Weekly Market Update by Retirement Lifestyle Advocates

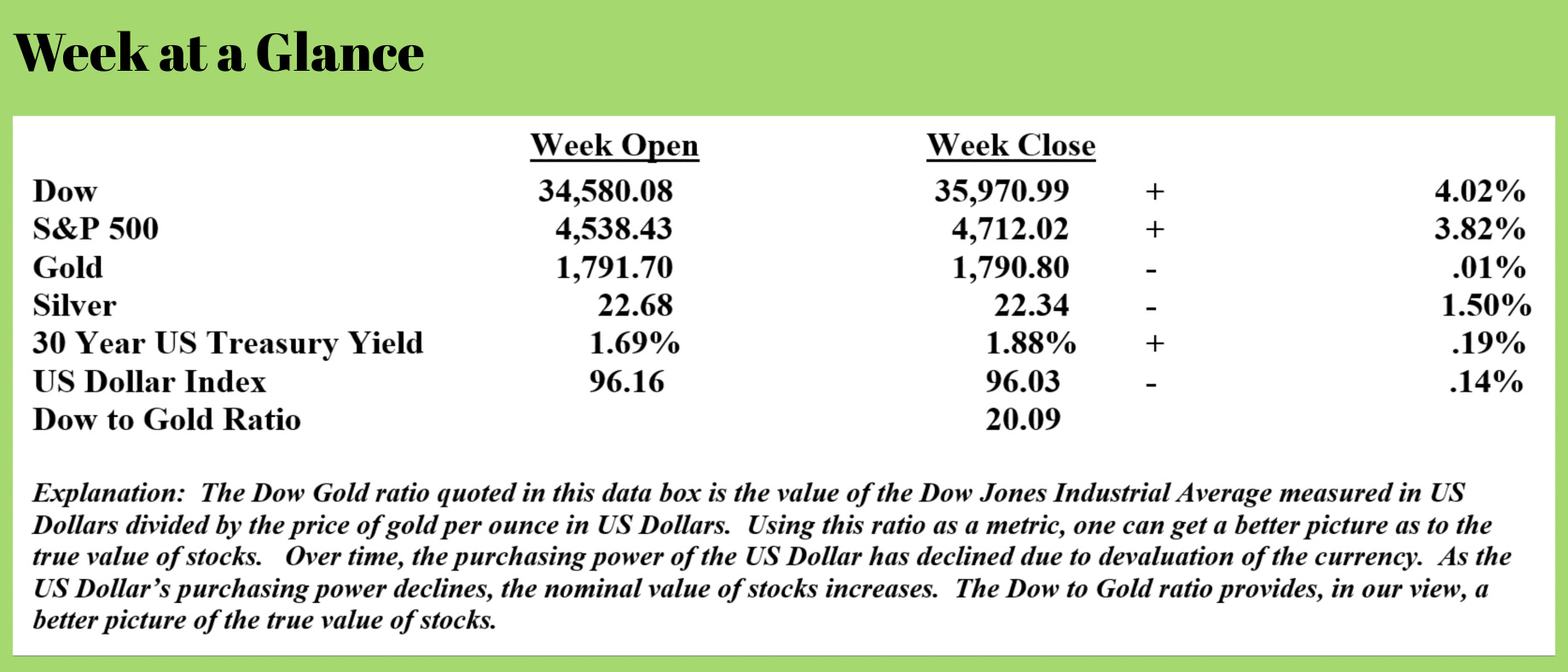

Stocks rallied last week although they remain off their highs of about one month ago. Unless these prior highs are taken out, we view the current stock trend as down. We will have to wait and see if a year-end Santa rally can bring the market to new highs.

Longer-term, I am bearish on stocks. As I have been discussing, in early fall, my monthly chart indicators turned bearish.

We have been recently discussing the math behind the federal government debt and deficit. The reality is that the fiscal problems of the United States are too large to be solved via higher taxes and across the board spending cuts of 41% would be required to balance the budget. And spending cuts of that magnitude simply balance the budget; they do nothing to pay down the debt or close the fiscal gap.

The Federal Reserve is now the buyer of last resort when it comes to government debt. The total debt held by China and Japan would now cover the operating deficit for only a matter of months. Until the budget issues are addressed, the currency creation will have to continue. The math contradicts the rhetoric.

As the currency creation continues, we will see inflation rise, but then at some future point, the inflation will be followed by deflation.

While no one knows WHEN inflation will be followed by deflation, we know from studying history that inflation will be followed by deflation.

