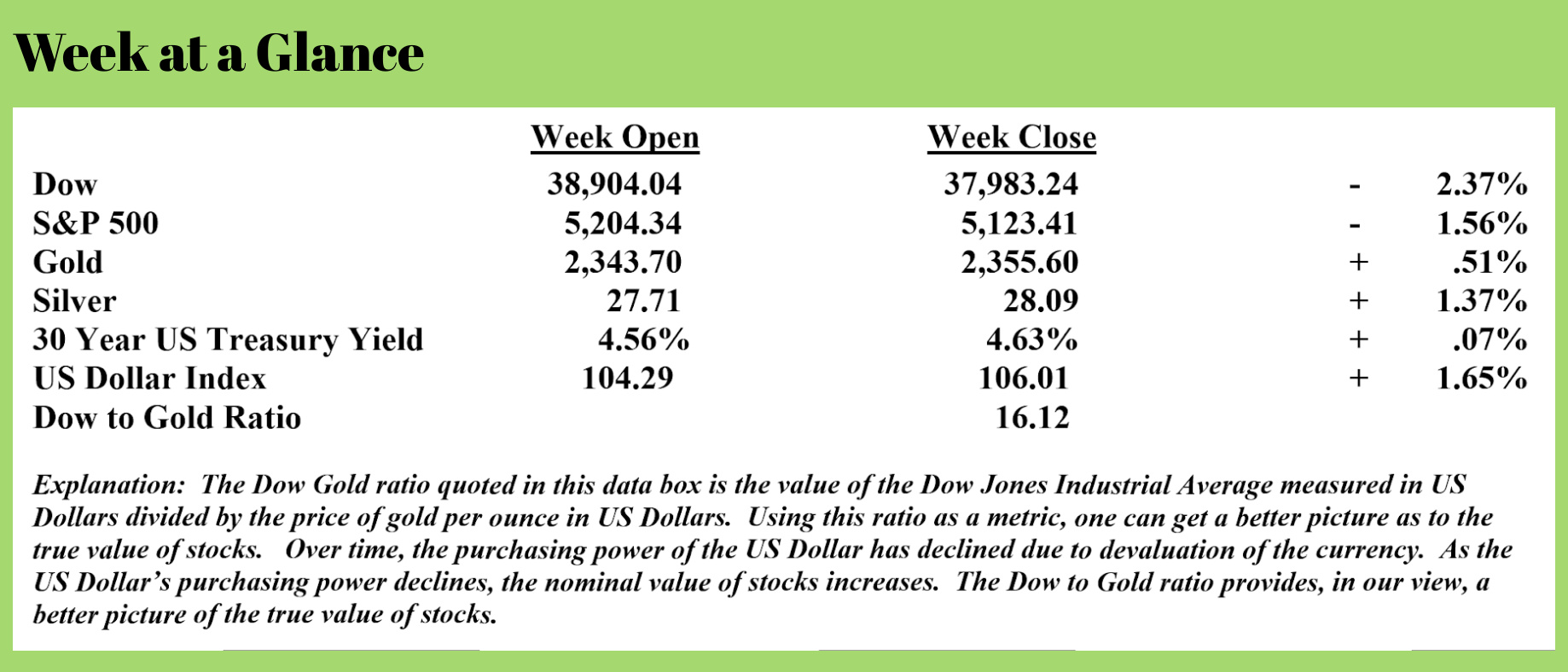

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

As we are now solidly into the fourth month of 2024, the number one economic story remains inflation.

The headline inflation rate, reported as the Consumer Price Index, was up 3.8% year-over-year when the March inflation numbers were released last week. This was a bigger number than the consensus of analysts projected. (Source: https://seekingalpha.com/article/4683124-cpi-march-2024-the-inflation-picture-for-markets-just-changed)

Of course, we all know the officially reported inflation rate is not the inflation reality that we all live with every day. The official inflation rate, like the official unemployment rate, has been massaged and manipulated to make the reported economic data appear more favorable. For example, the consumer price index uses substitution, weighting adjustments, and hedonic adjustments before the official CPI number is released.

