Weekly Market Update by Retirement Lifestyle Advocates

I want to begin this week’s “Portfolio Watch,” where I stopped last week’s report with a quote from the Austrian economist Ludwig von Mises.

“There is no means of avoiding the financial collapse brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

George Reisman, in an article published on “Mises Daily” clarifies: (Source: https://mises.org/mises-daily/credit-expansion-economic-inequality-and-stagnant-wages) (emphasis added)

Capital in the form of credit is normally and, certainly, properly extended out of previously accumulated savings. In sharpest contrast, credit expansion is the creation of new and additional money out of thin air, which money is then lent to business firms and individuals as though it were a supply of new and additional saved up capital funds.

Its existence serves to reduce interest rates and to enable loans to be made and debts to be incurred which otherwise would not have been made or incurred. Always and everywhere, to the extent that private banks participate in the process of credit expansion, they do so with the sanction and generally with the active encouragement of the government.

Economists, above all, Ludwig von Mises, have shown how credit expansion is responsible for the boom-bust business cycle and how its existence depends on deliberate government policy. Nevertheless, public opinion believes that the business cycle is an inherent feature of capitalism and that the role of government is not that of causing the phenomenon but of combating it. Indeed, as Mises observed, "Nothing harmed the cause of liberalism [capitalism] more than the almost regular return of feverish booms and of the dramatic breakdown of bull markets followed by lingering slumps. Public opinion has become convinced that such happenings are inevitable in the unhampered market economy."

The truth is that credit expansion is responsible not only for the boom-bust cycle but also for another major negative phenomenon for which public opinion mistakenly blames capitalism: namely, sharply increased economic inequality, in which the wealthier strata of the population appear to increase their wealth dramatically relative to the rest of the population and for no good reason.

I have two comments on Reisman’s piece.

One, there is no denying the wealth gap. This from “Real Investment Advice” reporting on a white paper issued by the St. Louis Federal Reserve Bank: (Source: https://realinvestmentadvice.com/wealth-gap-and-the-road-to-serfdom/)

One of the most interesting conundrums is the surging wealth gap in America. Despite two of the largest bull markets in history since 1980, most Americans struggle with making ends meet and are unprepared for retirement. Such a reality starkly differs from the belief that rising asset prices benefit the masses.

For example, in a recent St. Louis Federal Reserve Bank analysis, total household wealth was $139.1 trillion, covering 131 million families. Of that total wealth, 74% was owned by just 13.2 million families, or roughly 10% of the population.

And this, from CNBC: (Source: https://www.cnbc.com/2024/03/28/wealth-of-the-1percent-hits-a-record-44-trillion.html)

The wealth of the top 1% hit a record $44.6 trillion at the end of the fourth quarter, as an end-of-year stock rally lifted their portfolios, according to new data from the Federal Reserve.

The total net worth of the top 1%, defined by the Fed as those with wealth over $11 million, increased by $2 trillion in the fourth quarter. All of the gains came from their stock holdings. The value of corporate equities and mutual fund shares held by the top 1% surged to $19.7 trillion from $17.65 trillion the previous quarter.

Second, the current boom cycle has come about as a result of the most extreme credit expansion in our country’s history. The Federal Reserve created more than $5 trillion out of thin air and injected it into the economy. The result is an ‘everything bubble’ that will, at some future point, burst as bubbles always do.

We may now be seeing more signs of trouble for the current bubble.

The tallest building in Brooklyn, the Brooklyn Tower, also known as the “Eye of Sauron,” is headed to auction. According to marketing materials from JLL Silverstein Capital Partners an auction on the tower is scheduled for June 10. (Source: https://www.zerohedge.com/markets/tower-sauron-cant-pay-its-debt-brooklyns-tallest-building-foreclosure)

This is not an isolated incident.

