Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

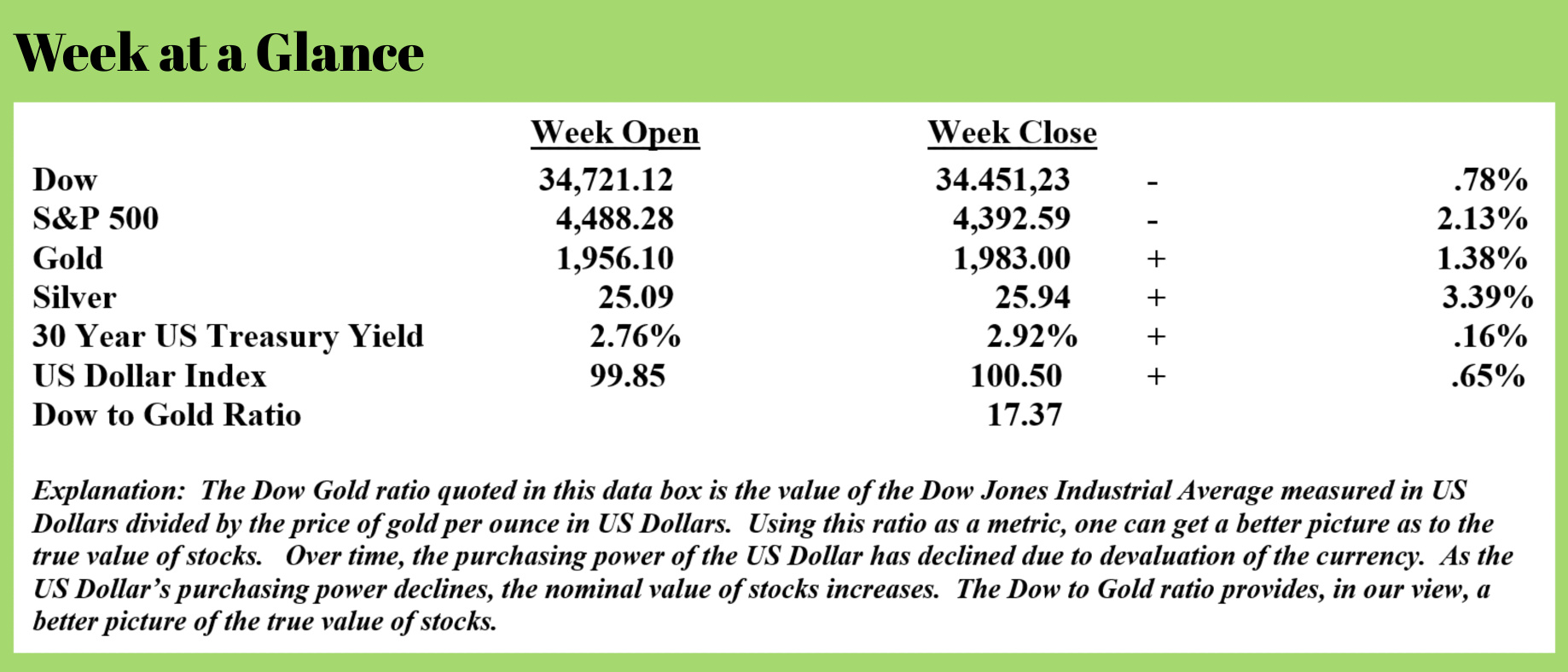

The big economic news the week before last week was the big decline in US Treasuries. Last week, the big economic news was once again the big decline in US Treasuries.

While the US Dollar Index is higher once again this week, as I discussed last week, it’s important to remember that this measure of the US Dollar’s purchasing power is a relative measure and compares the purchasing power of the US Dollar to a weighted basket of 6 other fiat currencies.

On an absolute basis, the US Dollar’s purchasing power is declining as the official inflation rate rose to 8.5% last week. The real inflation rate is much higher than this heavily manipulated Consumer Price Index number.

John Williams, the economist at www.shadowstats.com, uses the inflation rate calculation methodology that was used pre-1980 to determine the inflation rate. Using that calculation methodology, which was used the last time we had inflation at these levels, the current inflation rate is 16.77%.

That feels more like what we are all experiencing.

Inflation levels are now either at or approaching levels that will cause more inflation. When inflation levels get high enough, the inflation cycle begins to feed on itself, creating even more inflation.

In today’s inflationary environment, it’s nearly impossible for a builder to comfortably and confidently quote a proposed building project. Assuming a building project will take a year or two to complete, the prices of the materials needed to complete the project will likely rise enough by the time the materials are actually needed to render any current quote attempts fruitless.

The same could be said about farming. Input costs have risen a staggering amount. Many farmers are not planting the same crops or the same quantity of crops as in past years due to uncertainty about the ability to make a profit.

And, of course, there is always the concern about what politicians might decide to do about inflation. That concern is rightfully heightened in an election year like this one.

In past issues of “Portfolio Watch”, I have forecast that we will likely see price controls or perhaps even rationing of certain products especially as the election approaches.

While history unequivocally teaches us that price controls never work, that fact has never kept self-serving politicians from implementing price controls on an uninformed public to make it seem like the politicians are doing something to address the problem.

In the 1970s, after stating that “the (expletive deleted) things don’t work” referring to price controls, President Nixon reversed course and implemented price controls when his advisor reminded him he needed to navigate re-election.