When looking at price inflation, there are many signs that the average American is nearing the end of the proverbial rope.

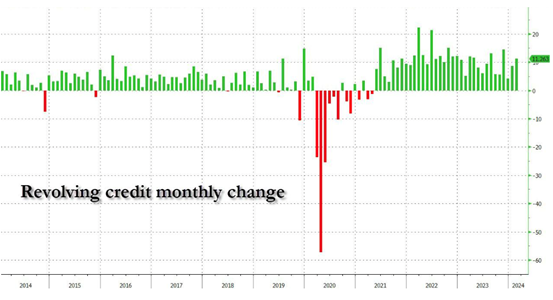

Let’s begin with credit card debt, which is now at an all-time high. The levels of credit card debt that were reported initially for both January and February have now been revised upward.

Let’s begin with credit card debt, which is now at an all-time high. The levels of credit card debt that were reported initially for both January and February have now been revised upward.

The chart (Source: https://www.zerohedge.com/markets/credit-card-debt-surges-new-all-time-high-just-card-apr-rates-hit-fresh-record) illustrates.

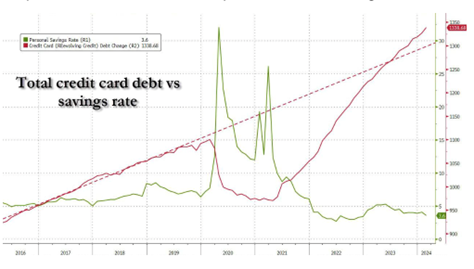

Total credit card debt is now at $1.34 trillion and has been steadily increasing over the past three years as the personal savings rate has declined. The second chart illustrates.

Note from the chart that in mid-2021, total credit card debt was less than $1 trillion.

For perspective, note that total credit card debt is now about equal to the annual outlay for Social Security. (Source: https://www.statista.com/statistics/217603/outlays-for-social-security-and-forecast-in-the-us/). That’s absolutely mind-blowing when you think about it. Total revolving debt currently being carried on credit cards is equal to the total ANNUAL outlay for Social Security.

For perspective, note that total credit card debt is now about equal to the annual outlay for Social Security. (Source: https://www.statista.com/statistics/217603/outlays-for-social-security-and-forecast-in-the-us/). That’s absolutely mind-blowing when you think about it. Total revolving debt currently being carried on credit cards is equal to the total ANNUAL outlay for Social Security.

Think consumers have hit the wall?

Next, let’s look at the cost of food at a quick-service restaurant.

A recent TikTok video that went viral featured a quick-serve restaurant patron lamenting the cost of a 40-piece Chicken McNugget meal, including two orders of fries. With tax, the meal was $27. (Source: https://www.foxbusiness.com/lifestyle/mcdonalds-25-deal-viral-users-blame-californias-minimum-wage-increase-new-normal). Drinks were an additional cost.

Recently, in this publication, I wrote about the dollar store chain “99 Cents Only,” closing all 371 of its locations. The CEO cited unenforced theft and inflation as two of the biggest reasons for the closure of all the chain’s stores.

There are two more signs that inflation is continuing to take a toll on average American consumers.

Homeowner’s insurance costs are also rising rapidly. “The Daily Mail”

reports that there are additional insurance rate increases on the horizon for homeowners all across the country. This comes on the heels of recent 20% rate increases on average. (Source: https://www.dailymail.co.uk/yourmoney/consumer/article-13259763/home-insurance-premium-record-warning-rising-states.html)

Here is an excerpt from the article on “The Daily Mail”:

Ken Brown is worried he is going to be forced out of his house if his home insurance premium continues to go up.