“Bloomberg” published an article that suggested the required refinancing of nearly $1 trillion in commercial real estate debt this year could topple hundreds of banks. (Source: https://news.bloomberglaw.com/bankruptcy-law/calling-cre-manageable-is-just-wishful-thinking-macro-view)

“Bloomberg” published an article that suggested the required refinancing of nearly $1 trillion in commercial real estate debt this year could topple hundreds of banks. (Source: https://news.bloomberglaw.com/bankruptcy-law/calling-cre-manageable-is-just-wishful-thinking-macro-view)

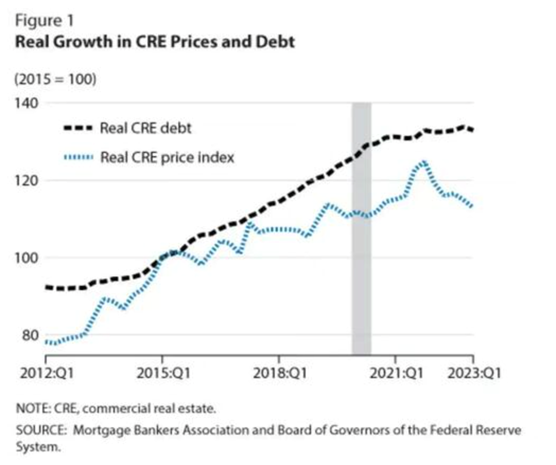

The chart on this page (left), compiled with data from the Mortgage Banker’s Association and the Fed’s Board of Governors, shows the widening gap between commercial real estate debt and the value of commercial real estate.

One glance at the chart has a rational person concluding that there are a lot of commercial real estate owners who are ‘upside down’ in their properties, setting the stage for defaults.

Defaults mean that banks will suffer, and many won’t survive.

Commercial loan delinquency rates have already jumped to 6.5%, up 30% in a matter of months. (Source: https://www.zerohedge.com/economics/meltdown-commercial-real-estate).

Seems that our “Minsky Moment” may be quickly approaching.

If you are unfamiliar with the term “Minsky Moment”, the term is named for American economist, Hyman Minsky. In short, a “Minsky Moment” is a hard crash or financial market crisis brought about by a sudden and widespread collapse in asset prices, usually after a long period of speculative investment, excessive borrowing, and pervasive financial risk-taking.

If you’ve ever played musical chairs, a Minsky Moment is when the music stops and investors stop buying, revealing that the economic expansion was really a Ponzi scheme. A Minsky Moment happens abruptly rather than gradually.

While I don’t profess to know the timing of when such a moment might occur, I do know that we are getting closer.

This from Peter St. Onge: (Source: https://www.profstonge.com/p/fiscal-collapse-accelerates)

This from Peter St. Onge: (Source: https://www.profstonge.com/p/fiscal-collapse-accelerates)

It’s official: the Department of Treasury is now issuing debt at pandemic levels. It’s worth noting the pandemic record was double the previous record, which had stood for 231 years.

In raw numbers, the latest numbers for Q4 2023 show Treasury issued $7 trillion in new debt. For the entire year, it came to $23 trillion.

This has bloated the Treasury market to $27 trillion -- up 60% since the pandemic. In other words, one-third of Treasuries have fresh ink on them. And it's up roughly sixfold since the 2008 crisis.

Meaning if we hit another crash, it could be a lot bigger.

At this point, federal debt is rising by $1 trillion every 90 days, and US government spending as a percent of GDP is at World War 2 levels.

Given we're not in a World War -- in theory -- nor are we in a pandemic, why so much debt? Easy: it's buying growth.

Or, as Balaji Srinivasan puts it: “The economy isn't real. It's propped up by debt. They will fake it till they break it.”

In closing, let me repeat last week’s question: got gold?

This week’s radio program features an interview I conducted with the editor of “Gold Newsletter” and the producer of the “New Orleans Investment Conference,” Mr. Brien Lundin. Brien and I analyze the current breakout in gold and forecast where the metal’s price could go.

Be sure to check out the interview now posted by clicking on the "Podcast" tab at the top of this page.

“Spring is when you feel like whistling even with a shoe filled with slush.”

-Doug Larson

Comments