Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

Merry Christmas.

The most desired Christmas gift this season is the present of money. Statista’s Anna Fleck reported (Source: https://www.statista.com/chart/29001/most-desired-christmas-gifts-in-the-united-states/) that a survey of American adults found that 50% of women respondents and 36% of the men who responded stated their preferred gift was cash or a bank transfer.

This from the Statista piece:

When looking at a breakdown of the data for men and women, however, while there is a fair bit of overlap, some slight differences do emerge. As our chart shows, smartphones, tablets, and accessories were a fairly popular choice for both men and women, selected by 24 percent and 22 percent of the groups, respectively. Women showed slightly more interest in travel-related gifts (20 percent versus men at 13 percent) as well as event tickets (19 percent versus men at 11 percent), with the two options placing in rank nine and ten for women. Out of the polled options, ‘decoration articles’ were among the lowest-scoring gifts, only desired by 7 percent of female respondents and 6 percent of men.

When looking at a breakdown of the data for men and women, however, while there is a fair bit of overlap, some slight differences do emerge. As our chart shows, smartphones, tablets, and accessories were a fairly popular choice for both men and women, selected by 24 percent and 22 percent of the groups, respectively. Women showed slightly more interest in travel-related gifts (20 percent versus men at 13 percent) as well as event tickets (19 percent versus men at 11 percent), with the two options placing in rank nine and ten for women. Out of the polled options, ‘decoration articles’ were among the lowest-scoring gifts, only desired by 7 percent of female respondents and 6 percent of men.

The chart on this page, taken from the Statista article, shows that after cash, vouchers and gift cards were the next preferred gift, followed by clothing, textiles, and shoes, followed by cosmetics, perfume, and body care.

Jewelry and watches, books, and food and drink occupied the next places on the list.

Is this desire for cash for Christmas a reflection of the US economy?

Perhaps.

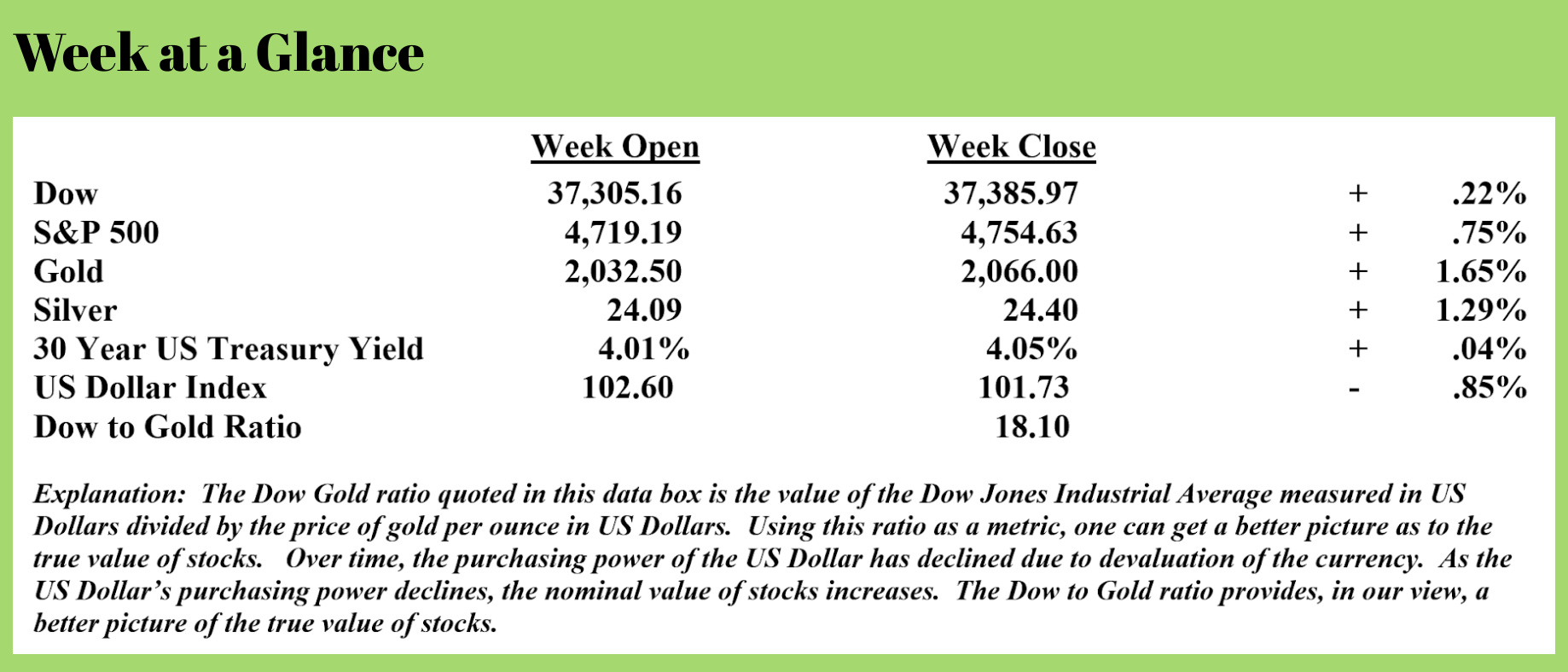

Statista also surveyed Americans as to whether or not they were taking a vacation this holiday season. (Source: https://www.statista.com/chart/31389/share-of-respondents-who-will-spend-the-holiday-season-on-vacation/)

This from the Statista piece:

While Christmas and the holiday season are usually reserved for spending time at home alone, with friends, or visiting family, some people, for example, like to trade in the Western climate for warmer weather or engage in a winter sports vacation over the holiday break. Our chart based on data from the Statista Consumer Insights Christmas and Holiday Season special shows that the percentage of people going on Christmas vacation this year is comparatively low.

