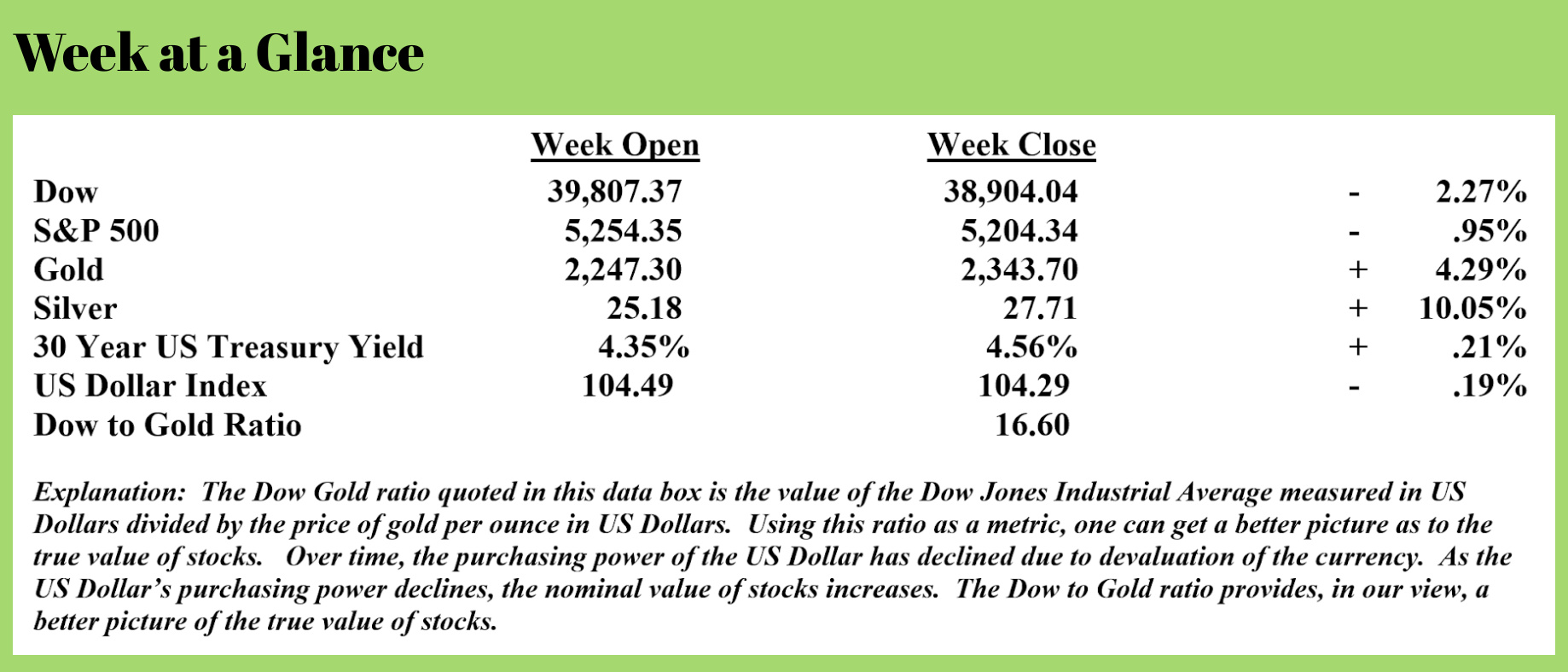

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

If you’re watching news reports about recently released economic data, you may be under the impression that the economic data being reported seems rosier than economic reality.

I’ve been hearing that from a lot of people lately.

Take the recent jobs report for an example and this story published by “CNN” (Source: https://www.msn.com/en-us/money/markets/march-jobs-report-comes-in-hot-the-us-economy-added-303000-positions-last-month/ar-BB1l7gMc):

For all intents and purposes — and by most economists’ predictions — job growth was supposed to slow by now, as the pandemic recovery grew complete. The US labor market also was supposed to weaken under the pressure of 11 interest rate hikes.

Instead, on Friday, yet another jobs report defied expectations.

