Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

As longer-term readers of this newsletter know, we have long advocated for a “Two-Bucket Approach to managing assets. Over the past few years, as we have been forecasting the events that are now occurring, other individuals and companies in our industry have begun to promote what they label a two-bucket approach to managing assets.

The best-selling book “Revenue Sourcing” clarifies our approach which is unique. To a casual observer, the differences between other approaches to asset management and the one described in the “Revenue Sourcing” book, may seem trivial; however, they are not.

In this short piece, we will explain the premise of the Two-bucket approach described in “Revenue Sourcing”. From our experience, this premise goes unnoticed and unrecognized by most in the financial industry, advisors, and analysts alike. Sadly, this means that their clients miss out on this particularly important principle as well.

The evidence points to the fact that we are nearing the end of a credit cycle and a currency cycle.

Here is the point of this week’s “Portfolio Watch” newsletter, once the currency cycle busts and resets, traditional asset management and planning strategies will fail those who use them.

A credit cycle ends when the system has reached its capacity to service debt. Credit cycles peak and then subsequently bust much faster than currency cycles. Digging deeper into credit cycles we find that private sector credit cycles boom and then bust more frequently than public sector credit cycles primarily because the private sector comprised if individuals and businesses can only accumulate debt to the point that they have the income to service the debt.

The same thing was once true for the public sector or government credit cycles. When governments operate under a balanced budget, debt can only accumulate to the point that there are tax revenues to service the debt.

Once the noble pursuit of fiscal responsibility is abandoned and the policymakers resort to money creation to paper over budget gaps, the currency cycle bust begins. The currency cycle bust progresses slowly at first but then, over time, it feeds on itself accelerating dramatically into the final bust and reset.

There is additional evidence that we are moving closer to a reset. While predicting the exact timing and character of a reset is impossible, there are now statements being published about monetary policy that were but speculation a few months ago.

Alasdair Macleod discusses some of these statements in his most recent article titled, “China is Killing the Dollar”. Mr. Macleod reports that on September 3, 2020, the state-owned Chinese newspaper “Global Times” ran a front-page article featuring a quote from Xi Junyang, a professor and the Shanghai University of Finance and Economics. The professor stated, “China will gradually increase its holdings of US debt to about $800 billion under normal circumstances. But of course, China might sell all of its US bonds in an extreme case, like a military conflict.”

As Alasdair correctly states, the professor’s statement was obviously sanctioned as front-page news by the Chinese government.

Mr. Macleod comments, “While China has already taken the top off its US Treasury holdings, the announcement (for that is what it amounts to) that China is prepared to escalate the financial war against America is very serious. The message should be clear: China is prepared to collapse the US Treasury market. In the past, apologists for the US Government have said that China has no one to buy its entire holding. The most recent suggestion is that China’s Treasury holdings will be put in trust for covid victims — a suggestion, if enacted, would undermine foreign trust in the dollar and could bring its reserve role to a swift conclusion. For the moment these are peacetime musings. At a time of financial war, if China put her entire holding on the market Treasury yields would be driven up dramatically, unless someone like the Fed steps in to buy the lot.”

Should China take this bold step, the country would have about $1 trillion in US Government bonds to sell. And should China take this step, they would not be alone. It would likely mean that just about every other country holding US Government bonds would follow suit.

The result of such action, now being openly discussed, would be either the Federal Reserve printing more money to buy the discarded bonds or a rapid and likely increase in interest rates on the bonds as new bond investors would be looking for a higher return on their investment in order to properly compensate them for the increased risk of holding US government debt.

The likely course of action would be the Fed printing more money which, at a certain future point would mean reaching a tipping point where confidence in the US Dollar is lost.

Mr. Macleod points out in his piece that we may be closer to reaching that tipping point. China has been accumulating more tangible assets since March of this year when the Fed changed bank reserve requirements to 0% and openly stated that it would pursue easy money policies. Subsequent to that announcement, the Fed has printed about $3.5 trillion out of thin air and more recently changed its inflation targeting policy to allow inflation to run above the 2% target for as many months as it runs below the target.

It’s important to note that the Fed is using an extremely flawed metric to measure the rate of inflation. As we have discussed in past issues of this publication, neither food prices nor fuel prices are included in the official inflation measurement. The officially reported inflation rate is also seriously understated using subjective adjustments like hedonic adjustments, substitution, and weightings.

The Fed allowing inflation to continue at a rate of over 2% when the real-world inflation rate according to private, credible, third-party sources is between 8% and 10% likely translates to 1970’s style inflation or greater.

Since March, when the Fed made its initial announcement, China has been accumulating tangible assets. This from Mr. Macleod’s article (Source: https://www.goldmoney.com/research/goldmoney-insights/china-is-killing-the-dollar) (Emphasis added):

China is now aggressively stockpiling commodities and other industrial materials, as well as food and other agricultural supplies. Simon Hunt, a highly respected copper analyst and China-watcher put it as follows:

“China’s leadership started preparing further contingency plans in March/April in case relations with America deteriorated to the point that America would try shutting down key sea lanes. These plans included holding excess stocks of widgets and components within the supply chains which meant importing larger tonnages of raw materials, commodities, foods stuffs and other agricultural products. It was also an opportunity to use up some of the dollars which they have been accumulating by running down their holdings of US government paper and their enlarged trade surpluses.

It is apparent that the Fed’s policies are accelerating a move away from the US Dollar which was already underway. It’s a sign that we are moving ever closer to the end of the currency cycle while we arrive at the conclusion of the credit cycle simultaneously.

The two-bucket approach outlined in the “Revenue Sourcing” book attempts to account for this. Once one understands the currency cycle, one also understands the ‘dual realities’ that exist.

