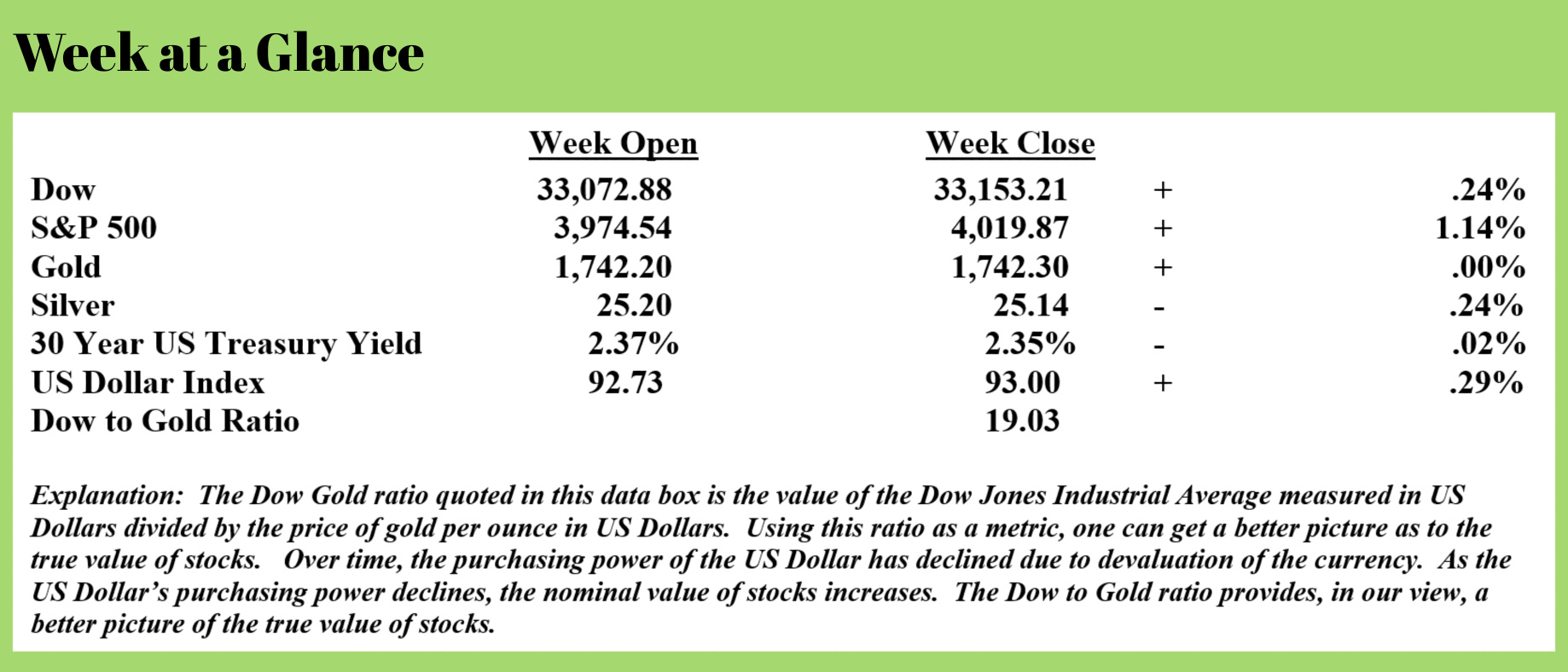

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

My view remains that many markets are very extended here and a price correction at some point is inevitable.

To this point in time, the Fed’s easy money policies have kept price bubbles moving higher and these markets could continue higher for a bit longer, but at some future point, the prediction made by Thomas Jefferson will have to come to pass in my opinion. Mr. Jefferson warned us against allowing private bankers to control the issue of our currency stating that first by inflation then by deflation, the bankers will essentially destroy the country.

That is exactly what we are presently seeing.

