Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Using the longstanding and widely accepted definition of recession, the United States now finds herself smack in the middle of one.

If you’ve been a long-term reader of “Portfolio Watch”, you know that I have been suggesting that we are in recession since the first of the year. Now, the facts are confirming that this is the case.

The Bureau of Economic Analysis reported that second-quarter economic growth was negative. This follows negative economic growth in the first quarter. Two consecutive quarters of negative economic growth has always been the textbook definition of a recession.

Despite the facts telling us that we are in a recession, there are many politicians and policymakers predictably trying to spin this dire economic news as better than it is. While spinning a news story is nothing new, this one is a lot harder to put in a positive light.

Perhaps that is why some of those who stand to be politically harmed by a recession are attempting to spin this story favorably by changing the accepted definition of a recession. Yet, no matter how they try to spin it, the economy is weakening. This from “Mises Wire” (Source: https://mises.org/wire/gdp-shrinks-again-biden-quibbles-over-definition-recession):

The U.S. economy contracted for the second straight quarter during the second quarter this year, the Bureau of Economic Analysis reported Thursday. With that, economic growth has hit a widely accepted benchmark for defining an economy as being in recession: two consecutive quarters of negative economic growth.

According to the BEA, the US economy contracted 0.9 percent during the second quarter in the first estimate of real GDP as a compounded annual rate. This follows the first quarter's decline of 1.6 percent.

This comes just a few days after the Biden administration's Treasury Secretary Janet Yellen attempted to preemptively head off talk of labeling the decline a recession when she declared that a second consecutive decline in GDP doesn't really point to recession, and "we're not in a recession" because the labor market—a lagging indicator of economic activity—is allegedly too strong.

President Biden said the same on Monday. White House spokeswoman Karine Jean-Pierre continued Yellen's PR campaign on Wednesday quibbling over the "technical" definition of a recession.

Given Thursday's GDP numbers, however, the most appropriate answer to the question "is the US technically in a recession?" is "who cares?" The data is clear that the US economy is extremely weak and gives every impression that it's getting weaker.

Moreover, the "technical" definition of a recession is decided by an obscure panel of eight economists—seriously, it's eight economists from prestigious universities—who decide if the US is "technically" in recession.

Meanwhile, on the street, two quarters of declining economic growth means "the economy isn't looking good" however one wants to slice and dice it. Or, as Rick Santelli put it Thursday morning, the two-quarters-of-negative-growth definition may not be the "technical" definition, but it is a recession "in the eyes of investors who trade in markets." That is, for people in the real world who buy and sell things, the US is either in recession or something very close to it. Santelli concludes "call it whatever you want."

Meanwhile, the Federal Reserve and the administration are tenaciously clinging for dear life to the job numbers as evidence that the economy is doing too well to be called a recession. Perhaps. But the job numbers are nothing to crow about and point toward more weakening themselves. When we look at real wages, the news is anything but great. Specifically, both Fed chair Powell and Sec. Yellen have repeatedly pointed to the nonfarm total employment numbers, and the JOLTS data showing a healthy supply of job openings. But this is only a small slice of the story.

For example, there are two surveys of employment, and only the "establishment" survey of large businesses shows job gains. The household survey, on the other hand, shows jobs have gone nowhere for months, and have even declined slightly (month-over-month) for two of the past three months. The establishment survey is a survey of jobs. The household survey is a survey of employed persons. The fact that the former is growing while the latter isn't suggests people are taking on second jobs to deal with price inflation, but that more people aren't actually becoming employed.

This would make sense given that real wages have fallen below the trend. Looking at median weekly real earnings, we find that incomes are falling. That's not exactly evidence the economy is too strong to be in recession.

Other indicators often look even more grim. The yield curve points to recession. The small business index—which goes back 50 years, just hit a record low. The Chicago Fed's National Activity Index shows two months below trend—which points to recession.

So, will the NBER's little board of economists conclude the US was "technically" in recession in mid 2022 when it issues its opinion months from now? It doesn't really matter when it comes to making a judgment about the state of the economy right now. The state of the economy is not good.

One example of the economy weakening can be found when looking at the automobile industry. This, from “Zero Hedge” (Source: https://www.zerohedge.com/markets/july-new-vehicle-retail-sales-expected-crash-108):

It sure looks like the recession that the White House continues to claim doesn't exist is hitting the auto market. At least according to new projections by J.D. Power, who this week released their estimates and analysis for July 2022.

A joint forecast from J.D. Power and LMC Automotive predicts that "retail sales of new vehicles this month are expected to reach 988,400 units, a 10.8% decrease compared with July 2021 when adjusted for selling days".

Without adjusting for the one less selling day in July 2022, the plunge would have been 14.1%.

Meanwhile, the Federal Reserve continues to tighten. At the recent Fed meeting, the Fed Funds rate was increased by .75% getting the rate to between 2.25% and 2.50%; hardly a move back toward interest rates that one would consider to be more ‘normal’ from an historical perspective.

