Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

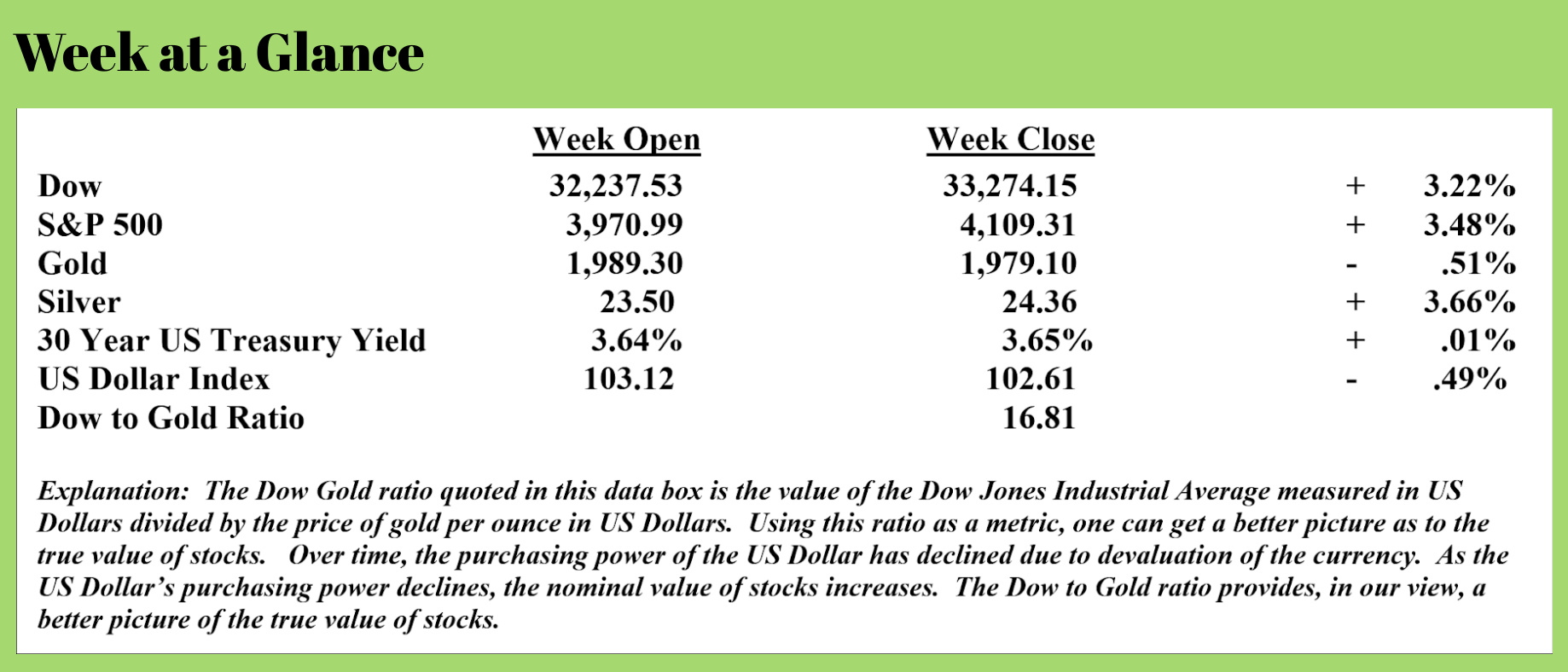

There were two big market movers last week. Stocks and silver both advanced between 3% and 4% on the week.

As far as stocks are concerned, the downtrend line that has been in place since January of 2022 has now been broken to the upside, as noted on the weekly chart of an exchange-traded fund that tracks the Standard and Poor’s 500.

Note the trend line on the chart that has been drawn from the beginning of calendar year 2022. The highs made in early February took out the highs made in December. However, last week’s market highs did not take out the highs made in early February. At this point, the primary trend in the S&P 500 is down, but on a more intermediate term, stocks are in a trading range.

From a fundamental perspective, stocks remain overvalued by many measures. Robert Burgess makes this observation about the performance of the S&P 500 (Source: https://www.advisorperspectives.com/articles/2023/03/31/this-stock-market-splash-has-a-disturbing-undertow):

The benchmark S&P 500 Index is wrapping up its second straight quarterly gain, rising 5.50% through Thursday and adding to the 7.08% surge in the final three months of 2022. This will be cheered as good news, confirming the stock market’s recovery from last year’s bear market and resiliency in the face of stubbornly high inflation, rising interest rates, and bank failures. Don’t fall for it.

Underneath those topline numbers lurks a disturbing development — a very small percentage of stocks actually account for the rise. If not for a handful of highfliers such as Nvidia Corp., Meta Platforms Inc., Tesla Inc., Warner Bros Discovery Inc., and Advanced Micro Devices Inc., which all chalked up gains of between 50% and 87%, the S&P 500 would be struggling. In fact, when all stocks are weighted equally, the index is actually little changed, rising less than 0.5% for the quarter. Broader measures of the stock market, such as the New York Stock Exchange Composite Index, are essentially flat.

On Wall Street, this is known as bad breadth and a sign that despite the outward appearance of health, all is not well with the stock market. Longtime Wall Street watcher Ed Yardeni, who is credited with coining terms such as “bond vigilante” and “Fed model” highlighted the diverging performance between the S&P 500 and its equally weighted alternative in a note to clients this week. He pointed out that the ratio between the two tends to peak before recessions — making the recent January high a cause for worry. Other measures of breadth also signal weakness: the number of equities on the New York Stock Exchange trading above their 200-day moving average is lower that the average for the past decade; the same is true for the number of stocks hitting new 52-week highs less those touching 52-week lows.

