Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

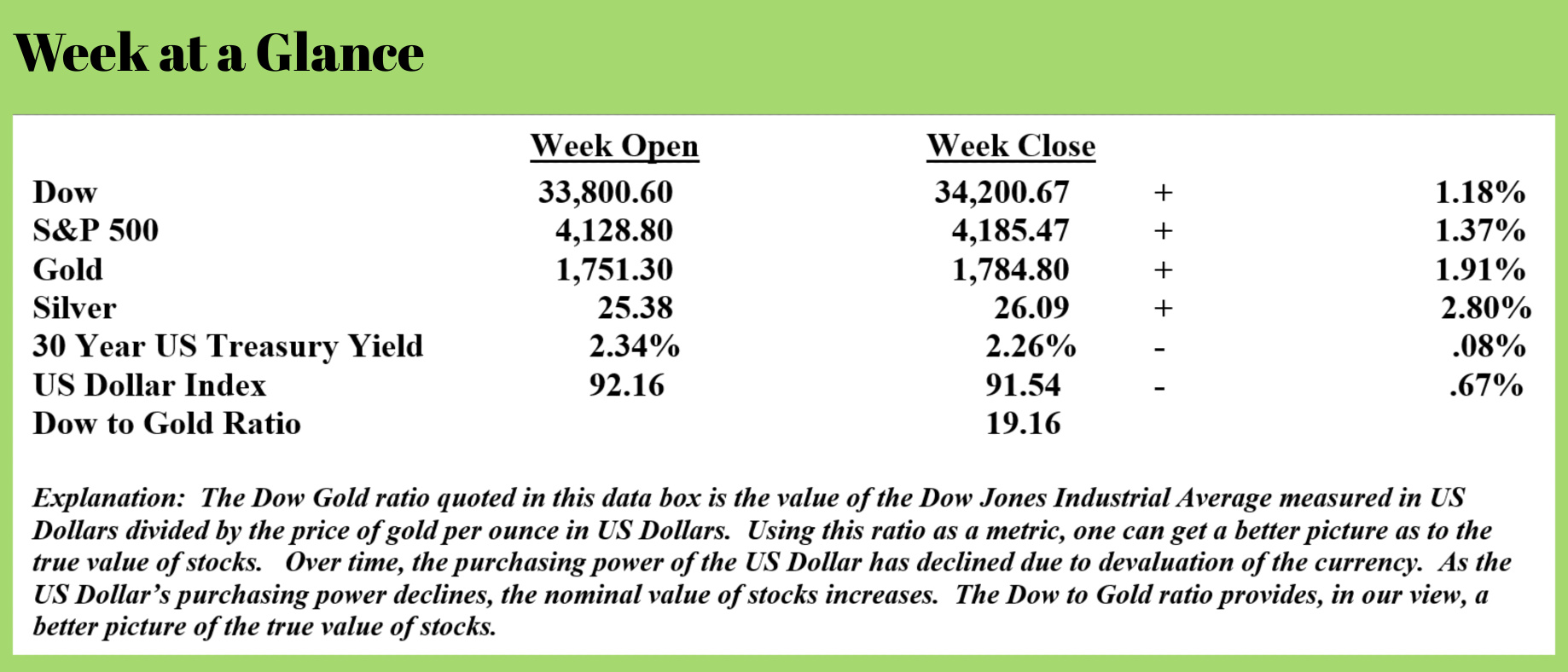

Stocks advanced again last week with the Dow climbing 1.18% and the S&P 500 rallying 1.37%. The rally in stocks has been very broad-based across almost all market sectors in April with only energy stocks declining.

I can’t help but think about the old market axiom, 'sell in May and go away.' This old saying came about because seasonally speaking the six months beginning in May often sees stocks decline. Given how overvalued stocks are here, that old axiom could once again come into play this year.

US Treasuries are beginning to show signs of life after a dismal start to the year. It’s too early to turn bullish on US Treasurys but they are extended significantly on the downside relatively speaking.

When looking at the financial and economic news and attempting to find one word to describe what I am observing - surreal is the word that comes to mind.

The dictionary defines surreal as ‘having the disorienting, hallucinatory quality of a dream; unreal”. That describes the current state of the financial markets and the economy.

Let’s begin with the example of real estate. According to Zero Hedge, there are now more real estate agents than there are properties for sale in the United States. (Source: https://www.zerohedge.com/markets/there-are-now-more-real-estate-agents-homes-sale-us). This from the piece:

If there has been one surefire beneficiary of the Fed printing trillions of new dollars and bailing out the entire U.S. economy at the cost of what will likely be a hyperinflationary disaster in the future, it has been the housing market.

The real estate market has surged into 2021, as newly cash-flush U.S. citizens (thanks to a slew of government 'free money') leave cities and look to settle down in the suburbs. To say the market is running hot would be a vast understatement.

And this, of course, has resulted in an influx of new realtors. In fact, as the Wall Street Journal reports, "there are more real-estate agents than homes for sale in the U.S.". It marks only the second time in history The National Association of Realtors member count is above the number of homes on the market. The other time was in December of 2019.