The 71-year-old retiree who lives near Rapid City, South Dakota, has seen his annual cover with American Family skyrocket almost 110 percent in the last year - from $1,665 to $3,490.

Ken is on a fixed retirement income, while his wife Valeria, 68, is still working to help cover the insurance bill - and a whole host of other rising costs.

Grim new forecasts say US home insurance rates will hit a record high this year - with the typical annual premium rising 6 percent to $2,522 by the end of 2024.

Meanwhile, the US Postal Service is once again increasing the cost of postage stamps. This from “Zero Hedge” (Source: https://www.zerohedge.com/economics/stamp-prices-rise-8-second-time-4-months):

It's only appropriate that on the day the BLS reported that prices are once again galloping away from the Fed's 2% inflation target - and hit fresh monthly record highs - that the Post Office announced stamp prices would also rise to a record high... for the second time this year.

According to the U.S. Postal Service, the price of the woefully misnamed First-Class Mail Forever stamp will increase to 73 cents on July 14, 2024, up by a nickel from the 68 cents one currently costs. When it was first introduced in 2007, a Forever stamp was 41 cents. The stamps were named as such so one knew they could use the stamp "forever," regardless of when it was purchased.

This is the second time the price of the Forever stamp will increase this year: it rose to 68 cents in January, from 66 cents.

The latest proposed changes also include a nickel hike to the price to mail a 1-ounce metered letter, to 69 cents, the postal service said Tuesday in a news release.

Mailing a postcard domestically will soon cost 56 cents, a 3-cent increase, while the price of mailing postcards and letters internationally are both rising by a dime to $1.65.

All told, the proposed changes represent a roughly 7.8% increase in the price of sending mail through the catastrophically run agency. The silver lining: the price of renting a Post Office Box is not going up, and USPS will reduce the cost of postal insurance 10% when mailing an item, it said. The only problem: virtually nobody rents PO Boxes any more or uses insurance for that matter.

As an aside, despite these increases in the cost of postage, the US Postal Service is expected to lose more than $6 billion in 2024.

In response to these inflationary pressures, consumers and central banks are investing in gold. Even Costco continues to offer gold to the company’s customers with gold sales now in the neighborhood of $200 million per month.

This from “Oil Price.com”: (https://oilprice.com/Metals/Gold/What-Costcos-Gold-Bar-Bonanza-Tells-Us-About-the-Economy.html)

Last December, wholesale retailer Costco announced that they had sold over $100 million worth of gold in Q3 2023.

"You've probably read about the fact that we're selling one-ounce gold bars. We sold over $100 million of gold during the quarter," said CFO Richard Galanti.

Now, Wells Fargo estimates that Costco "may now be running at" $100 million to $200 million per month in gold sales.

Costco is selling one-ounce bars made of nearly pure 24-karat gold. While the price is not disclosed online to nonmembers, it’s estimated that the product generally sells for about 2% above the spot price.

Sales of Costco gold bars are now limited to five per customer (up from two), while executive members receive 2% back.

Spot prices for gold have notably been on a tear this year, rising over 13% YTD amid persistent inflation, nearly $35 trillion in national debt (and growing), and investor fears over the state of the 'deteriorating US fiscal situation,' according to the report.

According to DataTrek co-founder Nicholas Colas, "The move suggests that many foreign governments feel the need to hedge geopolitical outcomes that might be negative catalysts for other risk assets like stocks."

While the Fed has been speaking confidently about controlling inflation, it’s obvious that the battle is not yet won.

I expect that inflation will continue to rise along with the price of precious metals, although a near-term pullback in metals’ prices would not be surprising given how overbought they are currently.

This week’s radio program features an interview that I did with Mr. Simon Popple, an accomplished writer on the topic of gold investing and commodity investing.

Be sure to check out the interview now by clicking on the "Podcast" tab at the top of this page.

“Success is stumbling from failure to failure with no loss of enthusiasm.”

-Winston Churchill

Comments