Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

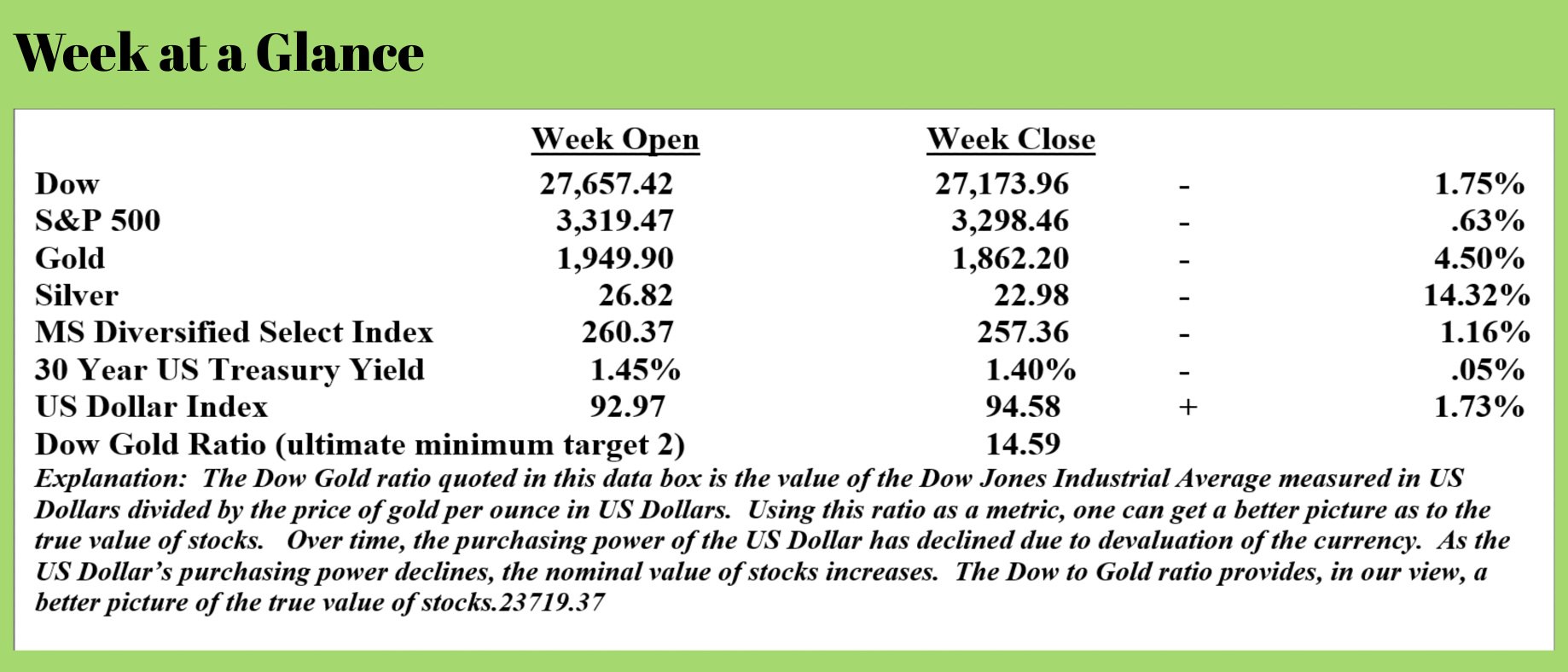

With the exception of the US Dollar Index, all markets were ugly last week. Silver led the way as far as declines went, falling a whopping 14.32%. As we have warned, when markets rise parabolically like silver did, a pullback is highly likely. We are now seeing that pullback.

We believe the current pullback is another opportunity to accumulate metals and are holding to our long-term forecast of the Dow to Gold ratio reaching 2, or even 1. For new readers, the Dow to Gold ratio is calculated by taking the value of the Dow Jones Industrial Average and dividing by the price of gold per ounce. The present Dow to Gold ratio stands at 14.59 which is only marginally changed from last week.

We have intentionally avoided making a prediction as to what these levels will be. In an outcome that is more deflationary, a Dow to Gold ratio of 1 could have both the Dow at 5,000 and the price of gold per ounce at $5,000.

An inflationary outcome or hyperinflationary outcome could see the numbers much higher. But we would still expect a ratio of 2 or 1.

Egon von Greyerz, of Matterhorn Asset Management, shares this perspective. He expects the Dow to Gold ratio to reach 1. However, in light of current monetary policy, he expects parity between the Dow and Gold to be at high levels, perhaps as high as 50,000. If the Dow were to rise to 50,000, it would represent an approximate doubling. If gold were to rise to $50,000 per ounce it would represent more than a 25-fold increase from these levels.

While those are hard numbers to swallow given current levels, in an outcome that is highly inflationary, which is the outcome that Mr. von Greyerz sees, they are possible. When reading an article, he published in March and comparing it to a recent article, it seems his views have changed slightly given current Fed policy.

Mr. von Greyerz recently published a piece in March that explains his views. He begins his piece by making an extremely ominous statement.

This is it! The party is over. The world is now facing the gravest economic and social downturn in modern times (18th century). We are now entering a period of global crisis that will change the world for a very long time to come. This should come as no surprise to the people who have studied history and also read my articles for the past few years. Many others have also warned about the same thing. But, since Main Stream Media never talks about the excesses in the world or the risks, 99.9% of people are totally unprepared for what is coming next.

