Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

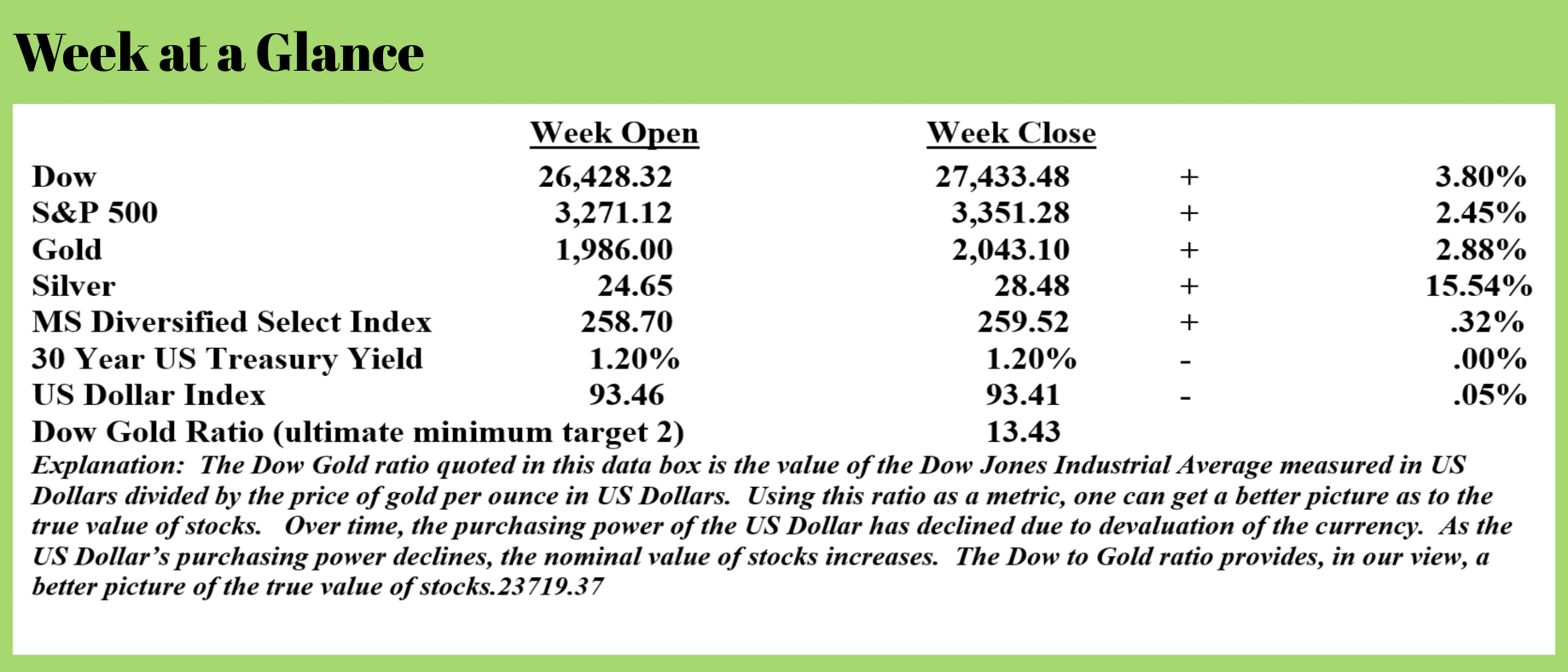

Silver continued its monster breakout last week, rising 15.54%. All markets were higher with the exception of US Treasuries and the US Dollar Index which were mostly unchanged.

When discussing the performance of markets, it’s important to remember that market performance is measured in US Dollars. As US Dollars are devalued, markets move nominally higher. Measured in real terms, adjusted for the true inflation rate, markets may not be moving much or may actually be declining.

Let’s look at an example.

To examine a scenario that is realistic, we need to use an inflation rate that is not the official inflation rate or the Consumer Price Index. As we’ve considered in past issues of “Portfolio Watch”, the CPI measure of inflation is heavily manipulated and does not reflect the real experience of an average American.

The Chapwood Index measures inflation without the manipulative maneuvers that take place in the calculation of the Consumer Price Index. The Chapwood Index measures the cost of a basket of goods and services in a metropolitan area in one year and then compares it to the cost of that same basket of goods and services one year later.

Using the Chapwood Index method of measuring inflation, the average inflation rate over the past 5 years ranges from 9% to 13% depending on which part of the country one lives in.

Five years ago, the Dow stood at about 17,800. It presently has reached the 27,400 level. If one grows the Dow for five years beginning with a value of 17,800 at a real inflation rate of 10%, the Dow would stand at approximately 28,700 today due to the devaluation of the US Dollar.

There’s a good argument to be made that stocks are higher only due to currency devaluation.

This currency devaluation has been taking place for a long time; however, recently it’s accelerated radically.

If one goes back to 1933 when the law was changed to make it illegal for US citizens to own gold, one would find that the price of gold per ounce stood at $20.67.

Today, gold is selling for $2043 per ounce. A little, simple math concludes that the dollar has been devalued versus gold by about 99%. There was a time this past week that the price of gold exceeded $2,067 per ounce, a level exactly 100 times higher than in 1933!