Breadth is an important indicator of the health of a rally in stocks. If the advance has most stocks participating, the rise in stocks is considered to be more sustainable. If the advance is propelled by a small number of stocks, it is not as likely to be sustainable long term. Think about it using a military analogy. If the charge is led by the generals and the troops aren’t following, the mission is unlikely to be successful.

That describes the current stock market advance.

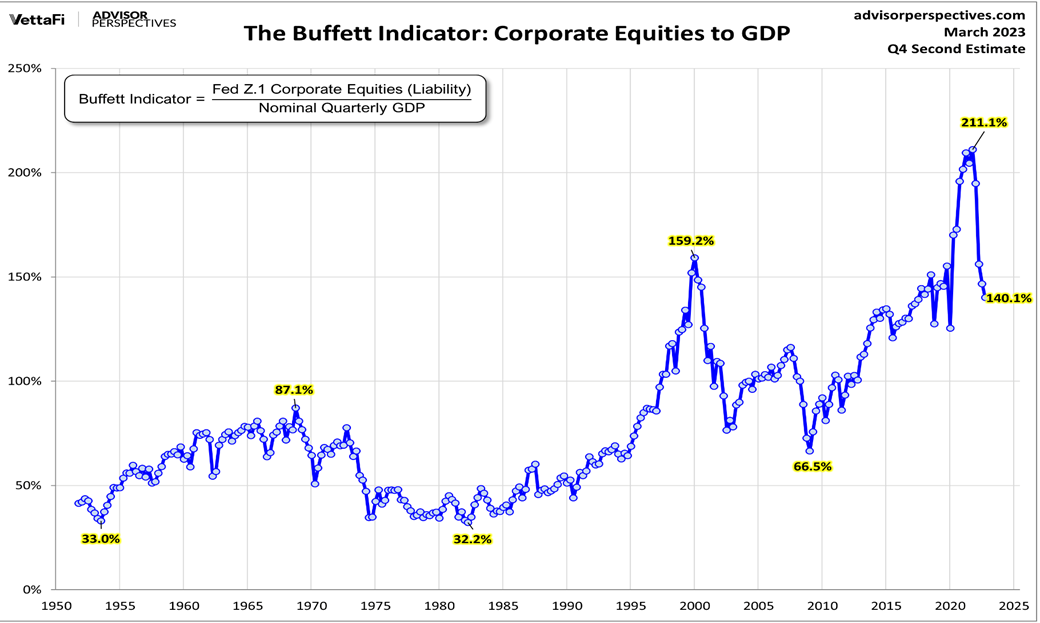

The “Buffet Indicator” is a stock valuation metric popularized by legendary investor Warren Buffet in an interview about 20 years ago. The stock market valuation measure takes total stock market capitalization and divides it by gross domestic product. In other words, it takes the devaluing US Dollar out of the measure and compares the total value of stocks measured in dollars and divides by gross domestic product measured in dollars. Since both statistics are measured in dollars, it is a comparison rather than a stand-alone dollar measure.

This chart (Source: https://www.advisorperspectives.com/dshort/updates/2023/03/06/buffett-valuation-indicator-february-2023-update) shows the current value of the Buffet Indicator compared to where the indicator has stood historically.

Notice that the Buffet Indicator currently stands at 140%. While that is down significantly from the 211% of late 2021 when I called the market top, it is just below where the decline began at the time of the tech stock bubble bursting and well above where the decline began at the time of the financial crisis.

Since I believe that the odds are fairly high that we may be on the verge of repeating the financial crisis, the downside for stocks from here could be greater than in 2007 – 2008.

As far as silver is concerned, it’s no secret to longer-term readers that I have been a silver bull.

My silver optimism is purely based on fundamentals.

I expect that inflation will continue and differ with some of my RLA Radio guests as to what the future policies of the Federal Reserve will be.

There are some bright people whose opinions I respect and value who believe the Fed will stay the course and continue tightening to get inflation under control.

I have long held that the Fed would pivot at some future point, and to a certain extent, the central bank already has.

The recent bank bailouts were backstopped by the Fed via currency creation.

Past RLA Radio guest Peter Schiff had this to say on the topic recently. (Source: https://schiffgold.com/interviews/peter-schiff-bank-bailouts-will-devalue-the-dollar/):

In just two weeks, the Federal Reserve added nearly $400 billion to its balance sheet. That’s money created out of thin air. That’s inflation. And so, when you do that, you destroy the value of all the money that’s already in circulation. So, Americans are going to pay, not because they are taxpayers, but because they are US dollar owners and US dollar earners. Everybody’s paycheck is going to be reduced in value because of the bank bailouts. These bailouts are endangering everybody’s bank deposits, even the banks that are solvent. Now it’s inflation that is the risk. And so it doesn’t matter if your bank fails. You’re still going to lose. In the event that your bank failed, you lose your money. But now, because the government won’t let the banks fail, everybody who has a bank account is going to lose purchasing power.”

I am also bullish on silver due to increasing industrial demand. Although technically speaking, it may not be the best time to invest in silver, over the longer term, I expect the metal to move much higher.

The radio program this week is a ‘best of’ presentation featuring an interview with Dr. A. Gary Shilling. Dr. Shilling is a returning guest on the radio program.

I talk with Dr. Shilling about what lies ahead for the US economy, as well as the stock, bond, and real estate markets.

You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“Be great in act, as you have been in thought.”

-William Shakespeare

Comments