Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

Americans Seeing Far Less Value in College Education

A new “NBC News” poll found that two-thirds of registered voters now believe that a college education is not worth the cost. (Source: https://www.nbcnews.com/politics/politics-news/poll-dramatic-shift-americans-no-longer-see-four-year-college-degrees-rcna243672)

33% of registered voters polled stated that a four-year college degree is worth the cost because people have a better chance of getting a good job and earning more money over their lifetime.

Compare that with 63% who think that it’s not worth the investment because graduates typically do not have specific job skills, and also have a lot of debt to pay off.

Those views mark a dramatic shift from a dozen years ago, when 53% said a degree was worth it and 40% thought it was not.

This shift in perspective is occurring across all social groups, including those who have a college degree.

Jeff Horwitt of Hart Research Associates, a democratic pollster, conducted the poll in conjunction with Republican pollster Bill McInturff of Public Opinion Strategies. Horwitt had this to say about the poll results: “It’s just remarkable to see attitudes on any issue shift this dramatically, and particularly on a central tenet of the American dream, which is a college degree. Americans used to view a college degree as aspirational – it provided an opportunity for a better life. And now that promise is really in doubt.”

Interestingly, interest in technical and vocational programs has soared. Bottom line is there are simply not a lot of practical applications for many degrees like (yes, these are all actual degrees) (Source: https://blog.collegevine.com/weirdest-college-majors/) puppet arts, comic art, adventure education, costume technology, entertainment engineering, and popular culture.

Combine that with the fact that the inflation-adjusted cost of a four-year degree has more than doubled since 1995.

It’s not surprising that rapidly rising higher education costs and the emergence of obscure, impractical degrees coincided with ridiculously easy student loan accessibility. Easy money for student loans has created a tuition price bubble that is now beginning to unwind.

Many liberal arts colleges are now continuing to cut staff and programs. This trend will continue.

Here’s the Main Reason Many Americans Are Broke

I was recently reading a review of a book that was written about life in the Panama Canal zone in 1910. What was interesting was the pay that employees working in Panama earned for their efforts. It’s also worth noting that the income earned at that time was income tax-free since the income tax became legal in 1913.

A junior engineer working in the canal zone in 1910 earned $250 per month or $3,000 per year. Since, at that time, the US Dollar was gold, every dollar earned was paid in 1/20th of an ounce of gold. For working the entire year in the canal zone a junior engineer, not more than a few years removed from college would be paid 150 ounces of gold each year.

