Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

The big news in financial markets last week was the big decline in US Treasuries. Not surprising given the news I discussed last week; Russia has now loosely tied its currency, the Ruble, to gold and required any country that Russia deems to be unfriendly to use Rubles or gold when trading with Russia.

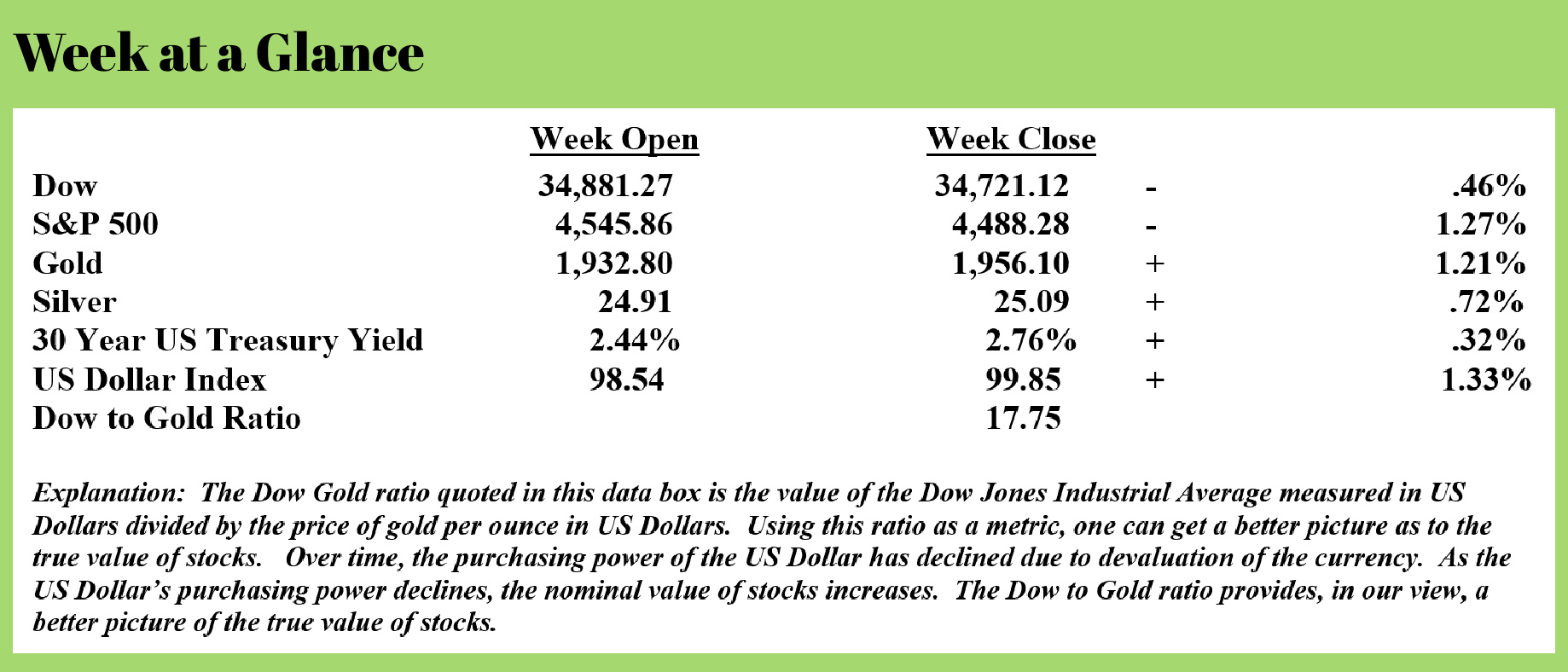

As I noted last week, this move will likely be bullish for gold and negative for the US Dollar. Many readers could be looking at the performance numbers in the databox above and noting that the US Dollar moved significantly higher last week. It’s important to understand that the US Dollar Index is a relative measure of the purchasing power of the US Dollar, not an absolute measure. The US Dollar Index measures the US Dollars purchasing power relative to the purchasing power of the Japanese Yen, the Euro, the Swedish Krona, the British Pound Sterling, the Swiss Franc, and the Canadian Dollar.

All one needs to do is visit a grocery store or purchase any consumer item to quickly realize that the US Dollar is losing absolute purchasing power. The other fiat currencies used in the US Dollar Index are simply performing more poorly than the US Dollar on a collective basis.

This move by Russia, I believe, is the biggest economic news of our time. As big as when Nixon eliminated the convertibility of the US Dollar for gold.

Interestingly, at the time Nixon made that move, the ultimate implications of the action were not widely understood by the populace. I think one could reasonably state that the same could be said about this move by Russia that could be the catalyst for big currency changes globally moving ahead.

From my perspective, currency changes typically occur slowly. It’s taken more than 50 years for the US Dollar to lose 98% of its purchasing power. The US Dollar has been the preferred currency for international trade since the Breton Woods agreement of 1944. After Nixon eliminated the US Dollar redemptions for gold in 1971, an agreement was struck with Saudi Arabia to sell its oil exports in US Dollars in exchange for military favors.