Employers added 303,000 jobs in March, the Bureau of Labor Statistics reported. The unemployment rate fell to 3.8% from 3.9% the month before.

Friday’s jobs report not only highlights the US labor market’s remarkable resilience in the face of high interest rates and elevated inflation, but also shows that amid this enduring strength, inflation pressures are easing.

In the interest of preserving space, I’ll stop the article excerpt there.

If you were reading that article, you’d think that the economy was doing pretty well wouldn’t you?

Undoubtedly yes. But it’s what the article doesn’t say that’s important. Here is what the article leaves out. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/behind-todays-stellar-jobs-print-it-was-literally-all-part-time-jobs-and-illegals)

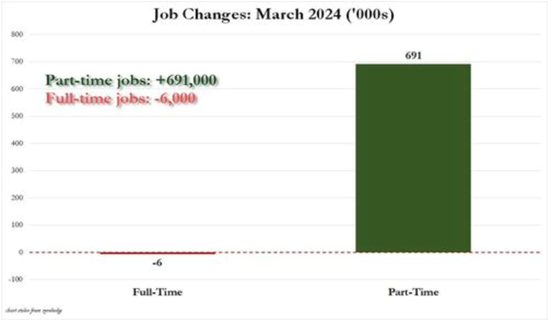

However, that's where the mitigating factors end, because while there was some improvement in the quantitative aspect of the March report, when it comes to the qualitative aspect, it was another disaster for one simple reason: all the job gains were part time jobs!

Here is exhibit A: in March, the number of part-time jobs soared by 691K to 28.632 million, up from 27.941 million while full-time jobs dropped by 6,000, to 132.940 million from 132.946 million.

Here is exhibit A: in March, the number of part-time jobs soared by 691K to 28.632 million, up from 27.941 million while full-time jobs dropped by 6,000, to 132.940 million from 132.946 million.

This number only gets scarier when we extend the period to the past year: as shown in the next chart, since March 2023, the number of full-time workers has collapsed by 1.347 million while the number of part-time workers exploded by 1.888 million!

There's more.

Regular readers are aware that all the job gains since 2018 have gone to immigrants, mostly illegal immigrants, something we spent last month's jobs post discussing in detail.

So what happened in March? It will come as no surprise that there was more of the same, and after the collapse in native-born workers in the last three months when nearly 2.5 million native-born workers lost their jobs, March saw some pick up, and 929K native-born workers were added. Meanwhile, after last month's record increase in foreign-born workers, in March illegal immigrants added another 112K jobs, pushing the total number of foreign-born workers to a new record high of 31.114 million.

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers... ... but there has been zero job-creation for native born workers since July 2018!

ALL job gains are for part-time workers, full time jobs are declining.

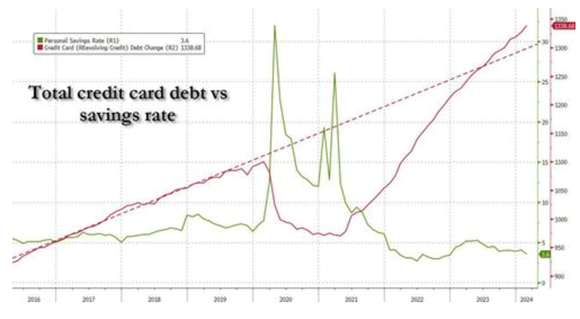

When one looks at the other economic data being reported, the proverbial dots begin to connect. Let’s look at credit card debt which has been steadily increasing over the past few years as inflation has accelerated. (Source: https://www.zerohedge.com/markets/credit-card-debt-surges-new-all-time-high-just-card-apr-rates-hit-fresh-record)

Just when you thought US consumers had finally learning their lesson, and had stopped buying stuff they can't afford with money they don't have... we got the latest consumer credit data which collapsed that particular thesis in a millisecond.

