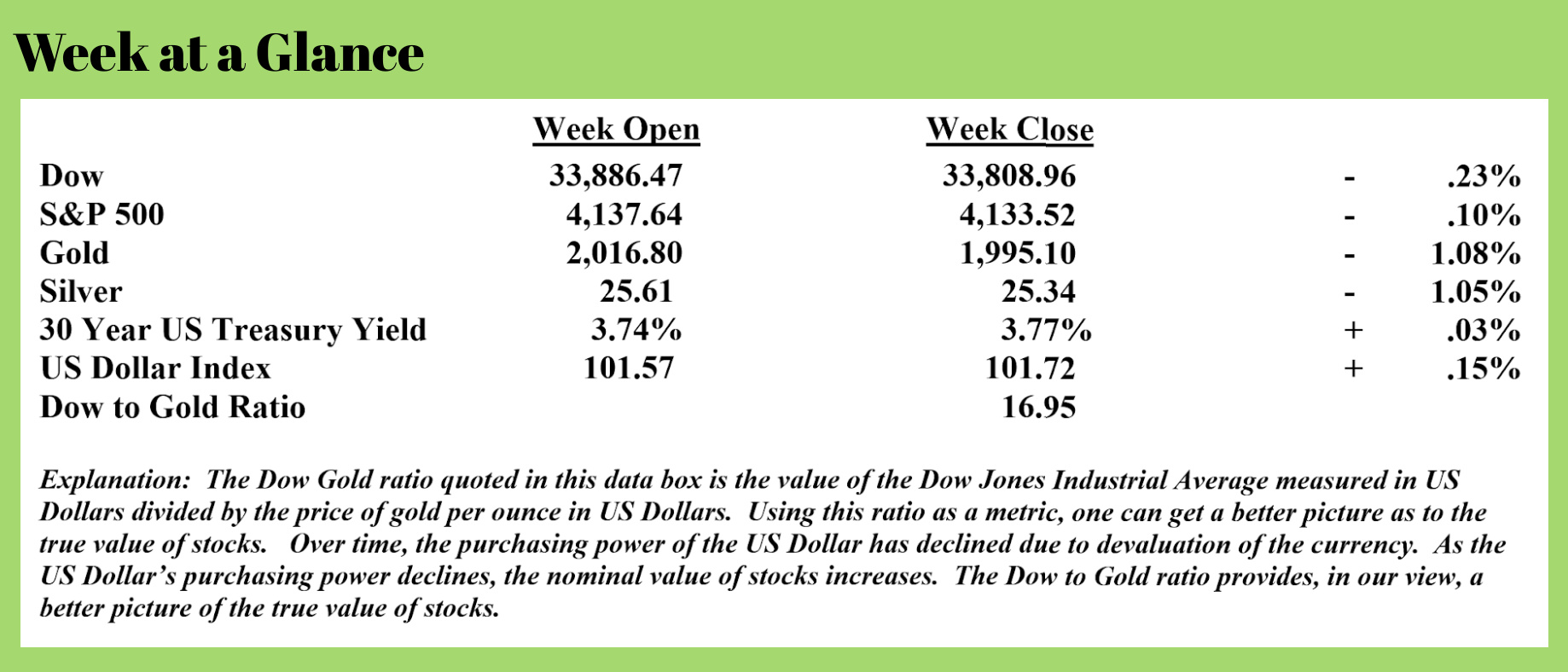

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Last week, here in “Portfolio Watch,” I discussed some of the movement away from the US Dollar globally.

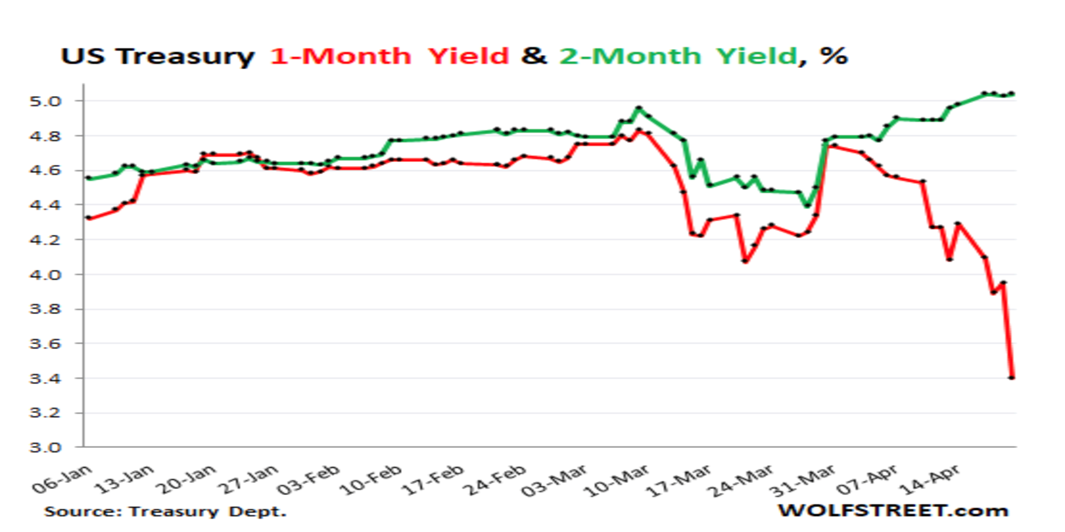

This week, something else very interesting occurred. There is now a HUGE disparity between the yield on a 1-month US Treasury bill and a 2-month US Treasury bill. This from Wolf Richter (Source: https://wolfstreet.com/2023/04/20/short-end-of-the-treasury-market-goes-totally-nuts-doubts-creep-in-over-debt-ceiling/):

Today was another weird mess – and by far the biggest weird mess – in a series of daily weird messes in the very short end of the Treasury market, with Treasury securities that have remaining maturities of around one month. The one-month yield plunged 55 basis points today to 3.40% at the close – meaning prices of these securities jumped amid huge demand. Intraday was down as much as 75 basis points. Panic-buying frenzy! Since March 31, the one-month yield has plunged 134 basis points (red line below).

