Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

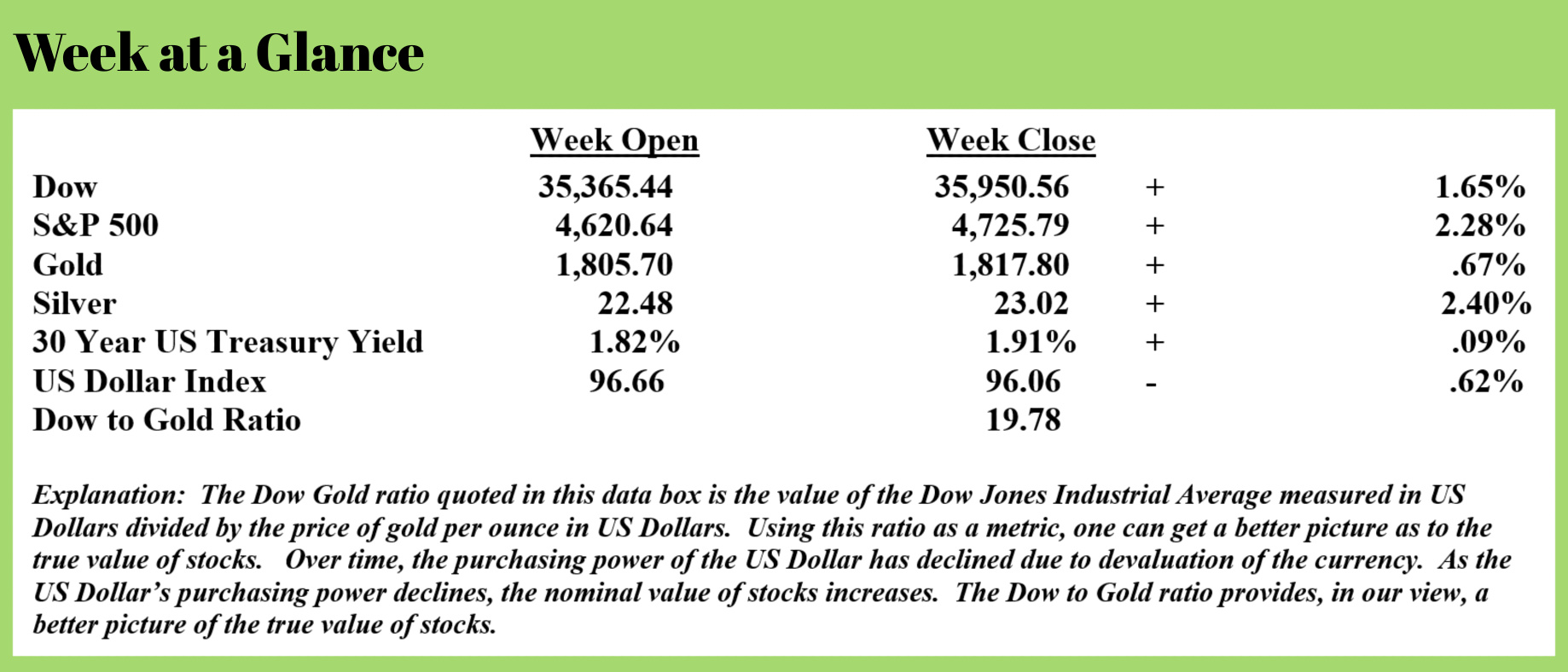

Despite last week’s rally in stocks, the highs of mid-November remain the market’s high point. As I have been noting, my long-term, trend-following indicators remain negative.

This past week, I began to read the most recent book by James Turk, a past guest on my radio program. Mr. Turk’s book is titled, “Money and Liberty; in the Pursuit of Happiness and the Natural Theory of Money”.

In the book, Mr. Turk offers a perspective similar to the perspective I have offered in the past regarding money and currency and the difference between the two. Currency is used in commerce and money is a good store of value over time. Sometimes in history, currency and money have been the same thing, other times, including the present time, they are not the same thing.

Mr. Turk offers the example of West Texas Intermediate crude oil. When a barrel of oil is priced in US Dollars, Euros, or the British Pound, one concludes that the price of crude oil has risen significantly since 1950.

However, when priced in gold grams, the price of a barrel of crude oil hasn’t changed since 1950.

Fiat currencies, over time, are devalued by central banks or governments. That makes fiat currencies poor measuring units.

Economic output, or gross domestic product, is measured in fiat currencies. Devalued currencies make the reported economic output number look better than it is in reality.

The same is true when it comes to stock values. Stock prices reported in fiat currencies move up as the currency is devalued. The same devalued fiat currencies that make the price of consumer goods like groceries rise also make the price of stocks increase.

Historically speaking, this devaluation of currency is controlled and gradual initially, but then the politicians and policymakers lose control of the devaluation process and inflation gets out of control.

Economist John Meynard Keynes, the father of the loose money policies that are being pursued worldwide today, knew that control over the devaluation process would eventually be lost with dire consequences.

In 1923, Keynes wrote a tract on monetary reform. The second chapter of the tract is titled, “Inflation as a method of taxation”. Keynes, in his writing, discusses devaluation of a currency or inflation as a method of taxation that allows a government to survive when there is no other means of survival. This from his tract (Source: https://delong.typepad.com/keynes-1923-a-tract-on-monetary-reform.pdf):

A government can live for a long time, even the German Government of the Russian Government, by printing paper money. That is to say by this means, secure the command over real resources – resources just as real as obtained through taxation. The method is condemned, but its efficacy, up to a point, must be admitted. A government can live by this means when it can live by no other. It is the form of taxation which the public finds hardest to evade and even the weakest governments can enforce when it can enforce nothing else.”

