Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Last week, I gave you an update on the housing market. It’s my strong opinion that real estate is now at the beginning of a decline that will rival the plunge in prices experienced at the time of the Great Financial Crisis.

This development fits in with my long-held belief that our economy will experience inflation followed by deflation. In the interest of full disclosure, this is not an original economic theory, one of the founding fathers, Thomas Jefferson warned us of this inevitable outcome if we allowed private bankers to control the issue of our currency.

I don’t need to convince anyone reading this that we are now experiencing the inflation part of this cycle. However, beginning in 2022, we are now seeing the beginning of the deflationary part of the cycle.

As I’ve commented in the past in this publication, the time frames separating inflationary periods from deflationary periods are not perfectly defined; there is evidence of both phenomena emerging at the same time.

It’s becoming increasingly probable from my viewpoint that we are headed for a stagflationary time – the prices of consumer essentials rise while the value of some financial assets fall.

Some of you are likely taking issue with that forecast given what Federal Reserve Chair, Jerome Powell had to say last week after the Jackson Hole Fed meeting.

In case you missed Mr. Powell’s statement, here is a bit from an article published on “Yahoo Finance” (Source: https://news.yahoo.com/jerome-powell-us-stock-markets-235847493.html) (Emphasis added):

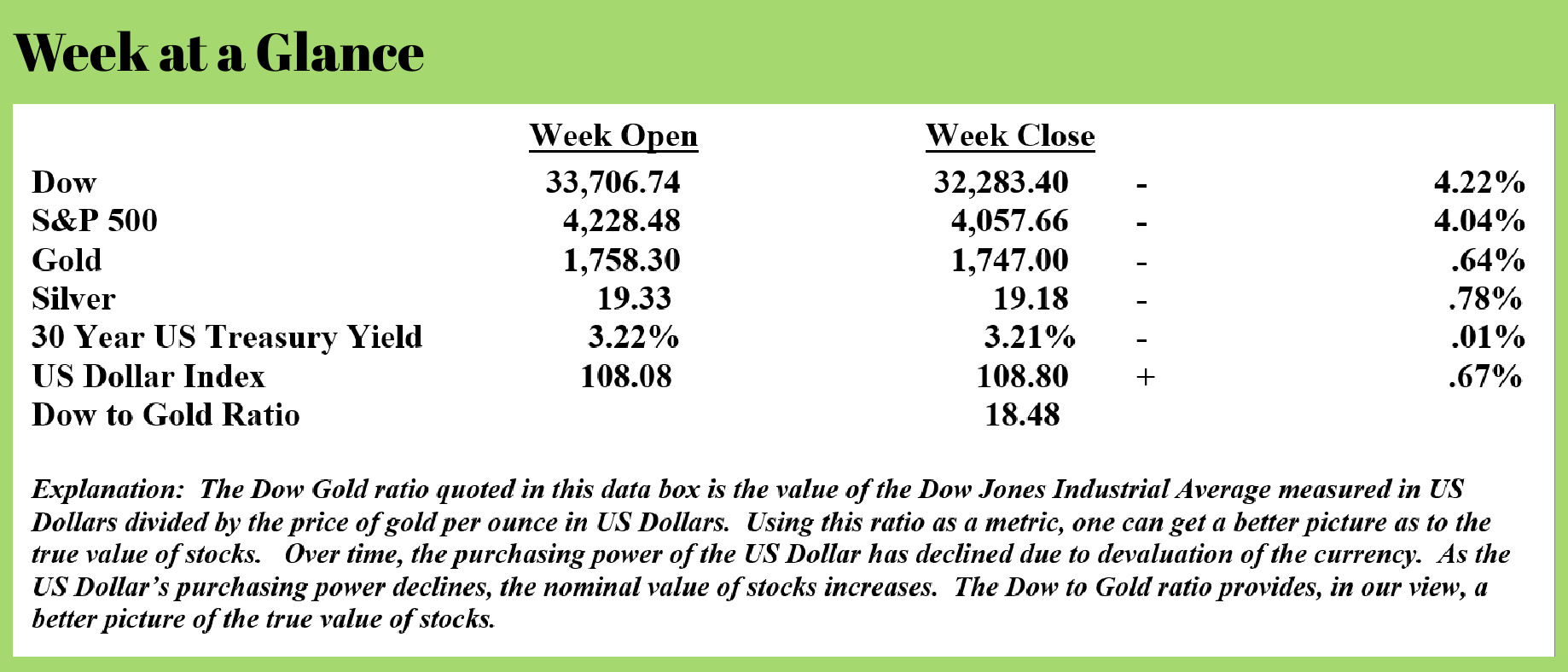

Stock markets in the US ended the week sharply down following tough comments by the head of the country's central bank, the Federal Reserve.

The bank's chairman, Jerome Powell, said the bank must continue to raise interest rates to stop inflation from becoming a permanent aspect of the US economy.

His words sent US stocks into a tailspin, with markets tumbling 3%.

It comes as Americans are having to pay more for basic goods.