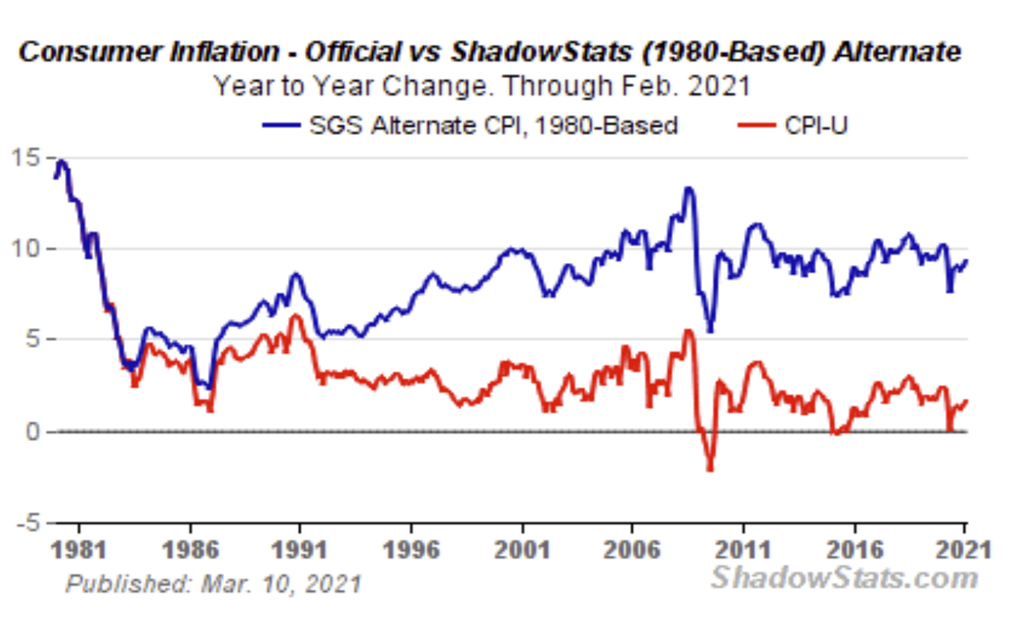

In past issues of “Portfolio Watch”, I have discussed the real inflation rate in detail. Suffice it to say for today’s discussion that the official inflation rate, typically measured by the Consumer Price Index, is heavily manipulated to present a headline number to the public that appears innocuous.

There are many privately administered inflation indexes that, in my view do a much better job of relating to the public what the real inflation rate is. John Williams of www.ShadowStats.com and Ed Butowksi of the Chapwood Index would estimate the real inflation rate to be somewhere between 8% and 12% depending on what part of the country you happen to live in.

The chart is reprinted from www.ShadowStats.com.

The chart is reprinted from www.ShadowStats.com.

Arguably, we are seeing inflation. While how much more we see is difficult to quantify, we know that debt levels in both the private sector and public sector are at nosebleed levels. I discuss this in April's “You May Not Know Report” titled “Are We Rocketing Toward a Reset?” If you are a client of our company, you should see this issue arrive in your mailboxes by mid-month.

When debt levels are unsustainable, as they are presently, at some point the debt will have to be dealt with. That’s when deflation kicks in and asset prices collapse. Ironically, the same easy money policies that have helped to stave off deflation to this point are the very reason debt levels get to unsustainable levels.

I’ve discussed stock valuations in the past. Warren Buffet’s favorite stock market valuation metric is market capitalization over gross domestic product. By this measure, stocks are more overvalued than at ANY time historically.

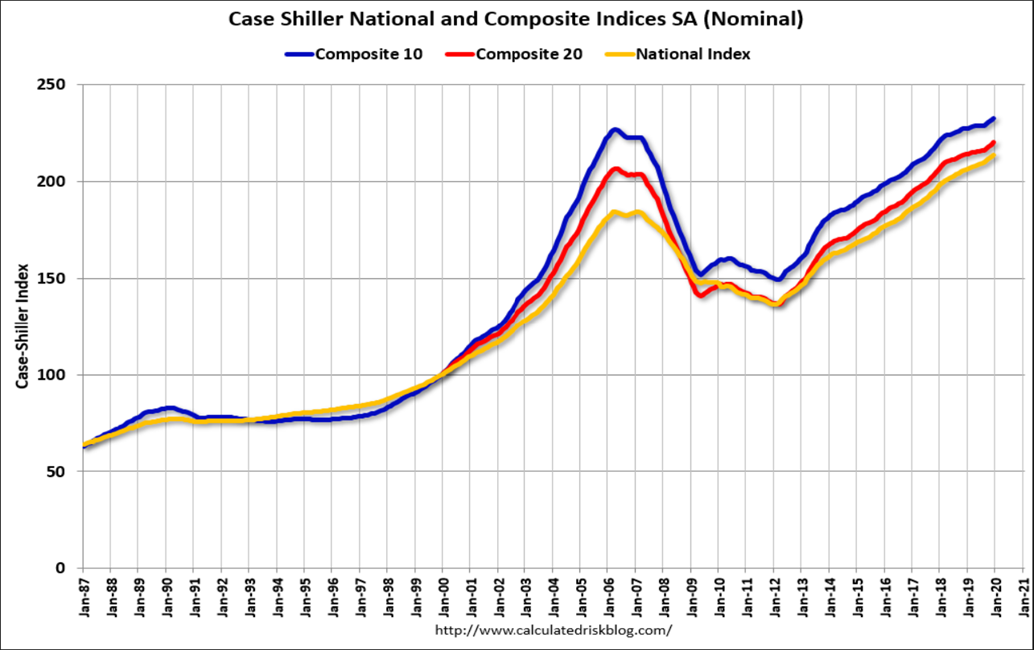

Real estate prices are also at record high levels and the real estate market is nothing short of crazy. The chart shows that the most commonly used real estate valuation measure, the Case Shiller Index, now has real estate prices more overvalued than at ANY time in history.

