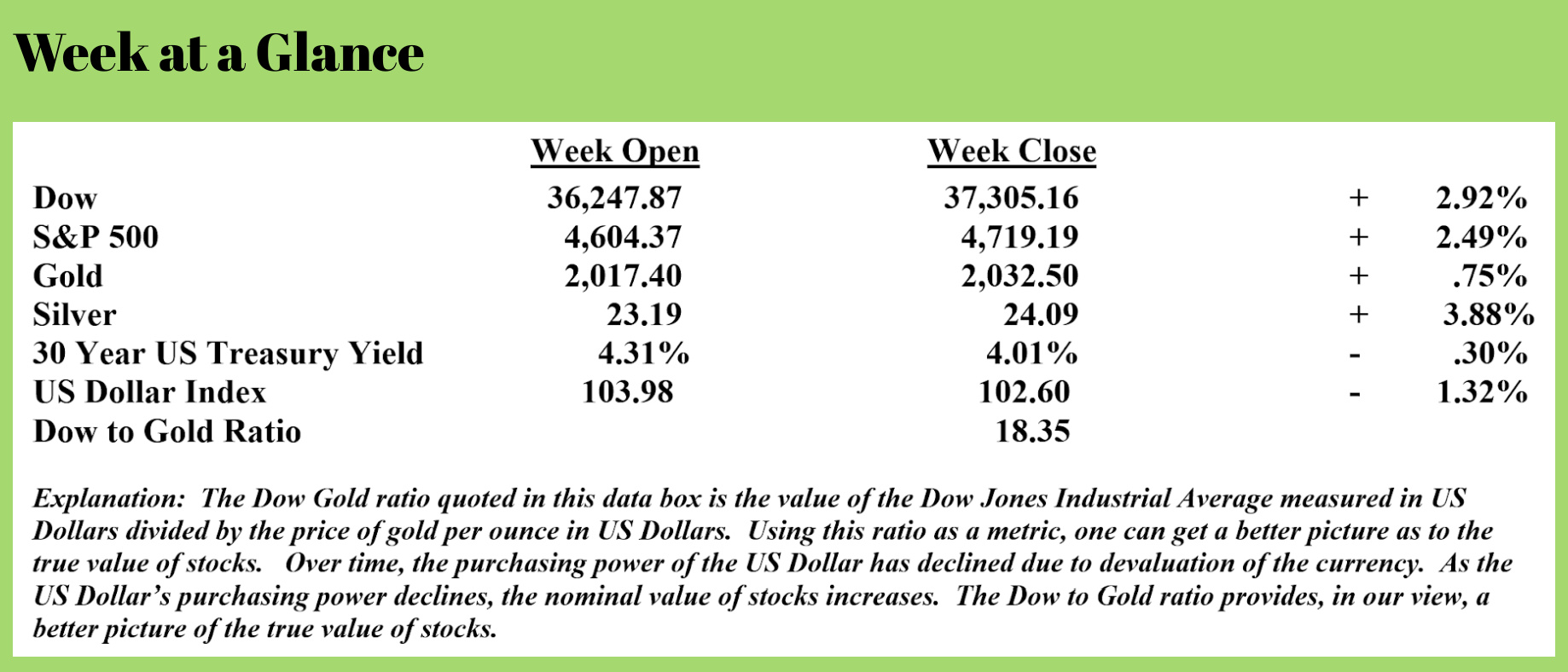

Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Alright, I’m going to say it. As much as many people hate it, I’m going to say it anyway.

I told you so.

What am I talking about?

It seems the Federal Reserve, as I predicted, is ready to ‘pivot.’ After increasing interest rates ostensibly to fight inflation, the Fed is now ‘greasing the skids’ for a rate cut.

Let’s take a little trip back in time, shall we?

This is from “Portfolio Watch” on May 23, 2022:

Stocks are following the script from 2018: the Fed tightens, and stocks fall.

The big question here is whether the Fed stays the course and continues to tighten. Count me among the doubters.

And this from July 18, 2022:

I expect that the Fed will ultimately reverse course on the interest rate increases so the ‘economy can be supported.’ I should also point out that there are some analysts who disagree with me on this arguing that the dollar would be devalued to an even greater extent, further threatening it’s use as an international currency.

I believe that is the outcome that the Fed will choose given that that other choice is a painful deflationary period.

If you’ve been a long-term reader of “Portfolio Watch,” you know that I have made this forecast many times.

Now, it seems, the pivot is getting close.

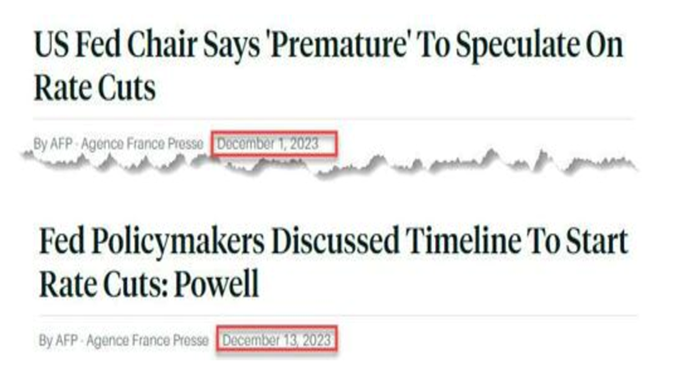

What’s interesting is the short time that elapsed between the Fed saying they would stay the course and the Fed saying that they are prepared to cut interest rates. This from “Zero Hedge” (Source: https://www.zerohedge.com/markets/now-it-all-makes-sense):

One day after the Fed's bizarre, unexpected pivot, many are struggling to wrap their heads around what happened: what exactly changed in less than two weeks for Powell to go from telling the market it was "premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease" to suddenly warning that rate cuts are something “that begins to come into view, and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today."

