Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

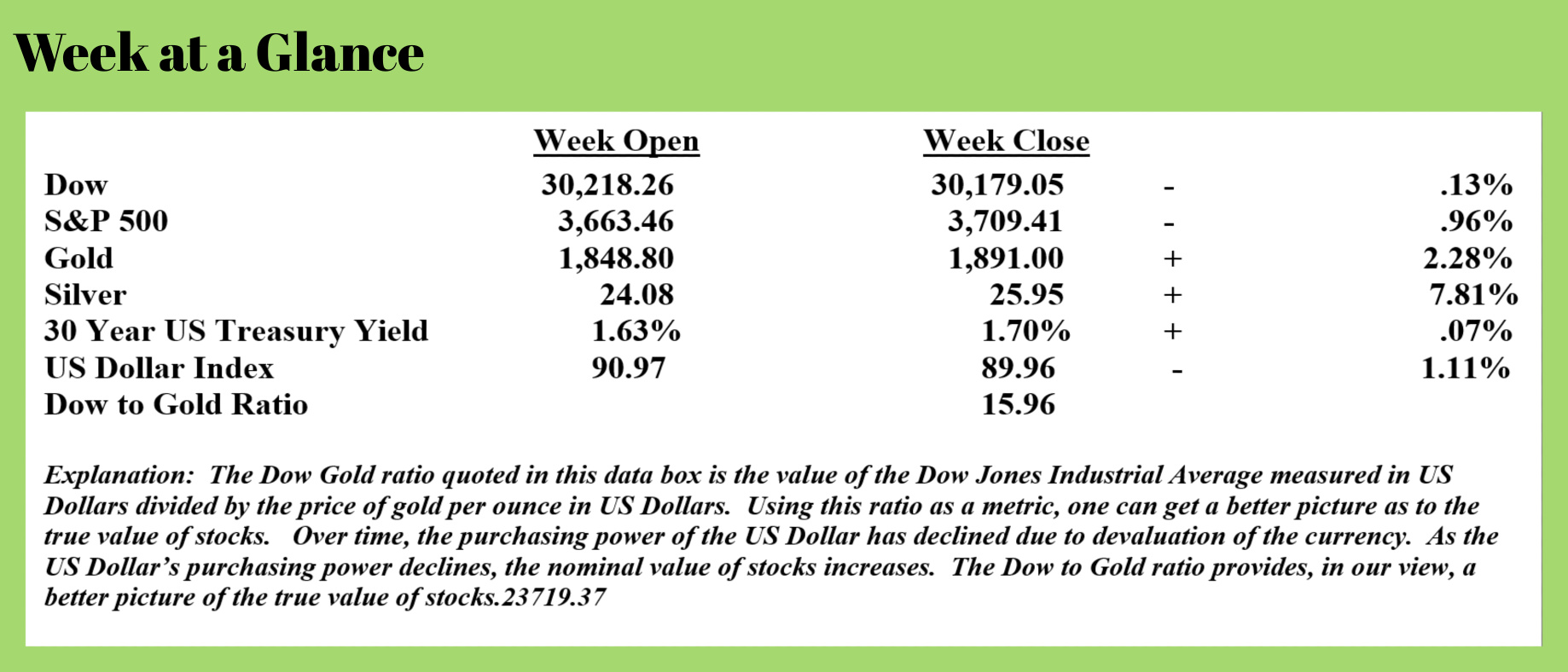

As one might expect during a holiday-shortened trading week, markets didn’t move much last week. All the markets tracked here in “Portfolio Watch” moved only marginally.

When analyzing stock price movement since the market bottom in March, small-cap stocks have significantly outperformed the broader stock market. The S&P 500 has risen about 68% from it’s low while the Russell 2000 (small-cap stock index) has risen 108%.

From a technical perspective, both markets are overbought and a quick look at a Russell 2000 price chart (on this page) shows that market’s price pattern going parabolic.

Notice on the weekly price chart that there is a “gap up” in price and then a near-vertical price move upward.

This market looks poised to correct at least moderately much the same way as gold did after a big up move earlier this year.

Metals markets, namely gold and silver have been consolidating since they peaked earlier this year.

Fundamentals favor metals moving higher in 2021 although the metals market does require some patience. There are multiple instances of market manipulation in the metals markets over the past several years with both Deutsche Bank and JP Morgan Chase admitting wrongdoing in these markets and paying fines.

At some future point, should current government overspending continue to be supported by new money creation by central banks, the metals markets will have to react favorably in my view.

The global debt and money creation numbers are simply staggering. Portfolio manager Peter Krauth recently offered a perspective on this topic in an article published on “Streetwise” (Source: https://www.streetwisereports.com/article/2020/12/22/buy-silver-now.html).

In the piece, Krauth notes that global debt is now $280 trillion. Governments and central bankers have implemented mammoth levels of stimulus spending, tens of trillions of dollars, and it’s far from over.

In the United States, as of the morning of the 26th, the $900 billion COVID stimulus package passed by the House and Senate has yet to be signed by President Trump. (More on this momentarily) The $900 billion in COVID relief was part of a $2.3 trillion spending package.

The Federal Reserve’s balance sheet began the calendar year 2020 at $4.2 trillion; it’s now $7.3 trillion and growing. Should the recently passed spending package become reality, add another couple trillion, give or take, to that total.

