Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

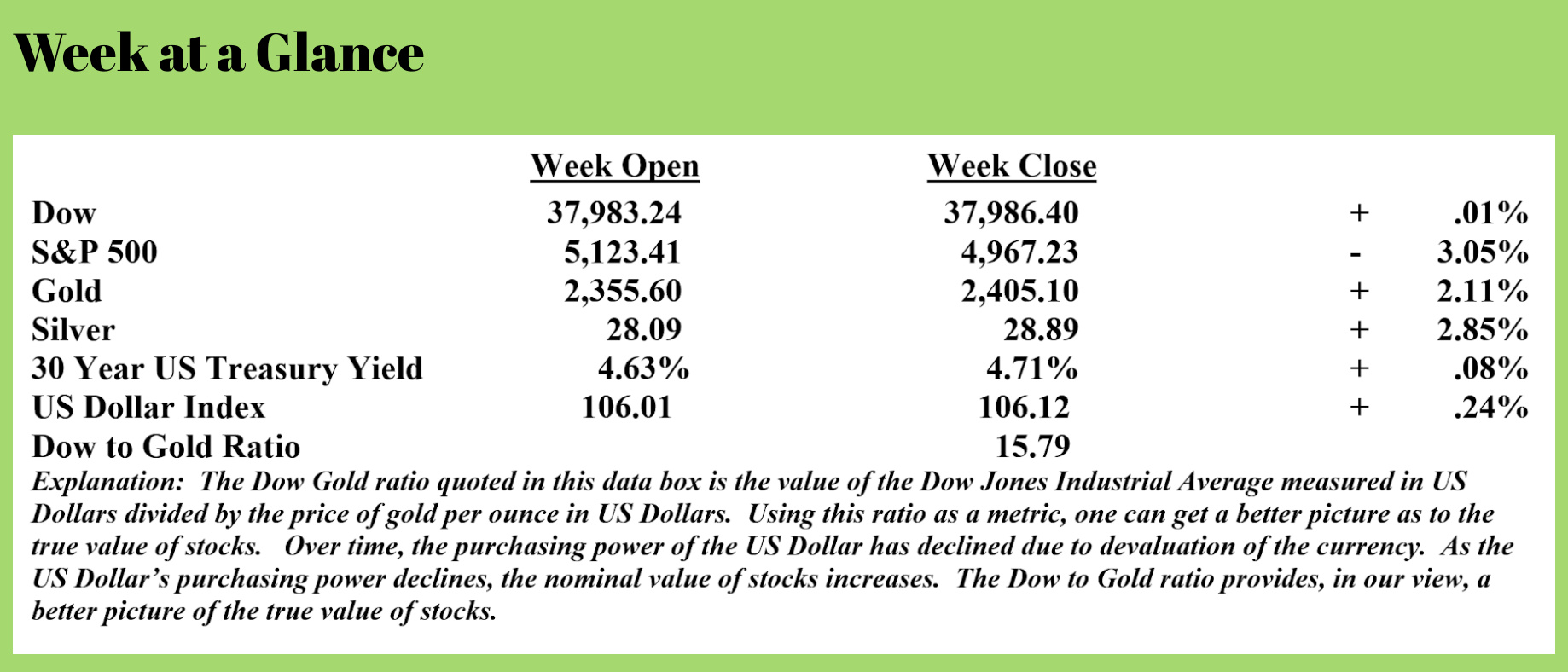

From where I sit, the evidence continues to validate my ultimate economic forecast of stagflation.

For those of you unfamiliar with the term, stagflation combines economic contraction with inflation, creating an economic environment that is simply miserable.

I devoted last week’s conversation to the topic of inflation. In case you missed it, let me briefly summarize.

The “headline” rate of inflation, reported as the Consumer Price Index, is a highly ‘massaged’ number. There are subjective adjustments made to the reported inflation rate, including changing the weightings of certain items in the index (for example, healthcare spending is about 20% of the US economy but only comprises about 10% of the index), substitution (when one item or service in the index gets too pricey, a bureaucrat might decide to substitute a less costly item into the index under the assumption that the substitution mimics consumer behavior), or hedonic or pleasure adjustments.

As anyone reading this has experienced, the real inflation rate is higher than the 3.8% year-over-year number reported for March.

Credit card debt is now approaching $1.4 trillion, more than the annual outlay for Social Security. The personal savings rate is near an all-time low.

Inflation is taking its toll. Whether it is grocery costs, car or homeowner’s insurance premiums, or energy costs, we are all paying more each year for these must-have items.

As I’ve discussed previously, inflation cannot be contained until two things happen. One, the federal government must operate with a balanced budget. Two, real interest rates must turn positive, meaning interest rates have to be higher than the REAL inflation rate.

Neither of these is close to occurring, so inflation will continue.

As I pointed out a few weeks ago, the economic growth that is being reported is artificial. If it wasn’t for government deficit spending, it is my view that we would already be in a recession.

In the 4th quarter of 2023, the US economy grew by a reported $343 billion. Government debt rose by $834 billion. That means the US Government spent $834 billion that they didn’t have or collect through tax revenues. Since government spending is part of economic output, it is fair to assume that had the government operated with a balanced budget in the 4th quarter of 2023; the economy would have contracted by half a trillion dollars.

Put another way, the government spent about $2.50 for every $1 in growth realized.

Here’s a news flash – that’s not growth. That’s debt accumulation disguised as growth.