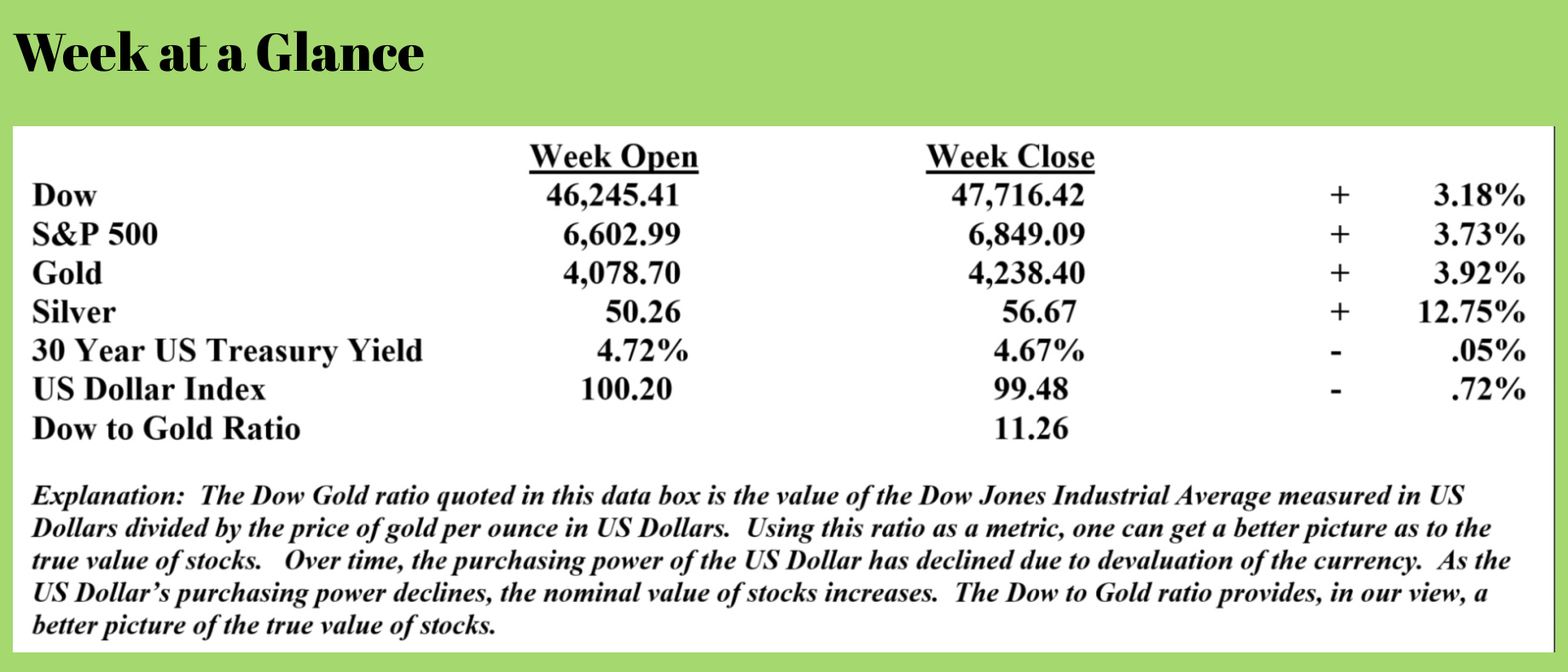

Let’s fast forward to today. As noted at the top of this issue of “Portfolio Watch”, gold closed last week at more than $4,200 per ounce. An employee earning 150 ounces of gold annually presently would be paid $630,000 per year. That’s enough to be in the top 1% of income earners in the United States, which requires an annual income of $407,500.

Going back to 1964, we can find a similar example.

1964 was the last year that silver coins in the United States contained silver. Coins minted in 1964 and prior were comprised of 90% silver. For every $100 in coinage, one possessed 72 ounces of silver.

One hundred silver dollars, 200 half-dollars, 400 quarters, or 1000 dimes all had the same amount of silver – 72 ounces. Any combination of these coins totaling $100 in face value meant that one had 72 ounces of silver.

In 1964, the minimum wage in the United States was $1.15 per hour (Source: https://www.dol.gov/agencies/whd/minimum-wage/history/chart).

A minimum wage worker in 1964 who worked 40 hours per week earned $46 per week. At the time, that was the equivalent of about 33 ounces of silver per week.

As noted above, silver closed last week at $56.67 per ounce. If US Dollars were still redeemable for silver, that would translate to a minimum wage worker today earning about $1880 per week or approximately $94,000 per year.

If you want to know why many American workers are struggling, look no further than the extreme devaluation that the US Dollar has experienced.

I bring this up because this devaluation will have to continue.

The Federal Reserve has just noted that the central bank will continue with devaluation, ending quantitative tightening that reduced the balance sheet of the Fed.

The Fed is now once again poised to continue inflationary or devaluation policies, as it has since the Fed was formed back in 1913. History teaches us that this will have to end at some point.

That point is when confidence in the currency reaches a tipping point. At that point, there will be a mad scramble for tangible assets. But, at that point, it will be too little, too late.

The time to do an income plan and determine the ideal level of tangible assets for you in your portfolio is now.

RLA Radio

The RLA radio program this week is a ‘best of’ program featuring an interview that I did as a guest expert on “The Financial Survival Network”. I talk about what 2025 will be remembered for and how artificial intelligence might affect the US economy moving ahead.

The program is posted at www.RetirementLifestyleAdvocates.com.

Quote of the Week

“Dare to think for yourself.”

-Voltaire

Comments