The brutal truth is that there is only one way more stimulus or spending can be funded; still more money creation. No matter how noble, well-intentioned, or needed additional stimulus may be, when the additional spending is funded by money creation, it is a tax that falls squarely on the shoulders of savers and investors in the form of inflation.

That, in my view, and as I have been suggesting for many years, will be bullish for metals. Krauth is exceedingly bullish on silver’s prospects going into 2021. Here’s an excerpt from Krauth’s article:

I think inflation will be the dark horse of 2021. As vaccination rates climb and the visible effects of the pandemic subside, I expect our wild rates of money printing will start to take effect. Currencies, in particular the U.S. dollar, are likely to weaken.

That's what gold and silver have been sensing, especially since massive stimulus programs and a Fed promise of near-zero rates until at least 2023 appeared.

Not only is silver demonstrating its ability to hedge against expected inflation, it's also flexing its industrial-metal muscle. Fifty percent of silver is consumed in industry, plus 10% goes into solar technologies. Factor in exploding investment demand and the metal's outlook is robust.

I agree with Krauth and with the gold/silver ratio now at about 72, silver could continue to outperform gold moving ahead. But, again, patience may be required.

That said, it’s remarkable to me how political culture regarding spending has changed. There used to be a hesitancy, even a strong resistance to unfunded spending. No more. Now such reckless behavior is encouraged.

Federal Reserve Chair, Jerome Powell, has openly encouraged more stimulus spending stating the Fed would “support” whatever expenditures congress approved.

Yet, when digging into the recently passed stimulus package, one finds that this monstrous spending bill has a little stimulus and a lot of pork.

The bill is a whopping 5,593 pages long. Kentucky Representative Thomas Massie noted that the house voted to suspend the rule that gives each representative 72 hours to read the bill. Instead, the vote on the monster bill was held 8 hours after the bill was distributed. A little simple math has us concluding that a representative would have to read about 700 pages per hour to read the bill in 8 hours. That’s about 12 pages per minute or a page every 5 seconds.

Even an Evelyn Wood speed-reading class couldn’t equip one for that task. So, it’s safe to assume that any representative who voted “yes” on the bill did not read the bill. My representative voted “yes” and he’s getting a letter from me.

Some of the provisions in the broad spending bill and the page on which these “pork” provisions are found (Source: https://nationalfile.com/2-3-trillion-spending-bill-tied-to-covid-stimulus-gives-billions-to-foreign-countries-600-to-americans/)

- $169,739,000 to Vietnam, including $19 million to remediate dioxins (page 1476)

- “Unspecified funds” for not-for-profit gender-accessible education institutions in Kabul, Afghanistan (page 1477)

- $198,323,000 to Bangladesh, including $23.5 million to support Burmese refugees and an additional $23.3 million for democracy programs (page 1485)

- $130,265,000 to Nepal for development and democracy programs (page 1485)

- $15 million for Pakistani democracy programs and an additional $10 million for “gender programs” (page 1486)

- $15 million for Sri Lanka so they can refurbish a high endurance cutter patrol boat (page 1489)

- $505,925,000 to Belize, Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and Panama to address the migration of unaccompanied, undocumented minors to the United States” (pages 1490-1491)

- $461,375,000 to Colombia for programs related to counter-narcotics and human rights (pages 1494-1496)

- $74.8 million to the Caribbean Basin Security Initiative (page 1498)

- $33 million for democracy programs for Venezuela (page 1498)

- “Unspecified funds” to Colombia, Peru, Ecuador, Curacao, and Trinidad and Tobago to mitigate the impacted refugees from Venezuela (page 1499)

- $132,025,000 for “assistance” for Georgia (page 1499)

- $453 million for assistance for Ukraine (page 1500)

- $500 million to Israel for “Israeli Cooperative Programs” (page 341)

Color me cynical, but I think it would be quite interesting to follow the money here and see who might be benefitting.

I’d encourage you to ask your representative how they voted on this bill and why.

I’d also encourage you to continue to look toward more tangible assets in your portfolio and take a more tactical approach to your asset management. To that end, we will be doing some additional educational webinars in the New Year.

As we have informed our clients by letter, our relationship with TD Ameritrade will be changing this week. To be clear this will not affect your relationship with TD Ameritrade or your relationship with us. TD Ameritrade was recently acquired by Charles Schwab and Schwab has a differing philosophy in working with smaller, independent advisory firms.

From your perspective, it will continue to be business as usual. We will be getting you more information on available options after the first of the year.

Thank you all for your continued support and referrals. If you are not participating in our weekly Monday update webinars, you can get more information on them at www.RetirementLifestyleAdvocates.com or catch the replays there.

If you need more information about the webinars or would like to schedule a phone conversation to discuss precious metals or tax planning, just give the office a call at 1-866-921-3613.

This week’s radio program features an interview with technical analyst, Dr. Robert McHugh. I get Dr. McHugh’s take on various markets and the entire US economy.

The interview is available at www.RetirementLifestyleAdvocates.com.

I wish all of you a healthy, prosperous, and peaceful New Year. Our team will continue to work hard to keep you informed.

Happy New Year!

“For a change, don’t add new things to your life as a New Year’s resolution. Instead, do more of what is already working for you and stop doing things that are a time waste.”

-Salil Jha