There is no doubt that we are now seeing inflation.

Historically speaking, when inflation has reached a point that the reported, ‘official’ inflation rate was too high to be considered palatable, the policymakers changed the way the inflation rate is calculated.

Adjustments to the Consumer Price Index have included hedonic (pleasure) adjustments, substitution, and adjustments to weightings. Each time an adjustment has been made to the inflation calculation methodology; the reported inflation rate has been more favorable.

According to economist, John Williams, of www.ShadowStats.com, if the inflation rate is calculated using the same methodology that was used prior to 1980, the current inflation rate would be about 15%.

The ‘officially reported’ inflation rate is now at a 39-year high. This from “The Wall Street Journal” (Source: https://www.wsj.com/articles/us-inflation-consumer-price-index-november-2021-11639088867?mod=Searchresults_pos7&page=1):

The Labor Department said the consumer-price index—which measures what consumers pay for goods and services—rose 6.8% in November from the same month a year ago. That was the fastest pace since 1982 and the sixth straight month in which inflation topped 5%.

The increase in prices for new vehicles, which came in at 11.1% in November, was the largest on record, as were those for men’s apparel and living room, kitchen, and dining room furniture. A 7.9% surge in fast-food restaurant prices last month marked the sharpest on record too.

The steady rise in restaurant prices during the past few months is a sign of pass-through from wages into higher prices, economists say. That dynamic is increasingly showing up in other industries. Wages tracked by the Atlanta Fed climbed 4.3% in November, up from 4.1% in October and the highest since 2007.

The latest strong inflation report strengthens the case for Federal Reserve officials to commit to hastening the wind-down of their stimulus efforts, paving the way to raise interest rates in the spring to curb inflation.

“I think the Fed already got ahead of today’s data by pre-announcing that they will accelerate the taper next week,” said Aneta Markowska, chief financial economist at Jefferies LLC.

Inflation, as I predicted is intensifying.

The Fed is talking taper, or talking about slowing the rate of currency creation. The evidence suggests they won’t as we will discuss in a moment.

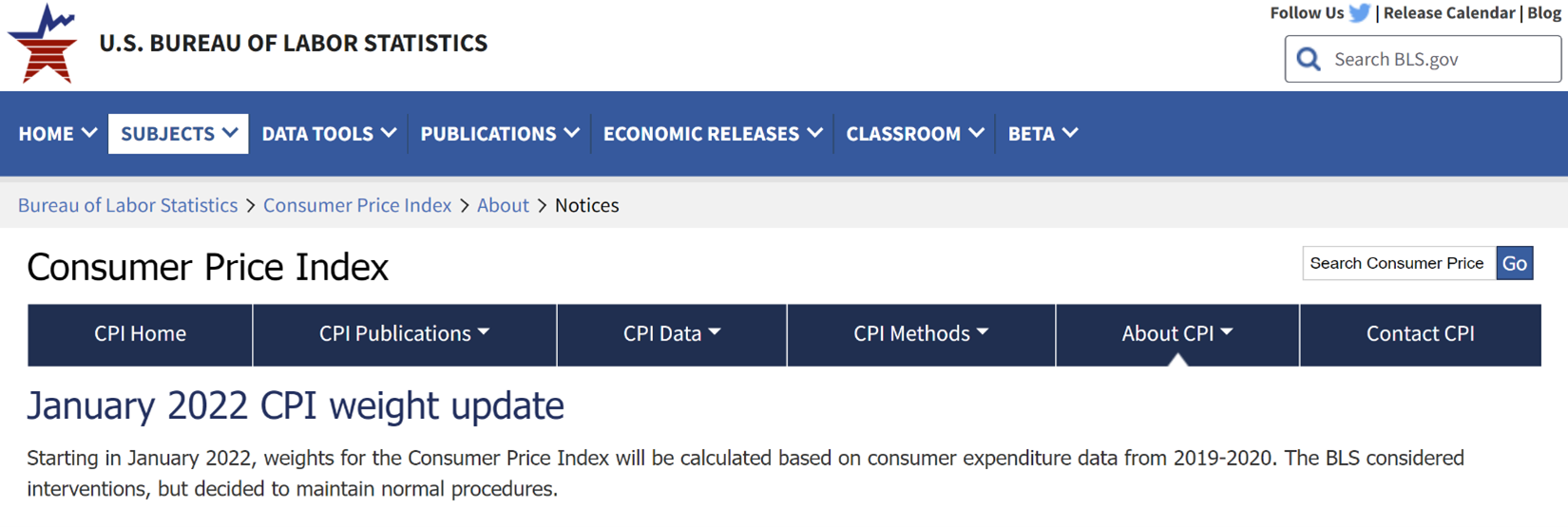

But the BLS is doing their part too. They announced that beginning next month, in January of 2022, the way the inflation rate is calculated will also change.

