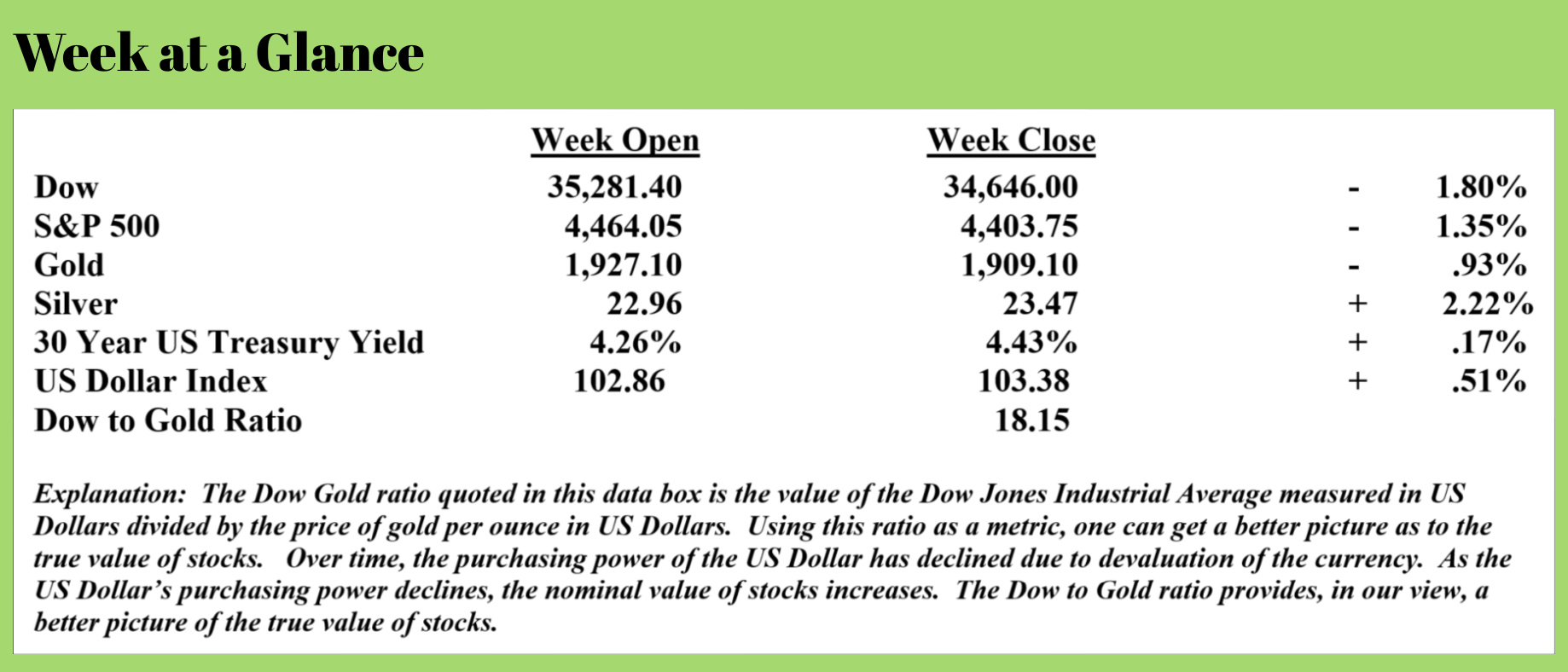

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Last week, I discussed the fact that the US consumer is stretched to the point that the economy is being affected; soon, the economy will be very noticeably affected.

The economic data (contrary to what you may be hearing from more mainstream news sources) is definitely weakening.

The Conference Board’s Leading Economic Indicators (LEI) continued its decline in July, falling 0.4% month-over-month. This is the 16th straight monthly decline in LEI (and 17 of 18 months) – the longest streak of declines in the LEI since the failure of Lehman at the time of the Great Financial Crisis, when the LEI declined for 22 consecutive months. (Source: https://www.zerohedge.com/economics/us-leading-indicators-tumble-16th-straight-month-signals-economic-activity-decelerate).

With the exception of the onset of COVID, the LEI now stands at its lowest level since September 2017.

On a year-over-year basis, LEI is down 7.5%. This is more evidence that my forecast of recession will end up being correct.

Assuming I’m correct, and recession becomes a reality, won’t the Fed just reverse course and once again reduce interest rates and make everything OK again?

I believe it’s inevitable that they will try, but I’m skeptical that they can be successful. Charles Hugh Smith wrote a piece last week titled, “No, Central Banks Won’t Save Us This Time” (Source: https://charleshughsmith.blogspot.com/2023/08/no-central-banks-wont-save-us-this-time.html). I’m in agreement with many of the points that Smith makes in his piece.

Smith makes the point that the era of low inflation has now ended. Here is an excerpt from his piece:

The central banks are now perched on the horns of a self-inflicted dilemma: to boost flagging growth, they need to lower interest rates (their "one weird trick" they picked up off a spam site somewhere), but since they let inflation become embedded and geopolitics is jacking up real-world costs, the usual tricks of dropping rates to near-zero and flooding the financial system with "free money for financiers", a.k.a. liquidity, will reignite still-simmering inflation.

I have made a similar point many times over the past several years. With worldwide debt levels now standing at $305 trillion, a deflationary environment seems completely unavoidable. Of course, without the central banks creating currency from thin air since the financial crisis, debt levels would have never reached these nosebleed levels.