Moving ahead, the Fed has stated that fighting inflation remains a top priority. That statement would seem to suggest more interest rate increases.

I will go on record again stating that I believe the Fed will reverse course at some point in the next 6 to 12 months and begin to reduce interest rates again pointing to a weak economy that might need support.

The Fed Chair, Jerome Powell, seemed to begin to open the door to such a possibility in his statement after the last Fed meeting. This from an article published on “Schiff Gold” (Source: https://schiffgold.com/commentaries/is-the-federal-reserve-at-the-end-of-its-rope/):

Federal Reserve Chairman Jerome Powell left even more space to retreat from the inflation fights, saying there is “significantly” more uncertainty right now than normal and the lack of any clear insight into the future trajectory of the economy means the Fed can only provide reliable policy guidance on a “meeting by meeting” basis.

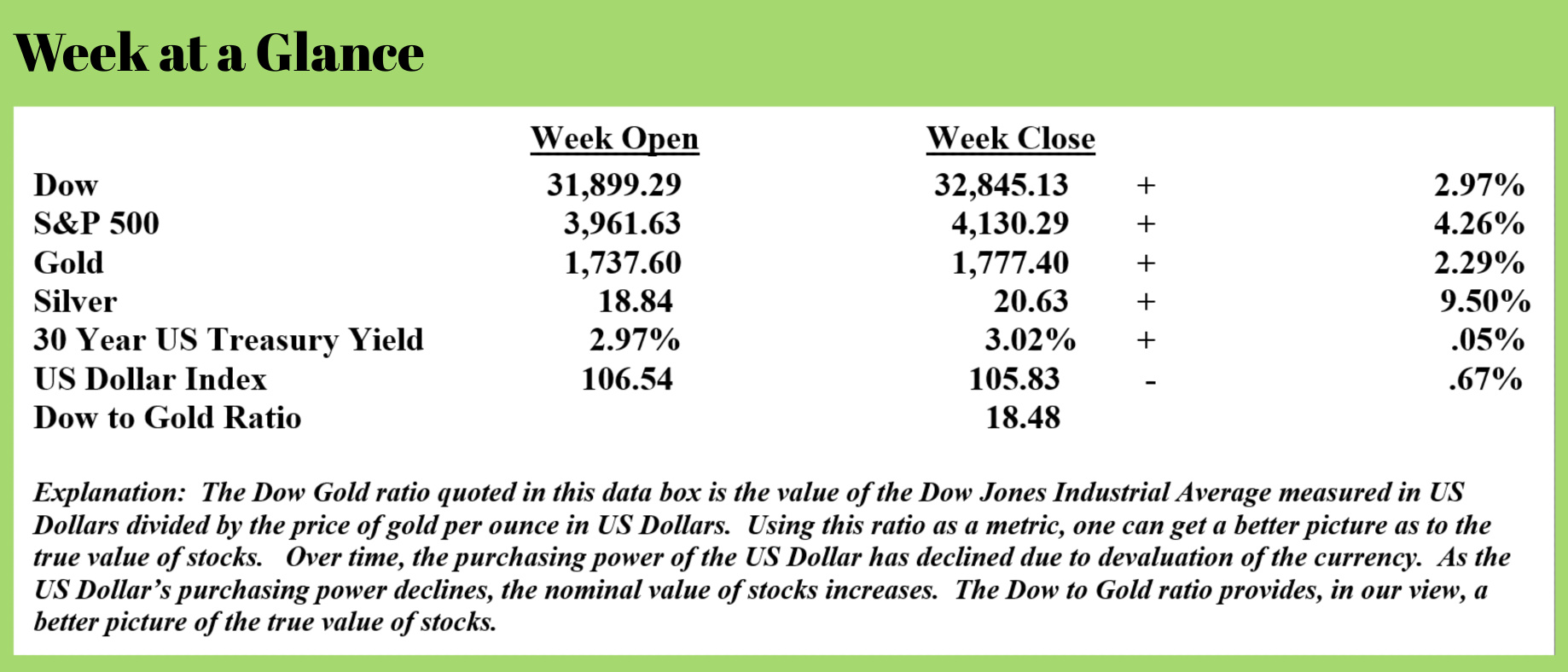

The markets seemed to interpret the Fed’s stance as more doveish. Stocks were up, as was gold.

When interest rates reached this level in 2018, the stock market crashed and economic data went wobbly. In response, the Fed reversed course and put tightening on pause. In 2019, it cut rates three times and relaunched quantitative easing. This all happened long before the extraordinarily loose monetary policies in the wake of the coronavirus pandemic.

Should the Fed’s policy reverse in the relatively near future as I believe it will, the price inflation we are now experiencing in consumer goods will likely intensify.

This week’s radio program and podcast features an interview with the brilliant market analyst, Michael Oliver.

I chat with Michael about where he sees stocks, bonds, gold, and Fed policies going in the future. He also has a very interesting take on how currencies may evolve in the future. Listen to the show now by clicking on the "Podcast" tab at the top of this page now.

“The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.”

-Ludwig von Mises

Comments