Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

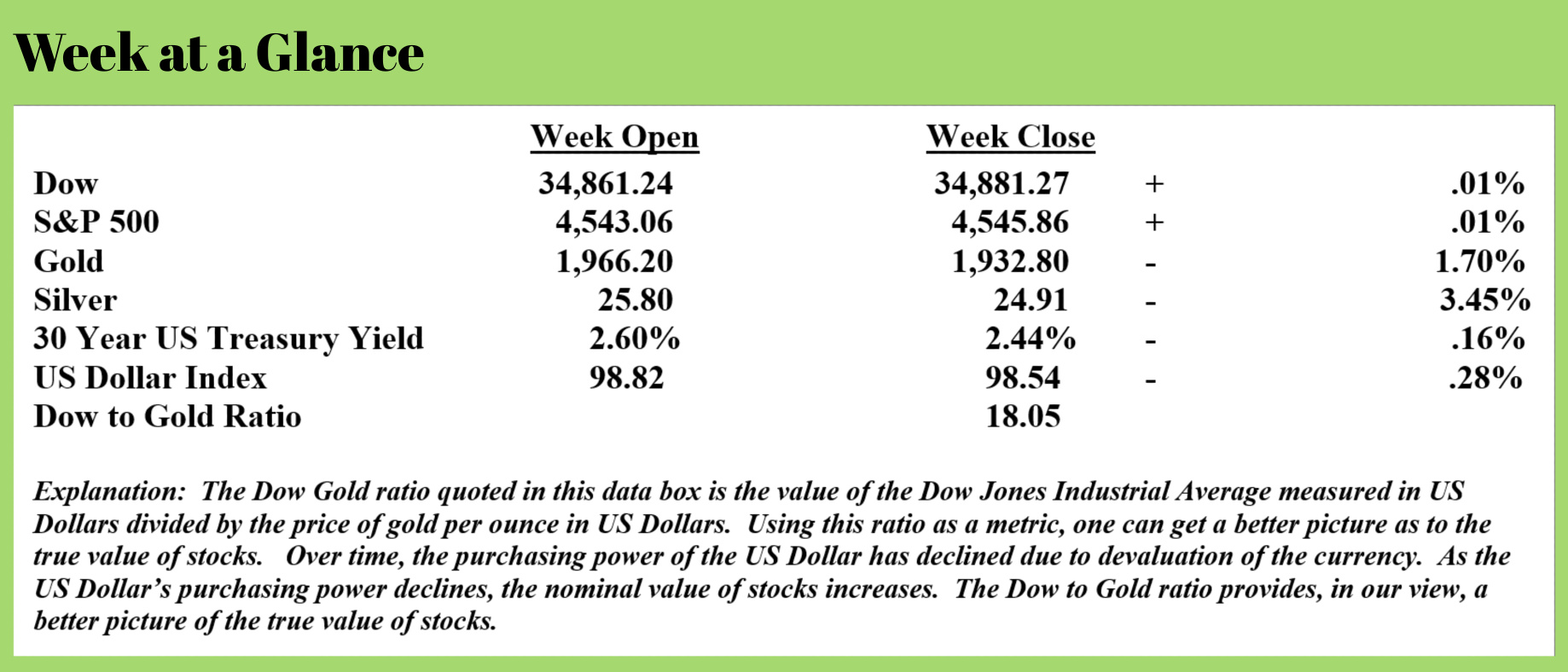

Despite the ever-so-slight rally in stocks this week, I view the primary stock market trend as down. Unless the market highs of the end of 2021 are exceeded, this will be the case.

This week, I want to discuss an event that has not been covered extensively so far as I can tell. But this event that recently occurred has the power to change the way the world does a lot of its business.

Here is why that could be a big deal to you – the rest of the world uses a lot of US Dollars in trade. As I have discussed in this publication previously, there has been a gradual, ever-intensifying move away from the US Dollar over the past twenty years or so. With this recent event, that move could really strengthen.