If central banks would have simply allowed the deflationary environment purge debt from the system at the time, when worldwide debt stood at about $100 trillion, we would have already been through the deflationary period. Instead, we are now staring a debt problem TRIPLE that size squarely in the face.

Smith, when he states that this problem is self-inflicted by the central banks is spot on in my view.

When the deflationary climate emerges in earnest, I believe the central bank will shoot the only proverbial bullet they have left in the gun – they will once again revert to currency creation further igniting the stagflationary environment that is, in my view, now inevitable.

Smith also notes, as I did last week, that American consumers are getting crushed. That’s exceptionally bad news for a consumer spending-dependent US economy. Smith puts it this way:

The statistical gaming can't hide the fact that inflation is still crushing wage earners. The statistical game is that inflation is measured year-over-year, as if it magically resets every year. But it doesn't reset; all the inflation of the previous years is still present, burdening wage earners.

Consider residential rents. The financial media is slobbering all over itself in its rush to declare that "rents are softening" and rent inflation is dead. You mean rents have fallen back to where they were in 2020?

Of course not; all those gargantuan rent increases (and other manifestations of inflation in other sectors) of the past few years are still strangling renters.

As the chart of asking rent below shows, even after "softening," rents are still 20% higher. Those increases are still crushing wage earners.

Wages have not caught up with either real-world inflation or asset bubble inflation. The chart of rent and household income reflects the unhappy reality that wages have lagged for 45 years, and continue to lag.

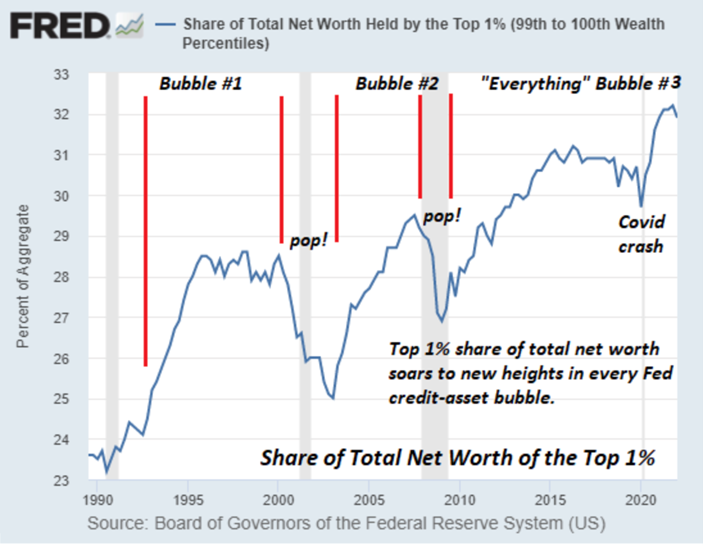

All the central bank-stimulated "growth" ended up in the wealth of the top 10%, not the populace's earned income. This reality has finally entered the public awareness, and so central banks can't goose the wealth of the top 10% under the guise of "stimulating economic growth."

As I noted last week, rents now consume more than 30% of the average renter’s income while credit card debt now totals more than $1 trillion for the first time in history and 401(k) emergency withdrawals are surging.

Smith correctly notes that lower income works are struggling while the top 10% are the group that has primarily benefitted from central bank policy.

The destabilizing extremes of wealth-income inequality generated by central banks are now shackles on its policy options. All the central bank tricks did was ignite a rocket under wealth-income inequality that then bled into the housing market, poisoning it by concentrating ownership of the housing stock in rapacious slumlord corporations and the top 10% who scooped up hundreds of thousands of dwellings as short-term vacation rentals, investment properties and speculative dumping grounds for their "excess capital."

Note my question on the chart of the Fed's ownership of mortgage-backed securities (MBS) which shot from zero to $2.6 trillion in a few years: how did we survive before constant Fed stimulus / intervention on behalf of corporations and the top 10%?

So hey, central bank cheerleaders, lackeys, toadies, apologists, apparatchiks and sycophants: no, the central banks aren't going to "save" your precious asset bubbles from popping. Every central bank "save" further distorted the financial system and the economy, to the detriment of the populace and social stability.

The costs and consequences of central bank distortions have finally come home to roost. The vultures are circling the asset bubbles, awaiting their opportunity to pick over the carcasses of all those who reckoned "central bank saves and asset bubbles are forever."

The costs and consequences of central bank distortions have finally come home to roost. The vultures are circling the asset bubbles, awaiting their opportunity to pick over the carcasses of all those who reckoned "central bank saves and asset bubbles are forever."

I believe that Smith is correct.

He published a chart in his piece that perfectly illustrates his point.

Note from the chart that the top 1% now controls about 1/3rd of all wealth. Each Fed-created bubble has seen the top 1% benefit to a greater extent with each bubble.

The “everything bubble’ that developed as a result of Fed policy will now have to unwind. While the exact timing of the reset is difficult, if not impossible, to predict, the numbers suggest the reset WILL occur, and it will be painful.

While the Fed may try its usual policy response, in my view, it will not likely be successful.

The radio program this week features an interview with the publisher of “Insight” newsletter, Dr. A. Gary Shilling.

Dr. Shilling shares his forecast for stocks and the US economy moving ahead.

I also get Gary’s forecast for real estate and discuss one reliable recession indicator.

The podcast version of the program is available now by clicking on the "Podcast" tab at the top of this page.

“I hated my last boss. He asked, “Why are you two hours late?” I said, “I fell down the stairs.” He said, “That doesn’t take two hours.”

-Johnny Carson

Comments