Keynes indirectly states that the positive effects of currency printing diminish over time when he states that “its efficacy, up to a point, must be admitted.”

Keynes clearly understood that in the long run, the point is reached when currency devaluation doesn’t work and the adverse consequences of currency creation emerge. One of Keynes’ most infamous quotes is “in the long run, we are all dead.” Keynes clearly understood that eventually, this monetary policy would fail but it would be long after he and his cohorts exited the planet.

Mr. Turk, in the aforementioned book, has this to say about Keynes’ statement.

“These words, which are frequently quoted, are among the most grossly irresponsible statements ever spoken by an economist. Actions have consequences and planning for the next generation is an essential element of economic activity. What is important to society and indeed our civilization is not just how we live, but what we leave for future generations. That the planet’s environment has become so scarred is an indication of how much we have accepted the ills of progressivism, socialism, and authoritarian control by the State and moved away from capitalism, private property, and individual liberty. The State today rarely leaves people alone.

Keynes's comment is typical of socialists and progressives who focus on satisfying their innate yet perverse need to control others rather than where their attention should be directed, which is the consequence of their actions. For example, they proclaim their vision that forces the world to drive electric cars so that we do not inhale the emissions from exhaust pipes, yet they are blind to the number of plants needed to generate the electricity to power all those new cars. Decisions cannot be made on emotion. In our world of limited resources, they must be made based on sound economics and that requires trustworthy money spent and invested at a true cost of capital. These are requirements that only gold can provide. Further, to achieve the best possible outcome decisions need to be unfettered by government involvement and their market interventions.

For Keynes, the long-run has arrived, and he wrote his own fitting epitaph:

‘Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually slaves of some defunct economist. Madmen in authority, who hear voices in the air are distilling their frenzy from some academic scribbler of a few years back.’

It’s time to bury Keynes, Keynesianism, and socialism.”

I agree with Mr. Turk.

But abandoning currency creation will come at a cost. A deflationary period of time will materialize. Continuing with the Keynesian policies of currency creation will not avoid the deflationary period, it will only make the eventual deflationary period worse.

The choices are grim; an ugly deflationary period or an uglier deflationary period. The longer currency creation continues, the more severe the resulting deflationary period will be. Keynes touched on this in his 1923 tract:

“In the first place, deflation is not desirable because it effects, what is always harmful, a change in the existing Standard of Value, and redistributes wealth in a manner injurious, at the same time to business and social stability. Deflation, as we have already seen, involves a transference of wealth from the rest of the community to the rentier class and to all holders of titles to money; just as inflation involves the opposite.”

“But, whilst the oppression of the taxpayer for the enrichment of the rentier is the chief, lasting result, there is another more violent disturbance during the period of transition. The policy of gradually raising the value of a country’s money to (say) 100% above its present value in terms of goods, amounts to giving notice to every merchant and every manufacturer, that for some time to come his stock and his raw materials will steadily depreciate on his hands and to everyone who finances his business with borrowed money that he will, sooner or later, lose 100% on his liabilities. Modern business, being carried on largely with borrowed money, must necessarily be brought to a standstill by such a process.”

If you’re not familiar with the term ‘rentier’ class, it refers to someone who relies on a pension, rents or other fixed income sources.

These people benefit from a currency that buys more over time.

On the other hand, borrowers benefit from a currency that buys less over time. Mortgage holders, business owners with debt, and the government all benefit from a currency that is being devalued. In this scenario, dollars borrowed, buy more than dollars that are used to pay back the debt.

What Keynes fails to acknowledge in his 1923 tract is constant money.

Gold is constant money.

When we go back and revisit the example of West Texas Intermediate crude oil that Mr. Turk used in his book, we find that the barrel of crude oil that sold for $2.57 in 1950 now costs more than $70 to purchase when using US Dollars in the transaction.

That barrel of oil purchased with gold grams in 1950 and today would cost the same amount. Gold has historically been constant money.

At different times in history, the paper currency has been only partially backed by gold which allows for more currency creation and is inflationary.

Today, there are zero currencies in the world with any level of gold backing. Currency creation worldwide has been expanding and consumer price inflation is now manifesting itself in earnest.

In response, many world central banks are raising interest rates to attempt to suppress inflation. Wolf Richter (Source: https://wolfstreet.com/2021/12/22/end-of-easy-money-global-tightening-in-full-swing-fed-promises-to-wake-up-in-time/) reported last week that the central banks of Czechoslovakia, Russia, England, Norway, the European Central Bank, Mexico, Chile, Hungary, Pakistan, Armenia, Peru, Poland, Brazil, Korea, New Zealand, South Africa, Iceland, and Japan have all increased interest rates.

The Fed has kept interest rates at zero; look for more inflation before we see deflation.

As for Keynes, he was right about being dead in the long run. Keynes passed away in 1946.

This week’s radio program features an interview with Alasdair Macleod, Head of Research at Goldmoney. I get Mr. Macleod’s updated inflation forecast. You can listen to the show now by clicking on the "Podcast" tab at the top of this page.

“If you pick up a starving dog and make him prosperous, he will not bite you. This is the principal difference between a dog and a man.”

-Mark Twain