To what event am I referring?

This from “Fox Business” on February 28 (Source: https://www.foxbusiness.com/markets/us-freezes-russian-central-bank-assets-held-by-americans):

The U.S. said it is blocking financial transactions of Russian central bank assets, effectively freezing any of those assets held by Americans.

The freeze is effective immediately, a senior administration official said in a briefing for reporters on Monday. The official said that the U.S.'s actions are in conjunction and cooperation with the European Union, Japan, the UK, Canada, and others. This means that not only will Russia not be able to access funds in U.S. dollars, they will be unable to use dollars in the other countries turn to other banks and other currencies.

By making the move effective immediately, before markets open, the official said, Russia will be unable to move assets to avoid or mitigate the consequences.

"Our strategy," the official said, "is to make sure that the Russian economy goes backward as long as President Putin decides to go forward with his campaign."

As one would expect, Russia fought back. The country is now demanding payment for its vast natural resource exports in either gold or rubles giving any of the rest of the world that does business with Russia another reason not to inventory US Dollars.

Analyst and economic writer, David Kranzler, whose work I have discussed previously recently penned a piece on this topic titled, “Did Russia Intentionally Trigger a Monetary System Reset?” (Source: https://www.investing.com/analysis/did-russia-intentionally-trigger-a-monetary-system-reset-200621146). It is a thought-provoking article, here are some excerpts:

Fiat currency is a "promise" to repay a debt obligation and nothing more. A hard asset-backed currency is a guarantee that repayment will occur.

On Mar. 7, Zoltan Pozsar, who formerly worked at the NY Fed, was an advisor at the U.S. Treasury and currently is a strategist at Credit Suisse, published a research report titled "Bretton Woods III."

Anyone familiar with the Bretton Woods agreement understands the reference. Nixon’s snipping of the final thread connecting currency to gold is considered to be Bretton Woods II. Pozsar makes the case that Bretton Woods III is a reversion back to a monetary system in which currency is backed by commodities as opposed to being backed by a sovereign issuer’s "full faith and credit."

The post-1971 fiat currency reserve banking system enabled by the removal of gold from the monetary system is nothing more than a Ponzi scheme. "Inside money" refers to the interbank repo/lending mechanism from which the fractional bank reserve monetary system blossoms.

Pozsar distinguishes "inside money" from "outside money." Inside money" is created by the Central Bank/inter-bank lending mechanism that can magically turn one dollar of reserve capital into nine dollars of "credit" capital. And the one dollar of reserve capital is backed by nothing tangible—just the "full faith and credit" of the issuing entity.

Think of this monetary system as an inverted pyramid, e.g., something like Exter’s Pyramid. In bankruptcy law, "full faith and credit" would be considered, at best, an unsecured loan. Get in line and pray that there’s value left over to be distributed to the unsecureds.

In contrast, Pozsar references Bretton Woods III as the "rising allure of outside money over inside money," where "outside money" is "commodities collateral," meaning tangible assets for which definitive value can be determined, as opposed to the sovereign promise of "full faith and credit."

In periods of banking crises, banks are reluctant to participate in the "inside game" (see 2008 and September 2019, for instance) because, at that point in time, they don’t trust the fiat currency collateral on which the fractional reserve banking system is predicated and thus are reluctant to lend money to their banking peers.

Every time this occurs, the Central Banks have to print more money to "lubricate" the system enough so that it functions. This in turn further devalues the "inside money" on which the system is predicated.

But if currency issued by Governments and printed by Central Banks is backed by hard assets, this problem is avoided. In this system, the counterparty to trade or financing transactions would have the option of demanding payment in the hard asset or assets backing the currency—most likely gold or possibly a pre-agreed upon commodity asset. Remember, fiat currency is nothing more than an unsecured debt instrument of the issuing entity.

