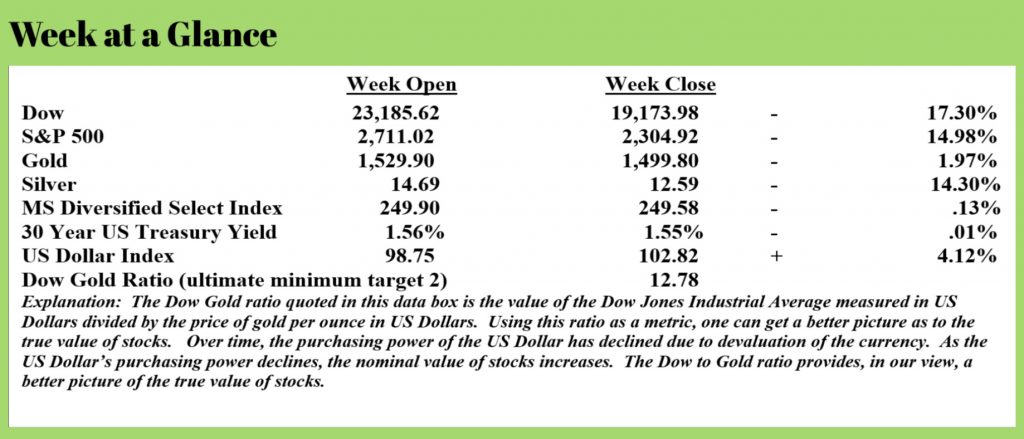

While the Coronavirus has been the pin that has popped the bubble, we have been forecasting a big decline in stocks for a couple of years. Admittedly, at times over the past couple of years, our calls for a major stock market decline in the near future were reminiscent of the boy who cried wolf. But, going back several years, we put out the forecast of the Dow to Gold ratio reaching at least 2, but more likely 1.

Given

where stocks are today, that forecast still sounds more like fantasy than

reality, but when looking at the facts, we are holding firm to that forecast.

For

the uninitiated or new reader, the Dow to Gold ratio is the value of the Dow

Jones Industrial Average divided by the price of gold per ounce in US

Dollars. As the databox above shows, the

Dow to Gold ratio currently stands just under 13. That means we are of the strong belief that

there will be more downside for stocks (probably much more) and more upside for

gold. It’s important to note that it’s

quite possible we could see a bear market rally before the downtrend continues

but, from a technical perspective, this still looks like a classic Elliot Wave

3 move. If you’re not familiar with

Elliot Wave analysis, it’s a method to interpret market movements. A wave 3 down (or up in a bull market) is a

strong and often long move.

The

chart compares the current decline in stocks to that of 1929 and 1987. Notice that the current decline is now worse and

more dramatic than the decline of 1929 at this point.

As the country plummeted into depression in 1929, economic

contraction was huge. The Federal

Reserve induced bubble known historically as the “Roaring Twenties” burst in

1929 as the economy contracted severely.

A

CNBC article (Source: https://www.cnbc.com/2020/03/20/goldman-sees-an-unprecedented-stop-of-economic-activity-with-2nd-quarter-gdp-contracting-by-24percent.html) reports that Goldman Sachs

is forecasting an economic decline of 6% in the first quarter of this year and

24% in the second quarter of the year.

Should that occur, it will be the biggest quarterly decline in US

history including during the Great Depression and the Civil War. These are historic times in which we live.

The

government is promising stimulus. Over

the past week, stimulus plans have been floated from $850 billion at the

beginning of last week to about $2 trillion over this past weekend as we are

writing this week’s issue of “Portfolio Watch”.

Meanwhile, there also appears to trouble brewing in the banking sector as we have also been discussing over the past couple of years. The Federal Reserve has been supporting or propping up the repo market which is the overnight lending market between banks since September. The Fed announced on Friday they would make up to $1 trillion per day available to big banks through the end of the month. (Source: https://www.pbs.org/newshour/economy/federal-reserve-to-lend-additional-1-trillion-a-day-to-large-banks)

Read

those last two paragraphs again. We are

talking trillions and trillions of dollars in an attempt to reinflate the

bubble.

Here’s

our forecast – it won’t work. As we have

often stated, you can’t solve a debt problem by creating more debt.

It didn’t

work in 1929 and it won’t work now.

The reality is, when looking at the fiscal condition of the government in 1929, the government wasn’t broke. Government debt was about 20% of economic output or Gross Domestic Product. Today, government debt is well over 100% of GDP, and that’s before the massive economic contraction hits this quarter and next. This could likely be far worse than in 1929.

