Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

There’s an eternal truth when it comes to finance that is not discussed as often as it should be, in my view. And that truth is simply this:

If there is too much debt to be paid, it will not all be paid.

That’s hardly an epiphany and probably seems very non-profound to you as you read this.

But it is that fundamental truth that will ultimately lead to an economic reset in many countries around the world.

First, some background.

Ever since 1971, the US Dollar has been loaned into existence. Prior to 1971, going all the way back to 1944 and the Bretton Woods Agreement, the US Dollar was an asset convertible to gold at a rate of $35 per ounce.

Ever since 1971, the US Dollar has been loaned into existence. Prior to 1971, going all the way back to 1944 and the Bretton Woods Agreement, the US Dollar was an asset convertible to gold at a rate of $35 per ounce.

In 1971, due to excessive currency creation by the United States brought about by extreme spending by the Washington politicians for Medicare, Medicaid, and the Vietnam War, the convertibility of US Dollars for gold was ‘temporarily suspended’ by President Nixon. Those redemptions have never resumed.

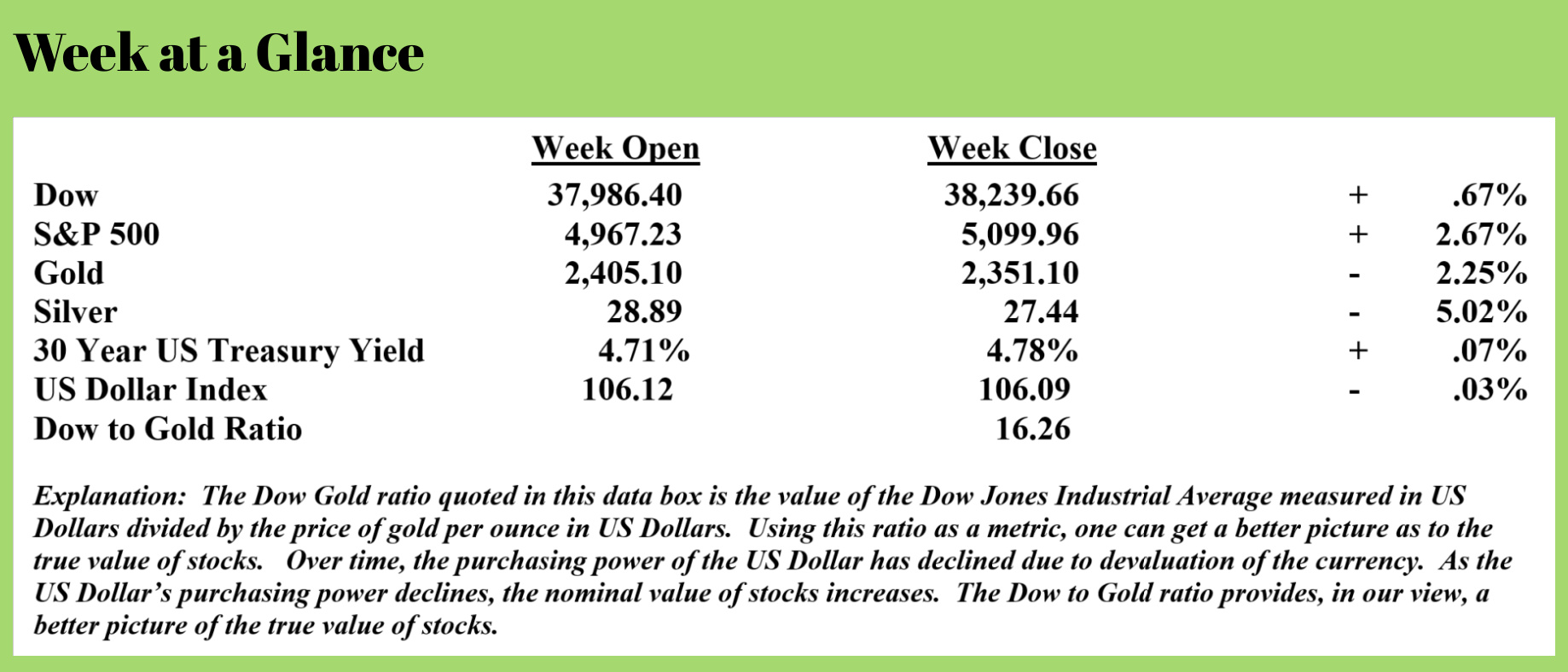

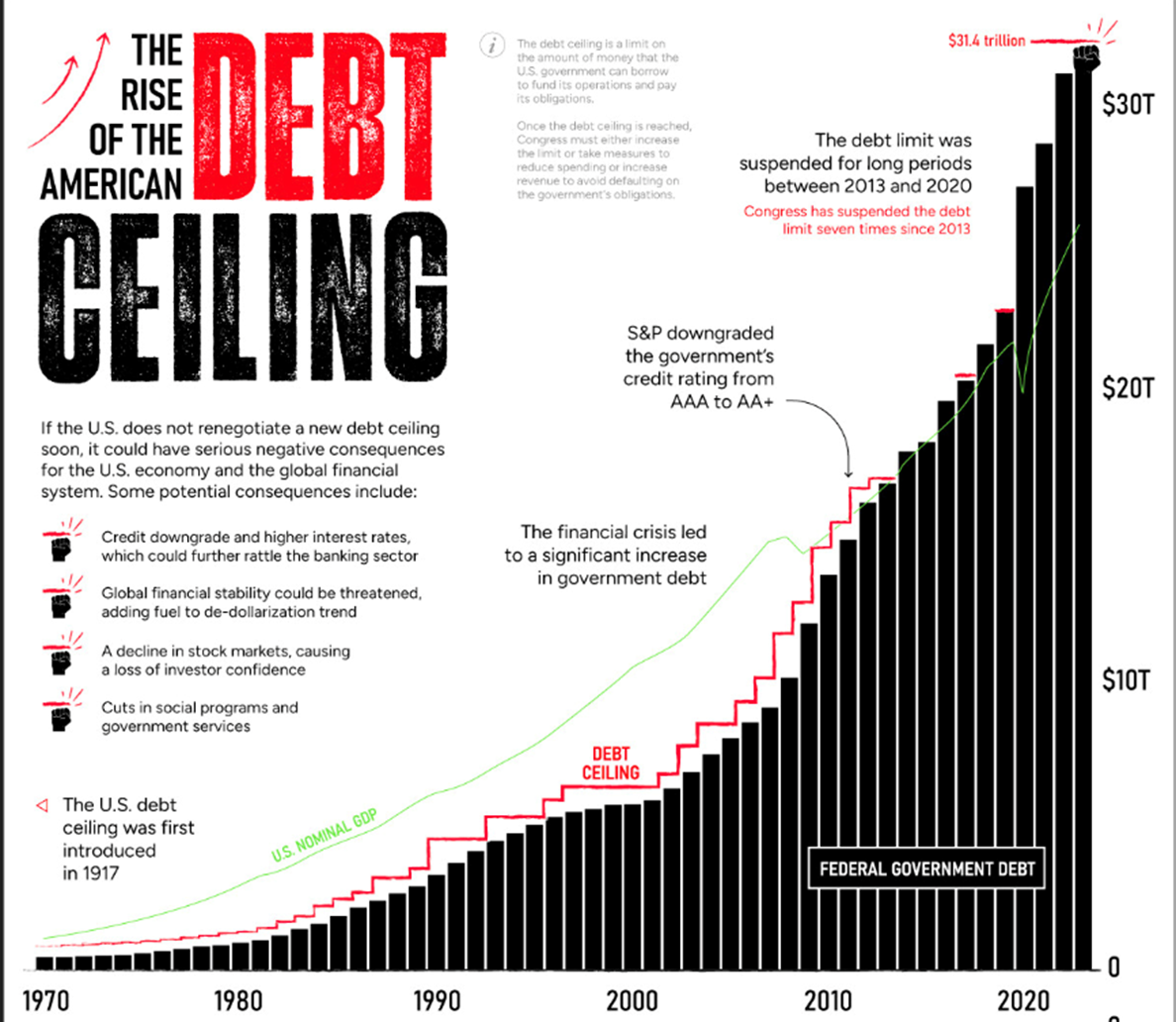

Once the US Dollar became a fiat currency, debt levels on the balance sheet of the federal government began to explode. The chart on this page illustrates.

Over the past few weeks in this publication, I have cited various quotes from the Austrian economist Ludwig von Mises. In my opinion, if you want to know what happens when the debt goes unpaid, you study history and von Mises.

Von Mises, when discussing the debt accumulation end game, said this:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come about sooner as the result of the voluntary abandonment of further credit expansion, or later, as a final and total catastrophe of the currency system involved.”

To paraphrase von Mises, you either quit accumulating debt cold turkey and deal with the deflationary consequences, or you continue accumulating debt, papering over the debt problem with newly created currency, resulting in a hyperinflationary environment that will then be succeeded by deflation.

