Weekly Market Update by Retirement Lifestyle Advocates

Weekly Market Update by Retirement Lifestyle Advocates

There are many signs that the economy isn’t healthy, at least as healthy as many politicians would have you believe.

For starters, there is a disparity between the reported inflation rate and the real inflation rate, which is the inflation rate that we all live with every day.

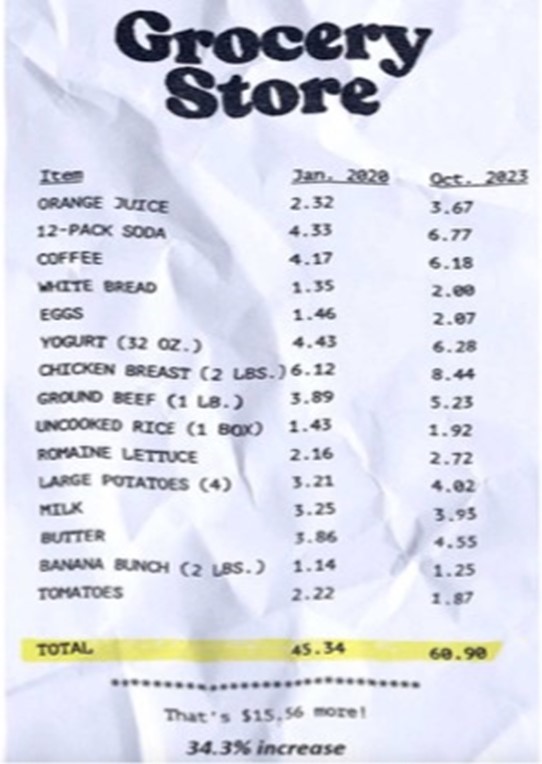

Charles Hugh Smith recently commented on this topic while posting a couple of grocery receipts, one from 2020 and one that is current.

Charles Hugh Smith recently commented on this topic while posting a couple of grocery receipts, one from 2020 and one that is current.

Notice that over that 3 ½ year time frame, grocery costs (at least for the items Smith listed) are up more than 34%!

What used to be a $45 trip to the grocery store is now a $60 experience.

Smith comments (excerpts from his piece follow)(Source:https://charleshughsmith.blogspot.com/2023/11/never-mind-bogus-measures-of-inflation.html):

The official measure of inflation since January 2020 is up 19%. Whether that actually maps the decline in our purchasing power can be massaged--stop believing your lying eyes!--but what can't be massaged away is the reality that costs are rising for structural reasons that aren't going away.

If your earnings rose by 34% from January 2020 to October 2023, congratulations, the purchasing power of your labor kept pace with higher costs. All of us who aren't earning 34% more since January 2020 have lost ground, i.e. purchasing power: it now takes more hours of work to buy groceries and everything else we need.

He then explains one of the ways the reported inflation rate is manipulated:

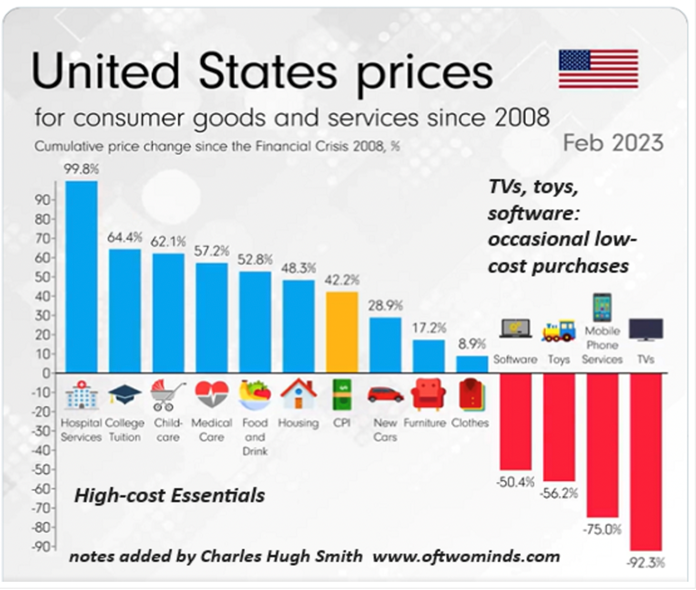

The basic gimmick of distortion is to underweight whatever is eating away at the purchasing power of earnings and highlight the trivial items that are getting cheaper due to declines in quality and globalization. So your rent went up by $200 a month, or $2,400 a year, but since TVs dropped $40 and toys dropped $20, inflation is only 3%. So stop feeling poorer, everything's great! Inflation is dropping!

