Weekly Market Update by Retirement Lifestyle Advocates

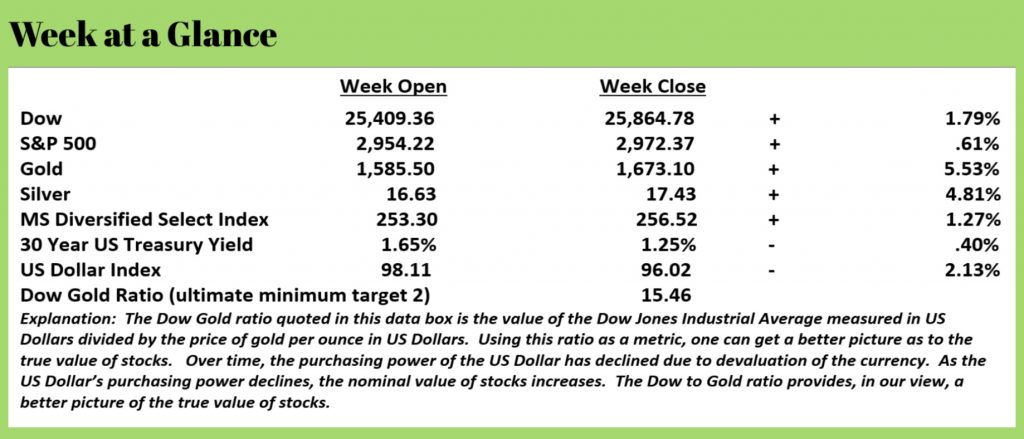

Another

extremely volatile week for stocks. The

fact that stocks finished up for the week doesn’t tell much of the story.

Take the

Dow Jones Industrial Average as an example.

While it opened the week at 25,409.36 and closed the week at 25,864.78,

during the week it touched 27,051 and 25,302.

That’s a swing of about 7% within the confines of 5 trading days.

The stock

market volatility saw many investors moving for other assets. US Treasuries rallied monstrously. The 30-Year US Treasury’s yield now stands at

1.25%. Gold and silver also benefitted

from stock’s volatility. Gold rallied

5.53% and silver followed closely, gaining 4.81%.

The events

that we have been writing about for a long time may be coming to pass. As we have often stated, central bank easy

money policies lead to prosperity illusions that historically speaking, ALWAYS

end badly. Put another way, you can’t

print your way to prosperity.

We’ve long

predicted a Dow to Gold ratio of 2, but more likely 1. In December of last year, that ratio stood at

about 20, it is now approaching 15, that’s a move of 25% in a few, short

months.

For those

of you who are not familiar with the Dow to Gold ratio and why we use it, in

light of the volatility in the markets, we thought it would be helpful for all

of our readers if we explained.

The Dow to

Gold ratio is calculated by taking the value of the Dow Jones Industrial

Average in US Dollars and dividing that by the cost of gold per ounce in US

Dollars. As the markets closed last

Friday, the Dow stood at 25,864.78 and gold was selling for 1673.10 per ounce.

Here’s the

trouble with measuring things in US Dollars; their value isn’t constant. Over time, because of the easy money policies

referenced above, US Dollars lose purchasing power. As purchasing power is lost, costs and values

rise. At least they rise nominally

speaking.

For

example, on January 1, 2000 the Dow Jones Industrial Average stood at

16,717. Comparing that to the value of

the Dow today, one concludes that the Dow has increased about 55% over the last

20 years.

But that

increase is in NOMINAL terms, not real terms.

Since calendar year 2000, the US Dollar has lost a significant amount of

purchasing power. Let’s look at just a

couple of items.

In calendar

year 2000, a base model Ford Mustang Coupe retailed for $17,190. Today, 20 years later, it retails for

$26,670. That’s an increase of 55%.

How about

looking at the price of hamburger?

In calendar year 2020, according to the website beef2live.com, a pound of hamburger cost $1.48. Today, according to the Bureau of Labor Statistics, a pound of hamburger averages about $3.69. That’s an increase of 149%.

We would

argue that most of these increases are a result of the devaluation of the US

Dollar.

