Weekly Update from RLA Tax and Wealth Advisory

Weekly Update from RLA Tax and Wealth Advisory

By: Dennis Tubbergen

Credit Tightens

In my 2026 forecast, I am predicting that interest rates will continue to rise despite the Fed’s cutting of the Fed Funds rate.

The Federal Reserve has initiated rate cuts since September 2024, reducing the Fed Funds rate by 1.50%. If you’re not familiar with the Fed Funds rate, it’s the interest rate that financial institutions charge each other for overnight loans.

There is a common misconception about the Fed Funds rate. Many believe that when the Federal Reserve drops interest rates, consumers who borrow money pay a lower interest rate on loans. While this has been true historically at times, it is not always the case.

As noted above, the Federal Reserve began cutting interest rates in this most recent cycle in September of 2024. At that time, the average interest rate charged on a 30-year mortgage was 6.09%. Presently, the average interest rate on a 30-year mortgage is 6.21%.

As the Fed has reduced the Fed Funds rate, the interest rate paid by consumers has risen. That’s because lenders charge an interest rate that is commensurate with the risk of making the loan.

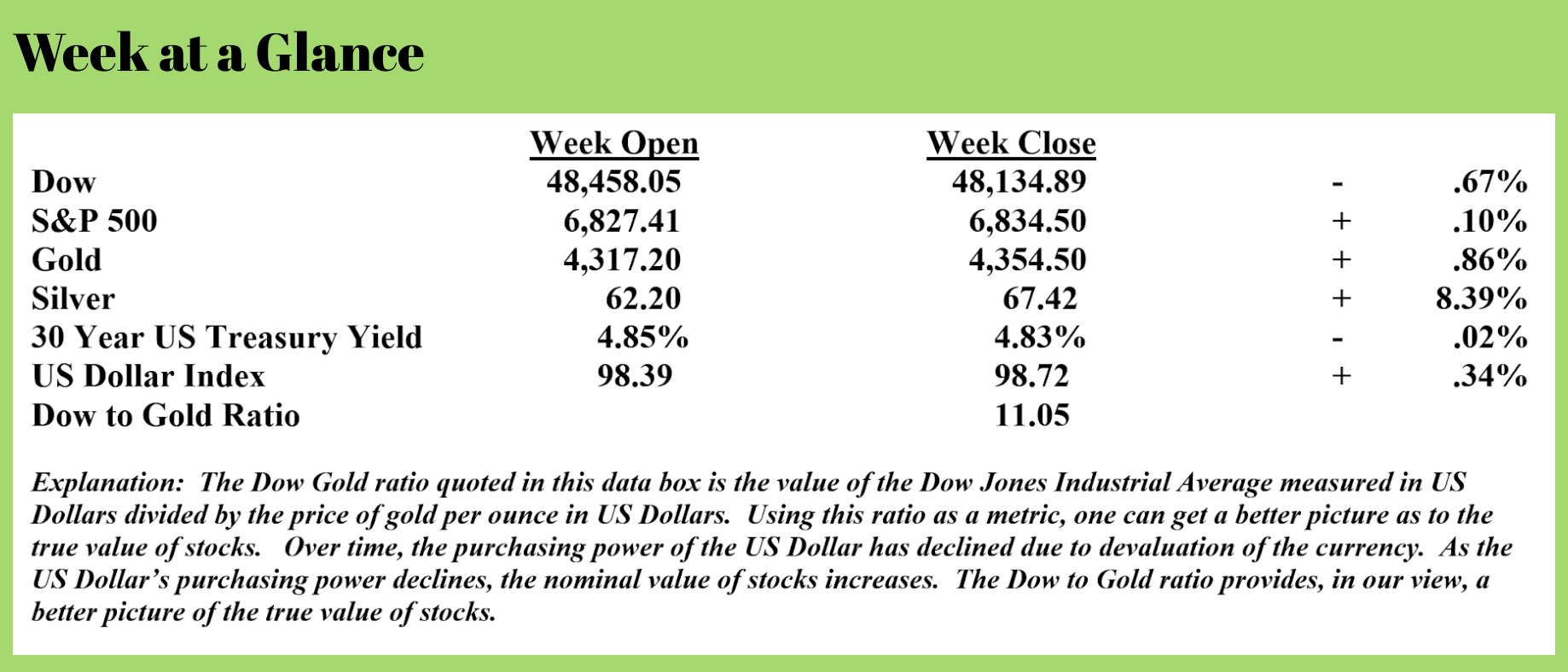

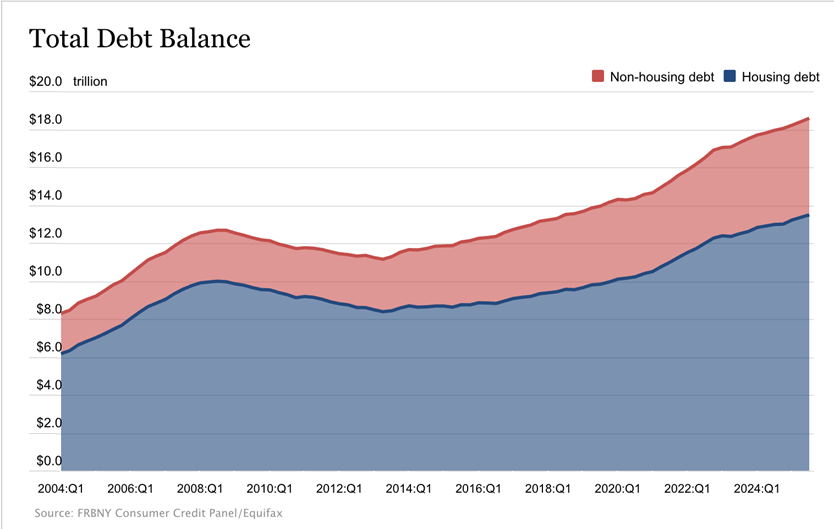

The reality is that consumers are up to their proverbial necks in debt. The chart here, from the Federal Reserve (Source: https://www.newyorkfed.org/microeconomics/hhdc

illustrates how much household debt has been building over the past 20 years.

illustrates how much household debt has been building over the past 20 years.

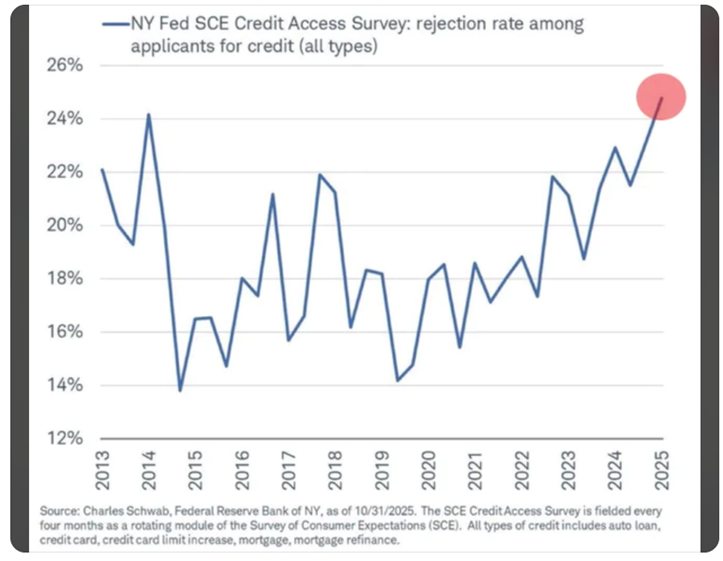

Notice that from the first quarter of 2004, household debt has increased by about 125%! That explains why about 25% of all consumer credit apps are now being declined, as illustrated by the chart below (Source: 5 https://www.reddit.com/r/economy/comments/1p9xjcy/consumer_credit_applications_are_now_being/)