Along with accelerating inflation (even the officially reported inflation rate was much higher than the consensus estimate), there are now signs beginning to appear that the real economy is showing signs of weakness.

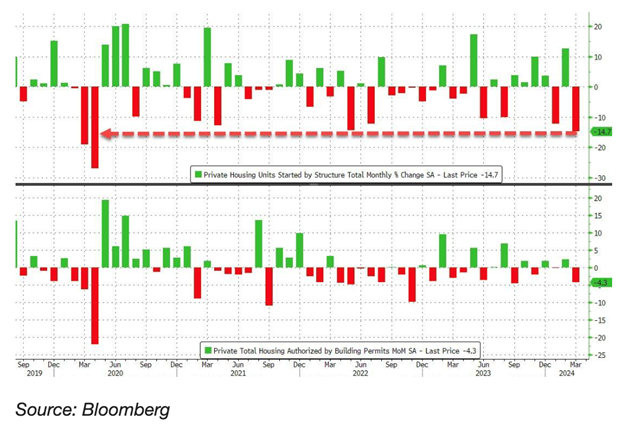

US housing starts absolutely collapsed in March. This from “Zero Hedge”. (Source: https://www.zerohedge.com/markets/us-housing-starts-collapsed-march-biggest-drop-covid-lockdowns) (emphasis added):

US housing starts absolutely collapsed in March. This from “Zero Hedge”. (Source: https://www.zerohedge.com/markets/us-housing-starts-collapsed-march-biggest-drop-covid-lockdowns) (emphasis added):

The roller-coaster ride in housing permits, starts, and completions in the last few months is set to continue today... and 'surprise' they did. After a big (+10.7%) surge in February, Starts crashed 14.7% MoM in March (massively worse than the 2.,4% drop expected). Building Permits also plunged (-4.3% MoM vs -0.9% exp)...

For context, this is the largest MoM drop in housing starts since the COVID lockdowns...

The chart on this page from the “Zero Hedge” article and courtesy of “Bloomberg” illustrates.

Adding to the burgeoning trouble in the real estate market, commercial real estate foreclosures jumped in March by a whopping 117%! This from “Fox Business”. (Source: https://www.foxbusiness.com/economy/commercial-real-estate-foreclosures-jumped-march-trouble-looms):

The commercial real estate market is starting to buckle under the weight of higher interest rates and remote work.

There were 625 commercial real estate foreclosures in March, up 6% from February and 117% from the same time last year, according to a new report published by real estate data provider ATTOM.

The figure is calculated based on commercial properties with at least one foreclosure filing — including default notices, scheduled auctions and bank repossessions — entered into the ATTOM Data Warehouse during the month.

California had the highest number of commercial foreclosures in March, with 187 properties. While that marked an 8% decrease from the previous month, it is a stunning 405% jump from the previous year.

"California began experiencing a notable rise in commercial foreclosures in November 2023, surpassing 100 cases and continuing to escalate thereafter," the report said.

New York, Florida, Texas and New Jersey also saw notable increases in commercial foreclosures last month.

Foreclosures have steadily risen since May 2020, when they hit a record low of just 141 properties. At that time, the U.S. economy was still in the throes of the COVID-19 pandemic, and many lenders offered commercial loan forbearance to borrowers to help them stay afloat.

The end game here, as I have been writing and talking about for many years, is clear. With debt levels that are unsustainable, it’s only a matter of time until the Fed goes back to the currency creation policies of the past to attempt to stave off the debt collapse for a little longer.

They cannot be successful. These policies will only make the eventual stagflationary environment worse.

Matthew Piepenberg of Gold Switzerland puts it this way (Source: https://vongreyerz.gold/the-implications-of-fatal-debt-expect-more-lies):

America’s debt to GDP is 120%, its deficit to GDP is around 6%, and every 100 days we add another $1 trillion in borrowing to our shameless bar tab of debt addiction masquerading as capitalism.

Even our own Congressional Budget Office will confess that unless we issue more debt (and print more debased money to monetize it), our Medicare and Social Security piggy bank will be empty by 2030.

Meanwhile, the US is staring down the barrel of $212 trillion in unfunded liabilities, yet only $190 trillion in assets.

In other words, and based on objective math, America literally has the balance sheet of a banana republic.

For years, I have pounded my fist, reminding readers and viewers that debt destroys nations and currencies. Every time and without exception.

And for years, I have pounded my fist, saying that Powell’s ‘war on inflation’ was a ruse, as every debt-soaked nation needs to debase its currency to inflate away debt.

And from day one of Powell’s claim that inflation was transitory, I’ve been calling his bluff.

For years, I’ve argued that the Fed would simply lie about inflation (i.e., grossly under-report it) in order to make it appear statistically lower than what we actually knew/felt it to be.

Even Larry Summers, who is the classic arsonist (from his repeal of Glass-Steagall to regulating the derivatives markets) now playing at fireman, has publicly stated that the actual US CPI scale, using the pre-1983 housing methods, peaked last year at 18%, not the official 3.7% range.

If we then tack on a US debt/GDP ratio that is 30% higher today than in 2009, we mathematically see that despite Powell’s repressive “higher-for-longer” rate policies, we’ve made zero dent in our debt – instead we’ve increased it.

In other words, our war against inflation is a loss, and our debts have increased.

This week’s radio program features an interview that I did with Mr. Kerry Lutz, founder of The Financial Survival Network.

Check out the interview now by clicking on the "Podcast" tab atop this page.

“The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.”

-Ludwig von Mises

Comments