Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

“California’s $20 Minimum Wage for Fast Food Workers Proves to Be a Failure”

The National Bureau of Economic Research reported that the $20 per hour minimum wage for fast food workers has failed.

Researchers Jeffrey Clemens, Olivia Edwards, and Jonathan Meer found that fast food jobs in California dropped 3.2 percent after AB1228, the law that increased the minimum wage for fast food workers to $20 per hour, went into effect in April of this year. (Source: https://www.thegatewaypundit.com/2025/07/ca-minimum-wage-law-succeeds-libs-obliterates-jobs/)

That 3.2% reduction in fast food jobs translates to about 18,000 jobs lost, according to the researchers.

The law was passed in September 2023, but as noted above, it went into effect in April of this year.

Fast food employment across the rest of the country grew slightly.

Fast food employees are typically college-age and high school-age workers who do not depend on the income from their job to make a living wage.

And, since most consumers won’t pay $25 for a hamburger, fast food restaurant owners have been forced to eliminate employees while relying more on self-service kiosks and the like.

Look for more news like this from the State of California since the City of Los Angeles recently voted to increase the minimum wage of hotel and airport workers to $30.

Bottom line: wage controls never work, and this attempt at controlling wages didn’t work either.

Second Quarter GDP Growth Exceeds Projections

Gross domestic product jumped 3% for the second quarter of the year. That’s according to figures adjusted for seasonality and inflation. (Source: https://www.cnbc.com/2025/07/30/gdp-q2-2025-.html)

That growth that exceeded many estimates reverses the .5% contraction reported for the first quarter of the year. Consumer spending rose 1.4% and imports fell. Remember that a trade surplus adds to GDP while a trade deficit reduces GDP.

US Government Debt Continues to Build

U.S. government debt is expected to reach nearly $38 trillion by the end of 2025. (Source: https://wolfstreet.com/2025/07/29/the-recklessly-ballooning-us-government-debt-spikes-by-519-billion-since-debt-ceiling-expected-to-hit-37-8-trillion-by-yearend-722-billion-in-treasury-auctions-this-week-alone/)

According to Wolf Richter (source above), there were $722 billion in Treasury auctions last week alone.

Of course, if you’ve been a long-time reader of “Portfolio Watch”, this is no surprise to you, as I previously reported that the US Government would need to refinance record levels of maturing debt this year.

While yields on US Treasuries fell somewhat last week, in my view, this is a countertrend move. Given the level of deficits and the amount of debt that needs to be refinanced, I expect higher interest rates in the future.

Margin Debt and Stock Market Performance

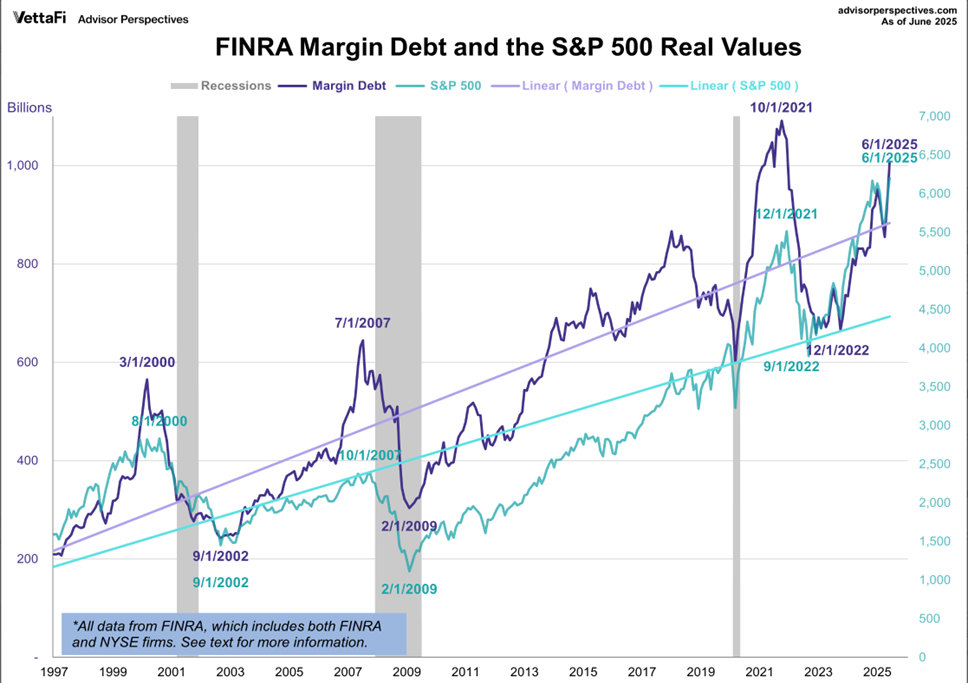

Margin debt is a term that is used to describe a loan that an investor takes to buy securities, typically stocks. Historically speaking, there is a strong correlation between stock performance and margin debt.

As the chart below illustrates, when margin debt reaches high levels and then pulls back, a stock market correction often follows. (Source: https://www.advisorperspectives.com/dshort/updates/2025/07/23/margin-debt-surges-record-high-june-2025)

FINRA’s latest data, through June, reveals record-high margin debt of more than $1 billion. The level of margin debt is up almost 25% from just one year ago.

Just another reason to be cautious with stocks since margin debt now exceeds the levels seen prior to the Great Financial Crisis and the tech stock bubble bursting.

RLA Radio

The RLA radio program this week features an interview that I conducted with Mr. Egon von Greyerz, founder of von Greyerz Gold. You can listen to the interview now by clicking on the "Podcast" tab at the top of this page.

I chat with Egon about his forecasts for precious metals and fiat currencies. Egon is a brilliant economic historian and offers some terrific insights in this interview that you won’t want to miss.

My weekly “Headline Roundup” newscast is also available by clicking on the "Headline Round-Up" tab at the top of this page. Please note that due to extended travel this month, there will not be a Headline Round-Up broadcast on August 4, 11, or 18. We will resume the Headline Round-Up broadcast on Monday, August 25, 2025.

Quote of the Week

“The American wage earner and the American housewife are a lot better economists than most economists care to admit. They know that a government big enough to give you everything you want is a government big enough to take everything you have.”

-Gerald R. Ford

Comments