Ironically, Nixon was right. Price controls didn’t work. As always happens price controls lead to empty store shelves as producers stop producing when the profit incentive is gone.

Now, as I predicted we would see earlier this year, there is talk among some Washington politicians to implement price controls. Here is an excerpt from an op-ed piece written by Stephen Moore in “The New York Post” (Source: https://nypost.com/2022/04/06/threatened-price-controls-wont-curb-biden-flation/)

Now the Biden administration complains that producers are taking advantage of product shortages and supply-chain constraints by jacking up their prices. He wants to penalize the meatpackers for the high beef prices, the poultry industry for the rising expense of a chicken dinner, the drug companies for the high cost of pharmaceuticals, and the oil and gas industry for recording record profits while gas prices soar.

He wants the Federal Trade Commission and other regulatory agencies to impose price ceilings to be monitored by an army of federal price-control police.

This is economic amnesia. We tried all these government manipulations in the 1960s and 1970s. The ruinous price regulations on industry made inflation worse. Back then we had Soviet-style central planners imposing price limits on everything: long-distance phone calls, oil and gas, airlines, rail service, trucking, and banking services.

This was supposed to protect consumers, but by making it illegal for prices to rise, we got hit with empty shelves, shortages, and gas lines.

The price ceilings became de facto price floors. Inflation shot up from 5% to 8% to 10% by 1980.

Even Democrats Jimmy Carter and Ted Kennedy realized that things were going haywire. They took the lead in ushering in an era of decontrol of prices. And when President Ronald Reagan was elected, his first executive order was to end oil and gas price controls.

What was the result? A famous study by the Brookings Institution found that the airline prices collapsed by one-third (ushering in an era of everyday Americans being able to afford to fly here, there, and everywhere) and banking charges fell by half, as did trucking and rail costs. The price of oil briefly rose when the price controls were lifted, but then as energy supplies were unleashed, prices fell by more than 60%.

Brookings found “in every industry” in which price controls were lifted, “prices fell and service quality improved.”

Why is this history lesson so hard for the modern Democrats to learn?

Just this week, Bernie Sanders called for a backdoor form of price controls with his proposal of a 95% windfall-profits tax on such firms as oil companies, pharmaceuticals, and meat producers. No one told the senator that when you tax something, you get less of it. This will only make supply-chain problems worse and fuel even higher prices.

Businesses aren’t charities. And it’s not “greed” or price gouging to make a profit. Adam Smith taught us in 1776 that it’s profit, not “benevolence,” that induces companies to produce more of the things we want at prices we can afford. That eventually brings prices down.

How depressing that here we are 250 years later and our politicians in Washington still don’t understand that enduring economic lesson.

Hopefully, price controls don’t get taken out of the tired bag of tricks, but this is an election year and inflation is continuing to accelerate. I’m hopeful but not holding my breath.

The reality is that inflation is a result of extremely loose, I would argue reckless, monetary policy. Paul Volcker ended the inflation in the 1970s by raising interest rates to nearly 20 percent which caused the money supply to meaningfully contract.

Here’s the problem with following Volcker’s plan of action today – the Federal Reserve is indirectly monetizing government deficit spending. To tighten monetary policy permanently, the federal government’s budget will also have to be tightened.

That’s why I believe the Fed’s current actions to tighten will be reversed at some future point citing another economic emergency that requires more currency creation.

Meanwhile, following increasing yields on US Treasuries, mortgage rates rose as well with interest rates on a 30-year mortgage now rising past 5% for the first time in more than 10 years. This from “The Guam Daily Post” (Source: https://www.postguam.com/business/real_estate/mortgage-rates-hit-5-ushering-in-new-economic-uncertainty/article_396d6358-bc70-11ec-b78e-8b82b1f2f504.html)

Mortgage rates swelled above 5% for the first time in more than a decade - an unexpectedly rapid ascent that has begun to temper the U.S. housing boom and could usher new uncertainty into an economy dogged by soaring inflation.

The 30-year fixed-rate mortgage, the most popular home loan product, hit the threshold just five weeks after surpassing 4%, according to Freddie Mac data released Thursday. The average has not been this high since February 2011.

The run-up comes as the Federal Reserve has launched a major initiative to rein in the highest inflation in 40 years. Fed officials are betting that higher interest rates will slash inflation and recalibrate the job market. But their plan also rests on the assumption that higher rates will cool demand for housing, especially while homes themselves are in such short supply.

Low rates fueled the revival of the U.S. housing market after the Great Recession and have helped drive home prices to record levels. But after two years of hovering at historical lows, rates have been on a tear: In January, the 30-year fixed average was 3.22%. It was 3.04% a year ago. And while mortgage rates had been expected to rise, they've done so more quickly than many economists predicted.

"I'm not surprised that rates have hit 5%, but I am surprised that everyone else is surprised," Curtis Wood, founder, and chief executive of Bee, a mobile mortgage app, said via email. "If you look at historical action by the Fed in a high-rate environment and compare that to what the Fed is doing today, the Fed is underreacting to the reality of inflation in the economy.

"I'm surprised that rates aren't at 6% right now," he added, "and wouldn't be shocked if they're at 7% by end of year."

This week’s radio program and podcast features an interview with Mr. Michael Pento, host of the “Midweek Reality Check” podcast. In my interview, Michael shares his thoughts on inflation and what's coming next. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“Any fool can make a rule, and any fool will mind it.”

-Henry David Thoreau