Credit is tightening.

Banks are pulling back.

Banks are pulling back.

US bankruptcies have now reached the highest level since COVID.

Despite the actions of the Federal Reserve, interest rates will likely continue to rise, and credit will continue to tighten.

Consumers, collectively speaking, are becoming less creditworthy.

Home Sales Fall to Crash Levels

As we move into calendar year 2026, commercial real estate is slow, and residential real estate is slowing. As a result, real estate prices are beginning to fall.

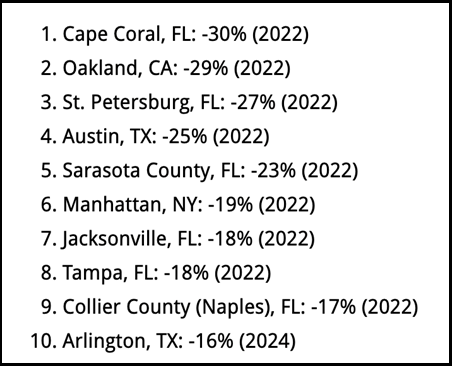

Just take a look at condominium sales price drops from their peak in ten markets around the country.

Just take a look at condominium sales price drops from their peak in ten markets around the country.

But it’s not just condos. Sales of single-family homes have fallen by 37% from their peak in 2021.

Annual sales of single-family homes fell to 3.8 million in 2025 from about 6 million in 2021. That’s the approximate level of annual sales that closed at the time of the housing bust.

Another metric that tells us that residential real estate is likely ready to decline is the cost of renting a home versus buying the same home. A survey by Kiplinger found that renting a home is now cheaper than buying a similar home in all 50 states. The typical mortgage payment for a median price home ($412,778) was $2,703 monthly, while the typical rent for the same value home was $1979 per month. That’s a disparity of $725 monthly or $8600 per year.

History tells us this ratio will eventually close. I’m looking for a 30% drop from these levels in residential real estate.

RLA Radio

The RLA radio program this week features some of my economic and investing forecasts for 2026. You can listen now by clicking on the "Podcast" tab at the top of the page, or you can find it on your favorite podcast channel.

Quote of the Week

“Personality can open doors, but only character can keep them open.”

-Elmer G. Letteran

Comments