But, but, but… the two-month yield – so tracking Treasuries maturing in about two months – was very well behaved, smiled all day long, ticked up 1 basis point to 5.04%, and was up 25 basis points since March 31 (green line).

There is now an unspeakably crazy spread of 164 basis points between the one-month yield and the two-month yield – a sign that some people are panicking and piling into whatever they will be out of at face value in about one month.

This is US Treasury market activity that is truly unprecedented.

There is so much demand for 1-month US Treasuries that the yield fell to 3.4%. Yet, the demand for 2-month US Treasuries hasn’t changed much. As Richter notes, there is a difference in yield of 1.64% (164 basis points) between a US Government debt maturing in one month versus US Government debt maturing in two months.

That begs the question, why?

More from Richter:

The cost of insuring US government debt against default has been rising for weeks. Today, the spread on 5-year US credit default swaps jumped further, to a decade high, nearly doubling from the beginning of the year, according to S&P Global Market Intelligence.

There is now a lot of speculation why some people are panickily piling into something that they will get paid back in about one month, and why they’re so eager to pile into it that they’re paying extra to do so, while the rest of the bond market is just sort of fine, within the massive inversion of the yield curve. The stock market doesn’t really care about anything anyway. So, for most people, today was a non-event.

But some people are getting antsy about a US default.

The debt-ceiling farce being performed currently in Congress could turn from a mildly entertaining political show that has been played 79 times since 1960, and whose ending everyone knows, into a truly hilarious financial show with a new ending where the debt ceiling isn’t lifted, and where the US will then default on some of its obligations, and where everyone in Congress – these folks are rich – will lose 60% or whatever of the value of their financial assets in no time.

I’m curious to see how they would spin that one. Surely, everyone would blame everyone else. I’m also curious if anyone in Congress is actually hedging their financial assets against that kind of event.

Today’s problem was that tax receipts from Tax Day were somewhat lackluster, which might move the out-of-money-date, the X-date, a little closer than previously anticipated.

The X-date is when the Treasury Department will run out of “extraordinary measures” and will run out of cash in its checking account, the Treasury General Account at the New York Fed.

The Treasury Department might then begin to prioritize what it will pay and what it will not pay, for example it would stop paying for salaries, travel reimbursements, and toilet paper for everyone in Congress. At least, that’s where I would start.

If the debt ceiling doesn’t get raised quickly after the initial failure to raise it, eventually, the US government might not have enough cash on hand to be able to redeem a bond issue when it matures, and holders of these securities who thought they would get paid face value at the end of June might not get paid anything at the end of June, which would represent a maturity default, which would be very messy. Globally.

Obviously, this isn’t going to happen, knock on wood. The good folks in Congress are surely too worried about their financial wealth, and surely, sheer greed will force them to agree on a deal. But the bet today was that maybe, just maybe, this calculus could be wrong. And it infused a little bit of suspense – as they usually try to do – into the farce so that not everyone will fall asleep, and so that they’ll get a little more political traction with it.

As Richter notes, could it be that investors are piling into one-month Treasuries and taking a much lower yield because they are concerned that the x date to which Richter refers is between one and two months out?

Meanwhile, as the Washington politicians negotiate how to raise the debt ceiling, the rest of the world is moving away from the US Dollar. Past RLA Radio guest, Dr. Charles Nenner recently did an interview with Greg Hunter of “USA Watchdog” with some comments on this topic. Here is a bit of what he said (Source: https://usawatchdog.com/dollar-finished-america-in-danger-charles-nenner/):

Renowned geopolitical and financial cycle expert Charles Nenner has been warning his war cycles are going up. Nenner also predicted a few years back that, at some point, the U.S. dollar cycle would be headed down—way down. The future is here, and Nenner explains, “We have known each other for many years, and I said the dollar is going to hold up, but not anymore, not anymore. It is really in trouble. There is actually no reason to be in the dollar. They especially underestimate this BRICS situation, and all the countries will be forming an anti-dollar. . . . Saudi Arabia is coming onboard, and that means the end of the dollar as the reserve currency.” Nenner says his cycles see, “The dollar going down to 70 on the dollar index.” It’s a bit over 100 now, but it gets worse. Nenner points out, “I don’t want people to get depressed, but I am really worried. If the U.S. does not rule the world anymore. . . . They think they can still tell the world what to do. Physically, the Americans are in danger, and they don’t seem to understand that. . . . The economy is really going to suffer. If the dollar goes really low, we could have a small bounce in the economy because it’s good for exports. That’s just a fooling bounce for people. Longer term, it’s just finished.

Given these circumstances, it makes sense to own some assets in your portfolio that are not denominated in US Dollars. While there are many ways to accomplish this, one of the easiest ways is to own precious metals.

If you’d like help or would like to talk about metals further, give my office a call at 1-866-921-3613.

The radio program this week features an interview with Mr. Mark Jeftovic, publisher of “The Crypto-Capitalist Letter.” I talk to Mark about the future of central bank issued digital currencies as well as buying stocks in crypto companies.

If you haven't had a chance to hear the show, you can listen now by clicking on the "Podcast" tab at the top of this page.

“The price of greatness is responsibility.”

-Winston Churchill

Comments