It’s this

devaluation of the currency that makes measuring economic output and stock

performance difficult. The reality is

that when it comes to stock performance, nominal returns don’t matter, it’s

real returns that you can feel in your pocketbook.

To make the

point, let’s take a look at gold prices over the same 20-year time frame. In calendar year 2000, gold prices stood at

$272 per ounce.

A Ford

Mustang could have been purchased with 63 ounces of gold. Today, the same base model coupe version of the

popular car could be obtained for about 16 ounces of gold.

In calendar

year 2000, an ounce of gold purchased about 184 pounds of hamburger. Today, that same ounce of gold buys 454

pounds of hamburger.

Since an

ounce of gold never changes (unlike US Dollars), it’s a better metric to use

when determining real prices.

What about

stocks?

There are

many sources that graph the Dow to Gold ratio.

In 2000, an investor could buy the entire Dow for about 40 ounces of

gold, while today it only takes 15 ounces.

Here’s the

very important point.

Measured in

terms of US Dollars, asset values and consumer prices have been rising. Measured in real terms, they have been

declining.

The same

point could be made about economic output typically measured by Gross Domestic Product.

In calendar

year 2000, the economic output of the United States as measured by Gross

Domestic Product was $10.3 trillion. In

2019, economic output was $21.4 trillion.

In nominal terms, that’s an increase of 107%. Impressive right?

Not so fast.

Let’s look

at it in real terms.

In 2000

economic output measured in ounces of gold was about 37.9 billion gold ounces.

Last year,

taking the low price of gold for the year of about $1270 per ounce, US economic

output measured in ounces of gold was 16.85 billion gold ounces.

Money creation creates prosperity illusions. And, lest some of you readers think this is a political rant, it’s not. We are using a 20-year time frame very intentionally.

In real

terms, we are in a deflationary environment.

In nominal terms we are in an inflationary environment. What that means is storing some of your

wealth in tangible assets has increased the purchasing power of that stored

wealth. Storing your wealth in paper

assets has seen purchasing power decline.

Given our

forecast for the Dow to Gold ratio to reach 2 or even 1, we expect this trend

to continue and intensify over the long term.

The Fed

will do what they can to fight back.

This past week, the Fed cut interest rates by .5%. The yield on the 30-Year US Treasury Bond now

stands at 1.25% an all-time low.

Can

interest rates go lower?

We think

so, although an increase in interest rates from these lows given last week’s

extreme price activity seems likely. If

you own long term US Treasuries, you might even consider taking some profits

here and buy a dip in bond prices moving ahead.

(Note: this can be confusing since bond prices and yields move in

opposite directions. When yields fall,

prices rise and vice versa.)

Before the

election later this year, we would not be surprised to see negative interest

rates on some US Treasury issues and perhaps even helicopter money from the

politicians.

Helicopter

money is money that is created and given directly to citizens rather than banks

as in the case with quantitative easing.

Helicopter money could come in the form of a tax cut that is advanced to

taxpayers.

While free

money might sound nice on the surface, it’s ultimately very destructive.

Should

these two events, helicopter money and negative interest rates, occur, you’ll

want to be tangible with more of your assets.

Gold, silver and some kinds of real estate may be attractive for many

investors moving ahead.

If you have

not yet adopted the ‘two bucket’ approach to managing money, we would urge you

to strongly consider. It’s our strong

conviction that using the traditional ‘one bucket’ approach used by “Wall

Street Only” financial professionals will fail many investors in the near

future.

We saw

first-hand the devastation it wrought with many aspiring retirees in 2007-2008

and before that in 2000-2002. When this

bubble bursts, it has the potential to be far worse.

This

week’s Retirement Lifestyle Advocates Radio Program is now posted at www.RetirementLifestyleAdvocates.com. This week host, Dennis Tubbergen chats with

Karl Deninger about stocks and money printing.

If you are not yet a client of Retirement Lifestyle Advocates and would like to learn more about using the two-bucket approach to managing your assets, consider attending a free, educational event. Details are posted at www.SocialSecurityDinner.com.

“If I cannot do great things, I can do small

things in a great way.”

-Dr. Martin Luther King