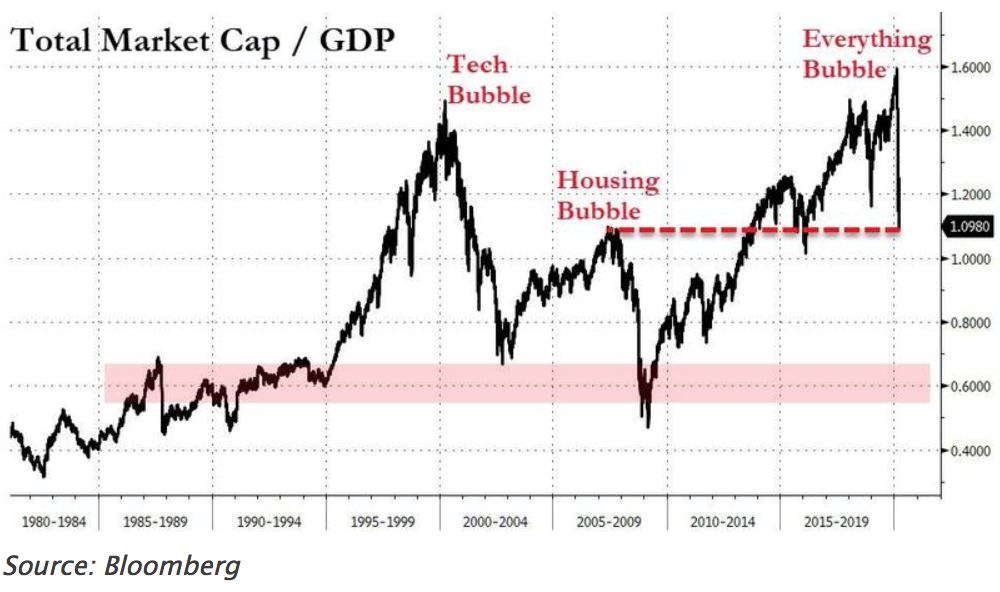

For readers who think that the stock market will come roaring back once the coronavirus situation gets under control – you may want to think again. Despite this massive and painful sell-off, stocks are still extremely overvalued.

This

chart, from Bloomberg, shows total market capitalization compared to Gross

Domestic Product. The important thing to

note from the chart is that stock valuations, after the recent huge decline, are

back to where the decline started prior to the financial crisis of 2007 and

2008.

In

other words, the recent decline has now gotten us back to valuations were when

the financial crisis began.

That’s stunning. And, it also

makes the case for our Dow to Gold forecast stated above.

A

salient comparison point is that during the financial crisis, the 4th

quarter of 2008 saw GDP decline 8.4%, that’s about 1/3rd of what

Goldman is forecasting for the second quarter of this year after a 6% estimated

decline in GDP during the first quarter of this year.

Doing

some rough math, if GDP contracts by 30% from here and the economy recovers in

the 3rd quarter (which is pure speculation at this point), the

economic decline stands to be three times worse than in 2008. GDP will fall from about $21 trillion to

under $14 trillion.

In

2008, stocks fell more than 50% from these current levels when using the market

capitalization to GDP ratio. It’s

reasonable to hypothesize that a bigger decline from these levels is likely

given that the economic decline will be three times worse.

With

the Dow at about 19,000, a 50% decline from here puts it at 9,500. An 80% decline which in our view is more

likely given the projected economic contraction puts the Dow at about

4,000. That would be in the neighborhood

of our longstanding Dow to Gold ratio forecast of 2 at a minimum.

It is our strong conviction that this is not a ‘buy the dip’ correction. There will be more downside and we believe that forecasts for a rebounding market and economy at year-end are far too optimistic.

If

you are using the two-bucket approach to manage your assets as many of our

readers are, the assets in your deflation bucket have remained constant and

stable. You have experienced no

losses. That’s good and will keep many

retirement plans on track.

If you are not using the two-bucket approach but would like to discover how to potentially implement it in your situation, feel free to give the office a call. We would be glad to schedule a phone consultation to give you details. The office phone number is 1-866-921-3613. Rest assured, the phone consultation will be informational only, and we’ll get you some educational handouts prior to the call. If you have dreams of retiring and you’re concerned about your retirement nest egg, get educated. And, as we’ve outlined here, time is of the essence.

But

there’s another piece of this puzzle that we should discuss.

Inflation. All this new government spending cannot be

funded by tax revenues. In a period of

economic contraction, tax revenues decline.

Prior to the current crisis, the US was already running $1 trillion

deficits as far as the eye could see.

Now, in light of the current situation, government operating deficits

could be triple that number.

While

there are strong deflationary forces presently, we believe these forces will be

overtaken at some point by inflationary, even hyperinflationary forces. That’s why having assets in the second bucket

is essential. To preserve purchasing

power.

While it is hard to imagine inflation given the massive decline in the value of many financial assets presently, the current policy response can likely lead to no other outcome at some future point.

Exactly

when this inflation will appear is tough to predict, but there is a tipping

point that we will have to reach given the massive new money creation by the

Fed.

As we

wrote in last week’s “Portfolio Watch”, “after the financial crisis, the Fed

engaged in quantitative easing to the tune of $85 billion per month, or about

$1 trillion per year. Last week, in one

day, QE totaled $1.5 trillion.”

Get educated. We are in the process of developing

additional educational materials to keep you informed as these anticipated

events occur. Look for more information

by next week.

This

week’s Retirement Lifestyle Advocates Radio Program is now posted at www.RetirementLifestyleAdvocates.com. This week, host, Dennis Tubbergen, interviews

John Rubino author of “The Money Bubble”.

They discuss current economic events and where things may go from here.

In

these times, if you know of someone that might benefit from the information in

this weekly publication, direct them to get a free subscription at www.RetirementLifestyleAdvocates.com.

As

you all know, we respect the privacy of our subscribers and never inundate them

with e-mails.

Blessings

to all of you.

“No act of kindness, no matter how small, is ever wasted.”

-Aesop