Of the six markets analyzed in this seasonal survey, Brazil is the only country where the share of respondents claiming that they want to spend the holiday season on vacation hit double figures. This isn't necessarily due to geographical or weather reasons, as only seven percent of Mexicans surveyed were planning a Christmas vacation, the same share as in Germany and the United Kingdom.

Of the six markets analyzed in this seasonal survey, Brazil is the only country where the share of respondents claiming that they want to spend the holiday season on vacation hit double figures. This isn't necessarily due to geographical or weather reasons, as only seven percent of Mexicans surveyed were planning a Christmas vacation, the same share as in Germany and the United Kingdom.

Across all surveyed countries, spending Christmas at home was the most popular option, with percentage shares ranging from 53 percent (France and Mexico) to 66 percent (United Kingdom). Options that consistently rank lower than going on vacation are spending the holidays at an event, at a restaurant and at work.

It seems that more Americans desiring cash as a gift and fewer Americans traveling and spending the holiday at home could be blamed, at least to some extent, on the economy and inflation.

Polling seems to back up this theory.

“The Epoch Times” reported this (Source: https://www.theepochtimes.com/article/it-was-meant-to-be-a-campaign-winner-is-bidenomics-a-liability-5549202?src_src=partner&src_cmp=ZeroHedge)

The Fed's policymakers are now predicting three rate cuts in 2024, more than previously projected, offering a ray of hope to investors who have been gloomy for the past two years.

President Biden, who's running for reelection, has struggled to win over Americans with his economic agenda, which he calls "Bidenomics." The 46th president may now want to capitalize on the recent stock market gains with the hope of making his economic message appealing to voters.

According to a new CBS News poll, Americans perceive the current economic challenges as the most severe they've faced in generations, surpassing the 2008–09 financial crisis and even the inflation rates and gas shortages experienced in the 1970s.

Despite positive job reports and discussions of a "soft landing" in the economy, people still focus on their personal experiences rather than broader economic data. An overwhelming number of respondents say their incomes aren't keeping up with the rising cost of living.

According to a recent poll by Bankrate, 59 percent of Americans believe the United States is in a recession, with many referring to it as a "silent recession."

Individual struggles have a tremendous influence on people's perceptions, exposing the disconnect between macroeconomic facts and personal financial conditions, according to Merrill Matthews, a resident scholar at the Institute for Policy Innovation, a public policy think tank.

"Within the economy, there's reality, and there's perception, and perception always trumps reality,” he told The Epoch Times.

The main reason Americans are still struggling, according to Mr. Matthews, is that Bidenomics has erased the so-called wealth effect.

The wealth effect is a behavioral economic theory that suggests people feel more financially secure and confident about their wealth when the values of their homes or investment portfolios rise. When consumers feel wealthy, they tend to spend more, which benefits the economy as a whole.

Economic factors such as the stock market, inflation, home values, and consumer confidence contribute to the wealth effect.

For example, when Americans witness their retirement savings plateau or decline, it has a significant influence on their sense of financial well-being. This is especially important given that the majority of Americans are investors in the stock market.

According to a Gallup survey, 61 percent of Americans own stock, whether through direct investments or a retirement savings account such as a 401(k).

Bottom line: Americans don’t feel wealthy.

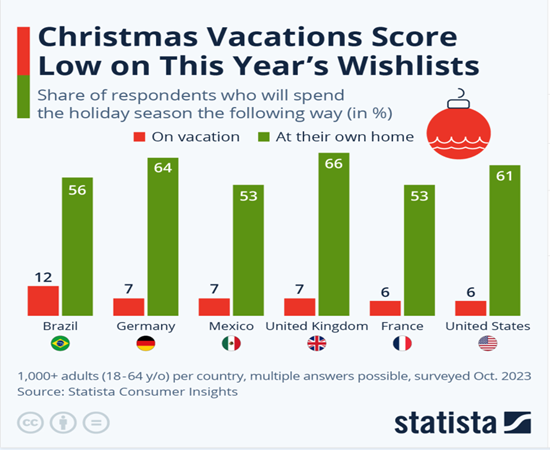

Take a look at the weekly price chart of the Standard and Poor’s 500 published here. Notice from the chart that stocks have not yet made it back to the market highs of late 2021. That means that as inflation has eroded the purchasing power of the US Dollar over the past two years, IRA and 401(k) investors who are invested in stocks have seen the real value of their investments fall.

Take a look at the weekly price chart of the Standard and Poor’s 500 published here. Notice from the chart that stocks have not yet made it back to the market highs of late 2021. That means that as inflation has eroded the purchasing power of the US Dollar over the past two years, IRA and 401(k) investors who are invested in stocks have seen the real value of their investments fall.

Will the stock market make new highs?

Will 2024 be another great year for stocks as the Federal Reserve moves to ease?

We’ll have to wait and see but count me among the skeptics.

The radio program this week features an interview that I did with Dr. Robert McHugh, a technical analyst and newsletter publisher at www.TechnicalIndicatorIndex.com.

Dr. McHugh shares his research with the listeners and offers his forecast for stocks, bonds, and gold.

You can listen to the podcast by clicking on the "Podcast" tab at the top of this page or on your favorite podcast source.

“Christmas is doing a little something extra for someone.”

-Charles M. Schultz

Comments