Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Since 2011, in my book “Economic Consequences,” I have forecast inflation followed by deflation.

This is old news to the long-term readers of “Portfolio Watch.”

This week, I want to drill down on this forecast and share what exactly this means and then give you some current examples of the inflation that still exists and the deflation that seems to be emerging.

Technically speaking, an economy has to experience either inflation or deflation since the proper definition of each monetary phenomenon reveals that inflation and deflation are polar opposites of each other.

Correctly defined, inflation is an expansion of the currency supply.

On the other hand, deflation, accurately defined, is a contraction of the currency supply.

Increasing prices on many items are a SYMPTOM of inflation, and falling asset values are a SYMPTOM of deflation.

In our banking system, a fractional reserve banking system, the currency has typically been loaned into existence. The Federal Reserve, the central bank of the United States, sets reserving requirements for member banks and also interest rates.

Presently, banks operate under a minimum reserve requirement of 10%, meaning that when you make a bank deposit, your banker has to reserve at least 10% of the deposited amount. The other 90% can be loaned out to other bank customers.

In the past, when the Federal Reserve wanted to create inflation (increase the currency supply), the central bank would reduce interest rates, enticing more borrowing by bank customers and increasing the velocity of money from financial institutions to financial institutions.

This currency expansion technique quit working after the financial crisis when the Federal Reserve reduced interest rates to zero without the desired level of borrowing following the interest rate reduction.

That’s when quantitative easing was utilized by the central bank. Simply described, quantitative easing had the Federal Reserve create currency from thin air and use the newly created currency to buy securities from member banks.

It was this process that saw the balance sheet of the central bank increase by $5 trillion over roughly two years!

The result was an increase in the currency supply and higher consumer prices.

While those higher prices are continuing to take a toll on many American households, there is now hard evidence that the currency supply is contracting. This from Mises (Source: https://mises.org/wire/money-supply-continues-its-biggest-collapse-great-depression):

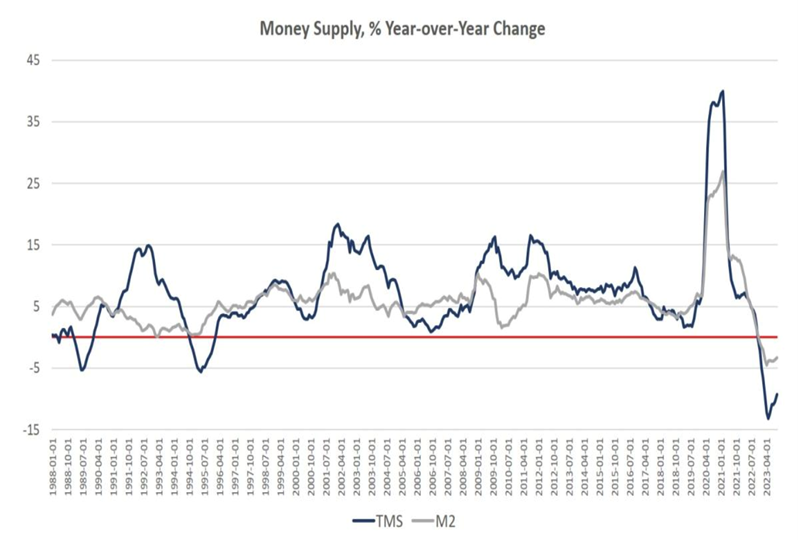

Money supply growth fell again in October, remaining deep in negative territory after turning negative in November 2022 for the first time in twenty-eight years. October's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years.

Since April 2021, money supply growth has slowed quickly, and since November, we've been seeing the money supply repeatedly contract year over year. The last time the year-over-year (YOY) change in the money supply slipped into negative territory was in November 1994. At that time, negative growth continued for fifteen months, finally turning positive again in January 1996.

Money-supply growth has now been negative for twelve months in a row. During October 2023, the downturn continued as YOY growth in the money supply was at –9.33 percent. That's up slightly from September's rate decline which was of –10.49 percent, and was far below October 2022's rate of 2.14 percent. With negative growth now falling near or below –10 percent for the eighth month in a row, money-supply contraction is the largest we've seen since the Great Depression. Prior to this year, at no other point for at least sixty years has the money supply fallen by more than 6 percent (YoY) in any month.