This dual reality is that unless Federal Reserve policies are suddenly and dramatically changed, we will have inflation in US Dollar terms but deflation in terms of gold which has historically been money.

Here’s our take: as prices in US Dollars continue to rise, prices in gold will continue to decline.

This has been abundantly evident over the past 50 years, 20 years, and even 1 year. We’ll examine housing as an example although similar conclusions could be reached using food, automobiles, or most any other item.

Almost 50 years ago, in 1971, then-President Richard Nixon eliminated the link between the US Dollar and gold, reneging on the promises the US made as part of the Bretton Woods agreement which guaranteed an exchange of the US Dollar for gold. At that time, gold was $35 per ounce and the median home sale price was about $25,000. That meant that it took about 714 ounces of gold to buy a home.

By calendar year 2000, the median home sale price was about $135,000 and the price of gold was about $250 per ounce. At that time, it took 540 ounces of gold to buy a new home. While it took 5.4 times more in US Dollars to buy a home, it took only 75% of the gold.

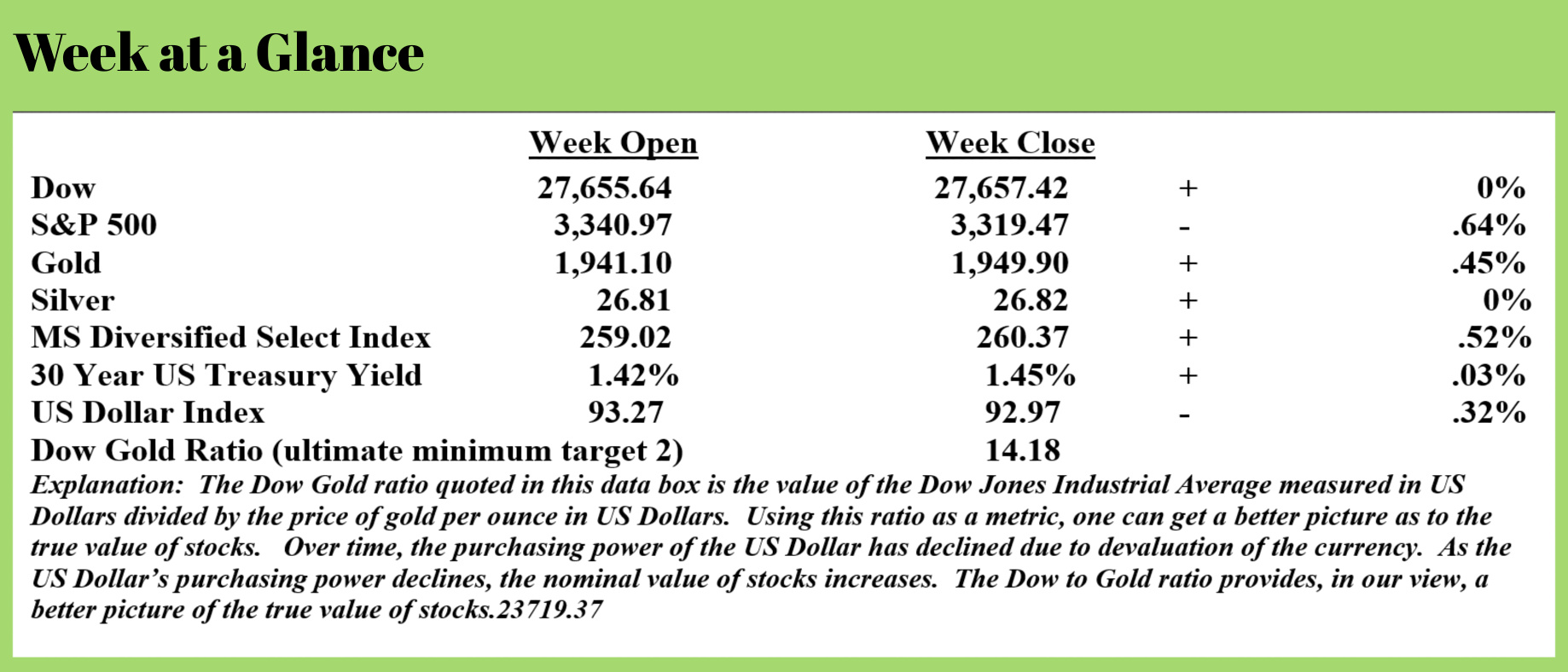

Fast forward to today. The median price of a new home is $278,000 and gold is selling for about $1950 per ounce. That means a new home can be purchased for about 142 ounces of gold. Compared to 1971 when the US Dollar officially became a fiat currency, it now requires roughly 1,100% more US Dollars to buy a new home. Priced in gold, a home can be purchased for only 20% of the gold that was required to make the same purchase in 1971. The 685 ounces of gold that would have purchased one home in 1971 purchases nearly five new homes today.

The two-bucket approach recognizes this trend and adapts a plan accordingly. This is especially important as we near the end of the currency cycle while at the same time reaching the end of the credit cycle.

This week’s radio program features an interview with Mr. Michael Pento. Michael is a frequent commentator and analyst on various news and financial programs and returns to the program this week to offer his forecast for stocks, gold, and other markets.

The interview is posted at www.RetirementLifestyleAdvocates.com. If you haven’t yet visited the website to download the Your RLA app to give you access to the radio program, the weekly webinar updates, and this newsletter, you’ll want to do so. Beginning in October, that will be the only method by which this newsletter is delivered.

“When someone asks you, a penny for your thoughts and you put your two cents in, what happens to the other penny?”

-George Carlin