Here is a perspective on this from Jan Niewenhuijs (emphasis added) (Source: https://www.voimagold.com/insight/gold-price-crosses-2-067-us-dollar-devalues-by-99-against-gold-in-100-years):

A world reserve currency is supposed to be superior in storing value, but through boundless money printing, the U.S. dollar hasn’t been able to compete with gold by a long shot. In 1932 the gold price was $20.67 dollars per troy ounce, today it crossed $2,067 dollars.

That’s a 99% decline in value of the dollar against gold. Other reserve currencies such as the British pound and Japanese yen have done even worse. The yen has lost 99.98% of its value against gold in 100 years.

Gold doesn’t yield if you don’t lend it, but it's the only globally accepted financial asset without counterparty risk. Because of its immutable properties, gold sustained its role as the sun in our monetary cosmos after the gold standard was abandoned in 1971. Central banks around the world kept holding on to their gold, despite its price reaching all-time highs such as now. This is due to Gresham’s law, which states “bad money drives out good.” If the price of gold rises central banks are more inclined to hoard gold (good money) and spend the currency that declines in value (bad money).

Presently, we are witnessing Gresham’s law in action as we report in the August “You May Not Know Report” newsletter. Central banks are adding to their gold holdings to the tune of more than 35 tons per month; the equivalent of more than 13 years of mining production at present production rates.

That’s telling.

If you’ve been to the grocery store recently, you’ve witnessed food inflation first-hand. While some of this food price inflation can be blamed on supply chain interruptions, it is our view that is only partially to blame. The primary cause of food price inflation, in our view, is Fed monetary policies.

The Washington Post reported (Source: https://www.washingtonpost.com/business/2020/08/04/grocery-prices-unemployed/) (Emphasis added):

Last week, Federal Reserve Chair Jerome H. Powell said consumer prices have been kept in check due to weak demand, especially in sectors such as travel and hospitality that have been most affected by the pandemic. But food prices are the exception.

“For some goods, including food, supply constraints have led to notably higher prices, adding to the burden for those struggling with lost income,” Powell noted.

Indeed, nearly every category of food become more expensive at some point since February, according to data released Friday by the Bureau of Economic Analysis. Beef and veal prices saw the steepest spike (20.2 percent), followed by eggs (10.4 percent), poultry (8.6 percent), and pork (8.5 percent).

Compared with this time last year, prices for beef and veal are up 25.1 percent. Eggs are up 12.1 percent, and pork is up 11.8 percent from a year earlier, according to seasonally adjusted BEA data.

Of course, it’s not surprising that the Fed Chair blamed supply constraints rather than monetary policy.

We fully expect this inflation trend to continue. The Fed has no choice. The reported economic data indicates a full-blown depression. This from Michael Snyder (emphasis added)(Source: http://themostimportantnews.com/archives/the-economic-depression-of-2020-is-becoming-an-endless-nightmare-for-millions-of-americans):

On Thursday, we got yet another sign that this downturn is here for the long haul. According to the Labor Department, approximately 1.2 million Americans filed new claims for unemployment benefits last week…

Four months after the COVID-19 pandemic largely shut down the economy and left millions of Americans out of work, employers continue to lay off workers at a historic pace.

About 1.2 million people last week filed initial applications for unemployment insurance – a rough measure of layoffs – the Labor Department said Thursday, down substantially from 1.4 million the previous week and the lowest level since March.

Initially, I thought that this was good news.

1.2 million is still a catastrophic number, but at least it appeared to be an improvement over last week’s level of 1.4 million.

Unfortunately, there is more to the story.

As Wolf Richter has pointed out, when you look at the unadjusted numbers and you include all state and federal programs, the number of continuing unemployment claims increased by a whopping 1.3 million last week…

The total number of people who continued to claim unemployment insurance under all state and federal unemployment programs jumped by 1.3 million from the prior week to 32.12 million (not seasonally adjusted), the Department of Labor reported this morning. It was the second-highest ever.

That would seem to indicate that unemployment is dramatically surging, and that is really bad news for an economy that is already deeply suffering.

Overall, more than 55 million Americans have now filed initial claims for unemployment benefits over the past 20 weeks. That is a number that should be almost theoretically impossible, but this is actually happening.

Prior to this year, the all-time record for new unemployment claims in a single week was just 695,000, and now we have been above a million for 20 consecutive weeks.

Up until recently, a weekly $600 unemployment supplement from the federal government had been helping tens of millions of unemployed Americans pay their bills, but now that supplement has expired, and Congress has not yet agreed to another one.

The response to this souring economic news is likely to be more money creation which will only exacerbate the problem. While gold and silver markets are surging here and a pullback is probably likely, if your time frame is long term, going tangible with a greater portion of your assets probably makes sense.

We have been offering this perspective and advice for a long time and it’s paid off well for our clients and readers who have followed it.

While a pullback in metals prices is likely in our view but not inevitable, continuing to add to metals holdings is likely still advisable for many of our readers.

This week’s RLA radio show is now posted at www.RetirementLifestyleAdvocates.com.

This week’s program features an interview with David Skarica, publisher of the “Addicted to Profits” newsletter.

During this interview, David offers his forecast for stocks, bonds, and metals.

“I know of no more encouraging fact than the unquestioned ability of a man’s ability to elevate his life by conscious endeavor.”

-Henry David Thoreau