Money-supply growth has now been negative for twelve months in a row. During October 2023, the downturn continued as YOY growth in the money supply was at –9.33 percent. That's up slightly from September's rate decline which was of –10.49 percent, and was far below October 2022's rate of 2.14 percent. With negative growth now falling near or below –10 percent for the eighth month in a row, money-supply contraction is the largest we've seen since the Great Depression. Prior to this year, at no other point for at least sixty years has the money supply fallen by more than 6 percent (YoY) in any month.

Clearly, deflation is now making its presence known.

This from MSN (Source: https://www.msn.com/en-us/money/markets/the-us-economy-has-a-new-twist-deflation-heres-what-that-means/ar-AA1laBzn):

After grappling with high inflation for more than two years, American consumers are now seeing an economic trend that many might only dimly remember: falling prices — but only on certain types of products.

Deflation is impacting so-called durable goods, or products that are meant to last more than three years, Wall Street Journal reporter David Harrison told CBS News. As Harrison noted in his reporting, durable goods have dropped on a year-over-year basis for five straight months and dropped 2.6% in October from their September 2022 peak.

These items are products such as used cars, furniture and appliances, which saw big run-ups in prices during the pandemic. Used cars in particular were a pain point for U.S. households, with pre-owned cars seeing their prices jump more than 50% in the first two years of the pandemic.

While the currency supply is now contracting which is, by definition, deflationary, much of the damage of the rampant inflation of the past few years has already been done. This from Michael Snyder (Source: https://theeconomiccollapseblog.com/a-constant-state-of-sticker-shock-here-is-proof-that-inflation-in-the-u-s-is-wildly-out-of-control/):

Do you believe the politicians in Washington or do you believe your own eyes? The politicians keep telling us that “inflation is low”, but everyone can see that everything sure does cost a lot more than it once did. Our standard of living just keeps going down, and even JPMorgan Chase CEO Jamie Dimon is admitting that “inflation is hurting people”. But how can inflation be “hurting people” if it is under control? Of course, the truth is that it isn’t under control. If the official rate of inflation was still measured using the formula that was in place in 1980, it would be well into double digit territory right now. Prices have been rising much faster than paychecks have, and that is putting an extraordinary amount of financial stress on the more than 60 percent of U.S. adults that currently live paycheck to paycheck.

Vox is a website that leans very far to the left, and even they are complaining about inflation.

In fact, a recent article posted on Vox boldly declared that life in 2023 “means being in a constant state of sticker shock”…

Life in 2023 means being in a constant state of sticker shock.

You walk out of the grocery store feeling like you’re not really sure what happened, but somehow, your normal fare ran you $50 more than you swear it should have. Did Diet Coke always cost that much? Or eggs? Maybe you’ve been putting off buying that new car in the hope prices go back to where they were pre-pandemic, but you’re starting to feel like the wait is awfully long. Or, the morning after a post-work happy hour, you’re left scratching your head. You swear you had two glasses of wine, but the size of your credit card receipt makes you wonder if it wasn’t four. “How expensive everything is today” is a top theme of conversation. The whole situation can be infuriating.

I don’t care for Vox much, but those two paragraphs are quite accurate.

Prices have reached absurd heights, and most of us really are “in a constant state of sticker shock” these days.

And the cold, hard numbers back this up.

According to a report from Republican members of the U.S. Senate Joint Economic Committee, the typical household in this country “must spend an additional $11,434 annually” in order to have the same standard of living that it did when Joe Biden entered the White House…

So, what is it?

Inflation or deflation? In my view, we are transitioning, and despite their insistence to the contrary, I expect the Fed will once again resort to some version of currency creation as we enter 2024.

The radio program this week features an interview that I conducted with Jeffrey Tucker, founder of the Brownstone Institute and daily columnist for “The Epoch Times.”

Jeffrey and I discussed the current health of the US economy as well as the state of liberty in the United States and around the world.

The podcast is available now by clicking on the "Podcast" tab above, or you can find it on your favorite podcast channel at Your RLA.

“Liberty means responsibility. That is why most men dread it.”

-George Bernard Shaw

Comments