Inflation in the world's largest economy is at a four-decade high.

During a highly anticipated speech at a conference in Wyoming on Friday, Mr Powell said the Federal Reserve would probably impose further interest rate hikes in the coming months and could keep them high "for some time".

"Reducing inflation is likely to require a sustained period of below-trend growth," he said at the meeting in Jackson Hole.

Investors are concerned that if economic growth falters, higher interest rates will increase the likelihood of a recession.

Mr. Powell conceded that getting inflation under control would come at a cost to American households and businesses but he argued it was a price worth paying.

"While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses," he said.

"These are unfortunate costs of reducing inflation but a failure to restore price stability would mean far greater pain."

Mr. Powell wants to avoid inflation becoming entrenched. Simply put, that means if people believe inflation will be high, they will alter their behavior accordingly, making it a self-fulfilling prophecy. For example, someone who thinks prices will go up 3% next year is more likely to seek a 3% rise in wages.

The last time this happened, Mr. Powell's predecessor, Paul Volcker, had to slam on the brakes, raising interest rates dramatically and sending the economy into recession.

In March, the Federal Reserve's key interest rate was almost zero; it has since been raised to a range of 2.25% to 2.5% in an effort to tackle inflation.

Interesting that the author of the article referenced Paul Volcker, comparing the actions of Volcker as Fed Chair to the policy decisions of the current Fed Chair, Powell.

THEY ARE VASTLY DIFFERENT.

Volcker increased interest rates to nearly 20% to tame inflation; that’s a far cry from the current 2.5%!

As I have previously stated, from my research, inflation will not be subdued without real positive interest rates. Interest rates need to be higher than the inflation rate.

I will also go out on a limb here and put forth my prediction that the Fed will reverse course as deflation takes hold. As noted above, deflation signs are becoming more obvious. Last week, I provided a housing update; this week, let’s look a bit more closely at corporate layoffs which are becoming more prevalent. This from Michael Snyder (Source: http://theeconomiccollapseblog.com/the-layoff-tsunami-has-begun-50-of-u-s-companies-plan-to-eliminate-jobs-within-the-next-12-months/):

Unfortunately, a brand new survey that was just released has discovered that 50 percent of all U.S. companies plan to eliminate jobs within the next 12 months. The following comes from CNBC…

Meanwhile, 50% of firms are anticipating a reduction in overall headcount, while 52% foresee instituting a hiring freeze and 44% rescinding job offers, according to a PwC survey of 722 U.S. executives fielded in early August.

These are executives’ expectations for the next six months to a year, and therefore may evolve, according to Bhushan Sethi, co-head of PwC’s global people and organization group.

Can those numbers be accurate?

I knew that things were bad because I write about this stuff on a daily basis.

But I didn’t think that half of the firms in the entire nation were already looking to cut workers.

Wow.

At this moment, I am at a loss for words.

It’s going to get bad out there. If you have a good job right now, try to do whatever you can to hold on to it.

Sadly, some of the biggest names in the corporate world have already started to lay off workers. For example, Ford Motor just announced that it will be laying off “roughly 3,000 white-collar and contract employees”…

Wayfair has also decided that now is the time for mass layoffs…

I thought that Wayfair was doing quite well.

I guess not.

In a desperate attempt to stay afloat, Peloton has also chosen to lay off “hundreds of workers”…

And even Groupon is getting in on the act. 500 of their workers will now be updating their resumes…

Other big names that have announced layoffs in recent weeks include Best Buy, HBO Max, Shopify, Re/Max, and Walmart.

Unfortunately, this is just the tip of the iceberg.

As this new economic downturn deepens, countless more Americans will lose their jobs.

And as that happens, all of a sudden there will be vast numbers of people that can’t pay their mortgages or make their rent payments, and that will make our new housing crash even worse.

We are now very clearly past the peak of the housing bubble, and the ride down is going to be really painful.

Last year at this time, the housing market in California was extremely hot, but now the numbers are definitely heading in the other direction…

Snyder goes on to quote statistics on the California real estate market. He notes that the sales volume of single-family houses in California fell 14% in July from June and by 31% from one year ago. Sales of single-family homes in California have fallen for 13 consecutive months. Price declines are now starting to follow sales declines as one might expect. Prices were down 3.5% in July from June. While that may seem like a relatively small decline, it’s significant should it continue month-after-month.

The forecast of inflation followed by deflation that I put out there in my “New Retirement Rules” book is now playing out.

This week’s radio program and podcast features an interview with the host of the “Midweek Reality Check” podcast, Mr. Michael Pento. Michael is a frequent guest expert on television news programs and is a very savvy market analyst.

You can listen to the show now by clicking on the "Podcast" tab at the top of this page. I get Michael’s forecast for stocks, bonds, and inflation. I know you’ll enjoy my conversation with him.

“Go through your phone book, call people and ask them to drive you to the airport. The ones who will drive you are your true friends. The rest aren’t bad people, they’re just acquaintances.”

-Jay Leno

Comments