Now though, as has happened many times throughout history, currencies are beginning to evolve more rapidly. Many years from now, looking back, I believe this move by Russia will be viewed as the catalyst of major currency changes that are yet to come.

Past RLA Radio Guest, Peter Schiff, recently commented (Source: https://schiffgold.com/key-gold-news/russia-is-quietly-making-the-case-for-owning-gold/):

The head of the Russian Parliament, Pavel Zavalny, made comments recently addressing the subject of economic and financial sanctions. It’s clear that gold is playing a large role in protecting Russian wealth. That role may get bigger and it could create a paradigm shift in how the world does business.

Russia has a lot of natural gas and oil. And it sells a lot of natural gas and oil to the world. Zavalny made it clear that Russia is happy to sell — in hard currency. And what is hard currency? Not dollars.

“If they want to buy, let them pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency. As for friendly countries, China or Turkey, which are not involved in the sanctions pressure. We have been proposing to China for a long time to switch to settlements in national currencies for rubles and yuan. With Turkey, it will be lira and rubles. The set of currencies can be different and this is normal practice. You can also trade bitcoins.”

Zavalny said Russia has no interest in dollars, saying “this currency turns into candy wrappers for us.”

In an op-ed published by “MarketWatch”, Brett Arends said this might not mean anything. But it could mean a lot if other countries like China and India follow Russia’s lead. As Arends notes, a lot of countries aren’t thrilled with the United Sates’ ability to control the global financial system with a monopoly on the reserve currency.

Arends also says this adds to the argument for having gold in a long-term investment portfolio.

Not because it is guaranteed to rise, or maybe even likely to. But because it might — and might do so while everything else went nowhere, or went down. Like in a geopolitical or financial crisis where the non-western bloc decides to challenge America’s financial hegemony and ‘king dollar.'”

Arends calls himself “gold agnostic,” but he said there is no question “it has its uses.”

Gold is completely private. It is completely independent of the SWIFT or any other banking system. And despite the rise of cryptocurrencies, it remains the most widespread and viable global currency that is not controlled by any individual country.”

Moves made by Russia in recent weeks could represent a huge paradigm shift in global finance. Many countries have been building toward this for years as the US has weaponized the dollar.

In effect, Russia put the ruble on a gold standard that is now linked to natural gas.

Russia holds the fifth-largest gold reserves in the world. After pausing during the COVID-19 pandemic, the Central Bank of Russia resumed gold purchases in early March before suspending them again a couple of weeks later. The Russian central bank resumed buying gold from local banks on March 28 at a fixed price of 5,000 roubles ($52) per gram. Since Russia is insisting on payment of natural gas in rubles and they’ve linked the ruble to gold, natural gas is now indirectly linked to gold. The Russians can do the same to oil, as ZeroHedge explained.

If Russia begins to demand payment for oil exports with rubles, there will be an immediate indirect peg to gold (via the fixed price ruble – gold connection). Then Russia could begin accepting gold directly in payment for its oil exports. In fact, this can be applied to any commodities, not just oil and natural gas.”

So, what does this mean for the price of gold?

“By playing both sides of the equation, i.e. linking the ruble to gold and then linking energy payments to the ruble, the Bank of Russia and the Kremlin are fundamentally altering the entire working assumptions of the global trade system while accelerating change in the global monetary system. This wall of buyers in search of physical gold to pay for real commodities could certainly torpedo and blow up the paper gold markets of the LBMA and COMEX.”

“The fixed peg between the ruble and gold puts a floor on the RUB/USD rate but also a quasi-floor on the US dollar gold price. But beyond this, the linking of gold to energy payments is the main event. While increased demand for rubles should continue to strengthen the RUB/USD rate and show up as a higher gold price, due to the fixed ruble – gold linkage, if Russia begins to accept gold directly as a payment for oil, then this would be a new paradigm shift for the gold price as it would link the oil price directly to the gold price.”

We could be seeing a slow unwinding of the petrodollar. And the petrodollar is one of the foundations of the dollar’s position as the world currency. We’ve already heard rumblings of Saudi Arabia accepting yuan for oil.

The US and other western powers have tried to lock down Russia’s gold. But as Arends explains, that is virtually impossible in effect.

“Despite some laughable suggestions that the West might somehow sanction ‘Russian gold,’ there is no way of tracing the identity, nationality, or provenance of bullion. American Eagle coins or South African Krugerrands can be melted down into bars. Gold is gold. And someone will always take it. Carry a Krugerrand to any major city anywhere in the world and you will find people willing and eager to take it off your hands in return for any other currency you want.”

Back in 2011, when I wrote the book “Economic Consequences”, I noted that the Federal Reserve would ultimately determine whether the United States experienced deflation or inflation followed by deflation. I reasoned that the outcome would depend entirely on monetary policy.

It now seems that the latter outcome is inevitable and perhaps even imminent.

This week’s radio program and podcast feature an interview with Mr. Alasdair Macleod. If you are not familiar with Mr. Macleod’s work, he is a brilliant researcher. I chat with him about this topic and what it means for inflation and financial markets moving ahead. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“In times like these, it helps to remember that there have always been times like these.”

-Paul Harvey