Put another way, you are either proactive about dealing with the debt or you are reactive, attempting to address the issue after inflation is completely out of control.

History is loaded with examples of the latter, reactive end game. Weimar, Germany after World War I, France in the 18th century (twice), the Roman Empire, and even early Colonial America.

It is not as often that politicians will stand up and proactively address the problem for one simple reason – there is a lot of economic pain that follows such a decision. But, that is exactly what is happening in Argentina.

Newly elected President, Javier Milei, ran for office on a platform of balancing the budget. Within 9 weeks of taking office, that is exactly what the new president accomplished. To do so, he slashed spending across the board.

When Milei took office, inflation in Argentina was out of control. Inflation was officially running at more than 270% annually. (Source: https://www.straitstimes.com/world/argentina-inflation-worlds-highest-slows-down-in-boost-for-milei)

Milei, stating the obvious, commented on his strategy to tame inflation, “If the state does not spend more than it collects and does not issue money, there is no inflation. This is not magic.”

However, by making a choice to attack inflation proactively and balance the budget, Milei has made the decision to have the country endure a painful deflationary period once the inflation subsides.

While it is early in the new president’s administration, signs are that the strategy is beginning to work.

Argentina’s monthly inflation rate was 25.5% in December, 20.6% in January, and 13.2% in February. While those are still big numbers, the monthly inflation rate has been almost cut in half in two months.

That’s progress, but the progress is not coming without economic pain. Milei knows that as bad as the pain might be presently from austerity, it will be less painful now than if the proverbial can is kicked further down the road for some future politician to deal with reactively.

Milei just celebrated the first budget surplus for Argentina’s government since 2008. This (source: https://www.straitstimes.com/world/argentina-s-javier-milei-announces-nations-first-budget-surplus-in-16-years) from “The Straits Times”:

Argentina’s spending-slashing new President Javier Milei has hailed his country’s first quarterly budget surplus since 2008 as a “historic achievement”.

In the first quarter of 2024, the South American country recorded a budget surplus of about 275 billion pesos (some S$400 million at the official rate), he told national TV late on April 22.

This amounted to a surplus of 0.2 per cent of gross domestic product.

“This is the first quarter with a financial surplus since 2008,” said Mr Milei, referring to his left-wing rival Cristina Kirchner’s first year in the presidency.

Mr. Milei, who took office in December, boasted of “a feat of historic significance on a global scale”.

“If the state does not spend more than it collects and does not issue (money), there is no inflation. This is not magic,” the self-described “anarcho-capitalist” said.

Milei had laid off thousands of government workers, warning them, “Do not expect a way out through public spending.”

As one might expect, there are many protesting Milei’s policies, all of whom are feeling the pinch of losing government benefits and/or support as the government is now spending less than it receives in tax revenues.

This from the article referenced above:

University students, backed by unions and opposition parties, have called a march for April 23 to protest against financing cuts to higher public education, research and science under the new president.

Universities have declared a budgetary emergency after the government approved a 2024 budget the same as the one for 2023, despite inflation approaching 300 per cent and a near 500 per cent increase in energy costs that higher learning institutions say has brought them to their knees.

“At the rate at which they are funding us, we can only function between two and three more months,” University of Buenos Aires rector Ricardo Gelpi said.

If Milei and Argentina can stay the course, the policies will bear fruit after a painful period of deflation, and Argentina may have a chance to get back to its former glory. At one time, Argentina was one of the wealthiest countries in the world, and Buenos Aires had the nickname “Paris of South America.”

All that changed as more socialistic policies were implemented in the country.

Interestingly, Argentina has a debt-to-GDP ratio that is far less than the United States. Argentina’s debt-to-GDP ratio for 2024 is about 85% (Source: https://www.statista.com/statistics/316929/national-debt-of-argentina-in-relation-to-gross-domestic-product-gdp/) while the United States has a debt-to-GDP ratio of about 127% (Source: https://www.visualcapitalist.com/how-debt-to-gdp-ratios-have-changed-since-2000/).

Argentina, at least for now, has ceased deficit spending. That is not the case in the United States, which helps explain the recent price action of gold, silver, mining shares, agricultural commodities, and other tangible assets.

This week’s radio program features a “best of” interview that I did with Mr. Kerry Lutz, founder of The Financial Survival Network.

Be sure to check out the interview now by clicking on the "Podcast" tab at the top of this page.

“Never argue with stupid people; they will drag you down to their level and then beat you with experience.”

-Mark Twain

Comments