Real estate prices are also at record high levels and the real estate market is nothing short of crazy. The chart shows that the most commonly used real estate valuation measure, the Case Shiller Index, now has real estate prices more overvalued than at ANY time in history.

I expect to see the real estate market turn negative by the end of this year unless some form of artificial support is used to intervene in this market or if mortgage forbearance programs are extended further.

The Consumer Financial Protection Bureau warned mortgage firms last week to take all necessary steps to avoid a wave of foreclosures this fall. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/feds-warn-mortgage-firms-tidal-wave-distress-amid-upcoming-forbearance-lapse):

The Consumer Financial Protection Bureau (CFPB) warned mortgage firms Thursday "to take all necessary steps now to prevent a wave of avoidable foreclosures this fall."

As of March 30, approximately 2.54 million homeowners remain in forbearance or about 4.8% of all mortgages, according to the latest data from Black Knight's McDash Flash Forbearance Tracker.

CFPB said mortgage firms should "dedicate sufficient resources and staff now to ensure they are prepared for a surge in borrowers needing help." To avoid what the agency called "avoidable foreclosures" when the forbearance relief lapses, mortgage servicers should begin contacting affected homeowners now to guide them on ways they can modify their loans.

"There is a tidal wave of distressed homeowners who will need help from their mortgage servicers in the coming months," said CFPB Acting Director Dave Uejio. He said,

"There is no time to waste and no excuse for inaction. No one should be surprised by what is coming."

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provided a safety net for borrowers with federally-backed mortgages who could access forbearance programs. With millions of borrowers in the program set to lapse in the second half of the year, unavoidable foreclosures will occur despite the government trying everything under the sun to keep people in their homes.

"Our first priority is ensuring struggling families get the assistance they need. Servicers who put struggling families first have nothing to fear from our oversight, but we will hold accountable those who cause harm to homeowners and families," Uejio said.

With the CFPB focused on preventing avoidable foreclosures, the government's forbearance programs end in September, which could result in the quick unraveling of the social fabric for many households who may find themselves homeless.

So here we have a government agency that is outright predicting a ‘tidal wave’ of ‘distressed homeowners’ who will need more help from their mortgage servicers. As with many (perhaps most) well-intentioned government programs, an action that was designed to help a segment of the population, in this case, homeowners, actually ends up harming them.

One visit to the Consumer Financial Protection Bureau’s website confirms this. This is taken directly from the CFPB’s website (Source: https://www.consumerfinance.gov/coronavirus/mortgage-and-housing-assistance/help-for-homeowners/learn-about-forbearance/) (emphasis added):

Forbearance is when your mortgage servicer or lender allows you to pause or reduce your mortgage payments for a limited time while you build back your finances.

For most loans, there will be no additional fees, penalties, or additional interest (beyond scheduled amounts) added to your account, and you do not need to submit additional documentation to qualify. You can simply tell your servicer that you have a pandemic-related financial hardship.

Forbearance doesn’t mean your payments are forgiven or erased. You are still obligated to repay any missed payments, which, in most cases, maybe repaid over time or when you refinance or sell your home. Before the end of the forbearance, your servicer will contact you about how to repay the missed payments.

The last point is the key point.

These forbearance programs don’t forgive any payments. The homeowner is still obligated to pay back payments as well as current payments.

How many of these distressed homeowners, when faced with this reality will just walk away from the house?

That will likely turn this real estate market on its head.

My advice?

If you’re thinking about selling real estate, doing so soon is probably something you should seriously consider.

And, if you’re thinking about buying, you might ponder taking a deep breath and waiting a bit to see how this plays out this fall.

You may just find your dream home for a much lower price.

Of course, all this hinges upon how much money creation the Fed actually engages in and how much inflation we might see before the inevitable deflation kicks in as Mr. Jefferson suggested.

`The radio program this week features an interview with returning guest expert, Karl Denninger.

Karl and I discuss Fed money creation and how he sees the end game playing out. We also talk a little politics. As is usually the case when Karl is on the program, the interview is thought-provoking and entertaining.

The interview is now available on the app or by clicking on the "Podcast" tab at the top of this page.

“It was self-serving politicians who convinced recent generations of Americans that we could all stand in a circle with our hands in each other’s pockets and somehow get rich.”

-Paul Harvey