Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

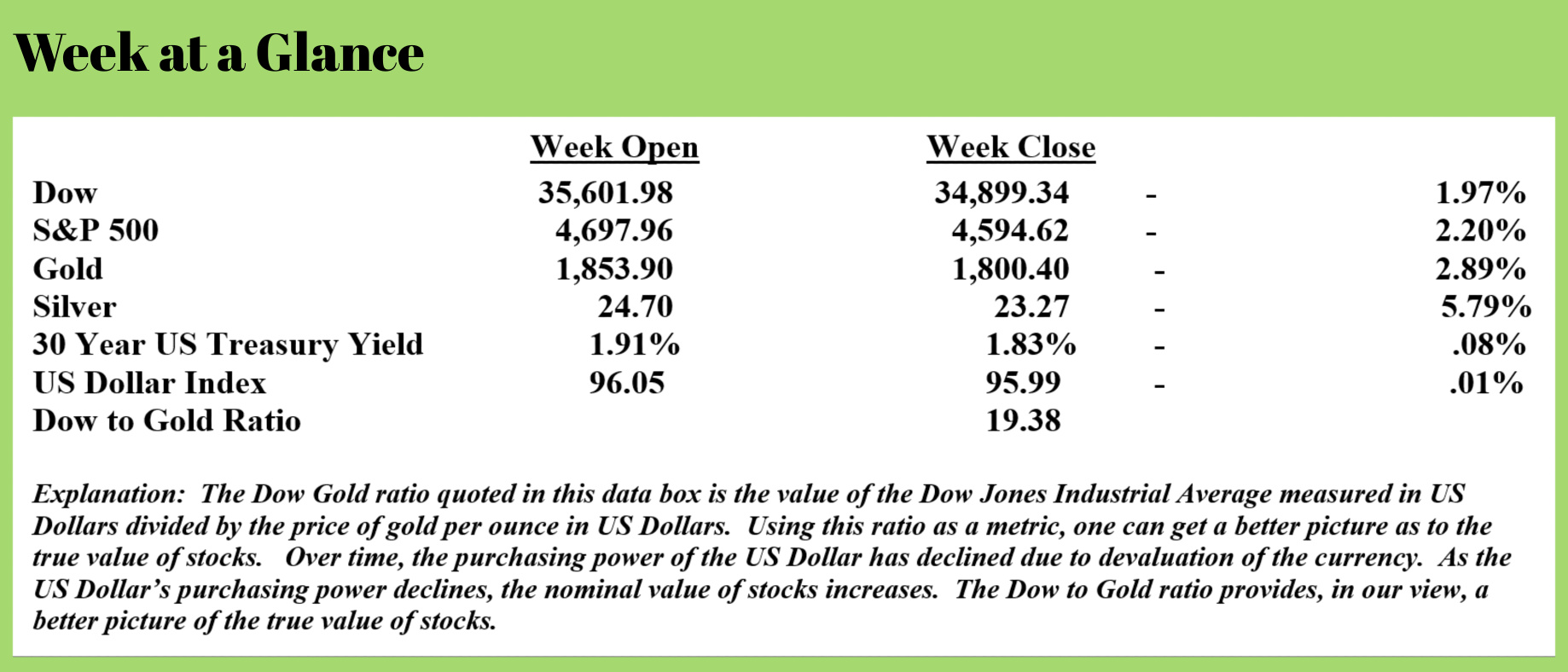

Stocks had a rough day on Black Friday. Even though markets were only open for half a day, on an intraday basis the Dow Jones Industrial Average fell 1000 points. The Industrials closed down 905 points for the day. The S&P 500 and the NASDAQ had ugly days as well.

In the “Positions” paid newsletter that I do for some clients and advisors, I have been suggesting that our long-term stock charts were showing weakness. Perhaps that weakness is now arriving.

The million-dollar question, or should I say trillion-dollar question, remains what will the Fed’s response be? Will they continue the taper (the slowing of currency creation) or abandon that effort to attempt to prop up markets?

I have said repeatedly that I believe any taper will be more form over substance. I reach this conclusion for reasons that I will outline in this issue of “Portfolio Watch”. I will examine it in more detail in the December issue of the “You May Not Know Report”.

This dialogue has to begin with the current state of US Government finances. Since the Fed’s currency creation is largely subsidizing the US Government’s deficit spending, if the Fed is going to eventually cease currency creation, the US Government will have to eventually balance the budget.

There are only two ways to balance a budget – increase revenues (taxes) or reduce spending.

No matter your political persuasion or leanings, we can all agree there is virtually no evidence that spending cuts are being seriously contemplated – quite the opposite is actually happening which is quite remarkable given the numbers I will review with you briefly.