At the end of January, there were 1.04 million homes for sale (down 26% YOY and the lowest on record since 1982). The NAR posted 1.45 million members, up 4.8% from the year prior.

The number of real estate agents always peaks just before a bubble bursts. The last time the real estate bubble burst, the number of members in the National Association of Realtors was at about 1.2 million. It fell to about 1 million when the real estate market bottomed. Since 2012, the number of realtors has increased by 45%; that’s significant by anyone’s measure.

And, with only 1 million homes to sell, it seems that history is repeating itself.

It’s not only the Fed that is printing trillions; nearly every central bank around the world is following the lead of the Fed and creating money out of thin air.

Cryptocurrencies have been a beneficiary of this policy. Longer-term readers know that I have been skeptical of the long-term viability of the current crop of crypto’s since their intrinsic value is essentially the same as the intrinsic value of fiat currencies.

I have noted that despite the recent market capitalization of crypto’s reaching $2 trillion, there are a couple of potentially strong headwinds that crypto’s face. One, since the price of crypto’s is not stable, it’s extremely unlikely that they are ever fully adopted as currency. Two, since increasingly desperate central bankers and politicians view crypto’s as a threat, look for more attempts to regulate or outlaw cryptocurrencies.

We saw another attempt last week by the Country of Turkey. (Source: https://www.zerohedge.com/crypto/bitcoin-tumbles-turkey-bans-cryptocurrency-payments):

With crypto prices trading at record highs, torrid retail interest in the sector caused Robinhood's crypto-trading platform to crash (though, as Zero Hedge readers probably understand, that's par for the course for Robinhood), the rally came to a screeching halt early Friday as dictatorial banana republic Turkey - of all places - decided to crack down on the use of virtual currencies in desperate hopes of preserving confidence in the Turkish lira, the world's worst-performing banana republic currency.

Bitcoin dropped as much as 4.6% on Friday as Turkey banned its use for payment, restrictions that will take effect on April 30.

The curbs also prohibit Turkish companies that handle payments and electronic fund transfers from processing transactions involving cryptocurrency platforms, essentially cutting off legions of Turkish retail traders - who have been finding respite in crypto from their increasingly worthless domestic fiat currency - from the country's banking system.

As for why, the central bank cited a lack of regulation, supervision mechanisms, or central regulatory authority, combined with the potential for criminal activity and the high volatility of their market value, which means digital tokens entail “significant risks."

Look for more countries to ban cryptocurrencies in the future citing the potential for use in criminal activities as one of the main reasons.

Central bankers will never openly admit that their easy money policies and money printing are the primary reason that crypto’s have become popular.

Meanwhile, China is accelerating gold imports. Could it be that China, already successfully testing a digital currency is looking to tie that digital currency to gold?

China has given domestic and international banks permission to import large amounts of gold into the country, five sources familiar with the matter said, potentially helping to support global gold prices after months of declines.

China is the world's biggest gold consumer, gobbling up hundreds of tonnes of the precious metal worth tens of billions of dollars each year, but its imports plunged as the coronavirus spread and local demand dried up.

With China's economy rebounding strongly since the second half of last year, demand for gold jewelry, bars, and coins has recovered, driving domestic prices above global benchmark rates and making it profitable to import bullion.

The local premium is now about $7 to $9 an ounce, according to gold traders in Asia, and would probably have increased further if more imports to satisfy demand had not been allowed.

About 150 tonnes of gold worth $8.5 billion at current prices is likely to be shipped following the green light from Beijing, four sources said. Two said the gold would be shipped in April and two said it would arrive over April and May.

The bulk of China's gold imports typically comes from Australia, South Africa and Switzerland.

The People's Bank of China (PBOC), the country's central bank, controls how much gold enters China through a system of quotas given to commercial banks. It usually allows metal in but sometimes restricts flows.

"We had no quotas for a while. Now we are getting them ... the most since 2019," said a source at one of the banks moving gold into China.

The PBOC did not respond to a request for comment.

Could it be that China sees the writing on the wall as far as the US Dollar is concerned? Could it be that China sees that the US Dollar’s days as the reserve currency of the world are numbered?

If China were to tie her currency to gold, she could possibly avoid the possible fate of the US Dollar. With this development, China may be closer to doing so.

And, if you didn’t notice, despite what I believe to be price manipulation in the precious metals markets, gold and silver rallied on the news.

From where I sit, we are at a historic place in economic and financial history. Currency changes will have to occur in my view and ultimately gold and silver will have to be the beneficiary.

History teaches us there can be no other outcome.

The radio program this week is a special edition program titled “Can you divorce yourself from the IRS in your IRA?”

We are also offering a copy of the updated book of the same title. Click here to request a copy.

The program is posted on the app or by clicking on the "Podcast" tab at the top of this page.

“I knew a man who gave up smoking, drinking, and rich food. He was healthy right up to the day he killed himself.”

-Johnny Carson