As you can see from the screenshot of the press release below, beginning in January 2022, the weightings used to calculate the official inflation rate will change and be based on consumer expenditures during 2019 and 2020.

Here is why that is significant.

Here is why that is significant.

As prices rise, consumers make different spending choices.

If the cost of a ribeye steak rises, a consumer may opt for a sirloin steak or hamburger. As consumers opt for goods they can afford, the weighting will now change which will make the officially reported inflation rate more favorable.

Interestingly, the notice stated that the BLS considered interventions but decided to refrain without mentioning what those interventions might have been.

This change is an often use play from a playbook that has only one play left. If you don’t like the outcome of the game, then just change the rules of the game.

Now for the evidence that suggests the Fed won’t slow the rate of currency creation. First, the math unequivocally concludes that the Fed can’t slow the rate of currency creation despite their statements to the contrary.

Second, it seems that while the Fed is talking taper, or slowing the rate of currency creation on the one hand, the Fed is using other methods to continue currency creation with the other hand. This from Matthew Piepenburg (Source: https://goldswitzerland.com/fear-and-inflation-the-timeless-policy-tools-of-discredited-systems/)

Perhaps more “exciting” was his not-so-subtle announcement that the Fed plans to begin a discussion at its next meeting to accelerate the Fed taper by a few months.

Hmmm…

Despite the fact that any Fed Taper will in substance be a “non-taper” given backdoor liquidity tricks from the Standing Rep Facility and FIMA swap lines, the optics of such continued taper-talk will be negative for almost all assets save for the USD, the VIX trade, so-called “safe-haven” Treasuries and possibly gold.

Mr. Piepenburg’s point is this; the Fed, despite the taper talk, will not taper. As he states, they have already put other liquidity tricks in place.

They have to. The math doesn’t lie.

So, we are looking at inflation followed by deflation as we have so often stated. And, the inflation is here and the inflation is worldwide.

Japan (Source: https://www.reuters.com/markets/asia/japan-nov-wholesale-inflation-spikes-rising-raw-material-costs-2021-12-10/) is experiencing inflation unlike any time in the last 40 years, paralleling the inflation in the United States:

Japan's wholesale inflation hit a record 9.0% in November, pushing gains for a ninth straight month, a sign of upward pressure on prices from supply bottlenecks, and rising raw material costs were broadening.

The rising cost pressures, coupled with a weak yen that inflates the price of imported goods, add to pain for the world's third-largest economy as it emerges from a consumption slump caused by the coronavirus pandemic.

"Japan imports a lot of goods, so prices may rise for a range of products. That could dent consumption," said Takeshi Minami, chief economist at Norinchukin Research Institute.

The year-on-year rise in the corporate goods price index (CGPI), which measures the prices companies charge each other for their goods and services, was the fastest pace since comparable data became available in 1981.

Brazil and Mexico are also experiencing inflation. This from Wolf Richter (Source: https://wolfstreet.com/2021/12/09/central-banks-in-latin-americas-largest-economies-grapple-with-raging-inflation-brazil-with-shock-and-awe-mexico-with-an-eye-on-the-fed/)

The Central Bank of Brazil has embarked on a series of shock-and-awe rate hikes in order to not fall further behind. The Bank of Mexico has largely mirrored the Fed’s rhetoric, expecting this raging inflation to go away on its own somehow, but it has started to raise rates in June, very gingerly. And the Fed has made a verbal U-Turn, but is still running the money-printer nearly full blast and is still repressing its policy rates to near 0%.

Consumer price inflation in Mexico spiked in November even more than the already high expectations, to 7.4%, from 6.2% in October, the red-hottest inflation since January 2001, according to Mexico’s INEGI today. Consumer price inflation in Brazil in October jumped to 10.7%, approximately matching January 2016, which had been the highest since 2003.

Historically speaking, this pattern of inflation followed by deflation repeats over and over again. If you’ve not already done so, take steps to protect yourself.

This week’s radio program is a ‘best of’ that examines this cycle in detail. You can listen now by clicking the "Podcast" tab at the top of this page.

“Never be afraid to try something new. Remember a rank amateur built the ark. A group of professionals built the Titanic.”

-Dave Barry