Weekly Market Update by Retirement Lifestyle Advocates

Volatility continues to rage

on in the financial markets.

After the worst week in

stock market history, stocks rebounded last week although Friday’s price action

in stocks confirmed the high level of volatility that exists. After strong rebounds for most of the week,

stocks fell hard on Friday. The Dow

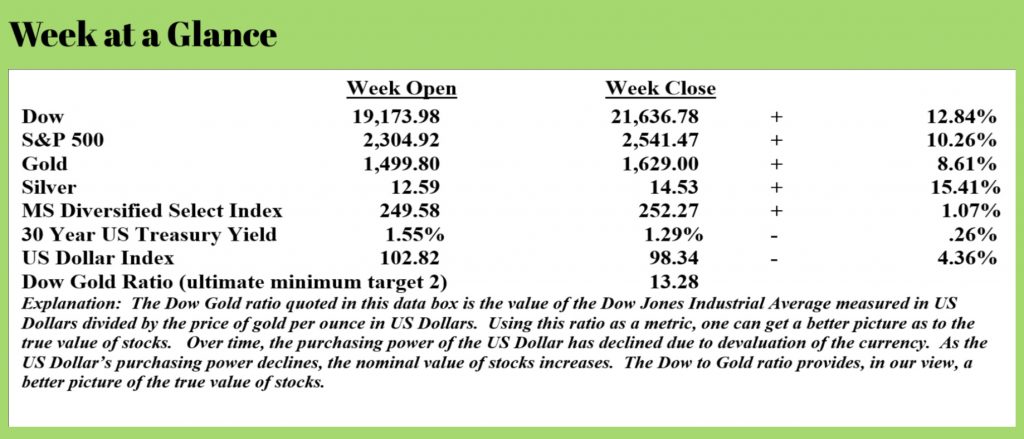

Jones Industrial Average fell more than 4 % in one day. Despite the decline, the Dow finished almost

13% higher for the week.

Gold and silver also

rebounded. The yellow metal rallied more

than 8.5% and silver advanced more than 15% for the week.

There is an interesting, and not unexpected development in the metals markets presently. The spot price of gold and silver which we track weekly in this publication has broken from the actual prices being paid in the actual physical metals markets. Premiums for physical gold and silver went through the proverbial roof last week and it was nearly impossible to find any quantities of gold or silver even with the much higher premiums.

Congress passed a record stimulus package on Friday in response to the Coronavirus situation. The initial package is for more than $2 trillion.

While we are still sorting

through the provisions of the stimulus package, there is one provision that is

as interesting as it is alarming. We

discuss this provision in detail in the April issue of the “You May Not Know

Report”.

Briefly, this provision

allows for the use of SPV’s or Special Purpose Vehicles to allow the US

Treasury to take an interest in private bond issues. At least that’s where it is starting.

This, in our view,

ultimately puts control of the printing press in the hands of the

politicians. What could go wrong?

This provision, included in

the CARES Act, emerges after the Federal Reserve has cut interest rates to zero

and committed to unlimited quantitative easing (money printing). We are definitely in uncharted territory

here. It’s obvious that they’re pulling

out all the stops to reinflate the bubble.

As we have previously stated, it is our belief that the Corona-virus situation is the pin that popped the bubble. We will continue to focus on the potential financial and economic aspects of the current situation. We are not qualified to discuss the medical implications and consequences. We urge you to follow all recommendations of the authorities when it comes to dealing with the Coronavirus situation.

SPV’s, or Special Purpose

Vehicles have been used previously, just not as they will be used moving

forward. The alarming development in our

view is that the US Treasury and ultimately politicians are now directly

involved in the decision to print more money.

History teaches us that whenever politicians can’t print money – they

will. And, always in ever more copious

quantities.

Jim Bianco wrote an opinion

piece that was published on “Bloomberg” that describes this new “partnership”

between the Federal Reserve and the US Treasury. (Source:

https://finance.yahoo.com/news/feds-cure-risks-being-worse-110052807.html). Here is a bit from that piece (emphasis

added):

But it’s the alphabet soup of new programs that

deserve special consideration, as they could have profound long-term

consequences for the functioning of the Fed and the allocation of capital in

financial markets. Specifically, these are:

CPFF (Commercial Paper Funding Facility) – buying

commercial paper from the issuer.

PMCCF (Primary Market Corporate Credit Facility) –

buying corporate bonds from the issuer.

TALF (Term

Asset-Backed Securities Loan Facility) – funding backstop for asset-backed

securities.

SMCCF (Secondary Market Corporate Credit Facility) –

buying corporate bonds and bond ETFs in the secondary market.