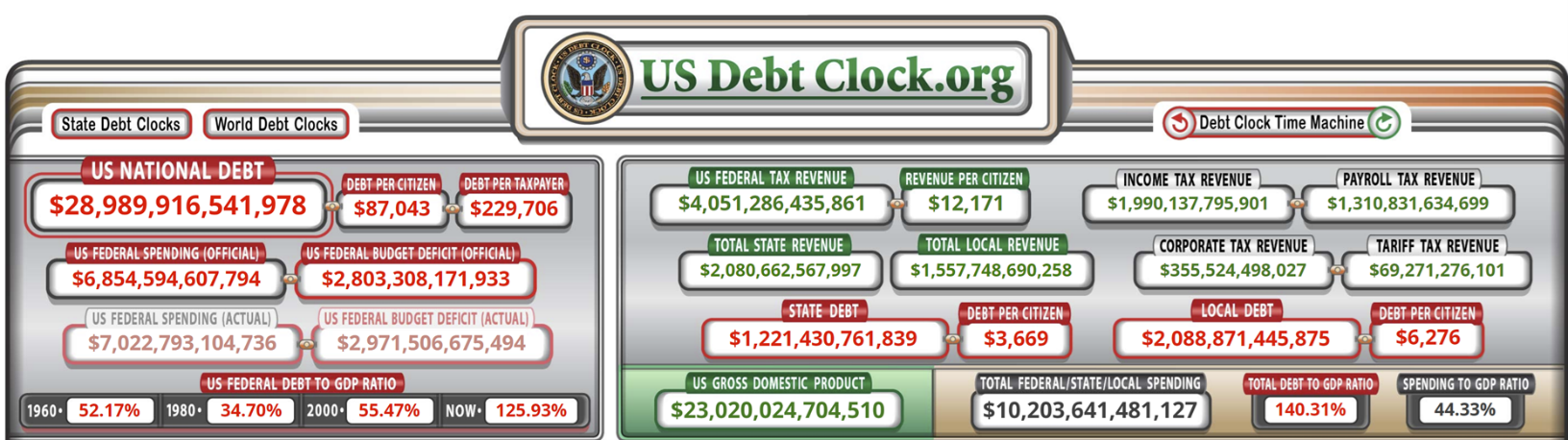

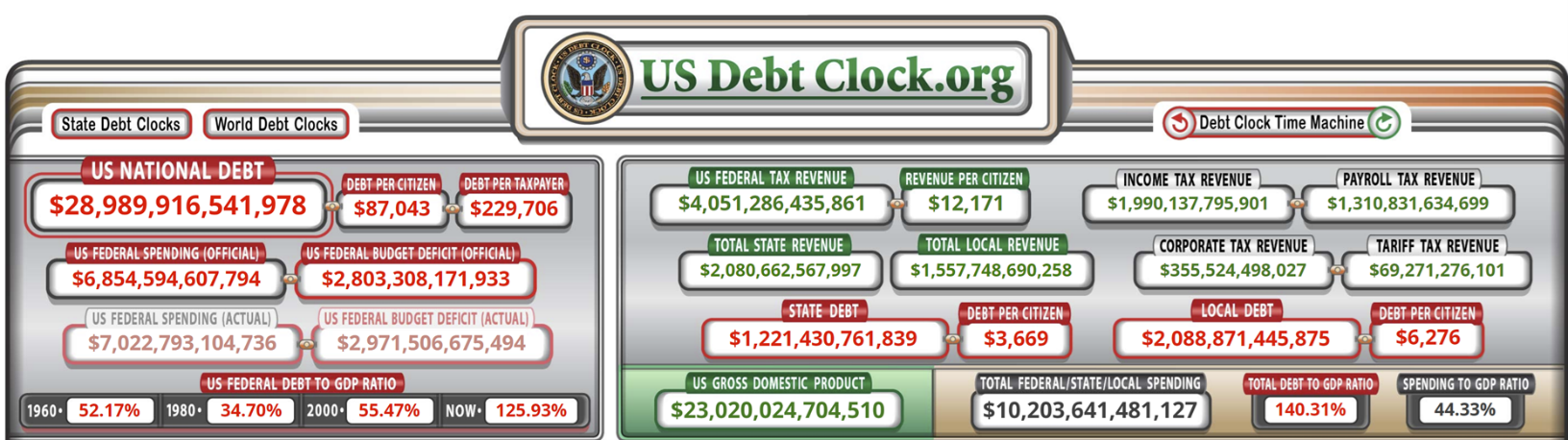

Let’s begin with the federal operating budget. The screenshot below is from USDebtClock.org.