You see the problem: the scale of spending on essentials such as shelter, healthcare, childcare, etc. is far greater than the trivial "lower in price" items. If 95% of your essential spending is rising in cost, trivial declines in the 5% of discretionary spending do not offset the gargantuan declines in purchasing power.

The chart below reflects this distortion. Essential expenses that cost thousands of dollars annually consume far more of our earnings now, and these vast declines in the purchasing power of earnings are not offset by the occasional purchase of cheaper TVs.

Seems Smith is correct.

Inflation is eroding the purchasing power of many Americans.

Discretionary purchases are taking a hit.

Boat sales are down, falling to the lowest level in a decade. (Source: https://www.zerohedge.com/markets/us-boat-sales-set-sink-decade-low). This from the article:

Bloomberg cites new data from the National Marine Manufacturers Association (NNMA), the leading trade association representing boat, marine engine, and accessory manufacturers, which states that 1.4 million new and used boats were sold in 2021, up 16% from 2019. This followed several years of low single-digit growth.

Fast forward to 2023, NNMA expects the industry will only sell 269,000 new powerboats and about 900,000 used ones, the lowest dating back to 2011.

Similarly, sales of RV’s are also down. This from “Zero Hedge”. (Source: https://www.zerohedge.com/markets/death-american-dream-under-bidenomics-housing-affordability-crisis-stokes-mobile-home):

The latest results from the RV Industry Association's June 2023 survey of manufacturers found more of the same: "Total RV shipments ended the month with 24,095 units, a decrease of (-46.4%) compared to the 44,942 units shipped in June 2022. To date, RV shipments are down (-49.2%) with 164,830 units."

RV sales are down more than 46%!

At the same time, sales of park-model RV’s are rising. This, also from “Zero Hedge” (Source: https://www.zerohedge.com/markets/death-american-dream-under-bidenomics-housing-affordability-crisis-stokes-mobile-home):

"Park Model RVs finished June up 7.7% compared to the same month last year, with 391 wholesale shipments," RVIA said in the report.

Park model RVs are mobile homes. A review of Google search terms confirms that more Americans are looking to deal with inflation by looking for cheaper housing options. This, once again, from “Zero Hedge” (Source: https://www.zerohedge.com/markets/why-are-searches-trailer-park-near-me-erupting):

The eruption in Google searches for "RV lot near me" has hit a five-year high. The reason for the surge remains unclear but could be attributed to the worsening housing affordability crisis ushered in by the failure of 'Bidenomics.'

This is not at all shocking, given that there is now a big housing affordability crisis in the United States. The chart illustrates the housing affordability index, which is now at a level not seen in more than 40 years.

If you are a long-term reader of “Portfolio Watch,” you know that since my 2011 “Economic Consequences” book was published, I have forecast that we would see inflation followed by a severe deflationary environment.

Seems this forecast is now playing out before our very eyes.

I expect more inflation in things we have to buy, like groceries, while things we own will see values fall due to deflation.

If you have not yet put together a plan designed to help you navigate this likely eventuality, now is the time.

The radio program this week features an interview with Karl Deninger of www.Market-Ticker.org.

I chatted with Karl about the probability of a severe recession, the future of inflation in his view, and the future direction of interest rates.

If you haven't had a chance to listen to the program, you can listen now by clicking on the "Podcast" tab at the top of this page.

“When I was a kid, my parents moved a lot, but I always found them.”

-Rodney Dangerfield

Comments