MSBLP (Main Street Business Lending Program) – Details are to come, but it will lend to eligible small and medium-sized businesses, complementing efforts by the Small Business Association.

To put it bluntly, the Fed isn’t allowed to do

any of this. The central bank is only allowed to purchase or lend

against securities that have government guarantees. This includes Treasury securities, agency mortgage-backed

securities and the debt issued by Fannie Mae and Freddie Mac. An argument can

be made that can also include municipal securities, but nothing in the

laundry list above.

So how can they do this?

The Fed will finance a special purpose vehicle

(SPV) for each acronym to conduct these operations. The Treasury, using the

Exchange Stabilization Fund, will make an equity investment in each SPV and be

in a “first loss” position. What does this mean? In essence, the Treasury, not

the Fed, is buying all these securities and backstopping of loans; the Fed

is acting as banker and providing financing. The Fed hired BlackRock Inc. to purchase these securities

and handle the administration of the SPVs on behalf of the owner, the

Treasury.

In other words, the federal government is

nationalizing large swaths of the financial markets. The Fed is providing the money to do it. BlackRock will be doing

the trades.

This scheme essentially merges the Fed and Treasury

into one organization. So, meet your new Fed chairman, Donald J. Trump.

In 2008 when something similar was done, it was on a

smaller scale. Since few understood it, the Bush and Obama administrations

ceded total control of those acronym programs to then-Fed Chairman Ben

Bernanke. He unwound them at the first available opportunity. But now, 12

years later, we have a much better understanding of how they work. And we have

a president who has made it very clear how displeased he is

that central bankers haven’t used their considerable power to force

the Dow Jones Industrial Average at least 10,000 points higher,

something he has complained about many times before the pandemic hit.

When the Fed was rightly alarmed by the current

dysfunction in the fixed-income markets, they felt they needed to

act. This was the correct thought. But, to get the authority to stabilize

these “private” markets, central bankers needed the Treasury to agree to

nationalize (own) them so they could provide the funds to do it.

In effect, the Fed is giving the Treasury access to

its printing press. This means that, in

the extreme, the administration would be free to use

its control, not the Fed’s control, of these SPVs to instruct the Fed to

print more money so it could buy securities and hand out loans in an

effort to ramp financial markets higher going into the election. Why stop

there? Should Trump win re-election, he could try to use these SPVs

to get those 10,000 Dow Jones points he feels the Fed has denied everyone.

What this means is that moving ahead, the rules have been

changed. The US Treasury will invest in

the SPV which will invest in commercial paper and corporate bonds. Where will the Treasury get the money to do

this?

From the Federal

Reserve.

Where will the

Federal Reserve get the money? They will

create it.

As we stated when

the money printing began, this is a slippery slope. Once money printing begins, history teaches

us it never stops. Over time it just

becomes more extreme; more and more money is created until it doesn’t produce

the desired outcome and a reset occurs.

We believe we may be nearing that reset point.

Since this provision of the stimulus package virtually ensures that more money printing will occur, look for the continued devaluation of the US Dollar over time. And, don’t expect the real inflation numbers to be reflected in the official inflation rate. But, watch the nominal cost of tangible assets, that’s where you’ll see evidence of the inflation.

Get

educated.

Beginning

this week, we are conducting weekly educational webinars for clients and also

for the general public. If you are a

client of our company, you will receive an invitation to the informational

webinars via e-mail. If you are a client

but have not received an invitation, call the office and let us know. Sorry, but our client only webinar updates

are restricted only to clients of our company and their guests.

If you would like to participate in a public webinar update, give the office a call at 1-866-921-3613 and we will arrange for your participation until we reach our technical capacity. Feel free to invite friends and family members who would appreciate additional educational information to this webinar

This week’s Retirement Lifestyle Advocates Radio Program is now posted at www.RetirementLifestyleAdvocates.com. This week, host, Dennis Tubbergen, interviews John Williams, economist, and publisher of the website Shadow Stats (www.ShadowStats.com). Mr. Williams is forecasting an economic impact as a result of the Coronavirus situation of an 11% GDP decline in the first quarter of the year and 37% in the second quarter.

Dennis

and John also discuss strategies to consider moving ahead.

Also,

as noted last week, if you know of someone that might benefit from the

information in this weekly publication, direct them to get a free subscription

at www.RetirementLifestyleAdvocates.com.

As

you all know, we respect the privacy of our subscribers and never inundate them

with e-mails.

Blessings

to all of you in these difficult times.

“Politics is supposed to be the second oldest

profession. I have come to realize it

bears a very close resemblance to the first.”

-Ronald

Reagan