For discussion’s sake, and ease of math, let’s assume an annual operating deficit at the federal level of $3 trillion. Let’s take that $3 trillion and divide it by the 126 million tax returns that are filed each year with an average federal income tax liability of $9,118. (Source: https://www.fool.com/retirement/2016/10/31/heres-what-the-average-american-pays-in-taxes.aspx)

Some simple math concludes that each of these taxpayers would need to increase their tax payments by 261% to balance the budget. That means the average taxpayer would have to pay $23,809 in taxes rather than $9,118.

But this is just to balance the budget. It does not address paying down the debt or funding the unfunded liabilities of Social Security, Medicare and other government programs. According to Professor Lawrence Kotlikoff, a past guest on the RLA Radio Program, the fiscal gap of the United States is more than $200 trillion. (Source: https://kotlikoff.net/wp-content/uploads/2019/03/The-2019-U.S.-Fiscal-Gap-Calculated-by-Laurence-Kotlikoff-and-Nils-Lehr.pdf)

That means that to solve these fiscal issues, in addition to paying 261% more in taxes, each taxpayer would have to ante up about $1.587 million over time. If one were to amortize that number over 30 years at 3% interest, that would require each of these taxpayers to part with another $80,292 annually FOR 30 YEARS!

Let me attempt to put that into perspective.

If we assume that the average taxpayer is married, filing jointly, in order to have a federal income tax liability of $9,118 in 2021, their taxable income would be $79,300. Assuming these taxpayers took a standard deduction on their tax return, and they were younger than age 65, their adjusted gross income would be $104,400.

Assuming a state income tax rate of 4.25% (which is the income tax rate in Michigan, the state in which I reside), current taxes paid by these taxpayers are:

Social Security/Medicare Tax $ 7,987

Federal Income Tax $ 9,118

State Income Tax $ 3,370

Total Tax $20,475

Now, to balance the budget, total taxes paid will need to be $35,166. But that does nothing to address the unfunded liabilities of government programs like Social Security or Medicare or to pay down the debt.

As noted above, based on a 30-year amortization and 3% interest, each taxpayer is now on the hook for another $80,292 annually as remarkable and unbelievable as that might sound.

Add the $80,292 to the $35,166 and one gets $115,458 or more than this household earns!

While I’m at it, let me dispel the notion that this problem can be solved by taxing the wealthy via a wealth tax or a tax on unrealized capital gains. Once again math trumps rhetoric.

Total wealth of all US billionaires is a little more than $4 trillion (Source: https://ips-dc.org/u-s-billionaire-wealth-surges-past-1-trillion-since-beginning-of-pandemic/). Adopting the radical policy of just confiscating all the wealth of all the billionaires only funds the deficit for 1.3 years and does nothing to address the debt or the unfunded liabilities of other government programs.

No matter how you slice it, these problems simply cannot be solved via increased taxation.

What about cutting spending as unlikely as that seems politically at the present time?

If you look at the numbers on the debt clock screenshot above carefully, you see that the deficit is about 41% of spending as ridiculous as that is.

In order to balance the budget by cutting spending, ALL spending would need to be cut by 41% across the board. That action alone would lead to a deflationary collapse.

And, once spending was cut 41%, the debt and the unfunded liabilities of government programs would also need to be addressed.

Taking the fiscal gap and amortizing it over 30 years at 3% interest, one quickly realizes that annual payments of more than $10 trillion are required AFTER spending has been cut by 41%!

Take a look at this screenshot again, where can you find an additional $10 trillion BEFORE you cut spending by 41%?

Bottom line is you can’t and there will, eventually, have to be government programs that don’t pay out all of the promised benefits.

The recent Social Security trustees report informed us that the underfunding of Social Security reached $59.8 trillion. That represents the gap between promised benefits and future payroll revenue and is $6.8 trillion larger than just one year ago! (Source: https://starkrealities.substack.com/p/social-security-steams-closer-to)

This is just one example but suffice it to say that the fiscal gap continues to grow.

If these problems cannot be solved via increased taxation and if cutting spending to the level it would need to be cut would lead to a deflationary depression, then policymakers and politicians are most likely to continue on their current course of action – create currency.

As noted in the past, creating currency works until it doesn’t work. Once confidence in a currency is lost as a result of inflation or hyperinflation, the deflationary crash occurs anyway.

In my view, it’s never been more important to have an income plan that’s funded with some assets to help preserve assets in a deflationary environment and some assets that will help to act as an inflation hedge.

This week’s radio program is an interview with Mr. Jeffrey Tucker of the Brownstone Institute. I talk to Jeffrey about these very topics and get his take on where future economic and health policy goes. Jeffrey is a prolific writer and commentator. I know you’ll appreciate his insights.

You can listen to the show anytime by clicking on the "Podcast" tab at the top of this page.

“Your hand and your mouth agreed many years ago that, as far as chocolate is concerned, there is no need to involve your brain.”

-Dave Barry