After two months ago we saw an unprecedented halt to growth in both revolving credit (i.e., credit card) growth - which rose by just $1 billion (since revised to $4 billion) - as well as non-revolving (i.e., auto and student loans) which practically actually shrunk by $1 billion - in January things were seemingly back to the American normal, as total consumer credit surged by $19.5BN, compared to the $0.9BN downward revised December print (from $1.561BN originally), driven by a powerful rebound in both credit card and auto loans. Things then continued on autopilot: moments ago, the Fed reported that in February, consumer credit rose by $14.125BN, roughly flat from the downward revised $17.684BN in January, driven by a powerful surge in revolving credit even as growth in non-revolving credit unexpectedly faded.

After two months ago we saw an unprecedented halt to growth in both revolving credit (i.e., credit card) growth - which rose by just $1 billion (since revised to $4 billion) - as well as non-revolving (i.e., auto and student loans) which practically actually shrunk by $1 billion - in January things were seemingly back to the American normal, as total consumer credit surged by $19.5BN, compared to the $0.9BN downward revised December print (from $1.561BN originally), driven by a powerful rebound in both credit card and auto loans. Things then continued on autopilot: moments ago, the Fed reported that in February, consumer credit rose by $14.125BN, roughly flat from the downward revised $17.684BN in January, driven by a powerful surge in revolving credit even as growth in non-revolving credit unexpectedly faded.

Starting at the top, revolving credit in February rose by $11.3 billion, up from an upward revised $8.6 billion... ... pushing total revolving credit to a record $1.339 trillion, which, as shown in the chart below means that the trendline from the pre-covid era has now been surpassed, while the savings rate is at an all-time low.

As the chart illustrates, the personal savings rate is near an all-time low, while credit card debt is at an all-time high. Those statistics are consistent with part-time work for many Americans.

In another development that sheds some light on the real economy, a chain of popular dollar stores has decided to close ALL its locations. This from “USA Today” (Source: https://www.msn.com/en-us/money/companies/99-cents-only-stores-to-close-all-371-spots-in-extremely-difficult-decision-ceo-says/ar-BB1l6hSK)

After over four decades in business, 99 Cents Only Stores will close all its doors permanently.

The retail chain, once known for its below $1 prices, announced the closure of all 371 locations on Thursday.

"This was an extremely difficult decision and is not the outcome we expected or hoped to achieve," interim CEO Mike Simoncic said in a news release. "Unfortunately, the last several years have presented significant and lasting challenges in the retail environment."

Simoncic said several factors contributed to the dire state of the discount store company, including the "unprecedented impact left by the COVID-19 pandemic." He also cited shifting consumer demands, inflationary pressures, and rising shrinkage levels, which refers to the loss of inventory or cash from theft, damage, or administrative errors.

"We deeply appreciate the dedicated employees, customers, partners, and communities who have collectively supported 99 Cents Only Stores for decades," Simoncic said.

Looking at the CEO’s statement it seems that inflation and unprosecuted theft are two big factors in the company’s decision.

And finally, this week, one of the largest US Banks issued a statement that is rather remarkable. Bank of America stated last week that a fiscal crisis is ‘imminent.’ (Source: https://www.msn.com/en-us/money/news/bank-of-america-says-imminent-fiscal-crisis-looming-experts-warn/ar-BB1l1g4Y?ocid=msedgntp&pc=U531&cvid=1c52f4fcbf824bc39bd657f80c9070d2&ei=14#)

Bank of America CEO Brian Moynihan and Joao Gomes, vice dean of Wharton, warn of an impending fiscal crisis due to escalating US national debt. They call for prioritizing debt payment, tightening fiscal policies, and a fundamental change in government budget management.

While we are all inherently aware that significant belt-tightening may make the ultimate fiscal crisis slightly more bearable, most of us aren’t expecting any such thing from the collective group of politicians in Washington. We are only debating the ‘when’ of the inevitable fiscal crisis.

Seems that we are beginning to see the cracks in the foundation of the economy.

If you aspire to a comfortable retirement, the time to take action is now.

This week’s radio program features an interview I conducted with best-selling author and economist Mr. Harry Dent.

I talk to Harry about the future of stocks and US Government bonds as well as the US economy.

Check out the interview now by clicking on the "Podcast" tab at the top of this page.

“If you could kick the person in the pants responsible for most of your trouble, you wouldn’t sit for a month.”

-Teddy Roosevelt

Comments