Mr. von Greyerz forecast that the Dow and property, both in a bubble, decline at least 90% in real terms. This is congruent with what we wrote in last week’s issue of “Portfolio Watch”:

This dual reality is that unless Federal Reserve policies are suddenly and dramatically changed, we will have inflation in US Dollar terms but deflation in terms of gold which has historically been money.

Here’s our take: as prices in US Dollars continue to rise, prices in gold will continue to decline.

In his March article, Egon states this in reference to the Dow to Gold ratio:

I expect the ratio to initially reach the 1980 level of 1 for 1. What the levels would be is hard to predict, but let’s say Dow 10,000 and gold $10,000.

Mr. von Greyerz published a new piece last week which touched on the same topic.

As I have stated previously, Coronavirus which started in early 2020, is not the reason for the current economic downturn in the world economy. It was just a catalyst. For some reason, when cycles are about to accelerate hard down, the trigger seems to be the worst possible. Although I have often talked about disease as one potential catalyst, I did not expect it to come now and cause a total lockdown of parts of the economy and society in so many countries.

When you are approaching the end of a financial era or cycle, it is very difficult to predict exactly how it all will end. Very few people understand that we are now living on borrowed time. But there is absolutely no doubt that we are now at the end of a major cycle.

The risk is here now and if you don’t prepare for this, you are not just likely to lose whatever wealth you have but also your job, pension, or social security depending on your circumstances. And if you live in a city, you are also likely to be affected by social unrest and crime plus a breakdown of services like medical care, schooling, law, and order, etc.

Many people are today trying to get out of the cities as a result of Coronavirus and the shutdown of offices and shops as well as increased crime rates. For the wealthy minority, this is not a big problem but for normal people, it is not self-evident to just move out. But it is very clear that home working will become much more prevalent and many cities will become ghost towns. Tax revenue will decline dramatically and the authorities will not be able to keep up even simple services such as water, sanitation, or cleaning. Also, many retail outlets and restaurants, as well as offices in cities, will close due to lack of customers, crime, and out-of-town or online shopping. This trend has of course already started in many cities. In the City of London (Financial District), there are now very few people working. Only some shops or restaurants are open and the ones that are, are hemorrhaging financially.

von Greyerz estimates that, at the outside, it will take 8 years for the “artificial edifice” the world has created to collapse but adds it could happen a lot more quickly. von Greyerz defines “artificial edifice” as all the fake assets that have been created due to central banks' deliberate recklessness.

We agree,

The Federal Reserve is a private entity that was given complete control of monetary policy back in 1913. Then, in 1971, when Nixon closed the gold window which turned the US Dollar into a fiat currency, this private entity was now free to create as much money as they wanted.

Think about that for a moment. These private banks have the ability to create money out of thin air, loan it out, and then get it back with interest. Pretty good deal – if you’re a banker. As Egon points out in his article, there is a huge benefit to standing next to the printing press. Zimbabwe’s former President Mugabe had this figure out. By using the money from the printing press first, he could buy tangible items quickly or exchange the newly created currency for US Dollars before the value of the Zimbabwe Dollars collapsed completely.

Mr. von Greyerz makes a great point in his most recent piece – printed money does not reach the “regular folks” who could use it the most.

In the US, the Fed has since the latest crisis started in August 2019, printed $3.3 trillion, and most of it since March 2020. Very little of this money has reached ordinary people. If it had, it would have meant a contribution of $25,000 to every one of the 130 million households in the US. Although printed money is basically worthless, it might have had some short-term beneficial effect on the broad economy.

But no, money printing is not for ordinary people. It is for the bankers and the wealthy and adds more fuel or liquidity to already massively overvalued asset markets rather than reaching the people who really need it. This has caused the NASDAQ to go up by 62% since late March and the Dow by 52%.

Egon then discusses his revised view of the Dow to Gold ratio and the potential numbers that we could ultimately see.

In a recent article, I discussed that we could see a liquidity fueled melt-up in stocks making the Dow double to say 50,000. Since I expect the Dow to Gold ratio to reach 1 to 1 or below (like in 1980 Dow 850 Gold $850), gold could at the same time reach $50,000 as inflation rises. As I consider stocks overbought and overvalued today, there is no fundamental or even technical reason for this to happen. Since markets today have nothing to do with fundamentals or sound valuation principles but are only liquidity-driven, this kind of move is not impossible.

As noted above, this outlook is consistent with our view that we will see inflation in terms of US Dollars and deflation in terms of gold. This means that US Dollars will lose purchasing power as the purchasing power of gold increases.

Mr. von Greyerz makes this point as well.

And don’t for one second believe that the assets you own whether they are stocks, bonds or property are really worth the thousands or millions that they are valued at in fake money.

The imminent wealth destruction will soon reveal to investors that their assets are only worth a fraction of the imaginary value they have today.

Central banks will not save the world, they can’t. Because how can you solve a debt problem with more worthless debt or how can you create wealth by issuing more debt? That Ponzi scheme is now finished for a very long time.

Physical gold and silver will in the next few years reveal the total delusion that the financial system has rested on. Investors who are not protected should take heed.

While timing is difficult to predict, current central bank policies will inevitably lead to the outcome we’ve forecast.

Make sure you’re protected.

On this week’s radio program, our guest is Mr. Karl Denninger. Karl gives us his forecast for the future of Medicare and Medicaid. If you are on Medicare or are approaching Medicare age, you won’t want to miss this interview.

The interview is available through the RLA app.

If you don’t yet have the RLA app, you can download it by visiting www.RetirementLifestyleAdvocates.com.

The RLA app gives you free access to all of our resources.

“When I was a kid my parents moved around a lot, but I always found them.”

-Rodney Dangerfield