One day after the Fed's bizarre, unexpected pivot, many are struggling to wrap their heads around what happened: what exactly changed in less than two weeks for Powell to go from telling the market it was "premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease" to suddenly warning that rate cuts are something “that begins to come into view, and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today."

As noted in the two headlines above, on December 1, the Fed Chair commented that it was ‘premature’ to speculate on rate cuts. Then, 12 days later the Fed Chair announced that it was time to begin to discuss when to cut rates.

What changed in less than two weeks?

Was it the economic data that was reported?

The answer to that question is an unequivocal ‘no’.

Inflation came in hotter than expected. Hardly a reason to consider interest rate cuts. Retail sales were also higher. The University of Michigan’s Consumer Sentiment report was much higher also.

When looking at the data, there is no good reason for the Federal Reserve to consider interest rate cuts, yet in just 12 days, the Fed Chair made a near 180-degree about-face on interest rates.

Why?

In my view, there are only two reasons.

One, the Fed is getting pressured to reduce interest rates to attempt to provide an economic boost as we enter an election year.

Two, the US Government needs another buyer for US Government debt, given the massive deficit spending that is continuing.

My guess is it’s some of each, but the sudden about-face in policy in such a short time frame likely means there was some political pressure.

I should add this is pure speculation on my part, but nothing else makes sense.

The “Zero Hedge” article quoted above contains an account about another time the policy of the Federal Reserve was dictated by a politician.

The year was 1965.

Then President Lyndon Johnson called then Federal Reserve President William Martin to his Texas ranch to give him an ear full after Martin cast the deciding vote to increase interest rates. Rumor has it that the physically intimidating Johnson pushed Martin into a wall during their private meeting. This from the piece:

Martin flew down to the Johnson Ranch on Monday, Dec. 6, along with Fowler and other advisers. The president met them at an airstrip behind the wheel of his Lincoln convertible. They piled in and he drove them to the house.

There, Johnson got Martin alone and did not mince words. According to different accounts, the 6-foot-4 Johnson pushed the shorter Martin up against a wall.

“You went ahead and did something that you knew I disapproved of, that can affect my entire term here,” Johnson said, as Martin recalled later in an oral history. “You took advantage of me and I’m not going to forget it, because here I am, a sick man. You’ve got me into a position where you can run a rapier into me and you’ve run it.”

“Martin, my boys are dying in Vietnam, and you won’t print the money I need,” he said.

Martin stood his ground. He pointed out that he had given the president fair warning that a raise was coming. More broadly, he insisted that he and the president had different jobs to do, that the Federal Reserve Act gave the Fed responsibility over interest rates.

“I knew you disapproved of it, but I had to call the shot as I saw it,” he said.

The two eventually stepped outside and tried to assure reporters that any differences had been patched up. Their sour expressions, captured in newspapers the next day, suggested otherwise.

Ironically, in the end LBJ got what he wanted, as the next episode from the NYT reveals:

... in 1965, President Lyndon B. Johnson, who wanted cheap credit to finance the Vietnam War and his Great Society, summoned Fed chairman William McChesney Martin to his Texas ranch. There, after asking other officials to leave the room, Johnson reportedly shoved Martin against the wall as he demanding that the Fed once again hold down interest rates. Martin caved, the Fed printed money, and inflation kept climbing until the early 1980s.

Did something similar just happen to make the Fed Chairman change his mind in such a short time frame?

We may never know.

Nevertheless, there is no denying the dismal state of US Government finances. We just finished the last fiscal year with a real operating deficit of about $2 trillion.

Given that this next year is an election year, it’s not unreasonable to think that after an election year giveaway or two, we could be looking at a deficit of $3 trillion or so.

On top of that, there is more than $7 trillion of existing US Government debt that will need to be refinanced over the next year.

Assuming this existing debt and new deficit spending is financed at an interest rate of 4% to 5%, the cost to pay the interest on the US Government’s debt will rise to somewhere in the neighborhood of one trillion dollars annually.

For comparison purposes, total outlays for the Social Security program are about $1.35 trillion!

Simple math dictates that this debt cannot be financed honestly but will likely require the Federal Reserve to step in and become the buyer of last resort for US Government debt. That will mean more currency creation by the Fed and more inflation for you and me to deal with.

This is where we are headed, in my view. Not because I have a crystal ball that is accurate, but because the math suggests there is no other option.

The Fed knows this, too.

If you’ve not yet prepared for what I believe will be an inescapable and inevitable outcome, there is still time.

The radio program this week features an interview that I did with Alasdair Macleod, Head of Research at Gold Money.

I get Mr. MacLeod’s forecast for the economy and fiat currencies in light of these facts.

The podcast is available today by clicking on the "Podcast" tab at the top of this page, or find it on your favorite podcast source.

“A chip on the shoulder is too heavy a piece of baggage to carry through life.”

-John Hancock

Comments