Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

There are lots of news items to talk about this week.

First, UAW members voted to strike if they determine it makes sense. 97% of United Auto Workers members voted to strike if they deem it to be necessary. This (Source: https://www.zerohedge.com/political/uaw-demands-largest-pay-hike-recent-memory-big-three-over-bidenflation) from “Zero Hedge”:

Bloomberg reported that the new demands are part of UAW's opening proposals in contract talks with General Motors Co., Ford Motor Co., and Stellantis NV. The union's current labor agreement with the automakers expires on Sept. 14.

The Detroit-based union has 150,000 workers producing Chevrolets, Fords, and Jeeps, called for an automatic 20% general wage increase upon ratification of a new contract "to offset the severe impact of inflation" over the last two years of negative real wage growth, according to a write-up obtained by The Detroit News.

The Detroit News described the new proposal as "the largest pay increase in recent memory."

Following this, the union asked for 5% wage increases every year for the duration of the agreement, which extends through 2027. This would mean the top wage for workers would be around $47 per hour, nearing the $49 mark recently achieved in a tentative agreement by the International Brotherhood of Teamsters with United Parcel Service Inc.

On Tuesday, UAW President Shawn Fain revealed an overview of the "members' demands" that called for "double-digit" wage increases. He also suggested the union would secure a 32-hour work week.

Compounded, if my math is correct, this would amount to a 46% increase in pay over 4 years. The current top UAW wage is $32 per hour, or about $67,000 annually, based on a 40-hour work week.

Should the union get their way, that annual figure would move to more than $98,000 annually! While it will be interesting to see how this plays out, it is illustrative of how inflation feeds on inflation.

While the UAW is using the ‘severe impact of inflation’ as a reason to ask for a monster raise, it seems that the effects of inflation are also becoming apparent when looking at credit card data. This (Source: https://schiffgold.com/key-gold-news/more-americans-are-having-a-hard-time-paying-their-big-credit-card-bills/) from “Schiff Gold”:

Since price inflation took off in the wake of pandemic-era stimulus, Americans have blown through their savings and run up their credit cards to make ends meet. Now they’re starting to have a hard time paying those credit card bills.

The number of Americans rolling credit card debt from month to month is now higher than the number of people paying their bills in full for the first time ever.

Americans are buried under more than $1 trillion in credit card debt. Credit card balances increased by $45 billion between April and June alone. Meanwhile, credit card interest rates have climbed to 20.6%. With both balances and interest expenses rising, more and more people are struggling to pay the bills.

Did you catch that?

More Americans are now carrying credit card debt from month-to-month than are paying their bills in full. This is the first time this has occurred. This is not because consumers are flush with cash.

Corporate America is also concerned about the effects of diminished consumer spending on the very consumer-spending-dependent US economy. After a three-year hiatus, student loan payments will once again begin in October, a fact that has many corporations who rely on consumer spending very nervous. This (Source: https://www.zerohedge.com/markets/corporate-america-panics-student-loan-chatter-hits-record-earnings-calls) from “Zero Hedge”:

Corporate America is panicking this earnings season as the prospect of more than 40 million Americans carrying student debt will have to start making payments in October after a three-year-long payment forbearance that had artificially boosted disposable incomes by tens of billions of dollars.

In June, Barclays economist Adirenne Yih wrote in a note to clients (available to pro subscribers in the usual place), explaining the restart of student loan payments would be a $15.8 billion monthly headwind -- or a $190 billion per year -- to the US economy as the average student debt holder sees an incremental monthly payment of -- $390 beginning this fall.

With the return of these payments for 40 million Americans, the threat of consumer spending sliding is high. We've asked: Student Loan Repayments – Will It Start The Recession?

... and comes as the latest revolving credit (i.e., credit card debt) data shows consumers are nearing a breaking point as the spending binge wanes with interest rates at 22-year highs.

Analytics company Earnest Insights wrote in a note that Frontier Airlines, Peloton, and Old Navy will be some of the hardest-hit companies come October.

Company execs have already warned investors what's about the incoming spending cliff:

Target's CFO Michael Fiddelke

"The upcoming resumption of student loan repayments will put additional pressure on the already strained budgets of tens of millions of households ... We remain cautious in our planning."

Levi's CEO Chip Bergh

"It's not going to help us ... The consumer is already under pressure, and this is just going to ratchet that up even further."

Macy's CFO Adrian Mitchell

"The expiration of student loan forgiveness beginning in October, higher interest rate levels, and lower new job creation are all new pressures on the consumer."

As I have often discussed, excessive debt levels are deflationary.

Debt accumulation spends tomorrow’s production today. When enough of tomorrow’s production has been consumed, the borrowing and spending trend HAS to reverse.

Debt accumulation is finite because tomorrow’s production is finite.

Looks like we may have now hit the debt accumulation limit. Credit card spending just fell off the proverbial cliff.

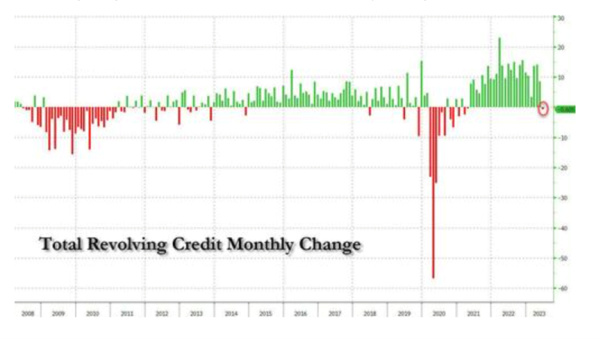

This chart illustrates revolving credit or credit card debt.

This chart illustrates revolving credit or credit card debt.

Notice how, in the most recent month for which data is available, that credit card spending fell very dramatically.

Could this mean that deflation is about to set in?

While deflation is inevitable, in my view, it is likely that the Fed, despite the current tough talk, will reverse course at some future point when deflation becomes the more dominant economic force.

And deflation will have to be the dominant economic force, given the debt levels that exist in both the private sector and the public sector.

Ultimately, the harsh reality is the debt will have to be dealt with, and the Fed, at some future point, will be unable to ‘paper over’ the debt problem.

It may be that time has now arrived.

The radio program this week features an interview with prolific commentator Karl Denninger.

Karl and I chat about what lies ahead for housing and stocks.

We also discuss the banking system and the rising number of corporate bankruptcies.

The podcast version of the program is posted at www.RetirementLifestyleAdvocates.com.

“I’m on the diet where you eat vegetables and drink wine. I lost 10 pounds and my driver’s license.”

-Larry the Cable Guy

Comments