It’s likely that Putin knew ahead of time that the West’s response to Russia’s invasion of Ukraine would be to freeze Russian currency reserves held at western Central Banks. Of course, this response by the U.S./West brought to light the inherent Achilles’ Heel of the modern Central Bank fiat currency reserve system.

Any country that keeps currency reserves for trade settlement purposes at foreign Central Banks, specifically the Federal Reserve and the ECB, is at risk of having those reserves confiscated, thereby rendering them worthless.

In response, Russia is now demanding payment for energy in either rubles or gold from what it deems to be "unfriendly" countries. Whereas in the "inside money" banking system, settlement of trade is merely a matter of accounting ledger adjustments at the respective Central Banks, in this trade settlement arrangement, a country purchasing oil or gas from Russia in exchange for gold would need to 1) demonstrate that the gold being used for trade payment actually exists, and 2) transfer the ownership rights to Russia. Russia ultimately would likely demand repatriation of the gold. The U.S./G7 made it crystal clear that possession of assets is 100% of the law.

The response by the West—led by the U.S. and its control of the global reserve currency—in all likelihood has triggered a reset of the global monetary system. I actually do not like the term "Bretton Woods III" because it references an agreement which, in its essence, destroyed the gold-backed global monetary system.

Regardless, it appears for now that Russia—likely with China’s tacit support—has set in motion a global monetary system reset. In the new system countries which supply the world with goods that have price inelasticity of demand—oil, natural gas and food commodities, for instance—will have the power to enforce trade settlement in hard currencies, e.g., gold or other hard assets, rather than fiat currency Central Bank accounting ledger adjustments.

“Coindesk” recently published a piece (Source: https://www.coindesk.com/policy/2022/03/08/credit-suisse-strategist-says-were-witnessing-birth-of-a-new-world-monetary-order/) that provided additional perspectives from Zolton Pozsar:

Former Federal Reserve and U.S. Treasury Department official, and now Credit Suisse (CS) short-term rate strategist, Zoltan Pozsar has written the U.S. is in a commodity crisis that is giving rise to a new world monetary order that will ultimately weaken the current dollar-based system and lead to higher inflation in the West.

"This crisis is not like anything we have seen since President [Richard] Nixon took the U.S. dollar off gold in 1971," wrote Pozsar.

As the initial Bretton Woods era (1944-1971) was backed by gold, and Bretton Woods II (1971-present) backed by "inside money" (essentially U.S. government paper), said Pozsar, Bretton Woods III will be backed by "outside money" (gold and other commodities).

Pozsar marks the end of the current monetary regime as the day the G7 nations seized Russia's foreign exchange reserves following the latter's invasion of Ukraine. What had previously been thought of as risk-free became risk-free no more as non-existent credit risk was instantly substituted for very real confiscation risk.

What occurred surely isn't lost on China, and Pozsar sees the People's Bank of China (PBOC) faced with two alternatives to protect its interests – either sell Treasury bonds to buy Russian commodities, or do its own quantitative easing, i.e., print renminbi to buy Russian commodities. Pozsar expects both scenarios mean higher yields and higher inflation in the West.

Last week, I discussed how governments and central banks around the world are pursuing digital currencies with a great deal of determination. Perhaps this development helps to explain the sudden level of increased urgency.

It certainly makes the case for non-US Dollar-denominated assets in a portfolio like gold and silver.

This week’s radio program and podcast is a ‘best-of’ program featuring an interview with long-time “Forbes” columnist and publisher of “Insight” newsletter, Dr. A. Gary Shilling. You can listen to the show by clicking on the "Podcast" tab at the top of this page.

“Money is the barometer of a society’s virtue. When you see that trading is done, not by consent, but by compulsion–when you see that in order to produce, you need to obtain permission from men who produce nothing–when you see that money is flowing to those who deal, not in goods, but in favors–when you see that men get richer by graft and by pull than by work, and your laws don’t protect you against them, but protect them against you–when you see corruption being rewarded and honesty becoming a self-sacrifice–you may know that your society is doomed.”

-From “Atlas Shrugged”